Derick Hudson/iStock Editorial via Getty Images

Leading wine and spirits company Pernod Ricard’s (OTCPK:PDRDF) full-year organic EBIT outperformance should come as no major surprise to investors coming on the heels of similarly strong reporting from its listed peers. The biggest positive was the upbeat commentary from management, calling for pricing to be even stronger in FY23 (vs. the mid-single digit % gains in FY22). Coupled with potential operating efficiencies, the company should see ample support for its gross and operating margins, with incremental upside in the cards if execution is better than expected.

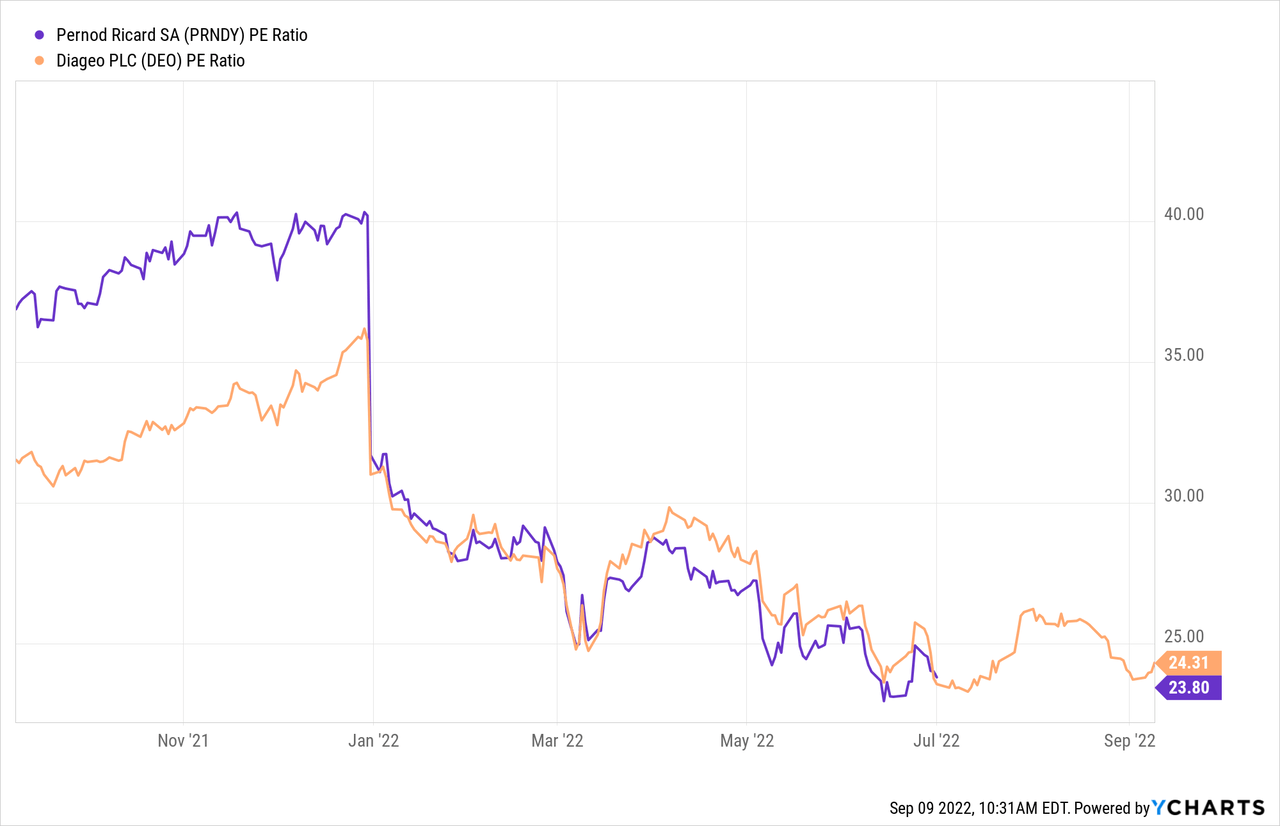

Plus, its diversified exposure across categories and price points makes Pernod one of the best-positioned names to navigate any near-term trade-up hurdles. Yet, Pernod stock trades at a wide discount to key peer Diageo (DEO) despite its best-in-class growth and margin profile. The updated EUR500m-750m buyback planned for FY23 (mid-single-digit % of average daily traded volume) presents a key re-rating catalyst for the stock.

Solid FY22 Growth Trends Despite the Headwinds

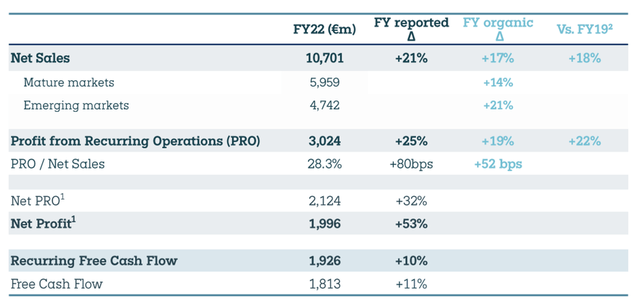

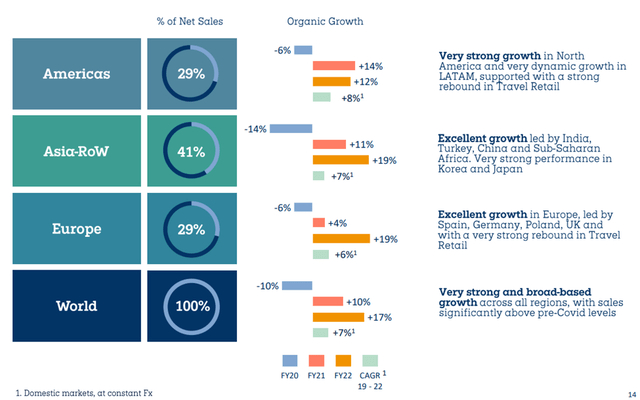

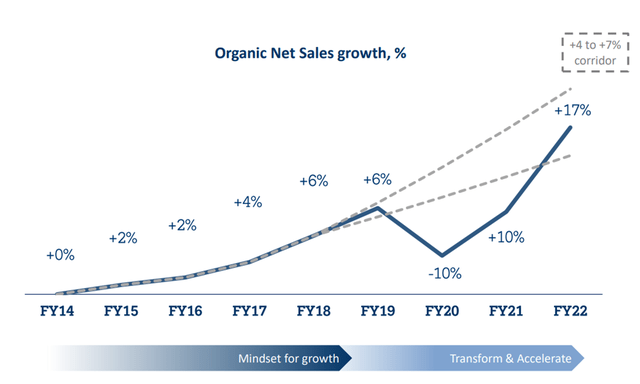

While Q4 tends to be a seasonally weak quarter due to inventory adjustments ahead of the new fiscal year, Pernod capped off FY22 with +17.0% organic sales growth, implying an impressive +14.0% organic growth print in Q4 2022. The outperformance was down to strength in Asia and Europe, partially offset by the Americas. The Asian growth was a positive surprise – while China lockdowns through the quarter weighed on expectations, sales momentum accelerated for India at +26% on a full-year basis.

Management also noted positive momentum in China from June following the easing of COVID lockdowns – a reassuring sign for investors given the softer +5% China growth for FY22 implies a sharp slowdown in Q4 relative to the +12% growth trend through the first three quarters. Of note, the China business also ended the fiscal year with healthy inventory levels, supporting steady price increases across key brands.

On the other hand, the Americas segment (~30% revenue contribution) delivered headline growth of +8%, implying a Q4 slowdown relative to the +13% in the first three quarters. Key growth drivers include the specialty portfolio (e.g., US Whiskies, Agave portfolio, and Redbreast), along with strong price/mix benefits ahead of the next round of price increases in September/October. Good news came out of Europe, though, as FY22 organic revenue growth came in at +19%, leading to reported revenue of EUR3.1bn. In addition to the FX boost (Pernod benefits from the weak EUR), the further recovery of on-trade focused markets such as Spain (+36%) and Italy (+42%) also helped, along with resilience in the UK.

Profitability Beat Supports Upsized Capital Return

The FY22 growth translated into stronger margins as well – Pernod’s full-year gross margin rose +10bps, with the H2 2022 numbers benefiting from pricing despite the China lockdowns. Marketing spending was slightly higher at ~16% of net sales (up 10bps YoY), but operating leverage benefits more than compensated for it (~100bps from marketing and ~20bps from structure costs). As a result, the FY22 organic EBIT margin was up an impressive ~130bps from pre-COVID levels and well ahead of company guidance. In turn, this also led to a net profit beat, supported by a lower tax rate for the fiscal year.

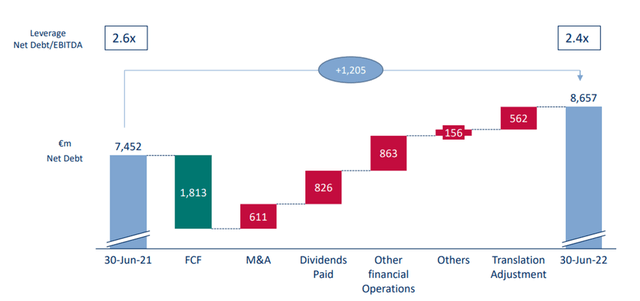

With another solid year of profitability under its belt, Pernod’s balance sheet looks healthier at a net debt/EBITDA of 2.4x. Given the key financial priorities (organic investment, portfolio management, and dividend distribution) have also been met, Pernod has ample capacity for a new round of buybacks. At EUR500-750m, the latest share buyback program for the coming fiscal year is well ahead of expectations and, coupled with the >30% dividend increase, bodes well for future capital return upside.

No Explicit Guidance, but the Near-Term Outlook is Favorable

Unsurprisingly, Pernod (like Diageo) refrained from setting specific guidance numbers for FY23. Instead, management reaffirmed the mid-term growth targets laid out at this year’s capital markets day at +4-7% organic revenue growth and 50-60bps/year of operating leverage. The commentary on the webcast was upbeat, though, with Pernod citing “dynamic, broad-based net sales growth” and a good start to Q1 2023.

This likely signals Pernod’s pricing has seen a positive response thus far – a good sign heading into another year of planned mid-single-digit % pricing globally. Coupled with product mix benefits and a volume recovery following the Russia-Ukraine shock this year, a high-single-digit growth outcome looks well within reach, in my view. Category trends have also been solid in the US and emerging markets, while even with on-trade risks in Europe, off-trade should offer resilience through any macro downturns. In the meantime, channel inventory levels are healthy as well, particularly in the US and China, likely allowing for more pricing gains in the coming quarters.

Margins are tougher to call, though, with management offering little color on the achievability of the 50-60bps organic EBIT margin expansion for FY23-25. For now, Pernod sees a flattish YoY gross margin expansion and some operating leverage – a potentially conservative outlook given pricing accelerated in H2 2022 and could provide some carryover benefits in FY23 as well. Plus, there remain ample operational efficiency gains to be unlocked throughout the supply chain; successful implementation here would go a long way toward protecting the margin profile against inflationary headwinds.

Finally, FX gains (mainly from the weaker EUR) offer a tailwind for FY23 numbers as well, so barring any unforeseen shocks, I see room for upward EPS revisions down the line. In turn, this should translate into strong FCF generation and more balance sheet capacity (vs. net debt/EBITDA at 2.4x in FY22), paving the way for another upsized buyback.

Robust Fundamentals Support Re-Rating Potential

Building off the strong FY22 results and a solid start to FY23 on expectations of “significantly positive” FX support, Pernod looks set for more beat-and-raise quarters ahead. Management’s timely investments into building out revenue growth management capabilities should help protect margins against ongoing inflation as well, supporting its pricing power. Plus, Pernod boasts a strong and diversified brand portfolio built over decades, along with a balanced geographic footprint and strong balance sheet, all of which should help the company manage macro risks and further pandemic-related lockdowns in China.

The current valuation likely incorporates a fair bit of (unwarranted) skepticism, though, at the relative P/E discount to Diageo. Yet, with an expanded buyback to be deployed through FY23 (mid-single-digit % of daily volume), there are clear re-rating catalysts on the horizon.

Be the first to comment