skynesher/E+ via Getty Images

Investment Thesis

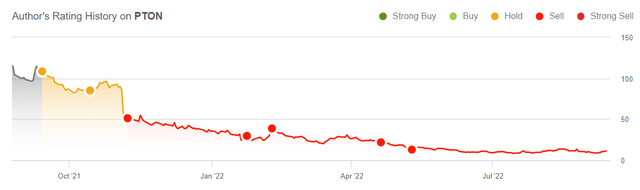

Peloton (NASDAQ:NASDAQ:PTON) has been through a really tough time. I’ve been consistently bearish on this name since the stock was $51 and I see very little here that makes me change my mind that this stock is overvalued.

The best way for this business to reverse course and attempt to salvage itself was to remove its co-founders from the business.

But that change won’t be enough. Right now, Peloton’s new CEO Barry McCarthy has his work cut out to not only stop the business from burning free cash flow but to also someway somehow figure out how to sell more Pelotons in a post-Covid world.

I keep my sell rating on this stock.

The Change That Was Needed

Peloton’s co-founders left Peloton. The business is in turmoil and the only way to make the necessary changes is without the oversight of its founders.

The proxy statement from last October shows that the two co-founders still own a significant amount of Class B shares, the voting shares. Hence, we can infer that the co-founders generally agreed to the dramatic change that is needed. That the business can only move forward without their presence around.

But how much is management to blame here? And how much was it down to an incredibly volatile environment? I suspect that it’s a bit of both.

At first, there was unprecedented demand. But when demand slowed down, it didn’t just slow down slowly over time, it plummeted.

And now to compound matters, given the high inflationary environment plus a slowing economy, this couldn’t be a worse macro backdrop for Peloton.

So what’s next? At the recent Goldman Sachs conference call, Peloton’s new CEO Barry McCarthy reiterated the importance of Peloton increasing its total addressable market by having lower-priced products.

Indeed that makes sense. When the cost of living is going up and consumers have to make do with less disposable income, it’s more important for the Peloton brand to remain relevant with consumers, to gain mindshare with a wider demographic of consumers.

We can think of it as a marketing tool. Rather than solely relying on often ineffective advertising, increasing the brand’s strength through word of mouth is a powerful tool.

The downside to this strategy is that it will dampen Peloton’s profit margins further at a time when the business is struggling to be cash flow positive.

Peloton’s Revenue Growth Rates Don’t Inspire Confidence

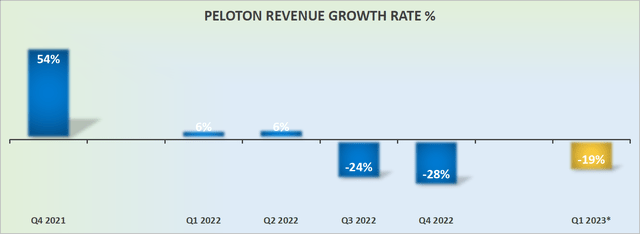

The problem with Peloton is that the business was a high-growth business. That attracted a certain crowd of investors with a growth mentality.

Now, as you can see in the graph above, Peloton is guiding to a negative 19% y/y of revenue growth rate for its upcoming fiscal Q1 2023. Further reinforcement that this is no longer a high-growth business.

But at the same time, the business is clearly unprofitable. The best that Peloton can dangle for investors is that by fiscal Q4 2023, ending June 2023, the business will be close to free cash flow breakeven.

Peloton Interactive Balance Sheet

As it stood at the end of fiscal Q4 2022, Peloton had $1.3 billion in cash and equivalents. However, Peloton is not expected to stop hemorrhaging cash until Q4 2023 at the earliest.

That means that even though Peloton today carries approximately $500 million of net cash, once the debt is factored in, I suspect that over the next two quarters, Peloton will end up carrying $100 million net debt position. This is if its financial position doesn’t take a turn for the worse.

Then to further complicate matters, Peloton’s debt agreement states that if the business still carries its $200 million convertible senior notes by November 2025, its $750 million term loan will be due in November 2025 rather than 2027.

Consequently, the business is on a knife edge, as it must successfully convert its senior notes to equity before 2025. Otherwise, Peloton could seriously struggle to refinance its term loan on anything less than very onerous terms.

PTON Stock Valuation – 1x Sales is Still Not Cheap Enough

Today Peloton is priced at 1x next year’s revenues. This appears like a cheap valuation. After all, only last year Peloton was being priced at around 5x this year’s revenues.

The problem with that thinking is that it makes very little difference what multiple investors were willing to pay for Peloton in the past.

What matters right now is what the future holds for Peloton. Ultimately, there’s simply seriously not enough here to get me compelled.

The Bottom Line

Nobody likes to read that the stock they own is a risky bet. It feels like an intellectual assault. But the fact remains that in this case, Peloton is indeed a risky bet.

Just because the stock is down more than 70% in a year doesn’t mean that there’s a bargain to be had from catching this falling knife.

Peloton has to stop burning cash sooner rather than later. And then, someway it must look to grow its revenues by selling more of its products in a slowing economy.

The odds for investors are not favorable.

Be the first to comment