urbazon/E+ via Getty Images

Published on the Value Lab 11/16/22

Pear Therapeutics (NASDAQ:PEAR) is a company that offers the CBT-based prescription digital therapeutics of reSET and Somryst for substance abuse and insomnia respectively. We’ve covered in the past from when it was a SPAC, and continue to cover it after the SPAC bubble deflated and decimated the PEAR price, and have held a bullish view. Its reSET PDT was a category creator and was the first ever digital therapeutic, going through the same prescription process as do approved, prescription medication. ASPs are in the thousands and regiments are less than a year long, so one customers’ insurance could be paying several thousands per covered life who are using Pear products. They continue to perform well a year into being a revenue generating company by onboarding payors whose population suffer meaningfully from substance abuse issues. Fulfilment rates are rising and prices are high. Repeat customer behaviour is being observed with Ohio who are going to continue to cover patients for Pear, and revenue guidance looks really good for 2023 FY. Financing is going to be required to get us into 2024, which is not a big surprise, and this could come from equity. Besides that, new markets are being mentioned that are low hanging fruit such as the incarcerated. Pear is getting revenue, it won’t need much more to start making the market cap look real small. The main risk continues to be dilution, but as long as revenue growth continues it is an acceptable issue as in all VC. If there is a sign that major payors may not be sticking to covering its lives for Pear products, or momentum with large state-level payors slows down meaningfully in the upcoming year or two, that would be circumstances under which to worry about valuation and addressable markets.

Q3 Breakdown

Let’s focus on a couple of salient points from the Q3 report:

- The most pertinent is that the plant to get into 2024 before financing is not materialising. Pear will need $40 million in financing to get to 2024, and this could come from equity – most likely it will. This could mean the first wave of 10% dilution in addition to the dilutions still latent from the de-SPAC.

- Revenue guidance is about $15 million this year, but next year has been guided by management between $27-37 million, so potentially more than double this year. There could be even more upside if we get some major state or large commercial payor coverage decisions. Revenue growth is really not an issue so far.

- Fulfilment rates are up quite a lot. They were 56% last quarter and are now 60%. This is impressive since motivation for treatment among people with substance abuse is hard to come by. This is a key operating metric that drives revenue so its substantial QoQ increase on top of general scale in total prescriptions is a good thing.

- The company pointed out an interesting market: the incarcerated. In the US the incarcerated population is 2.3 million, and current total prescriptions are at 11k for Pear. Moving into the incarcerated could be a huge market. They onboarded the South Carolina Dept of Corrections and this could be an important initial step. 85% of the incarcerated have substance abuse problems, meaning coverage density, and they are a captive market. Fulfilment rates are likely to be higher on these populations, and the coverage density is here. This is an important commercial opportunity that we value at around $3 billion in market value alone, assuming 30% NOPAT margins for Pear and a 10% discount rate with the scale of this opportunity being reached in about 3 years.

- 10 states have paid for reSET coverage and they are engaging 15 more. Just on state level payors we have major scope for growth. Commercial payors are more fragmented by a couple of Fortune 500 companies are already onboarded.

Bottom Line

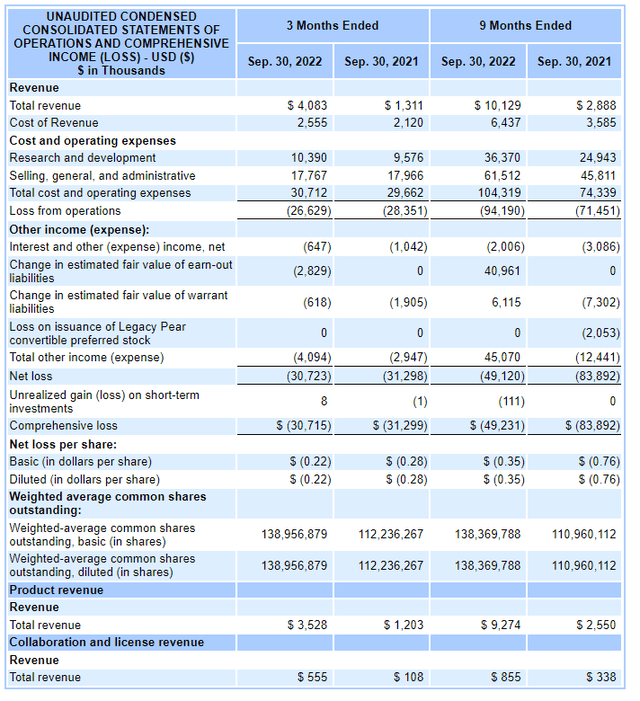

Pear is of course losing lots of money as it just emerges from pre-revenue stages, and the need for financing is not well received by us because it shows the cost of reflexivity, as Pear’s price has decreased a lot.

Pear IS (sec.gov)

But ultimately the commercial opportunity is huge. PDTs are still a totally new mode of treatment, and Pear is the first and most significant player. There are only a couple of others in this space and they are focused on very different markets and are less scaled. There is a lot of optionality in Pear. They have the Somryst insomnia product too which is well priced and continues to have its own momentum, but with the restructuring last quarter and the cutting of 10% of the workforce efforts are clearly shifting to reSET for now.

We reiterate our bullish view thanks to concrete inways possible with correctional facilities, which are going to be dense and high fulfilment rate markets. These are low hanging fruit that could create easy scaling with better than average unit economics. Otherwise, the company is demonstrating good scale and guides for continued triple-digit revenue growth rates.

Altogether we think the commercial direction is appropriate, and the products demonstrably good. Moreover, the PEAR price continues to languish and accounts for pressure on tech multiple in markets and also continued dilution risk. We take the likely upcoming 10% dilution on the chin in 2024 which eliminates some of the upside, but the upside remains massive as it is simply due to prevalence of the treatment areas and strong theoretical economics of digital therapeutics, naturally with the risks that come with an early stage, highly reflexive proposition like Pear. We continue to hold.

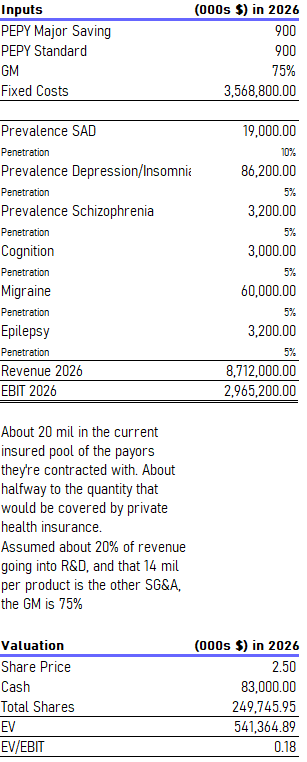

Market Opportunity (VTS)

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment