tibu/iStock via Getty Images

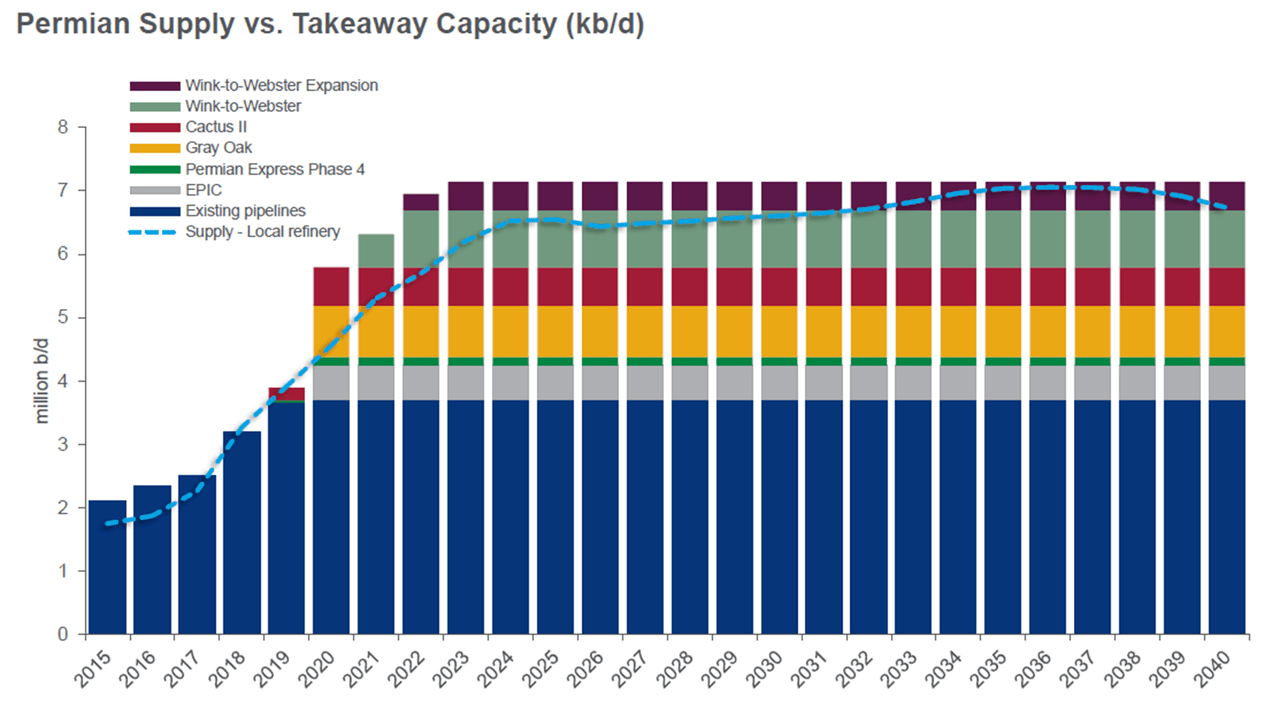

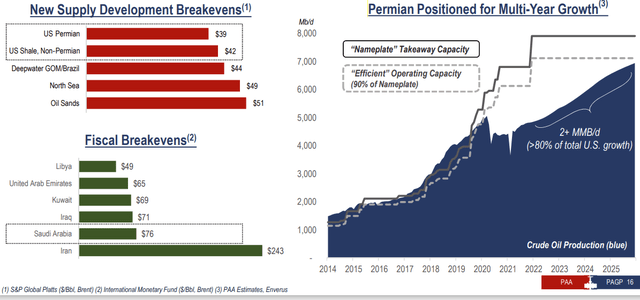

Crude oil focused midstreams operating in the Permian have been staring down a major problem over the past several years: overcapacity. 2016 – 2020 was best characterized as a frantic rush for infrastructure development in Texas, with many struggling to lay enough pipe to keep up with Permian production growth – both levels at the time and forecast rates. In fact, if we wind back the clock to 2019, many of the world’s renowned energy analysts were forecasting that Permian production would start to throw off between 7.0-8.5 million barrels per day (“mmbpd”) of crude oil by 2025. Wood-Mackenzie, while on the lower side of those estimates, was busy advocating for more capacity in 2019, stating that “the current Permian crude pipeline overbuild is only temporary”.

The coronavirus changed all that. The Permian has only just recently recovered to pre-pandemic production rates of 5.0 mmbpd, and guided capital austerity by producers going forward has significantly changed longer term projections on just how many barrels of crude will be pulled from the ground each year. For perspective, well completions would need to get back to the 500 per month range to support 7.0 mmbpd of production, a more than 40.0% increase from current levels. With many large producers in the Permian guiding to flat production rates in 2022 (Diamondback Energy (FANG), Devon Energy (DVN), others), those with mild growth plans like Exxon Mobil (XOM) or EOG Resources (EOG) are not going to be able to bridge that gap – even with the help of private drillers which have been much more willing to drill more to take advantage of current prices.

This presents a problem for asset owners in the area. Plains All American (PAA), Enterprise Products Partners (EPD), Energy Transfer (ET), and Magellan Midstream (MMP) combined own roughly 60.0% share of the current 7.6 mmbpd of Permian takeaway capacity. Even if you take the Plains All American outlook below at face value (which is above most forecasts), there is a yawning glut of excess capacity that will not be solved as these companies deal with a fair amount of asset recontracting over the 2022-2025 timeframe.

Midstream Flexibility

There is luckily more than one way to solve this issue, however. Oil production growth seems likely in the Permian and that is one avenue, but it is not guaranteed. Midstream pipelines currently targeting crude service could swap to other products, and that is a more permanent and desirable fix. Why would this happen? After all, pipelines are highly valuable assets that have minimal operating costs once up and running; there is little incentive to close them down.

There are incentives to convert though. Late in December, Magellan Midstream announced that it was exploring options to convert its Longhorn Pipeline to other forms of service. Enterprise Products Partners has also floated the idea of converting some of its pipelines to support carbon capture, utilization, and storage (“CCUS”) initiatives, at least so long as there is transparency and a firm outlook on the margin profile to do so. Underutilized assets in the Permian are a perfect use for that, particularly with so many potential injection well candidates nearby.

Natural gas conversion remains the easy answer until government policy comes into place. At current production rates, natural gas production in the Permian will outstrip takeaway capacity as early as 2024. With the days of flaring behind us, the conversion of a couple of crude oil pipelines to natural gas service knocks out two birds with one stone: solving natural gas takeaway at a time when even Texas pipeline permitting and construction can be difficult (remember Kinder Morgan (KMI) issues with Permian Highway) and solving the crude overcapacity problem. Swapping over is just a matter of pipeline cleaning and installation of compression. Overall costs are mild and the turnaround is pretty quick. While crude oil to natural gas conversions are more rare – mainly hurt by the fact that crude pipelines are typically lower diameter so they do not flow a lot of natural gas – spot rates in the Permian would imply very strong rates of return on conversion.

I would not be surprised to see at least one conversion announced in 2022 from one of these parties, which would go a long way to getting pipeline utilization back into a more healthy 80.0-90.0% utilization range. Longhorn Pipeline for instance has 275,000 barrels per day of capacity. Converting it and a similar sized pipeline would take 500,000 barrels of capacity offline, putting utilization at 75.0% given my own estimate of Permian production exiting 2022. That is well within spitting distance of a healthy profile.

Takeaways

Crude oil pipeline supply in the Permian is currently overbuilt. However, that gap is shrinking by the day as the basin continues to earn a disproportionate share of active rigs compared to pre-pandemic levels. Conversion of pipelines to alternative forms of service are currently quite viable, and I think utilization rates will improve due to actions on both ends of the equation: higher crude production and lower pipeline availability. Because of this, and contrary to some in the market, I think the issues in the area are manageable.

Concerns on Permian recontracting are a major reason for sour sentiment in several of the names mentioned earlier, particularly Plains All American which has the largest market share of Permian crude service and also the highest share of EBITDA coming from the region. Expect a sigh of relief from the market as these firms tackle this issue.

Be the first to comment