The drive in business for Penn casinos is dominant, airline woes are of minimal concern, unlike projecting Vegas future vs. lift capacity. This photo for illustration only. sanfel/iStock Editorial via Getty Images

“Though familiarity may not breed contempt, it takes the edge off admiration…” William Hazlitt1778-1830

The relative valuations awarded various gaming stocks by Mr. Market reveals a persistent flaw in thinking: PENN Entertainment, Inc. (NASDAQ:PENN) at $33 a share is the best value in the group by far observed on a landscape on which the business in general is now sitting. But investors have tended to display a “been there, done that” approach to the stock that in our view doesn’t reflect value. They have focused on Penn Entertainment’s sports betting unit and not really given full due to their casinos.

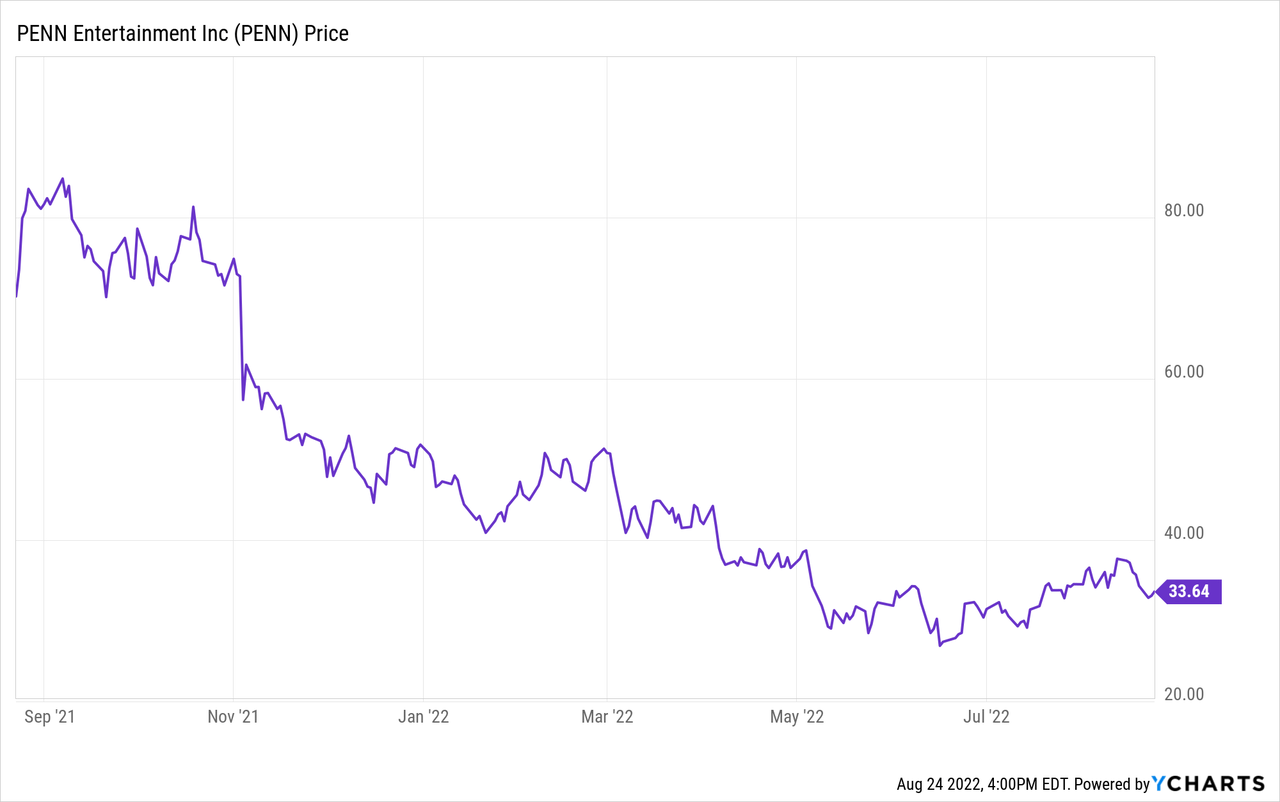

Above: Mr. Market not yet seeing value of fortress U.S. regional positioning.

During the sports betting stock run up of 2019 through 2021, Penn National Gaming (its prior corporate name) stock soared to a high riding on its 38% acquisition of Barstool Sports with its estimated 55 million sports crazy stoolies. The sports betting madness that had sent the entire sector soaring almost discounted the value of Penn’s powerhouse casino business.

The meme attitude toward the stock leaned on the presumption that the Portnoy “stoolie” nation would just be lining up by the millions to place their action on that site, pushing up Penn’s valuation all by itself. That was not to be the case.

Then, after Mr. Market took a closer look at the entire sports betting sector, the stock tumbled. It was as if the big ride had totally left Penn’s real strength into the “so what” stage.

February 1, 2021 $115 a share.

August 22,2021: $83.56 a share. Penn announces it will acquire Canada’s the Score media for $2b in cash/stock.

March 2, 2022: $50.24 a share

June 16h, 2022: $26.61 a share.

Price at writing: $33 a share.

The bear has growled on Penn largely due to EPS worries showing $0.15c a share vs. $1.17 for comparable 2021. Revenues in 2Q were up in all regions except the south, slightly down. But, overall its brick and mortar casino business was thriving in recovery.

By any measure, Penn has now become a news-flow stock related to the perception of recovery in the market of where the pandemic recovery is moving. Overall bullish outlooks on Vegas-based saw knockout gaming, tourist footfall and non-gaming revenue streams rapidly recovering. Adding to this is the widespread belief that the crucial convention business is also in the early recovery stage as the Vegas dominant companies are reporting strong bookings for 2023.

Regional news flow which is also positive is not getting the raves of Vegas—yet. That is largely because there remains lingering questions as to how robust the return of the over 55 slot market is as well as the arrival of millennials into databases due to the magnetic draw of sports betting, particularly the imminent launch of the crucial NFL season.

All this has pushed perception of Penn into the background in the ongoing opera that is the state of gaming industry stocks. From starring roles singing the sports betting arias investors loved, to the status of spear carriers in the misunderstood regional gaming business, Penn’s valuations have escaped many savvy investors. This stock in our view is vastly undervalued.

So what we have today is a disparity in my view between the valuations of Penn peers based on market positioning, geography and upside potential. In this beauty contest it seems to me that Penn has been sent to reside somewhere between honorable mention and an everyone gets a trophy games.

By contrast, in my view, Penn today stands as the most sturdy fortress against recession and lingering covid-19/labor shortages/inflation challenges. A good place to start is its key peer group, up 6 mo. 2022 prices. Note numbers below is apples to apples results and prices with Macau and Las Vegas Strip properties are not added for comparison purposes.

Stock Regional Rev. (ttm) # properties MC

Caesars (CZR) $2.8b 41 $9.8b

MGM Rsts. (MGM) 960m 5 13.5n

Boyd Gaming (BYD) $1.1b 28* 3.9b

Wynn Rsts (WYNN) $210m 1 7.07b

Penn Entertain (PENN) $3.12b 44 5.3b

Estimated 2022 total Penn revenue guidance: $6.2b.

*We have included BYD’s Las Vegas locals market revenues since by most definition the majority of its revenue comes from drive in. The exception is its downtown business, which does draw from Hawaii. But that is a relatively small component of its national spread across most regions of the U.S.

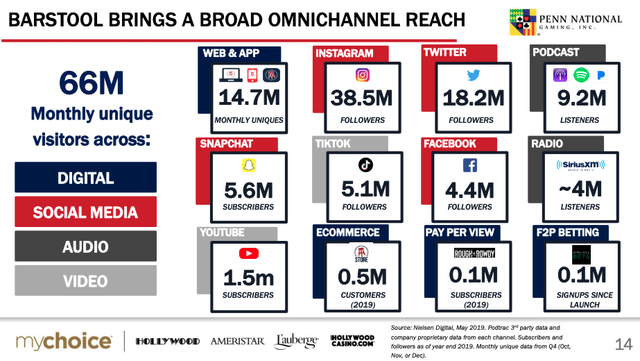

Above: No panacea in stoolies per se, but the core value of acquiring new members using Barstool database made good sense.

Penn’s integrated strategy to infuse its digital verticals with its brick and mortar casinos has resulted in a health boost of the most desirable demos. Sports bettors in large numbers are crossing from Penn sports books onto the casino floor. The in-numbers and demos show Penn has proven its strategy is already working:

Total new database signups this year 1.2m

By age:

21-34: +7%

35-44 +9%

45-54 +6%

55-60 +2%*

65+: 6%*

*Note the older demos have shown lower increased signups related to the fact that the existing database is already heavy in that demo. For them, the robust return of older folks has been ignited to a degree due to the encouraging signs of covid-19 infections in these regions.

What is more instructive here is management’s apparent ability to execute a marketing program that harvests greater numbers of millennials in the prime sports betting ages. The company’s MyChoice data base has risen to over 20 million. While considerably smaller than CZR’s at an estimate 55m, the key lies in the demographic composition, not as much as sheer numbers. The data bases of all the peer operators noted here are substantial. Duplication due to multiple card holding is real. But the key in our view is the focused effort by Penn to use its digital business to build its brick and mortar base.

Follow the money

There are tells in how Penn has lately allocated its assets. We’re not alluding to stock repurchase plans, which it has, like most peers. But to the truest of all litmus tests of casino managements: where are they putting their investments?

Above: Penn’s Morgantown property, the right size for the right demo.

In Penn’s case, they have long passed and continued to pass on Asia-well before the pandemic kill shot appeared. They have also appeared to take a pass on La Vegas. The opening of the massive Resorts World property on the Strip and the coming Fontainebleau (October 2023) will combine to add a total of 7,550 rooms to the Strip.

Right now the Strip has 150,000 first class rooms, so the two new additions will add up to ~5% increase in available rooms. Nobody is suggesting that Vegas is underserved, even as it crawls out of the pandemic. It’s a one-only world destination and has a good future. Yet at the same time, the price of admission in today’s construction and development worlds presages a considerable hurdle rate for developers.

Resorts World Las Vegas cost an estimated $4.3b. Fortunately for management (some of whom I worked with), they have a patient, long-term outlook majority holder in Mr. Lim Kok Thay, Asian billionaire. It will be a long climb to profitability, but they will get there. Marketing costs based on stealing share in Vegas are not getting any cheaper.

On top of this, New York developers who have bought the long-abandoned Fontainebleau project on the north Vegas Strip are promising a breakthrough, spectacular property estimated to cost $6b. Its due October 2023.

They will need to have covid-19 long in the rearview mirror by then-it is hoped. It is also hoped that the north Strip location will grow in popularity.

What this means in our view is that Penn, among peers, has a highly coherent focus and execution strategy confined to the U.S. It sees itself as a cutting edge leader in the digitization of gaming. It is experimenting in test properties with a total cashless gaming, seamless experience for customers system it hopes to eventually expand cashless to its entire 44 property geography.

Sports betting sense and sensibility

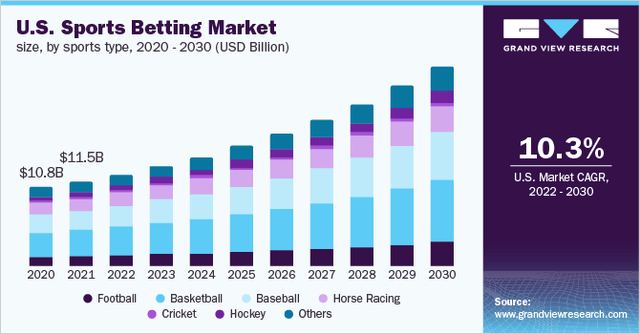

In 2021, for the full year Penn produced $419m in sports betting win, still in the red but getting closer to a goal of turning profitable by mid-2023. Enthusiasm for its sports betting move in buying Barstool in 2020 moved the stock because investors saw the stoolie nation producing monster handle. This was not to be.

It became clear as more and more states legalized and Penn participated in the gold rush mentality by throwing promotional millions to customer acquisition that the stoolie contingents were fine, but not as productive as they first appeared.

As of now, the Barstool Sports Book’s share of the total sports betting market probably sits in the mid to lower-single-digits as an average across all states in action. The domination of top tier platforms: Fan Duel, DraftKings (DKNG), Bet MGM, and Caesars Sports book have a pretty strong lock on about 60% of the total business.

But sheer volume as the strategy unfolded was not what Penn had in mind when it bought Barstool as well as the Score. It is aiming at becoming among the first platforms to turn profitable. It is in the business for more than booking bets on games. It is in sports betting because in the larger picture of its strategic planning for the company, it aims to integrate its entire brick and mortar businesses, using digital as first a marketing tool. Eventually, it sees digital applications as a high margin producer of EBITDA for the corporate totals.

The volatility of Penn’s trading trends over the past several years have never really reflected just how good, how stable and effective its pandemic recovery has been for its brick and mortar business.

Prices at writing:

CZR: $45.91

Rationale: Regionals feeding Vegas flagship through 55m rewards database. Management now moving to refine database with Pareto’s Law in mind: Excessive comping of less valued customers trimmed, more generous comping to top producing customers expanded. A management deal pending long term in Japan. Imminent opening in Danville, Va.

Positive: Size and scale works for them, but many properties need capex, even after massive renovation programs. Las Vegas fortress is a powerhouse of good properties.

Downside: Heavy debt burden of $26.6 bill yields a current ratio of 1.0 market getting antsy with no specific news yet about sale of Strip property.

It’s got a little run room if a property sale is announced, otherwise it’s a hold.

MGM: $34.41

Solid Vegas recovery, good upside in regions, prospects of turning its New York racino into a full service IR, strong balance sheet, management can execute. Continuing Macau crisis holds down possible higher valuations. Equal weight: HOLD.

Boyd Gaming: $55.51

This is the best play in the locals Vegas market with support from its smaller regional properties. Well managed, savvy financial asset allocation. Needs a few more quarters of good news from Downtown Vegas and regions to support a higher PT. But this stock is a long term keeper that will produce strong returns.

I think it has about 15% run room up.

Wynn Resorts Ltd. :$62.21.

Pardons in advance for suggesting here that were Mr. S. Wynn still in the saddle, we would not be talking about the stock as, at best, a hold. The company has a single regional casino that is doing well. It has no apparent designs elsewhere at the moment. The entire key that will unlock the upside would be the easing of China’s zero-tolerance covid-19 policy to liberate Macau. Right now, Wynn is dead-pooled despite its outstanding property portfolio.

Right now it’s a HOLD pending any good news from Macau or Beijing.

Penn Entertainment Inc: Price: $33.69.

Battered by an EBITDA that hasn’t exactly thrilled Mr. Market for 2Q22, the stock has been unduly punished by the swoon in overall sports betting valuations. But looking at its solid geography spread across 44 properties in 20 states where they really have done a great marketing job, I see a higher valuation. I like the coherence of its management strategy and its steady execution of a clear headed goal of discovering the formula to move the customer demo to younger while at the same time, keeping the all important over 55 group happy.

And they intend to build market share leadership with a possible foray into Asia, or even a giant step toward a Vegas flagship. This stock is a no brainer, period.

Generating a probable $6.2b in 2022 revenues, producing strong potential increases in EBITDA while building a sensible controlled cost digital life says to us that at $33 a share, Penn has entered the STRONG BUY territory with a PT of $57 by iQ23.

DCF value I calculate at $46.90.

Be the first to comment