NicoElNino/iStock via Getty Images

Thesis

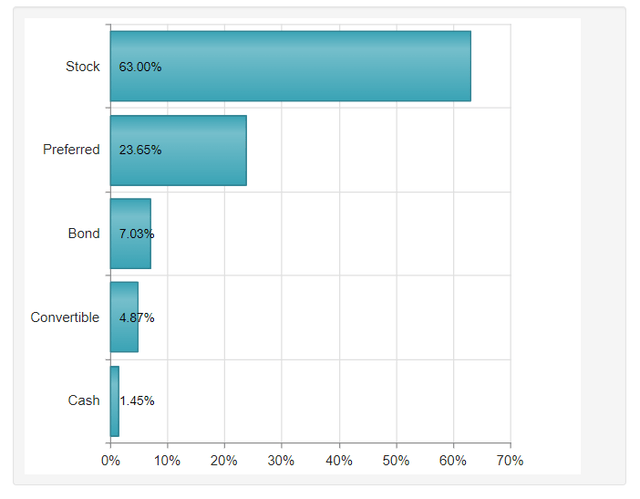

The John Hancock Premium Dividend Fund (NYSE:PDT) is a closed end fund which has high current income as its main goal, and modest growth of capital as a secondary one. The fund invests in a diversified portfolio of dividend paying common stocks and preferred securities. The current split shows a 63% common stock weighting and an approximate 24% preferred ownership, with the rest allocated between convertibles and bonds. The fund focuses on companies where the senior debt is rated investment grade, with a target of 80% of the fund’s total assets to come from such issuers. The fund is defensively set-up, with over 51% of its current composition coming from the utilities sector.

The vehicle comes from the same suite of products as the much better known DNP Select Income Fund (DNP) and has achieved similar long term results, albeit with a bit more volatility. PDT exposes a 5-year Sharpe ratio of 0.43 and a standard deviation of 16.3 versus a 5-year Sharpe of 0.48 and a standard deviation of 16.38 for DNP. On a trailing total return basis we see 5- and 10-year returns here that stand at 9.1% and 10.8% respectively for this fund. The fund has a fairly large leverage ratio of 33%, which magnifies returns in the long term but also contributes to a higher volatility and deeper downturns. Outside the Covid downturn, the fund usually exposes a -15% normal cycle drawdown and exhibits a bit more volatility than its DNP counterpart due to the portfolio composition. The fund has traded at a premium to par in the past 7 years, and is currently in the middle of the range for its historical premiums to NAV.

Coming from a premier asset manager PDT is a closed end fund focusing on the utilities, financials and energy common and preferred shares space in order to extract dividends. The fund currently has a 7.13% distribution rate which has historically been fully covered by the asset base. The fund is now trading at a 8% premium to NAV, which sits in its historical range. We like this fund and its robust long term returns, but we do not feel the current analytics warrant a buy signal. For retail investors already in the name this is a Hold, while new money looking to enter the space would be well suited to wait for a better entry point.

Holdings

The fund holds a mix of common stock and preferred securities:

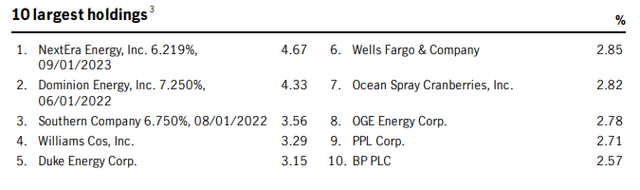

The top holdings for the fund are as follows:

The fund is not overly concentrated in any name, with the top holdings never exposing a portfolio percentage larger than 5%.

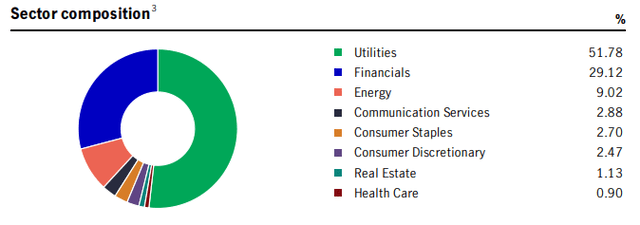

Utilities and Financials are the top sectors currently for the name:

Sector composition (Fund Fact Sheet)

The defensive tilt we see in the fund is highlighted here via the substantial utilities concentration, although the fund is not exclusively investing in this area. From a performance standpoint we will see in the next section that this type of allocation, while long term exhibits good returns, does tend to have deeper drawdowns than a pure utilities portfolio.

Performance

On a 5-year basis PDT benchmarks very favorably to DNP, although with a deeper drawdown during Covid:

Total Return 5-Year (Seeking Alpha)

On a longer, 10-year timeframe PDT tends to overperform its peer:

Total Return 10-Year (Seeking Alpha)

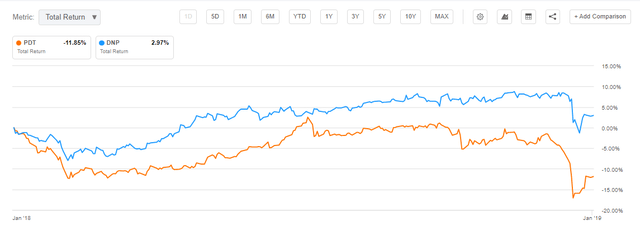

As highlighted above PDT is not an exclusively Utilities focused fund, hence the larger downward volatility we see in the fund in times of market distress. Also notable, but not available in the fact sheet, is the fact that PDT seems to run a higher assets duration than DNP, with the price action witnessed since the rise in the yield curve being negative versus the DNP price action:

YTD Performance (Seeking Alpha)

On a year-to-date basis PDT is marginally down while DNP is substantially up. During the last aggressive Fed cycle we witnessed a similar performance where DNP overperformed:

Jan 2018 – Jan 2019 Performance (Seeking Alpha)

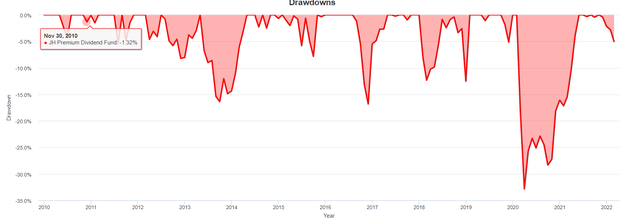

During the pandemic the fund sustained a substantial -33% drawdown:

Drawdown (PortfolioVisualizer)

We can also see from the above chart that outside exogenous events such as Covid, the drawdown here is fairly well limited at a -15% level in the past decade. The drivers for the historical drawdowns outside of Covid have been credit spread widening events such as the 2018 risk-off environment and the 2015-2016 Oil price collapse downturn.

Premium / Discount to NAV

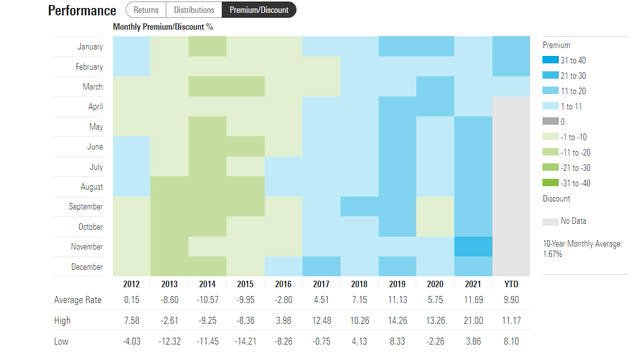

The fund has been trading at a premium to NAV in the past few years:

The fund is currently trading at a 8% premium to NAV which is in the middle of the range for the past few years. We can notice an interesting shift in investor behavior in the past 7 years, with a significant re-allocation of monies to this fund, which has resulted in a consistent premium to NAV for the CEF ever since 2016. A similar look at the DNP chart shows us that that fund has been trading at a premium to NAV for the past decade.

Distributions

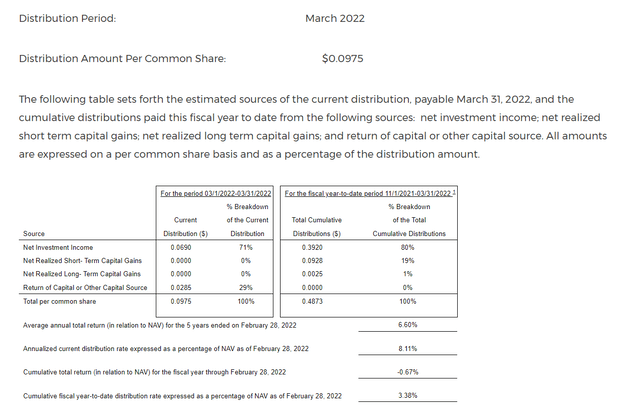

From the latest Section 19(a) we can see the fund has a fairly well covered distribution schedule:

Over a longer period of time the fund covers its distribution from investment income and capital gains, while over shorter period of times it tends to utilize ROC to make-up for timing issues. We believe these are the signs of a well-run portfolio and a very apt management team that correctly navigates the asset class and its trading mandate to achieve the stated objective of the fund.

Conclusion

PDT is a CEF focusing on common and preferred securities from the utilities, financials and energy sectors. The fund has income as its primary objective and it has shown robust long term total trailing returns which sit at above 9% on both a 5- and 10-year lookback period. The fund compares favorably with its much better known counterpart DNP when it comes to total returns during the past decade. PDT is currently yielding a little bit over 7% and is trading at an approximate 8% premium to NAV. We like this fund and its robust long term returns, but we do not feel the current analytics warrant a buy signal. For retail investors already in the name this is a Hold, while new money looking to enter the space would be well suited to wait for a better entry point.

Be the first to comment