Rob Kim/Getty Images Entertainment

Premium spirits leader Pernod Ricard SA (OTCPK:PDRDF) is rightly regarded as one of the best-run companies in the space, with its strong portfolio of brands supporting steady organic revenue and earnings growth through the cycles. While Pernod, like other distillers, carries some cyclical risk, the company’s exposure to secular growth drivers (e.g., an expanding global middle class) and its pricing power are key defensive characteristics that remain underappreciated, in my view. With Pernod also setting the bar relatively low with its near-term guide, the stock screens favorably relative to the quality on offer at ~20x fwd P/E (closest peer Diageo trades at ~22x earnings). Net, I see Pernod as a good defensive addition to any portfolio against the current macro uncertainty.

| P/E Ratio (fwd) | EV / EBITDA (fwd) | |

| Pernod Ricard | 19.8x | 14.0x |

| Diageo | 22.1x | 16.9x |

Source: Market Data (17th June 2022)

Well-Placed to Capitalize on Secular Growth Tailwinds

Since Alex Ricard took over as CEO, the company’s “mindset for growth” strategy has paid off handsomely – relative to the 0% to 4%-5% sustainable growth target, Pernod has delivered ~6% growth in 2018/2019. Since then, its strategy has shifted to “transform and accelerate” to capitalize on the industry’s growth runway. The key to realizing growth lies in the rapid expansion of the middle-class population in emerging markets such as China and India.

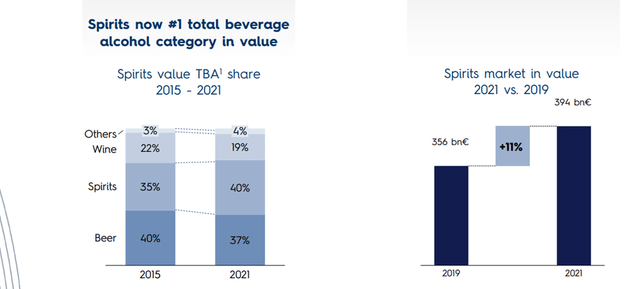

In China, for instance, there has been a ~7m/year increase in China affluents, while the growth in the Indian middle-class has been even more impressive at ~20m/year. In tandem, spirits have risen to become the leading category across global beverage alcohol markets at a ~40% value share in 2021 (vs. ~35% in 2015), amid a broader consumer shift away from beer and wine.

Post-COVID, the market has also seen a consumer shift toward at-home consumption – over the last year, for instance, the at-home revenue share of alcoholic drinks rose ~9% relative to pre-COVID levels. The convenience trend has resulted in several P&L shifts, including higher margins due to the single-serve nature and inelastic demand from on-the-go consumption. The closure of on-trade establishments through the height of the pandemic has also led to lower alcohol by volume (ABV) innovations in ready-mixed cocktails, matching the broader trend. Given the breadth of its portfolio and distribution capabilities, Pernod is positioned to capitalize on these shifts – not only does it boast a product line-up for all consumption occasions, but its extended distribution network and diversified global footprint also ensure earnings resilience through the cycles.

Pricing Power Insulates the Near-Term Earnings Outlook

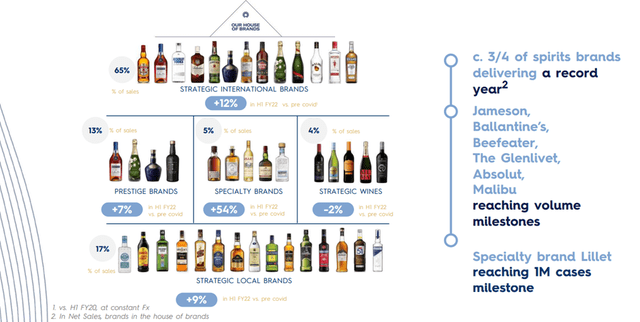

While management provided few formal updates on current trading trends at this year’s capital markets day, it reiterated its 2022 ~17% organic EBIT growth guidance – likely helped by easing COVID restrictions in some Chinese cities. With the premiumization trend in developed markets also very much intact, Pernod’s price/mix should quite easily hit +6% YoY for the full year (accelerating from +4% YoY in 2021 and flat in 2020). Helped by premiumization, Pernod has been able to flex its pricing power across the portfolio thus far, offsetting much of the recent step-up in commodity costs. Combined with the net revenue management capabilities being deployed across the business, expect management to lean further into pricing over the coming months.

An accelerating price/mix from here presents healthy upside to the 4-7% sales growth target in 2023 while also protecting margins from inflationary pressures. Successful execution should also allow operating leverage benefits to kick in, which, combined with the ~€750m buybacks planned for 2022, clears the path for upward EPS revisions in the coming months.

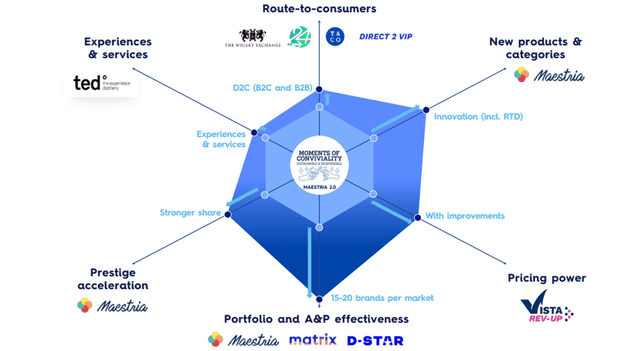

Catching Up on the Digital Transformation Front

Pernod spent most of the afternoon session of its CMD presentation emphasizing the buildout of its proprietary in-house data and digital capabilities as part of its business model transformation efforts. Early details have been promising – the Conviviality platform will leverage Pernod’s extensive brand portfolio and route-to-market capabilities to map out tailored solutions based on consumer needs. Given the company has >240 brands across >80 market companies, activating more brands (i.e., driving higher turnover vs. sitting on the shelf) will allow for accelerated and diversified growth opportunities. Management has guided to activating 15-20 brands/year in its markets going forward – well above the prior activation run-rate of 6-8 brands.

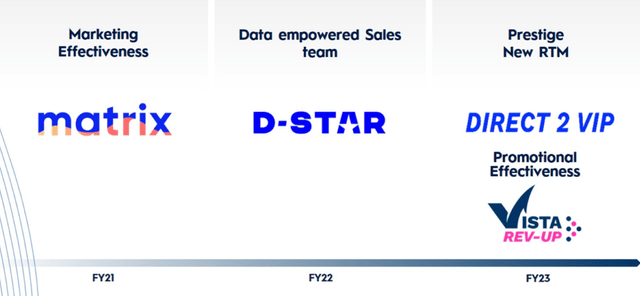

Efforts here also go a long way toward addressing investor concerns about Pernod’s lagging digital capabilities relative to Diageo. Pernod’s “Matrix,” for instance, has close parallels with Diageo’s “marketing catalyst” (both use machine learning capabilities to optimize marketing mix and advertising effectiveness), whilst the “D-Star” sales tool appears to be a direct response to Diageo’s “EDGE” tool (both use data and artificial intelligence for more effective targeting).

A Defensive Pick to Ride the Macro Turbulence

Pernod’s mid-term growth algorithm remains intact, supported by a diverse, high-quality brand portfolio as well as a geographic foothold in attractive growth markets such as China and India. Plus, the company has made strong progress on the digital front and looks set to catch up with first-mover Diageo (DiageoOne, Edge365) sooner rather than later. As the secular revenue growth tailwinds and operating leverage benefits continue to filter through to the P&L, I see the valuation gap relative to its closest peer Diageo narrowing over time. While a recession scenario could result in pressure on the valuation multiple, Pernod’s exposure to higher-income consumers and significantly de-levered balance sheet (vs. the 2008 recession) should support resilient earnings growth through the turbulence.

Be the first to comment