Charday Penn/E+ via Getty Images

Company Background

Amplitude, Inc. (NASDAQ:AMPL) engages in a digital optimization system that helps companies analyze its customer behavior within digital products. The firm delivers its application over the Internet as a subscription service using a software-as-a-service (“SaaS”) model. AMPL allows companies to understand how their customers interact with their products and services, information that is vital to any business.

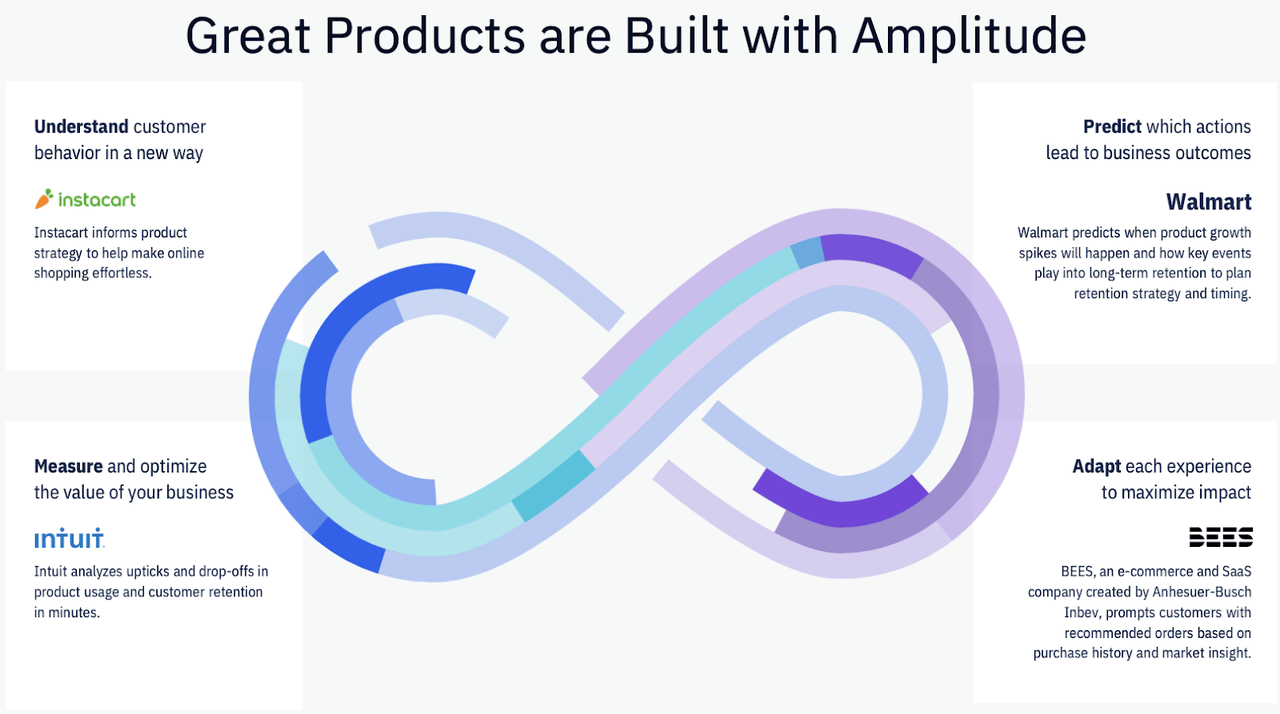

Company Presentation

Much like many of the IPOs that were introduced to the market in 2021, AMPL has very little to draw investors in from a fundamental standpoint, but hopes to do so through their potential and growth prospects. Any company whose main prowess is to attain the qualitative side of an investor’s story in the hopes of converting the qualitative into the quantitative has fallen out of favor with investors in 2022.

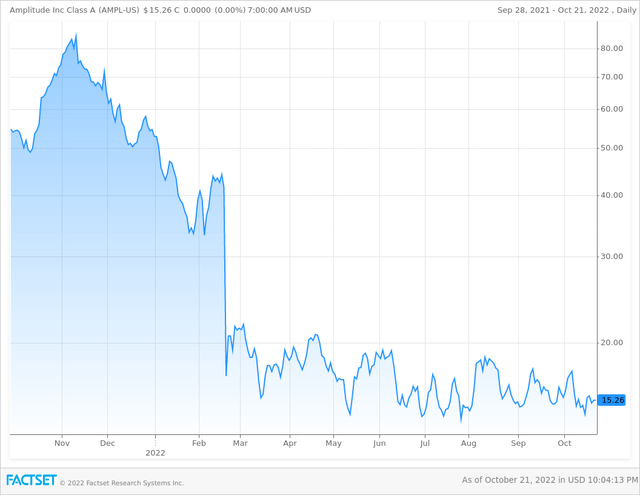

This is evident when studying the price action of AMPL. It IPO’ed on the 28th of September 2021 at circa $35, jumping to over $80 by October, in an omen to the bubble of 2021. A further testament to the change in investor sentiment in 2022, is the subsequent 75% fall in AMPL to $15.

It is vital to understand that a good story does not equate to a good investment. This is important as the basis behind any bull case, for AMPL is on the back of the importance and reliance companies have for the software that AMPL provides. This, however, does not facilitate an investor to forgo simple cognitive reasoning. The company is founder-led by Spenser Skates, the 33 year old founder of AMPL, who currently does not have a material ownership stake in the company. With the lack of experience and skin in the game, there are very few redeeming factors that should sway an investor towards AMPL.

AMPL serves many customers throughout the supply chain, but has a strong concentration as a consumer-dependent service company. Given the current economic backdrop, it is evident that companies are in need of slimming costs, and given their customers’ concentration in service oriented businesses, this directly affects AMPL, as made evident by management in their most recent earnings call.

However, if you look at our customer base overall, we’ve always been very diversified across lots of other verticals. So B2B, media, fintech, quick-service restaurants, lots of things that are not have the same level of exposure. And so we feel good about our ability to continue to grow regardless of what happens with that segment of customers… Our guidance reflects recent customer conversations, spend environment and event volume trends. For context, our assumptions on the macroeconomic environment result in a negative $1 million to $2 million impact on our Q3 revenue and a negative $3 million to $4 million impact on our fiscal ’22 revenue guidance

Spenser Skates, Q2 Earnings Call

Company Presentation

Financial State of the company

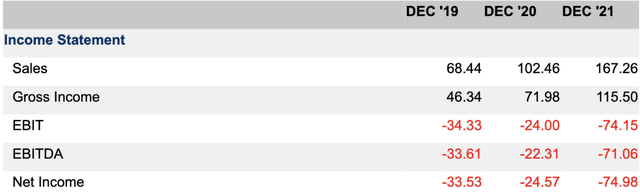

The company has been unable to transform its exponential growth in revenue into material improvement in operating margins. Revenue and paying customers have both increased more than 40% YoY, but operating revenue has decreased by 100% YoY.

On a valuation basis, the company has suffered losses to the measure of 75% from its $80 peak in October of 2021, falling to $15. Given this decline, the company currently boasts a Price to Sales ratio of 10. Given the expensive nature of the valuation of the company, it does not seem like a prudent investment given the macro environment.

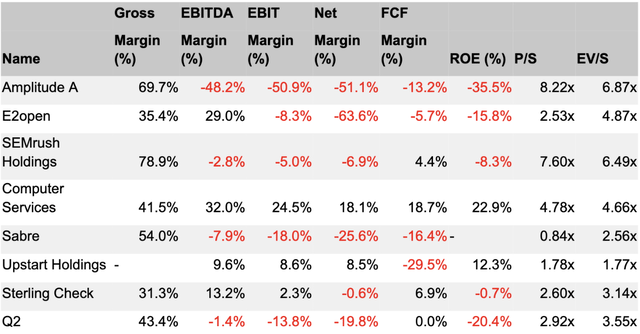

Compared to many of its competitors, AMPL exhibits signs of a business that has a competitive advantage, as made evident by its above-average Gross Margins. This quiver of hope is quickly extinguished when continuing the quest down through the income statement, as EBITDA and EBIT margins are the lowest within the below peer group. Given the economical outlook, this appears to be the expected outlook moving forward.

Last year, we saw very robust growth as COVID accelerated digital adoption. Today, customers face a more challenging and uncertain operating environment. Certain businesses, namely COVID beneficiaries, crypto and early-stage startups are seeing more volatility. We’re managing the business using key metrics like SaaS Magic Number, Rule of 40 and [quota theme]. Combined this with the current economic environment, we think it is prudent to lower our risk appetite on investments in the second half of the year. This means we’ll be more conservative with headcount growth. And thanks to our diversified customer base and product value, we are confident that we can navigate the environment and come out even stronger. Our long-term opportunity is huge. Customer overall demand for Amplitude remains strong, and we’re still very early in our market.

Spenser Skates, Q2 Earnings Call

At a valuation of 8.22x Price to Sales and 6.87 EV to Sales (FRWD Sales Forecast), AMPL is double as expensive as the median valuation within the below peer group. Given the large price decrease in FY 2022, it may be possible to believe that there is not much more room for further decreases, but something has to catch up, whether that be earnings or the price – and management don’t sound as if they believe it will be earnings. I have no reason to disagree with them.

Final Thoughts

AMPL is a company that provides a software that is necessary for a business, and will continue to be necessary, if not even more so moving forward. It is, however, a company led by its young founder who does not have an ownership share in the company, exemplifying significant principal-agent risk. The company has unluckily found itself within one of the most difficult economic challenges of the last half century, and, therefore, does not appear to be on a path to profitability. There is an imminent risk that larger companies offering a similar service are able to vertically scale their software and cross sell much more efficiently than AMPL.

Be the first to comment