hapabapa/iStock Editorial via Getty Images

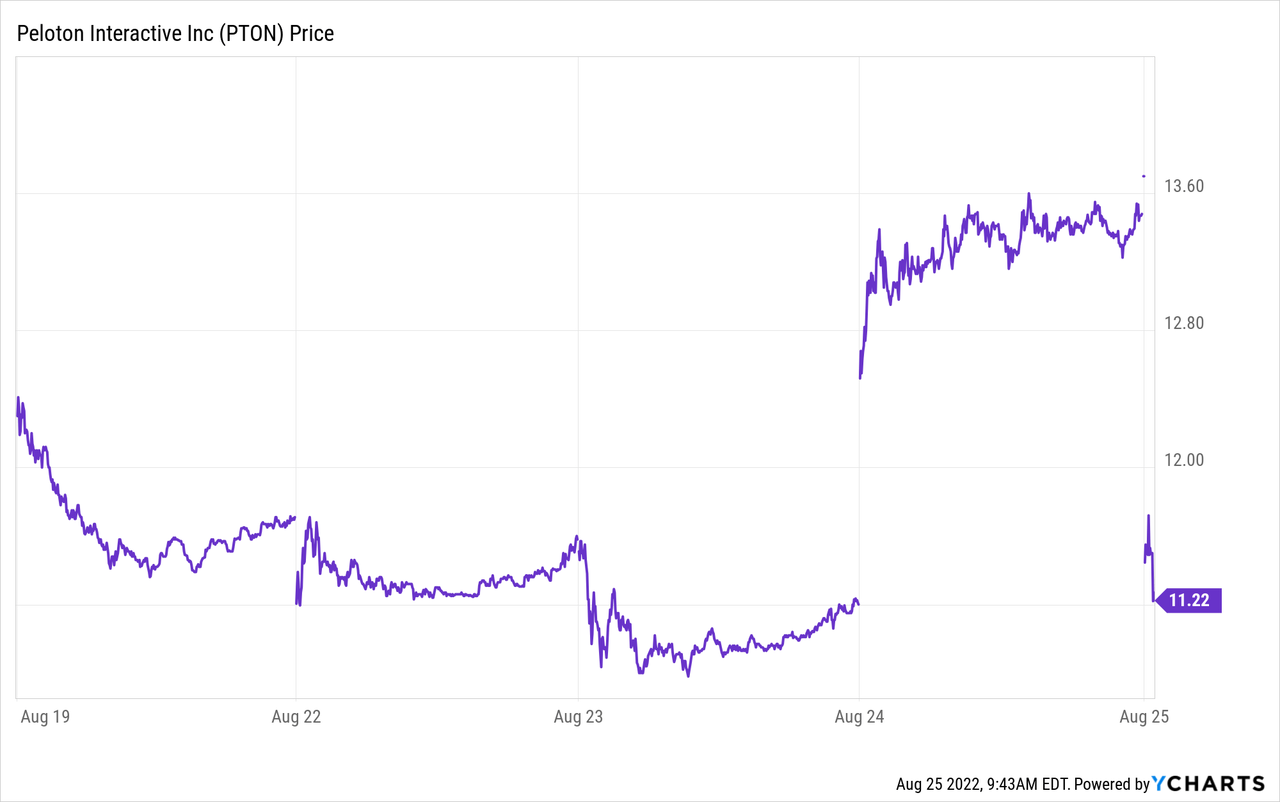

Peloton Interactive (NASDAQ:PTON) shares are taking a spill Thursday. The stock traded down by as much as 15% Thursday morning following a shockingly poor quarter. The company’s fiscal Q4 featured worse-than-expected results, weak guidance, and a rather blunt message from the CEO.

This came just a day after Peloton announced plans to begin selling products on Amazon (AMZN), which had generated substantial trading interest in PTON stock.

However, this earnings report has wiped out the prior rally, and with good reason.

Q4 Results: Ugly Numbers All Around

Peloton’s financial results were astoundingly bad. Revenues plummeted 28% as sales of its hardware products collapsed. The company’s gross margin on said hardware sales plunged to -$290 million. This came, incredibly enough, as it sold only $295 million of connected fitness products. Meaning, in other words, that it took Peloton nearly $2 in costs per $1 of bikes that it sold.

These results were bad enough to drag the company’s entire gross profit — including subscription revenues — into the red. Before, the hardware was losing money to subsidize subscriptions. Now, there’s no gross profit at all. Meanwhile, operating expenses exploded to $1.2 billion on the quarter, up 27% from Q3 of this year and 111% from the same quarter of 2021. The one silver lining is there are a ton of one-time expenses related to layoffs and inventory reductions and Peloton is making moves which will lower recurring costs.

Regardless, the overall numbers are pretty shocking. The company reported a net loss of $1.2 billion for the quarter. Adjusted EBITDA came in at negative $288 million, resulting in a minus 42% EBITDA margin. Meanwhile, the company burned $412 million on a free cash flow basis.

The company does have $1.3 billion of cash on hand, which gives it some breathing room even in the face of these sky-high losses. There isn’t too much time to turn things around, however, as Peloton has more than $3.4 billion in total liabilities. Peloton needs to stop the bleeding and figure out some way to get cash flow at least to breakeven territory.

A bull might be tempted to look past the financial metrics and point to user numbers to try to maintain a positive outlook. However, there’s not much to work with here, either.

Overall users for the quarter fell from 7 million to 6.9 million from the previous quarter. Connected fitness subscriptions were flat at 3.0 million. It gets worse from there.

Total platform workouts plummeted from 184 million to 148 million, down 20% sequentially. This is the reopening slump that some analysts had been anticipating. While Peloton’s user and subscriber numbers are still flat for now, the overall usage of the platform appears to be in sharp decline as folks return to gyms and other alternative training methods. To put it in another number, the average monthly workouts per connected fitness subscription slid from 19 to 15. Combine price hikes with falling engagement and you have the recipe for a struggling subscription offering.

Speaking of that topic, monthly customer churn nearly doubled sequentially, rising from 0.75% to 1.41%. Peloton has paid so much to acquire its average customer; it’s discomforting to see customer retention rates slump the moment that the company engages in serious cost-cutting.

More broadly, this cuts at the whole ethos around Peloton. It established itself as a luxury aspirational brand. Now the company is openly talking about affordability and reaching out to “value-conscious” consumers. This may be the correct direction for Peloton’s long-run survival, but it runs contrary to all the narratives that were necessary to support Peloton’s prior lofty valuation. A budget fitness brand doesn’t generate the sort of market cap that PTON stock reached over the past 24 months.

What Might Peloton Be Worth?

Let’s assume the company is able to cover its losses for the time being and can stabilize its user numbers around current levels. It gets through this dark period and eventually becomes a healthy profitable business.

That would suggest that Peloton can do roughly $1.5 billion in annual subscription revenues. I’m assuming hardware is a zero profit/zero valuation side of the business, which would be a significant improvement from today where the hardware is dramatically loss-making. As it is, subscriptions are the bull thesis on PTON stock.

It seems reasonable to think Peloton could eventually get to a 20% net income margin on its subscription business, or $300 million of net income a year off of $1.5 billion in revenues. Optimists might think that the company has a higher long-term net margin. However, I’d point out that Peloton is currently spending roughly $1.2 billion on sales, general and administrative expenses right now merely to maintain flat subscriber numbers. I’m not convinced you can slash this too far without seeing further erosion in subscriber churn.

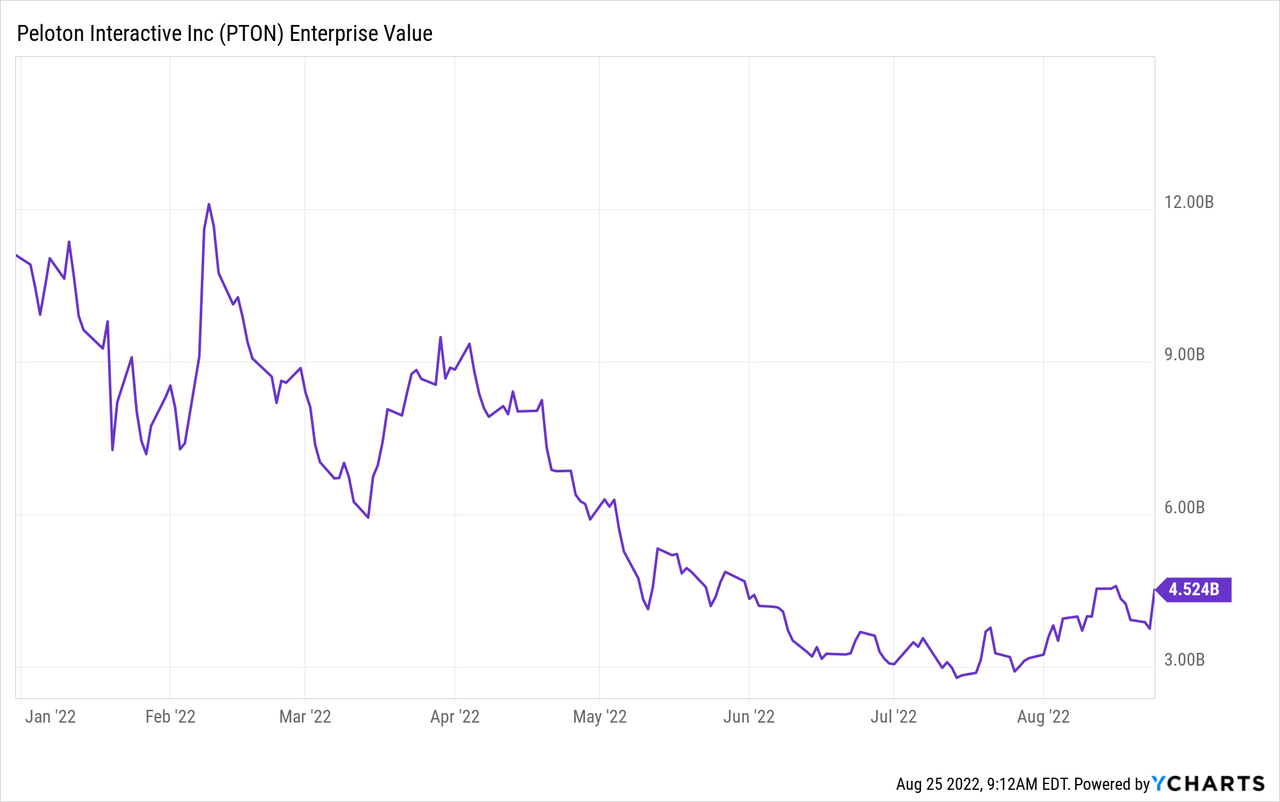

From our hypothetical 20% net income margin, I could justify paying an enterprise value of $4.5 billion, which would be 3x revenues and 15x earnings. For a slow growth business in a not especially exciting vertical (fitness stocks aren’t normally high-fliers), these seem like reasonable inputs.

Where does this $4.5 billion of enterprise value put PTON stock? As it turns out Peloton had an enterprise value of right around $4.5 billion prior to this earnings report, though it will be back below that mark following Thursday’s stock price selloff:

This might suggest that shares aren’t badly priced here. Keep in mind, however, this is my bull case for the stock, and Peloton shares already reflect this hypothetical scenario where things go as well as could reasonably be hoped for. Even in that case, shares are only worth something like $13 each.

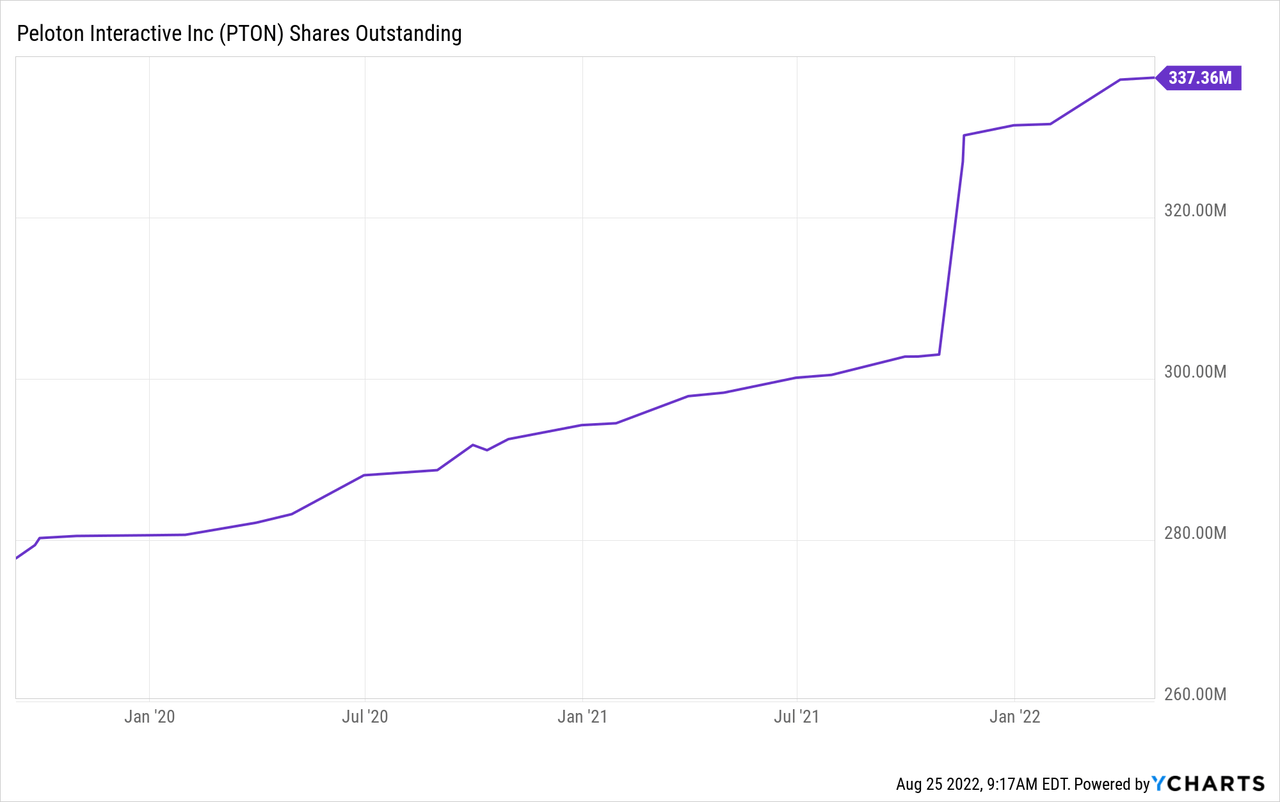

And that also doesn’t reflect ongoing losses and shareholder dilution. Peloton will likely lose hundreds of millions of dollars more before it can potentially reach breakeven on an operating basis. On top of that, Peloton regularly dilutes its shareholder base, meaning that investors’ claim on the companies assets is reduced over time:

By the time that Peloton potentially reaches profitability, the company’s share count may have climbed much further, which would lower the fair value on each existing share.

To summarize, in a bullish scenario where everything goes according to plan, I see Peloton stock worth something in the $10-$15 range. Given that this is where we were trading prior to this quarterly earnings report, the market seems to have been pricing in a rather optimistic set of assumptions for the company going forward.

By contrast, I would need to see shares in the mid single digits to see a big enough discount to potential value to think about getting involved in Peloton. Given the high level of risk here, investors should be demanding a big margin of safety before taking positions in the stock.

Peloton: A Ship Lost At Sea

CEO Barry McCarthy started off this quarter’s shareholder letter with a blunt message:

“When you look at our financial performance in Q4, I suspect what you see will be a function of where you sit. The naysayers will look at our Q4 financial performance and see a melting pot of declining revenue, negative gross margin, and deeper operating losses. They will say these threaten the viability of the business.”

I couldn’t have summed up Peloton’s problems better myself. These issues do in fact threaten the viability of the business. And most of the metrics we saw in Q4 ’22 continued to show erosion rather than improvement.

McCarthy is attacking the problem head-on rather than trying to sugarcoat things. And I commend him for that. But make no mistake, Peloton is facing an exceptionally difficult challenge in trying to turn things around with limited financial resources all while not losing what appeals to its core customers.

McCarthy concludes his letter with a story about a rescue situation he had while working on a cargo ship. He uses that as an analogy for Peloton’s situation today:

“Peloton is like that cargo ship. We’ve sounded the alarm for general quarters. Everyone’s at their station. We continue to add new inputs to evolve our go to market strategy to restore growth. When will the ship respond is the question. Our goal is FY23.”

This language from McCarthy himself should make the situation clear. Peloton is no longer a growth stock story or something where we’re focusing on valuation. Peloton, instead, is a company where the alarm bells are ringing. I, for one, hope they succeed, and I respect McCarthy as a leader who has done good work in his previous jobs. He may be able to right the ship for Peloton.

However, is this grave situation worth the current share price? That seems unlikely. Shareholders seem to be suffering from sunk cost bias, hoping for a miraculous comeback even as operating results keep getting worse and the CEO is forced to discuss the viability of the business.

If Peloton is able to turn things around, it will be a gradual process where we’ll see declining losses and then, eventually a small profit. Peloton is still in the midst of dramatic cost-cutting and wholesale changes to its business model. There’s no need to rush into this turnaround story today. I suspect there will be entry points in the single digits for investors that want to take a spin with Peloton stock.

Be the first to comment