herraez/iStock via Getty Images

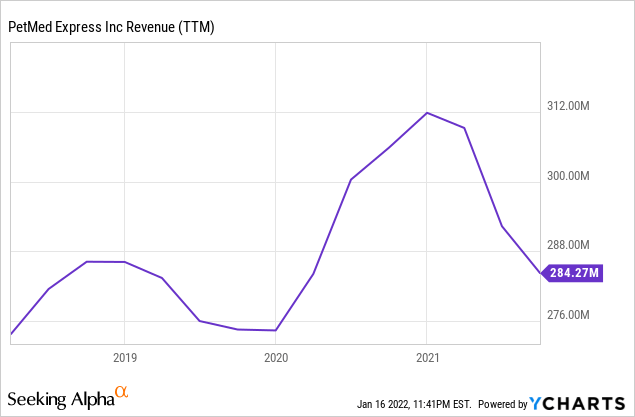

PetMed Express Inc. (NASDAQ:PETS) sells prescription and non-prescription pet medications and health products for pets, including dogs, cats, and horses, and other various pet supplies like beds, crates, etc. Additionally, the company began selling specialty dog food and other higher-end wellness products. Over the course of the pandemic, PETS gain incremental revenue of about $30 million, which was primarily driven by competitor brick and mortar store closures and the overall weak pricing in the advertising market, which allowed PETS to dramatically increase spending.

However, most of those gains have been given up as both fiscal Q1 and Q2 2022 earnings were disappointing. In Q1, revenue declined by 17.6% year-over-year, and earnings per share missed by $0.12 coming in at $0.23 versus $0.35 expected. In Q2, revenue declined double digits again by 10.7% and EPS missed by $0.04. In FY20 and FY21, advertising spending came out to $22.7 million and $21.6 million, respectively, but in Q2 2022 management acknowledged that it would be cutting advertising spending due to higher costs. In fact, the cost of acquiring a new customer increased from an average of a range of $50-54 over the last two years to $74. This cost increase blunts ROI and caused management to slash Q2 2021 advertising spend by 33% to $3.4 million. New customers acquired fell sequentially from 94,000 in Q1 to 65,000 in Q2, another all-time low.

Fortunately, reorder sales represent anywhere from 85-90% of total revenue, which is certainly a good indication of customer loyalty. Reorder sales fell by a less concerning amount of 8.5% and 10.3% for Q2 and YTD reorder sales, respectively. And management expects that most reorder sales will be recovered in the back half as customers refill prescriptions after seeing their vets, which largely occurred during the reopenings in the first half of 2021.

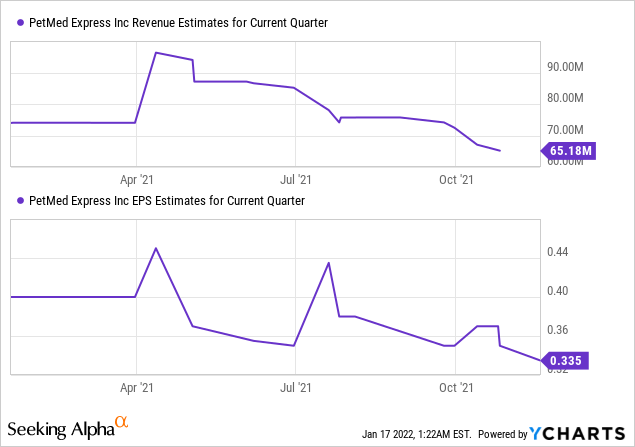

However, new order sales collapsed by an alarming 30% and 41.4%. Analysts have reduced their Q3 revenue and EPS estimates dramatically to reflect this negative momentum:

Although on the Q2 conference call, management indicated they have confidence in the back half of the year by rationalizing their advertising spend with their marketing partners and agencies to obtain new customers more effectively. It’s unknown when these new strategies were deployed, so it’s hard to say whether Q3 will see material improvement and whether investors should look to Q4 instead as the company will have had more time to implement their marketing strategies for testing and robust tracking.

One of the more interesting developments was talk about capital allocation, shifting from the singular focus of maintaining the dividend to potentially looking into strategic partnerships and M&A to further drive sales and earnings growth. Management stated that they will be looking to provide more detail sometime this year: “I would expect that we will make some decisions in the coming quarters.” One of the key challenges that PETS faces is that consumers usually wish to buy pet medication through their vet directly, rather than shopping online as it’s more convenient. PETS CEO, Matt Hulett, left the door open saying that they wish to develop a more positive symbiotic relationship with vets rather than to compete with them directly: “And our vet portal I think has a great start, but I think there’s a lot of opportunity to automate what they do in their clinics, and you know we’re going to be pro-vet in terms of how we approach the market. Our intent is not to be anti-vet.”

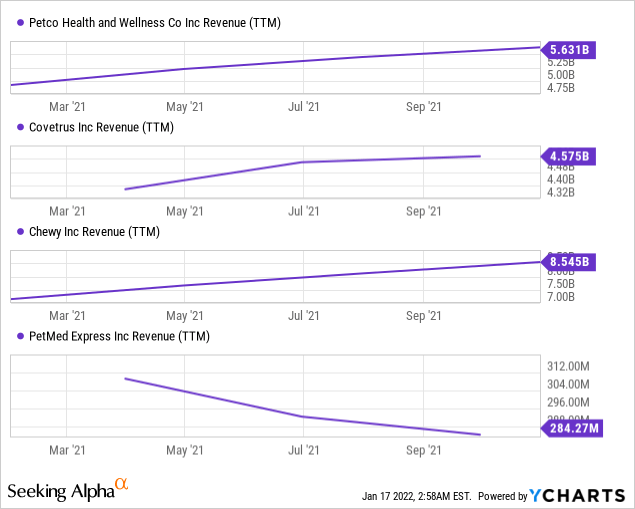

Looking to other competition, I think if PETS truly wishes to guard and grow its market share among the bigger players, it’s going to need to commit to something more aggressive and put the dividend on the backburner. Currently, PETS is facing industry behemoths that are targeting aggressive sales growth, including Chewy (NYSE:CHWY), Blue Buffalo via General Mills (NYSE:GIS), Petco (NASDAQ:WOOF), Covetrus (NASDAQ:CVET), Walmart PetRx, Amazon, which already generate billions in annual revenue. In other words, it’s not hard to see how these competitors’ pharmacies can quickly outspend PETS’ advertising budget of $20 million in a good year. And that also doesn’t consider a host of other private market pet retailers, including ones that have received VC funding as shown on owler.com.

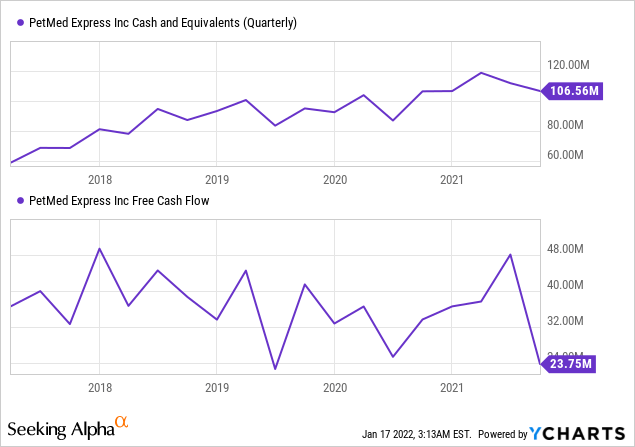

Pristine Balance Sheet

PETS holds a very healthy cash balance of $106 million, which is supported by its annual free cash flow of approximately $30 million. With $5 in cash per share and very minimal outstanding current obligations other than $16 million in accounts payable and accrued expenses, the company can easily continue to support the $1.2/share dividend, which yields 5%.

The question is whether the company should actually do so for shareholders. Currently, the business is priced for almost no growth and EBIT margins are trending at their lowest levels in over a decade. PETS discussion of the possibility of M&A should certainly be taken as a positive, especially if it’s one or two deals are struck at a favorable price: “with over $100 million in cash with interest rates being so low, you know I think there’s a lot of opportunities in this space to deploy cash and allocate capital more efficiently to get higher returns. There’s also a lot of businesses in the pet ecosystem that fortunately in this market different than other verticals, there’s a lot of ways to partner, a lot of ways to look at M&A as well, so we’re certainly going to be looking at those in the future.”

If the company can strategically partner with vets, other competitors, or entertain an acquisition to rapidly scale the business, investors would likely do better than the present path of muted incremental sales growth.

So far, however, a turnaround doesn’t appear to be visible just yet. If we back out the cash, the stock is selling for ~14x earnings. Despite the positive notes from management in Q2 regarding new products, their vet portal, and advertising optimization, I think operating performance challenges could still leave shareholders disappointed, at least in the near term.

Bottom Line

Investors should avoid PETS for now given the overwhelming competition in the industry as the business is still priced for modest growth. Unless a turnaround becomes more apparent, i.e. material catalysts translating into an improvement in new customers, or the stock trades below $20/share, the current valuation doesn’t seem appealing. After all, investors are accepting considerable risks, which are in part reflected by the extraordinarily high short interest of 23%. Unfortunately, though, a short squeeze cannot serve as a sustainable bull thesis unless underpinned by reinvigorated growth. What do you think? Let me know in the comments section below. As always, thank you for reading.

Be the first to comment