JHVEPhoto

Dear readers/followers,

The time has come to revisit Pentair (NYSE:PNR), a company I reviewed in September. Since that time and the initiation of my position, the company has more or less performed in line with market trends, not delivering any sort of exciting trends. But, I continue to believe that this is only the calm before the storm.

Pentair was massively overvalued in COVID-19, to levels never before seen. However, now it’s being traded like trash , which it decidedly is not, and which is also not supported by current trends.

Let me show you what the company has going for it.

Revisiting Pentair and its upside

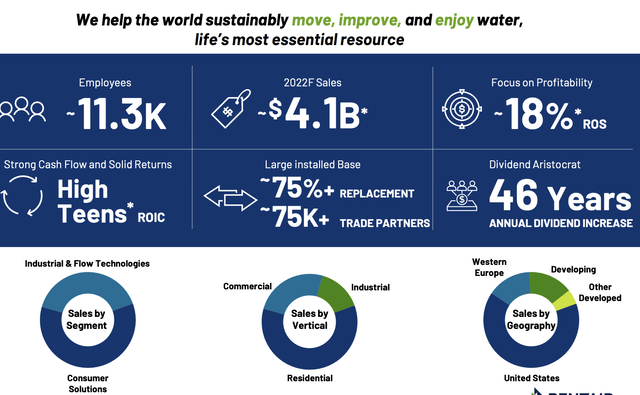

I made very clear in my first article why I view this company as being fundamentally attractive. The business is focused on various types of flow technologies. Two reportable segments make up around $4b in annual sales with around $700-$900M in income per year, with sales coming from Consumer Solutions, which designs, manufactures, and sells commercial pool equipment and related accessories, as well as residential water treatment products, as well as Industrial & Flow Tech, a segment that focuses on fluid treatment products for industrial and large-scale applications.

Basically, if you’re working with food and beverage, fluid separation, water, and wastewater treatment, fire impression, or agricultural and crop exposure, you have something to do with segments that Pentair works with.

The company has strong competition in some of these segments, even companies I tend to invest in. Alfa Laval (OTCPK:ALFVF) is one of them.

Input materials for the business are primarily steel and electronics, as well as plastics and paints.

Fundamentally, the company isn’t as good as Alfa, with a BBB- that isn’t improved, and isn’t the best credit rating out there – but Pentair doesn’t have the best debt situation either, so that makes sense.

Remember, though, Pentair is in the middle of a transformation that’s been ongoing for around 2 years at this point. The goals are to drive margin expansion and growth through the reduction of complexity and streamlining. At least 300 bps worth of margin expansion in the next 3 fiscals through a mix of complexity reduction, increasing speed of decision-making, developing and modernizing IT. So far, this program is delivering excellent results and EPS growth has not in any way slowed down. 2021 saw 36% of EPS growth, and 10% is expected for 2022 and near-double digits for the next years until 2024E.

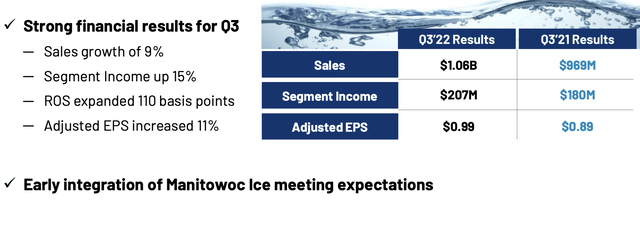

We have 3Q22 results to review – and fortunately, these results are very positive. The company reported top-line sales growth of 9%, but more importantly income increase, implying the company is beating the current inflation and input pricing issue trends through its measures, by increasing both segment income and adjusted EPS.

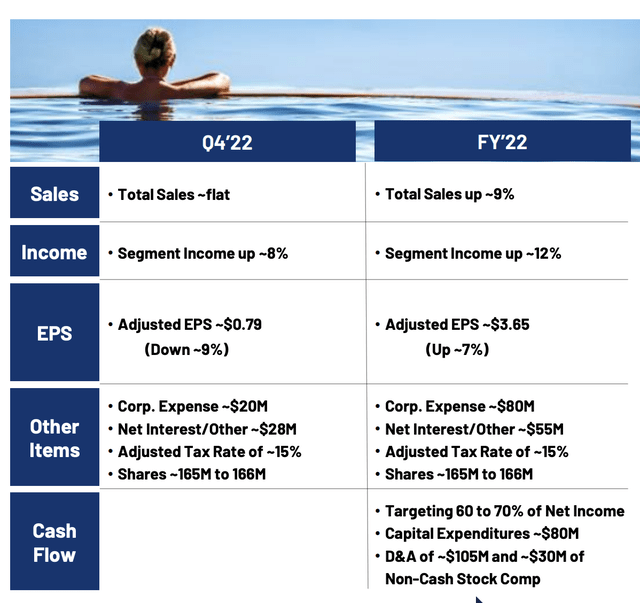

We have guidance for both Q4 and for FY22, and the company believes itself to be positioned well not only to deliver a good 2022 but to deliver excellent earnings for 2023 as well.

The company’s businesses all delivered good revenues and results for the quarter. Pricing was the key here with pricing changes, and acquisitions driving the positive sales results, despite an actual lower sales volume in terms of units. Consumer solutions drove an 8% YoY sales improvement and a double-digit improvement in income, while Industrial & Flow tech was even better – double-digit sales and a 25% segment income increase.

The company’s strategies are working. The reduction in complexity and processes are doing wonders for the company’s results, and the company’s debt situation, while not improved, is somewhat better. The biggest issue in terms of debt is that over 65% of the company’s current debt is at variable rates, with only 33% of $2.5B fixed, which means some exposure to the current fluctuations. With an average rate of 4.4% at this time, it’s likely we’ll see this increase. I do believe that there is some exaggeration of the risk here because the actual net debt/EBITDA on an adjusted/proforma basis is 2.6x, which isn’t all that high.

As I said, we have a full-year outlook.

The company expects inventory correction in the consumer segment, as well as increasing headwinds from FX – weighed up in turn by momentum on transformation, and improvements from the recent Manitowoc Ice M&A.

As I mentioned in my first article, Pentair isn’t a massive dividend-paying stock. In fact, in terms of dividends, it’s minuscule. Even at today’s troughing, sub-15x P/E valuations, that dividend is less than 2%. Of course, it’s extremely well-covered with less than 30% payout in terms of adjusted EPS, leaving ample room for the company to increase. I don’t foresee that they will do this, though, because Pentair’s dividend has never been a high priority for the company – so it shouldn’t be for us.

That’s okay though – because we have different upsides aside from the sub-2%.

The company does have strong demand, and a good backlog and its market position allow it to absorb price increases and inflation by passing costs along to consumers. The recent results are really just a continuation of the positive 3Q22 results.

There are several key main arguments for why this company is a potentially attractive prospect. We have an industry leader with a powerful portfolio, experiencing positive trends, and working with a sustainable business model with good growth initiatives. I look forward to seeing more from the transformation program.

The company has really crashed this year – which is bad for former shareholders, but good if we’re not yet “In” and looking to invest. Fortunately, that’s exactly the position we’re currently in.

Let’s take a look at the updated valuation thesis.

Pentair’s valuation

The fact that the valuation has really gone “Nowhere” since my last piece means that we’re looking mostly at a re-iteration of what I delivered to you in my last review.

Because we’re talking about a market leader trading at a mixed P/E of 12.34x – which usually trades closer to 20x, and has recently traded at well above 20x.

To any estimated valuation of close to 15x P/E, the company’s current forecasts give us 18% per year, to a total of close to 47%. And that’s to a conservative 15x P/E, not a return to premium. So your potential for making returns here is high. Even if we consider a 13.8x P/E as a sort of target, you’d still be raking in 12% annual RoR until 2024E.

The reason I’m talking lower than full normalization here, which by the way would give you returns like this…

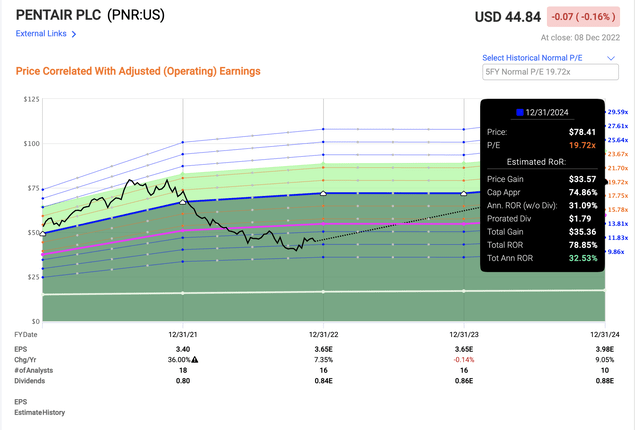

Pentair upside (F.A.S.T graphs)

…but the simple fact is that there are forecast inaccuracies that are beyond most things we’ve seen here. Even if the upside is very high – and it is – S&P Global sees a price target range of $41 to $77/share, which gives us very limited downside and significant upside. An average target of $58 gives us an average upside of close to 30%.

When people talk about specific valuation or company risks on Pentair, we’re usually talking about the very limited yield, which means that investments in bonds or treasuries can yield more appeal – especially as rates start to rise.

However, given the very real appreciation potential in this business, I would see Pentair as materially more attractive than any sort of treasury, provided that you have the time to wait for it to normalize.

This company is a market leader. While peers exist, the company’s position in NA and other markets is solid. My thesis for the company is simple – it’s undervalued, and I would put it at the very least at 15x P/E.

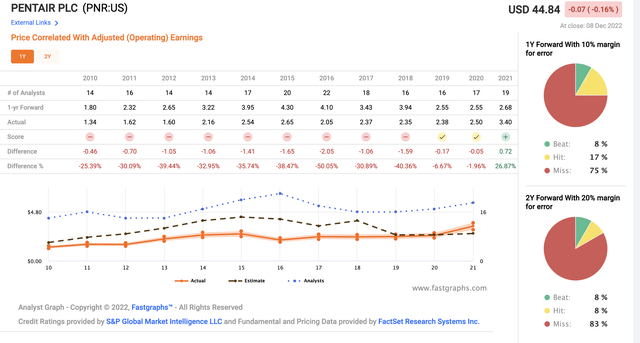

However, the reason I’m so cautious about normalization is how terrible forecast accuracy is. Analysts here have missed to accurately forecast this company for almost 10 years straight.

Pentair valuation accuracy (F.A.S.T graphs)

Make no mistake, those are some truly abysmal forecasts right there. You’d have better luck flipping a coin than following some of these targets, with misses of over 50%.

It doesn’t take away from the fact that we have an undervalued company here – but it means we probably shouldn’t expect a massive, quick reversal. If it happens – great. I’ve seen it happen before in other investments, like Fortum (OTCPK:FOJCF). I just don’t count on it.

The positive is, that we get an opportunity for an extended period of time to invest in a great business – and Pentair is a great business. There is plenty to like about this potential investment. The price target established of $56/share, here is my updated thesis on Pentair.

Thesis

My thesis on Pentair is as follows:

- Pentair is a quality company in the business of fluid filtering, pool solutions, and other various sorts of water and processing solutions and systems. The company is a market leader in key segments and is in the midst of a transformation. The drawbacks are a low yield, a low credit rating, and forecast uncertainties.

- However, valuation shows us a massive, 18-35% annual upside or a total RoR of up to 92% in less than 4 years. Even on the basis of a negative forward trading pattern, we have double-digit upsides that are not to be underestimated.

- Because of that, I’m giving the company a PT of $56 and going for a “Buy” here.

Remember, I’m all about:

-

Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

-

If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

-

If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

-

I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

The company therefore fulfills every single one of my investment criteria – and this makes it a clear “Buy” to me.

Be the first to comment