greenbutterfly/iStock via Getty Images

Investment Thesis

Perficient, Inc. (NASDAQ:PRFT) provides digital solutions to various business sectors. The company recently announced the acquisition of Inflection Point, which I believe can act as a primary catalyst to boost the company’s growth by creating a strong presence in the market. Further, this growth can remain sustainable, considering the massive rising demand for digital solutions.

About PRFT

PRFT is a digital consultancy that develops and delivers end-to-end digital solutions mainly to the healthcare, automotive, consumer markets, telecommunications, manufacturing, energy and utilities, life sciences, and financial services markets, including the banking and insurance sectors. It offers digital technology to clients to improve productivity, enhance its relations with its stakeholders, reduce information technology costs, and identify & target new opportunities in the market. The company deals primarily in six service categories: Strategy & Consulting, Data & Intelligence, Platforms & Technologies, Customer Experience & Digital Marketing, Innovation & Product Development, and Optimized Global Delivery. It generates revenue from Professional Services and Sales of Hardware and Software. Professional service revenues are generated from developing and implementing technology infrastructure and software applications, whereas other service revenues consist of referral fees, hosting fees, and maintenance agreements. It has a large client base spread across multiple locations throughout North America. The company’s target customer base mainly includes companies with more than one billion in annual revenue. Software and hardware revenue is derived from income from third-party software & hardware resale and income from internally developed software. The company is on a growth spree and has experienced strong revenue and EPS growth in the past.

Revenue and Earnings Trends

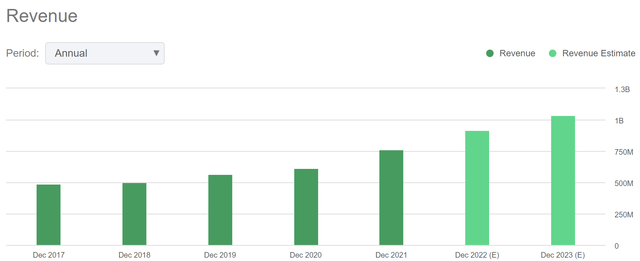

Revenue Trends (Seeking Alpha)

We can see in the above chart that the company has been on a growth spree for the last three years. The revenue has grown from $565.53 million in FY2019 to $761.03 million in FY2021 resulting in a 3-year CAGR of 17.07%. The company has reported revenue growth of 26.52% YoY in FY2021 compared to revenue of FY2020. Most of the company’s growth is organic and driven by the strong demand for its digital services in end markets. I believe the demand might continue in the coming years as the company is still experiencing strong demand in healthcare, financial services, automotive, energy, and utility verticals. The global Covid-19 pandemic has accelerated the adoption of digital solutions by businesses in nearly all industries. Therefore, the company is experiencing a significant rise in deal volume, which can support the strong demand in the end markets and fuel strong revenue growth in the coming years. After considering all these factors, I think the seeking alpha’s estimates about revenue in FY2022 and FY2023 are correct. According to seeking alpha, the company might achieve revenue of $916.08 million and $1.03 billion in FY2022 and FY2023, respectively. These estimates show that the company can achieve a 3-year CAGR of 10.61%. The company has also experienced strong EPS growth.

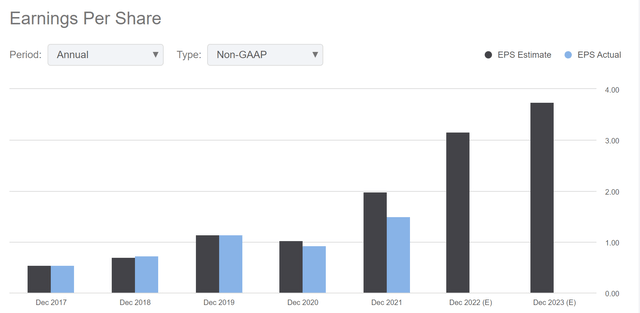

EPS Trends (Seeking Alpha)

The company’s EPS has grown from $1.15 in FY2019 to $1.50 in FY2021, resulting in a 3-year CAGR of 34.08%. The company’s EPS significantly increased last year as it has shown 58.20% YoY growth in FY2021. The 3-year EPS CAGR has surpassed the 3-year revenue CAGR by a huge margin, indicating that the company has strong operating and financial leverage. In FY2022, the company is experiencing a strong EPS growth as in the first half; it surpassed the full-year EPS of FY2021. The company has estimated that the full-year EPS of FY2022 might be $4.36. After considering the strong demand and revenue growth, I think the company’s estimates are conservative, and the real EPS might be $4.50.

Acquisition of Inflection Point

The global Covid-19 pandemic has accelerated the adoption of digital solutions by businesses in nearly all industries, including small-scale businesses. After the pandemic, the significance and demand for digital platforms have increased rapidly. In addition to this, the services provided by the company greatly help their clients to reduce the cost of customer acquisition, supply, and management. It also enables them to access real-time information about their partners, distributors, and suppliers. These factors have helped the digital consultancy market to gain new business opportunities and expand its scope. In this increasing demand scenario, the company recently announced the acquisition of Inflection Point, a software development & product development company with recurring revenue of $15 million. Inflection Point can strengthen the company’s nearshore delivery capabilities with improved agile software design, development & testing capacity. The addition of Inflection Point can expand the company’s product offerings with its expertise in product development, e-commerce, digital marketing services, and web content management, which I think can provide a competitive advantage to PRFT. This additional nearshore software development location will be in Mexico, which can help the company to expand its market presence across Latin America. This acquisition can also help to develop relationships with Fortune 1000 customers from several industries, including healthcare, financial services, education, high tech, and hospitality sectors, which can significantly boost revenue and earnings. Considering all the above factors, I believe this acquisition can act as a primary catalyst to accelerate the company’s growth and increase the company’s profit margins, which might be driven by enhanced innovation, increased market presence, and developing relationships with new clients.

What is the Main Risk Faced by PRFT?

Evolving Environment and Threat of New Entrants

The ability of the company to develop and implement services and solutions that foresee & respond to rapid changes in technology & industry advances by new entrants in order to suit the evolving needs of clients is essential to its success. Mobility, cloud computing, software as a service, artificial intelligence, machine learning, and the analysis of massive volumes of data are currently areas of major development. These technological advancements may significantly impact the price and use of technology by customers. The company’s growth strategy is focused on adapting to these advancements by fostering innovation within its core business and through new business efforts outside of its main industry that will allow it to stand out with its services and solutions. Services and the ability to create and retain a competitive edge may suffer if the firm does not sufficiently invest in new technology and industry advancements or if it does not make the right strategic investments to adapt to these developments and successfully drive innovation. The company also operates in an industry that has a low entry barrier. Its offers could become less distinct or less competitive compared to alternatives thanks to new services or technologies provided by rivals or new entrants, which could negatively impact its operational results.

Valuation

The rising demand after the Covid-19 outbreak and the acquisition of Inflection Point can drive the future growth of the company’s revenue and profitability. After considering these factors, I am estimating EPS of $4.50 for FY2023, which gives the forward P/E ratio of 14.6x. After comparing the forward P/E ratio of 14.6x with the sector median of 16.65x, I think we can say that the company is undervalued. The company is facing a risk of being unable to adapt itself to an evolving environment and the threat of low entry barriers. I think the Inflection Point acquisition can mitigate this risk with the expanded service offerings and enhanced agile software design. Hence, I believe the company can trade above its sector median in the coming years. After considering the potential growth factors of the company, I estimate the company might trade at a P/E ratio of 18x, giving the target price of $81, which is a 23.4% upside compared to the current share price of $65.66.

Conclusion

The company has recently announced the acquisition of Inflection Point to strengthen its nearshore delivery which can drive the company’s growth due to factors such as diversified product offerings, increased market presence, and customer acquisition, further increasing its profit margins. In addition, the demand for digital solutions is also expected to rise in the future, which can keep the company’s growth sustainable. After considering all these factors, I assign a buy rating for PRFT.

Be the first to comment