Keith Lance

Investment Thesis

Penske (NYSE:PAG) was extraordinarily well positioned during the pandemic and ensuing semiconductor shortage, bringing with it record high profits and stock prices. However, as the supply of new cars inevitably returns to pre-pandemic levels and consumer demand in the used market begins to dry up, Penske’s valuation leaves lots of room for downside risk. Additionally, the increased adoption of EVs could prove disastrous for Penske’s business model. Therefore, as the overall car dealership model could soon enter a secular decline, I argue that divesting and selling Penske’s stock at this high valuation is the best course of action for current owners.

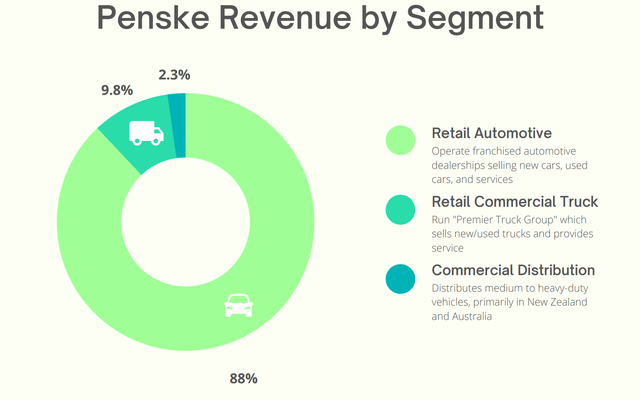

Consisting of 88% of total revenue and roughly 89% of the company’s gross profit, retail automotive is certainly the main driver behind the company’s growth. The semiconductor shortage caused by the pandemic bolstered this segment on multiple fronts. Most obviously, a lack of new cars drove buyers to Penske’s used offerings, which are traditionally much more profitable. According to the National Car Dealerships Association, a dealer can expect to earn $2,000 in profit on an average used car sale compared to only $1,200 on a new car sale.

Additionally, the customer lifetime value of a used car customer is often higher because older cars, on average, will require more ongoing service and maintenance than a new car would. While the recent mass adoption of used cars will likely provide years’ worth of revenue growth in Penske’s service and parts segment, the future of their sales is much less certain. In the past few months, used car listing prices have started to decline, illustrating a softening in demand as new car production increases and consumer confidence continues to worsen.

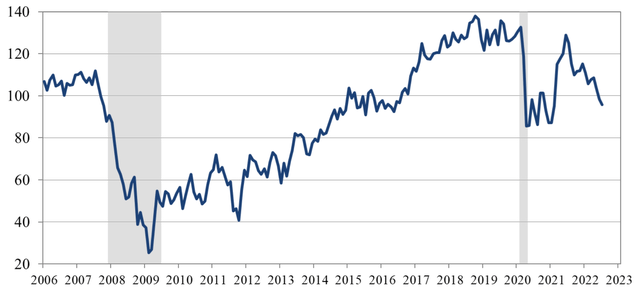

The Conference Board – US Consumer Confidence

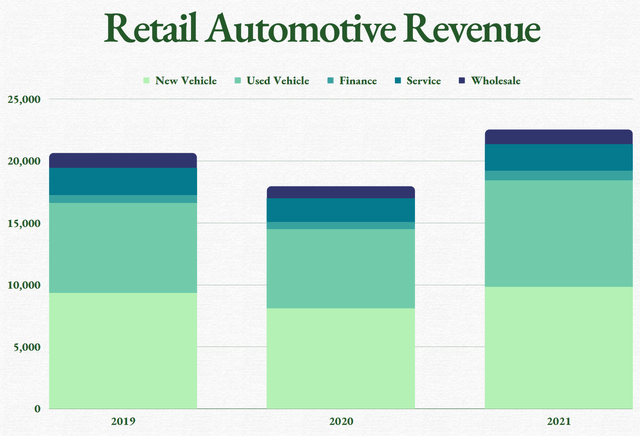

As seen in the graph above, consumer confidence is moving perilously towards 2020 levels, a time when Penske’s revenue dropped, and sales volumes of both new and used cars declined substantially. This can be seen in the graph below.

While many argue that Penske’s business is somewhat insulated from these macroeconomic trends due to the inelastic nature of its very profitable parts and services segment, future developments in the EV market may begin to change this reputation.

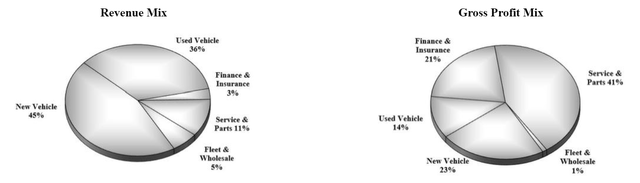

As previously mentioned, many analysts describe the service operations of car dealerships to be the cornerstone of the business as they are significantly more profitable than car sales, provide ongoing recurring revenue from “sticky” customers, and are insulated from economic downturns. For example, in 2019, Penske’s service and parts business made up 11% of the retail auto revenue but over 40% of its gross profit.

While the auto service and repair industry has remained largely unchanged for the past few decades, the large-scale rollout of EVs could bring about drastic changes.

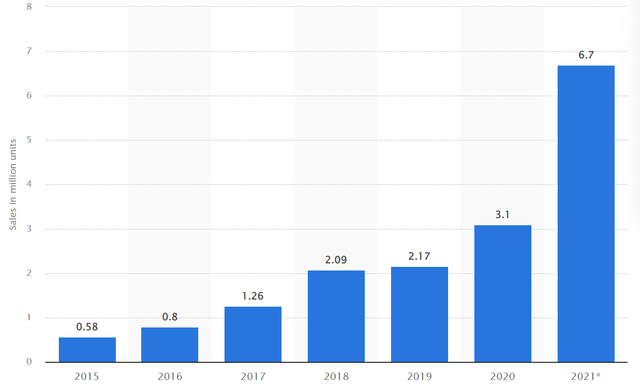

Statista – Estimated plug-in electric light vehicle sales worldwide from 2015 to 2021

In recent years, EV sales have exploded worldwide, growing with an impressive double-digit CAGR. While Penske is involved with the sale of some EV offerings from traditional car manufacturers, like the Mercedes EQS, they are not at all involved with many of the new EV companies, like Tesla (TSLA), which has taken a new DTC model, bypassing intermediaries like Penske. While just this alone is worrying for Penske’s car sales business, the impact EVs would have on their cornerstone service and repair business could be even more dramatic. This is because EVs have very few moving parts when compared to traditional gas-powered cars, and therefore, do not require nearly as much ongoing maintenance.

According to a Consumer Reports study, the lifetime repair and maintenance cost of an EV is half of a traditional ICE (internal combustion engine) vehicle ($4,600 vs. $9,200). Because parts and service are such a large proportion of Penske’s gross profit, any decline in this segment could drastically reduce the overall company’s profitability.

Valuation

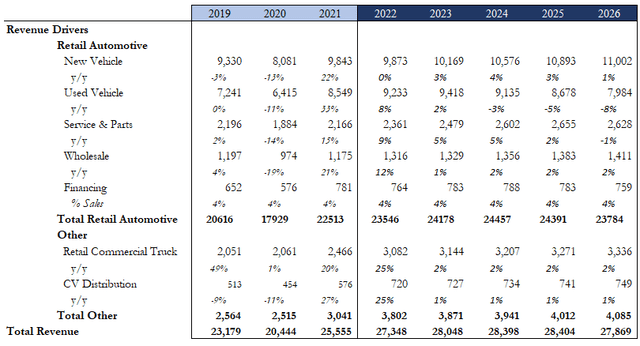

As can be seen from Penske’s recent financial reports, the company is currently in a strong financial state. Revenue increased by 22% in FY21 and its EBITDA reached a new high of $1.8 billion, an over 100% increase since pre-pandemic levels. However, as I discussed throughout the investment thesis, I believe the favorable market conditions that have allowed Penske to reach these impressive financial heights may be changing in the near future. Based on the introduction of EVs, and softening of used car demand among the other talking points mentioned in the investment thesis, the below revenue model represents what I believe to be a possible outcome for Penske.

Company Data, Bloomberg Professional, My Estimates

As can be seen above, an increase in new vehicle sales as global supply increases will lead to a decline in the prices and demand for used vehicles, causing Penske’s used vehicle revenue to slow and eventually drop. Importantly, the decreased number of used vehicles on the road combined with increased EV adoption will decrease revenue in Penske’s highest margin segment, parts and service. While this drop may be gradual and delayed because it is a lagging indicator of the macro shifts at play (a large number of used cars sold recently will still be on the road and need service for several more years), I believe it is inevitable at some point down the road.

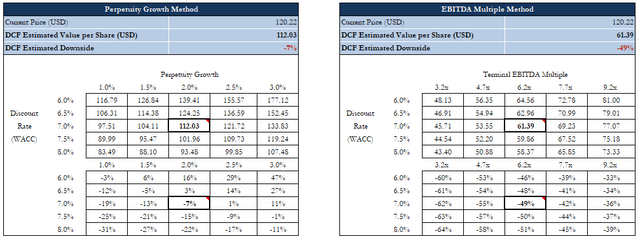

Using these revenue projections in a DCF model (7% WACC, 6.2x exit EV/EBITDA, 2% perpetuity growth rate) illustrates the potential downside to Penske’s stock.

My Estimates, Bloomberg Professional

The average DCF price target here is $86.71, representing a 28% potential downside to the shares. Additionally, the sensitivity tables above show how the downside/upside changes with different WACC, exit multiples, and perpetuity growth rates.

Conclusion

Penske has certainly come out of the pandemic as a financially stronger company. However, there is only so much the company can do, bar a complete shift in company strategy, in the face of macro uncertainty and disrupters in the form of EVs. On the bright side for Penske, EV adoption is still in the single digits and, as of now, the used car market is still much stronger than it was before the pandemic. Therefore, the company may still have several years of growth left in it, and management has ample time to pivot its business model to one more suited for the future economy. However, at Penske’s current valuation, the somewhat substantial long-term risks here outweigh the potential benefits – hence my sell opinion on the shares.

Be the first to comment