Sundry Photography

Peloton (NASDAQ:PTON) was once a ubiquitous part of the pandemic years, with the company’s black and red exercise bikes gracing garages and bedrooms across suburbia. I described Peloton as being well-placed to capture value against the disruption to gyms posed by the pandemic when I initially covered the company. Along with Zoom (ZM), the stock would go on to become a poster boy of the pandemic era and a darling of investors who took the position that the unique conditions of lockdowns would remain in place after people were allowed to leave their homes. This overextrapolation of lockdown demand into the future post-pandemic years led to Peloton’s shares trading at stratospheric multiples to revenue.

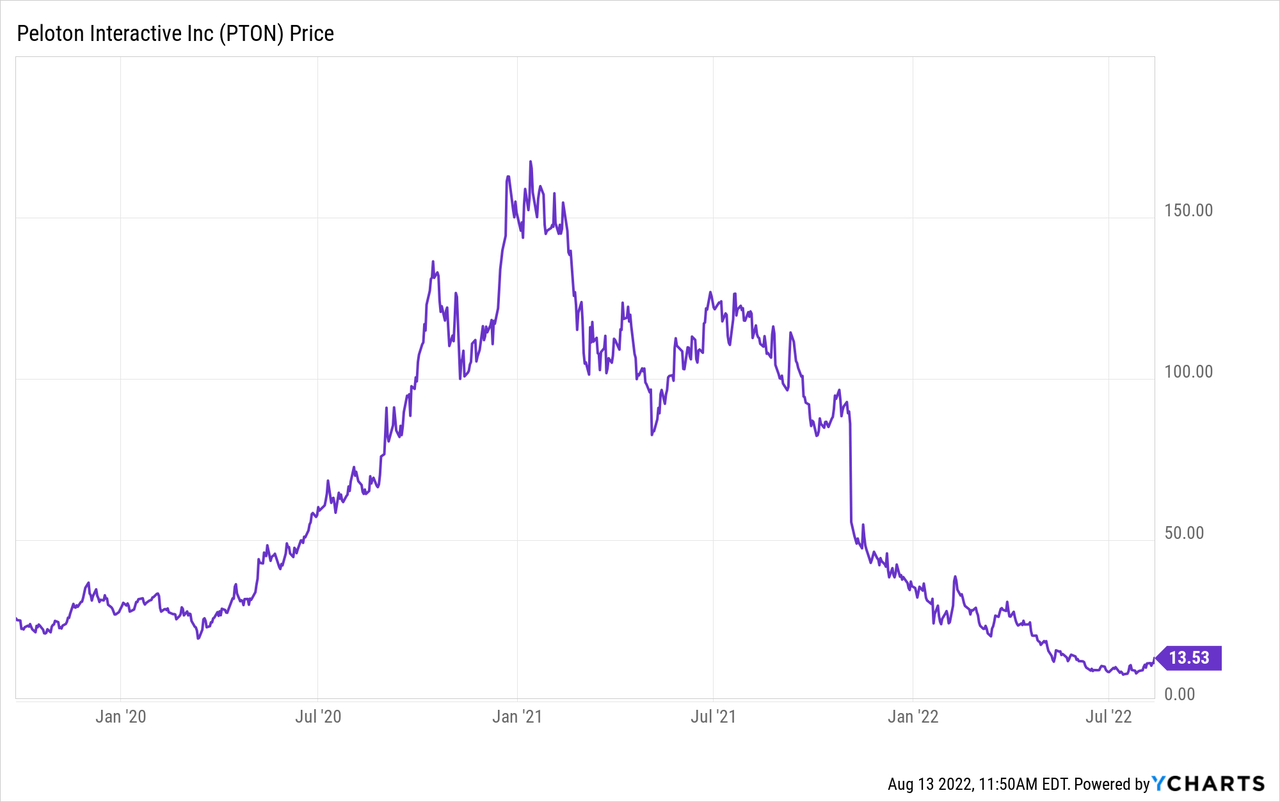

The company would go on to trade at an all-time high of just over $160 per common share, now down more than 90% as this demand failed to materialize, and the broader stock market collapsed on the back of rising inflation and a hawkish Fed.

Peloton’s profitability and underlying cash position have also worsened. This has placed going concerns at risk and forced management to initiate deep structural changes to the business in a turnaround attempt. Hence, current Peloton bulls have been asking whether these will be enough to save the company after seeing the value of their stake get crushed.

Bears don’t think so and have stated that these changes do not address the underlying issue facing Peloton; a lack of demand. The boom times are over, and Peloton thrived when gyms, its immediate competitors, had been shut down by the government. The zeitgeist that characterised Peloton’s rapid ascent has ended, and households will find it hard to justify parting with thousands of dollars when there are cheaper alternatives.

The Turnaround Attempt

Peloton’s latest turnaround attempt comes on the back of measures already implemented earlier this year when the company fired 2,800 of its employees, including its Founder CEO John Foley. The cuts at this time represented 30% of its workforce of just under 9,000 people as of the end of September last year.

The company’s new CEO Barry McCarthy has gone further a few months following the publication of its last earnings results which showed revenues down 24% year-over-year at $964.3 million. The results were dire with gross profits down nearly 60%, net loss that was up by a material 8,704% to $757.1 million from a loss of $8.6 million in the year-ago quarter, and negative free cash flow of $735 million.

McCarthy is cutting a further 800 jobs across Peloton’s distribution and customer service teams. These new cuts will mean an end to Peloton’s in-house customer service and equipment deliveries. Both these functions are being outsourced to a third party, along with the production of its Bike+ and Tread machines. With the company having already reversed course on a US factory, the wholesale outsourcing of its production to a Taiwan-based contract manufacturer is not surprising.

The company is also chasing demand-side measures by raising prices for its Bike+ and Tread machines, these come on top of a hike to the price of its content subscription service by $5 to $44 per month. It’s important to note that by demand-side measures, Peloton aims to squeeze out more revenue from a smaller pool of prospective buyers when compared to the pandemic era. The hikes are also a reversal of previous price cuts, which McCarthy stated impacted the image of the premium brand.

Bears will note that the turnaround has not focused on new innovative products or an expansion to other fitness verticals, but on deep cost-cutting and price hikes meant to stimulate revenue. The price of the flagship Bike+ is going up by $500 to $2,495 and its Tread treadmill by $800 to $3,495. Fundamentally, these do not address the structural issues facing the brand. Peloton might find it faces a Sisyphean task to move as much inventory as it did during the height of the pandemic, with demand also likely to be negatively impacted by plans to close many of its retail showrooms from next year.

A Runner’s High In Uncertain Times

Peloton now trades at a $4.56 billion market cap and has a limited runway if the current rate of cash burn is maintained. Its future is somewhat bleak and remains besieged by a class action lawsuit, deep losses, a declining cash balance, and a falling subscriber count. And while the turnaround has focused on cost-cutting so far, more has to be done to secure Peloton’s future as an innovative independent company.

I described Peloton as a runner’s high in the uncertainty posed by the pandemic during my initial coverage. However, I refrained from making predictive statements about long-term behavioural changes after COVID-19. Those changes are now clear and have been a disaster for a stay-at-home play that dominated so much of investing during its glory days. As Peloton continues to hurtle towards an unknown future, I would rate shares only as a speculative play on a potential buyout. The turnaround is unlikely to be successful.

Be the first to comment