Penn is highly attractive of millennials due to its digital presence and is seeing its critical over 55 slot players returning.

Lacheev/iStock via Getty Images

Tuchman’s Law:

“The fact of being on the record makes it appear continuous and ubiquitous whereas it is more likely to have been sporadic both in time and place. Besides, persistence of the normal is usually greater than the effect of the disturbance as we know from our own times.”

Barbra W. Tuchman Pulitzer Prize Historian 1912-1989, author of “The Guns of August.”

We quote Tuchman, one of the most astute observers and scholars of the cataclysmic events of the 20th Century, to support our premise that as utterly horrific as the present events and their consequences are, there is a persistence of normalcy, if you will, that always prevails.

You see words like “unprecedented” and “incomprehensible” – adjectives allied to what seems like an endless media screed of impending doom for the economy and a pandemic that many see as never leaving us. And it’s true that a combination of macro factors and a clearly colossal failure of inept US leadership at every level has brought us to a fearful, inevitable slide toward recession.

But the historical truth is: Been there, done that, the financial media echo chamber notwithstanding.

So investors seeming to get more rattled every day by the news flow – and who can blame them – seek safety. You flee to the sidelines, put your money into cash and equivalents and wait it out. Or you do a relentless house cleaning of your portfolio, exiting all the wannabe tech and consumer discretionary stocks, or reducing your positions. Or you bet on a recession by holding only dividend aristocrats, huge market cap stocks that are proven fortresses against dips, big or little.

What often gets lost in the shuffle in such parlous times is the fact that as historian Tuchman’s Law suggests, life does go on. People conduct their lives, make their adjustments, watch their bucks and pass on replacing the old junker in the garage – for now. Car prices are insane, as is the absurdity of having to wait six months to get one. This “normalcy” imperative in human nature is how we all survive and how through the tumultuous 20th Century, people endured one catastrophe after another.

So when it comes down to re-upholstering if you will, portfolios to face what appears to be a coming recession, investors need to see where safety and value come together in a stock. In mixed market like this, it’s not an easy thing to see. Yet they’re out there.

There are companies more well-armored against recession than others. When you identify one that does have resilience, and it’s also trading at a bargain price, it commands your attention. Thus, we present Penn National Gaming poster child for resilience.

Penn National Gaming (NASDAQ:PENN) armed to the teeth against a coming recession

In brief: Penn is among the most geographically well-balanced, durable, effectively managed companies that have a business model perfectly adapted to endure during a recession: And its balance sheet is strong.

Capsule glimpse 1Q22 results

Revenue: $1.56b a 1.9% beat. Y/y up 22.7%. Every geographic segment posted revenue increases y/y between 15% and 49%.

Adjusted EBITDAR: Up 10.7% y/y to $494m with operating margins down 344 bp but still at 31.6%.

EPS: 29c big miss against estimate of 45c. Among the key culprits, a $50m loss on its digital business and revival of sporadic COVID fears.

Penn repurchased 3.8m shares during the period for $175m, with another $574m remaining available against the total authorized by the board. We should expect to see more given the current bargain basement trading range of the stock going forward.

2020E guidance full year

Revenue: $6.15b-$6.55b.

Adj. EBITARe:$1.9b to $2b.

Pre-recession liquidity position:

Cash on hand (mrq) $1.81b

Cash per share: $10.97

Book value: $24.00

Total debt: $12.9b

Current ratio: 1.88

Price at writing: $27

DCF value est: $61

Market cap: $4.57b

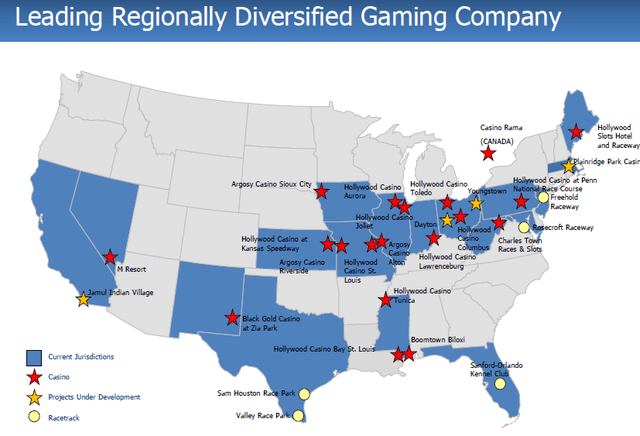

YTD: Stock is down 60% in a 52-week range $26-$86. Buying now is essentially at one year low assuming Mr. Market sees only faint hope of the shares having any catalysts to move them higher against a recession – or no recession. What Mr. Market is telling us I believe is that Penn still faces considerable threats across its 44 property, 20 state footprint, from periodic COVID outbreaks. Wrong. Penn is well armed to steam ahead.

Mr. Market does see some coherence in Penn’s well-thought-out digital presence “flagshipped” by its acquisitions of Barstool for its sports book and the Score for its Canada sports betting efforts. Penn also is stretching its legs in developing in-house IGaming casino real money content.

All this is sensible in terms of monetizing across both live and online verticals, its 25m member data base. The company also is in the lead in implementing a friction-free customer experience now operational in its Pennsylvania properties with 9 more slated to come on by next year.

This is the 3 “c”s: Cordless, contactless, cashless operations. Don’t think that “contactless” implies a reduction in customer service models of high one-on-one contact developed over the years by management. The idea as noted is to eliminate friction in transactions as an infused value of the business model meant to increase customer service interface over time.

It’s also to be noted that Penn continues to market heavily for sports betting business but does not spend anywhere near what sector leaders like DraftKings (DKNG) do. That means two things: One, its total sports betting market share will not move up to tier one position. But despite continuing to lose money like its peers, our take is that it will get profitable in sports betting with a single-digit market share sooner than most.

Overall, some analysts who remain bullish on the stock see the future more and more in digital. Wrong. The company is making inroads, proceeding sensibly in the area. But that, in my view, is not the reason to buy Penn as the economy faces whatever Armageddon that may be coming our way.

The base case rationale for buying Penn now is this:

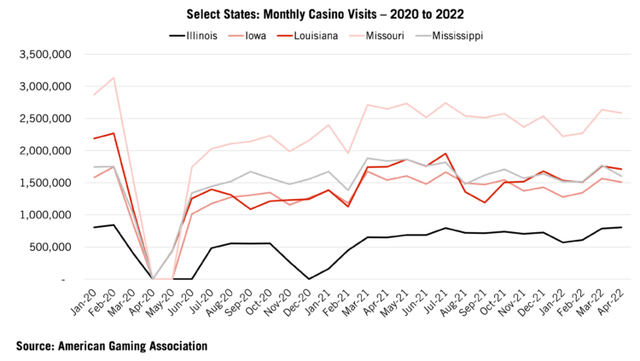

Pent-up demand is real and is growing. In case you have wondered whether the long touted pent-up demand is real, note that the American Gaming Association reported that US commercial gross gaming revenue as shown below is up 19.33b up y/y 24.3%. There are sporadic outbreaks, brief and mild that do impact visitation to some degree, but they don’t impede the over rising long-term trend of growth. If you note the statewide results you can see why Penn’s geographic spread is a fortress of resilience against recession which does tend to vary in its regional impacts historically.

Penn already has benefited from the return of the core slot player aged 55 and over who had been MIA during the worst COVID period between 2020 and 2021. At the same time, its younger demo play in the millennial sector returned in great numbers responding to considerable promotional effort in the digital verticals. This has been borne out by observations of the Penn casino floors, restaurants, and front desk arrivals by key friends and former associates shared with me since 4Q21.

No matter how difficult it may appear to project annual EPS growth going forward into what’s hoped will be some kind of endgame of COVID, the past is indeed prologue. Over the last three years, Penn’s annual EPS growth has been 39% compounded. Our expectation is that it will go higher in the endgame quarters ahead – assuming no new outbreaks.

In my view, investors at this price de facto are getting Penn’s digital promise for free. With $10 a share in cash and $24 of book value per share, just $3 below the trade, you are entering bargainville.

The 2021 run-up in Penn shares was mostly triggered by the general perception that sports betting stocks would indeed grow like trees to the sky. With its 25m data base added to by a presumed 55 million Barstool stoolies with a heavy gaming penchant, investors bought the gospel of a new age dawning. As reality bit, the sector tumbled, taking Penn with it to a great extent. What Mr. Market had totally missed was that Penn, with or without Barstool was a great stock to own on live gaming fundamentals and geographic footprint alone.

Penn’s Las Vegas footprint is a shrug at best in the Tropicana, a troubled location over the decades. Its best utility is serving as a Vegas destination for Penn’s 25m cardholders who pile up credits in their 44 properties in ten states. So it’s not a competitor there, but in reality, a serviceable marketing tool. And in moving its realty to Gaming and Leisure Properties, Inc. (GLPI) it’s no drag on earnings.

Conclusion

We’re looking for a PT by the end of 2Q23 of $64 at the low range. Our operating assumption is: Lingering COVID dilemmas receding but not totally gone by 4Q23.

Remember that Penn as we know it today is a collection of properties from a core grouping of limited geography and added to strategic step by step with acquisitions over the years. As a result, Penn casinos now bear 10 different “brands” with deep roots in the perceptions of its player population. I believe at the right time and right price we may well see more acquisitions before not too long even further extending Penn’s accretive EPS growth.

Be the first to comment