Wagner Meier

Thesis

Petroleo Brasileiro S.A. (NYSE:PBR) is a state-owned (controlling shareholder) leader in the Brazilian oil and gas industry. It is a highly profitable player, which derives about 80% of its earnings before tax (EBT) from exploration and production (E&P) activities. It’s mainly focused on crude oil and oil products and, to a lesser extent, on natural gas.

Recently, there has been a series of controversies on PBR, as its ex-CEO resigned. Notably, it’s the company’s fourth chief executive departure under Brazilian President Jair Bolsonaro, as he seeks to be re-elected amid rising oil energy prices and high inflation (close to 12% recently).

New CEO Caio Paes de Andrade has moved quickly to stamp his mark, as Petrobras reduced the gasoline prices recently to help cope with the challenging domestic conditions.

However, PBR stock didn’t react negatively to the move, as it held its early July lows. Therefore, we believe the recent collapse that started in May had largely priced in the impact of its price reduction. We also think it’s not likely to significantly affect its EBT margin (given its sizeable E&P exposure).

Notwithstanding, we believe that investing in PBR requires a great deal of conviction about the Brazilian economy (including forex risks) and the Brazilian President while navigating the energy market.

Consequently, we believe the market has astutely asked for higher free cash flow (FCF) yields to compensate for such heightened risks. While we think PBR is at a near-term bottom, we don’t believe the risk/reward profile is attractive yet.

Accordingly, we rate PBR as Hold for now.

Petrobras Is Fundamentally Strong, But Margins Could Have Peaked

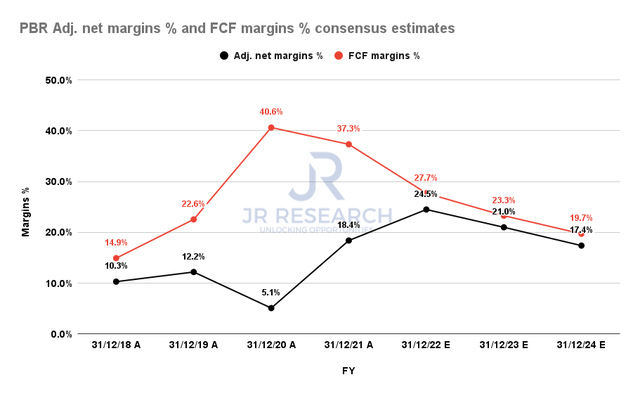

Petrobras adjusted net margins % and FCF margins % consensus estimates (S&P Cap IQ)

PBR’s massive surge from its COVID bottom also coincided with the tremendous uplift in its adjusted net margins, as seen above. As a result, the company reported an adjusted net margin of 18.4% in FY21 and an FCF margin of 37.3%. Therefore, we believe these highly profitable margins would be helpful to support its valuation, despite the macro and political risks emanating from its exposure to Brazil.

Notwithstanding, the consensus estimates (bullish) suggest that its net and FCF margins could fall markedly through FY24.

We believe the risks of falling energy prices resulting from potential demand destruction due to worsening macro risks are credible. A recent update by Sevens Report Research accentuated (edited):

Gasoline supplied, a measure of implied demand, only bounced by 459K bbl/day to 8.52M bbl/day last week after plunging 1.35M bbl/day in the previous week, which was the largest drop since the initial COVID lockdowns. – Seeking Alpha

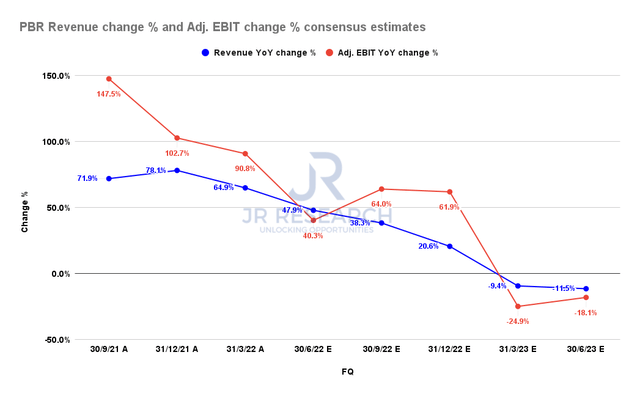

PBR revenue change % and adjusted EBIT change % consensus estimates (S&P Cap IQ)

Petrobras just released its Q2 production and sales report. Management highlighted in its commentary: “We delivered an operating performance fully in line with the Company’s plans. Average production of oil, NGL, and natural gas reached 2.65 MMboed, 5.1% below 1Q22.”

The Street expects Petrobras to post revenue growth of 47.9% in FQ2, below FQ1’s 64.9%. However, its operating leverage is expected to remain stable, even though its adjusted EBIT growth is projected to moderate to 40.3%.

But, we believe the market has attempted to price in the risks of falling topline growth and worsening operating leverage through Q2’23, as seen above, coupled with Brazil’s macro and political risks.

PBR – Ask Why The Market Demanded Such High FCF Yields

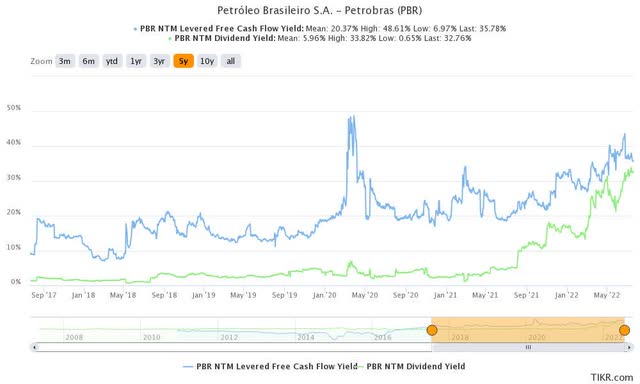

PBR NTM valuation metrics (TIKR)

PBR last traded at an NTM FCF yield and a dividend yield of 35.78% and 32.76%, respectively. These are massive yields that value investors would jump upon.

However, we also urge investors to consider carefully that the market rejected further buying upside decisively in May when PBR traded at an FY24 FCF yield of 17.22%.

| Stock | PBR |

| Current market cap | $72.35B |

| Hurdle rate [CAGR] | 5% |

| Projection through | CQ4’26 |

| Required FCF yield in CQ4’26 | 20% |

| Assumed TTM FCF margin in CQ4’26 | 19.5% |

| Implied TTM revenue by CQ4’26 | $92.19B |

PBR reverse cash flow valuation model. Data source: S&P Cap IQ, author

We applied a market-underperform hurdle rate of 5% in our valuation model. We believe a 20% FCF yield is appropriate as PBR formed a near-term bottom in July at FCF yields of about 26%.

However, note that Petrobras FCF margins are estimated to continue moderating through FY24 due to worsening leverage and falling revenue growth. Using a blended TTM FCF margin of 19.5%, we require Petrobras to post a TTM revenue of $92.19B by CQ4’26.

Based on the revised consensus estimates, Petrobras may miss our revenue target and disappoint investors.

Unless the market re-rates PBR confidently (requires lower FCF yields), it could be mired in an extended consolidation phase. Coupled with the political and macro risks of the Brazilian economy, we are not convinced with PBR at the current levels. We may reassess our rating if PBR falls further to around $9-9.5.

Is PBR Stock A Buy, Sell, Or Hold?

We rate PBR as a Hold for now.

We believe the market has justifiably demanded higher FCF yields to compensate for the risks of holding PBR. Therefore, investors should be less generous with their requirements and ask for an appropriate margin of safety.

Our valuation model suggests that PBR could underperform at the current levels unless the market materially re-rates PBR. We will reassess our rating if PBR falls into a deeper retracement.

Be the first to comment