mikdam

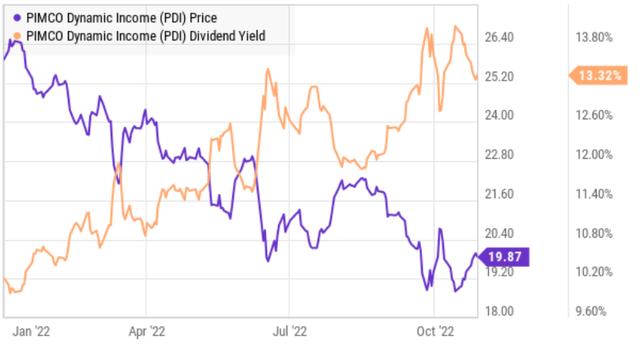

This has been a terrible year for bonds. As interest rates have risen sharply, bond prices have fallen sharply (and lending in general has been tumultuous). There are reasons to believe that interest rates will stabilize in early 2023 (as predicted by CME fed funds futures) but we all know how quickly expectations can and do change. In the meantime, owing attractive CEFs and BDCs (while waiting for their prices to rebound) can be much more tolerable considering some offer very large distribution payments. Let’s start with PIMCO Dynamic Income Fund (NYSE:PDI), currently yielding over 13% annually (paid monthly).

PIMCO

1. PIMCO Dynamic Income Fund, Yield: 13.3%

PDI is the gigantic $4-billion-plus gorilla in the room. Revered by many, its price has fallen and its yield has risen considerably this year.

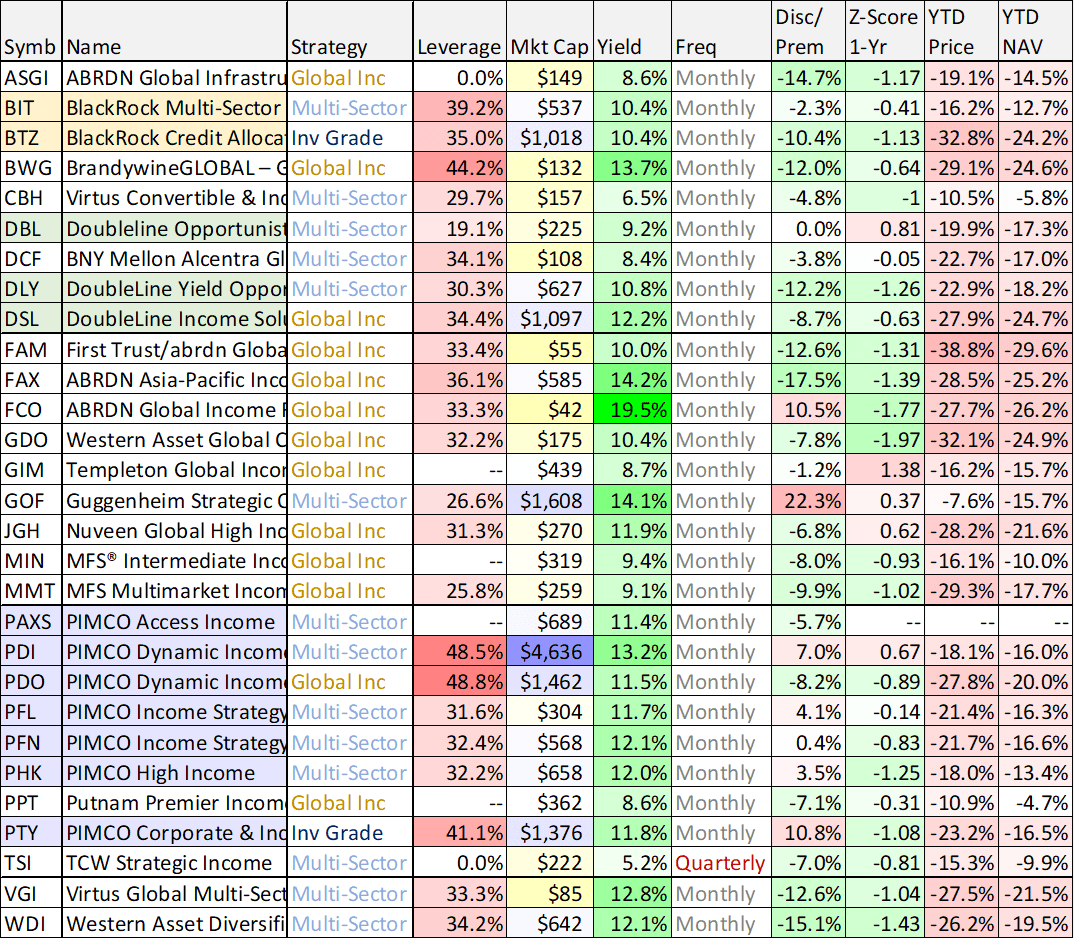

PDI was a big fund already, but grew to be one of the biggest at the turn of 2021-2022 as the assets of two other PIMCO CEFs were merged into it. And as you can see in the following chart, it is quite large compared to other bond CEFs.

data as of Fri 28-Oct-22 (CEF Connect)

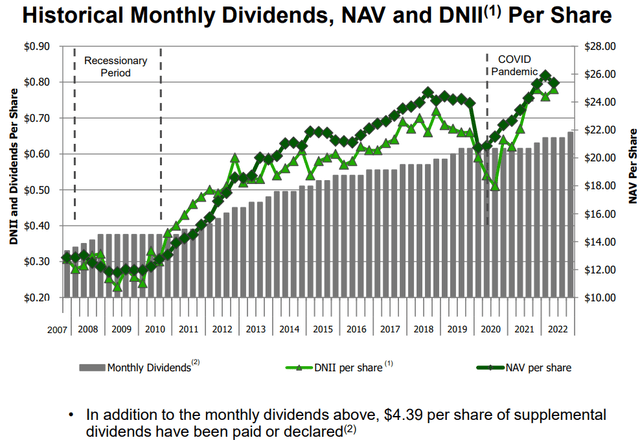

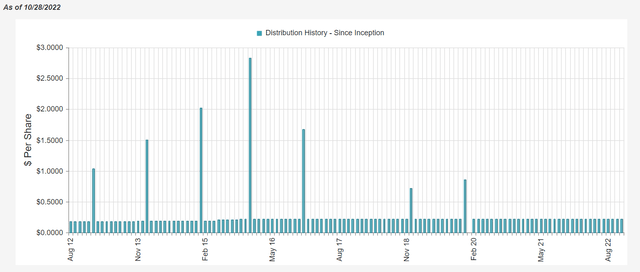

And what is special about PDI (besides its massive size, enormous yield and significantly decreased price) is that it has a very impressive track record of performance. It hasn’t reduced its distributions, and it continued to source the dividend this year with income and not capital gains or a return of capital (ROC is often undesirable because it can reduce your cost basis leading to a surprise capital gains tax if/when you do sell your shares). Here is a look at PDI’s distribution history, and as you can see–it even has a track record of paying additional special dividends.

However, PDI has been playing hard defense this year as it has reduced its duration (interest rate risk) from over 5 to around 3.4 as it has been bumping up hard against the regulatory 50% leverage limit (the leverage can boost returns and income during the good times, but magnify losses in the bad times–such as this year). This year’s defensive repositioning has been far less than ideal, but PDI now has roughly 28% of its holdings maturing in 0 to 1 years, and it is increasingly well positioned to benefit from higher rates once the fed stops hiking so aggressively (hopefully soon, but slated for early 2023 as per CME fed watch).

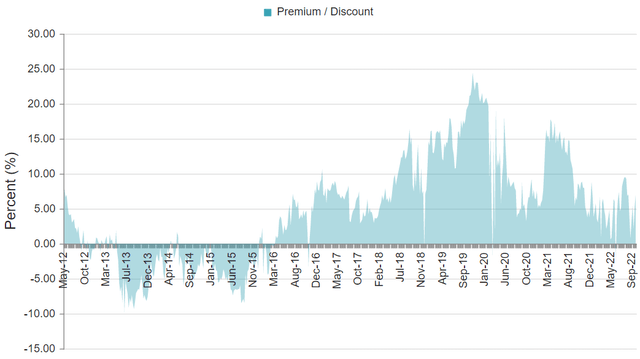

One drawback for PDI is that it trades at a premium to NAV. If you don’t know CEFs generally have a fixed number of shares and therefore trade based on supply and demand, which often leads to significant price premiums or discounts versus the net asset value (or NAV) of the underlying holdings. Here is a look at PDI historical premium-discount.

These premiums and discounts are different than most mutual funds and exchange traded funds (they have mechanisms in place to ensure to the price stays very close to NAV), and these divergences create risks and opportunities for CEF investors. We generally prefer to buy things at a discount (and not a premium), but in the case of PIMCO CEFs, premiums are often large and not uncommon because the firm is trusted by investors and has a long track record of delivering strong returns.

Overall, we view PDI an attractive high income investment opportunity, we expect the NAV declines to stop once interest rates stabilize, and the fund’s outsized distribution yield makes it much easier to tolerate any near-term volatility going forward. We have owned PDI in the past, but sold it earlier this year. However, if you are a contrarian investor, now is a good time to consider adding shares (it’s very high on our watchlist).

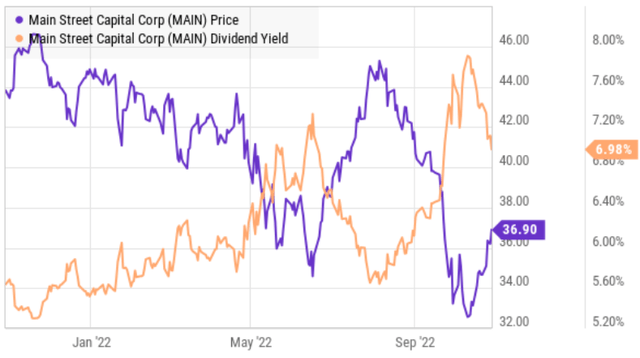

2. Main Street Capital (MAIN), Yield: 7.2%

Switching gears from CEFs to BDCs, Main Street is a perennial favorite for its internal management team and long track record of success. However, the shares have fallen (and the yield has risen) this year.

However, from a long-term standpoint, Main Street’s dividend has grown dramatically over time, and it has a history of paying supplemental dividends too.

Main Street Capital Q2 Investor Presentation

Main Street is also particularly well positioned to benefit from the changed macroeconomic environment as higher interest rates means higher net interest margins and more earnings for MAIN. Main Street also offers a conservative level of leverage (as compared to peers and as per regulatory limits) and it has an attractive mix of first lien loans down through equity investment opportunities too (as we’ll show in a later section of this report). And as an important note, Main Street consistently trades at a higher price-to-book value than almost all peers (because of its attractive differentiated business) so don’t necessarily let that deter you. Main Street is an attractive, long-term, big-dividend investment, and it’s currently trading at a very attractive price as compared to its value.

BDCs In General:

Broadly speaking, if you don’t know already, BDCs are similar to Bond CEFs in the sense that they are investing in loans, but unlike Bond CEFs (where the loans are usually already neatly packaged into a large bond issuance that is traded publicly), BDCs generally underwrite the loans (and financing terms) themselves thereby creating significant risk and reward opportunities.

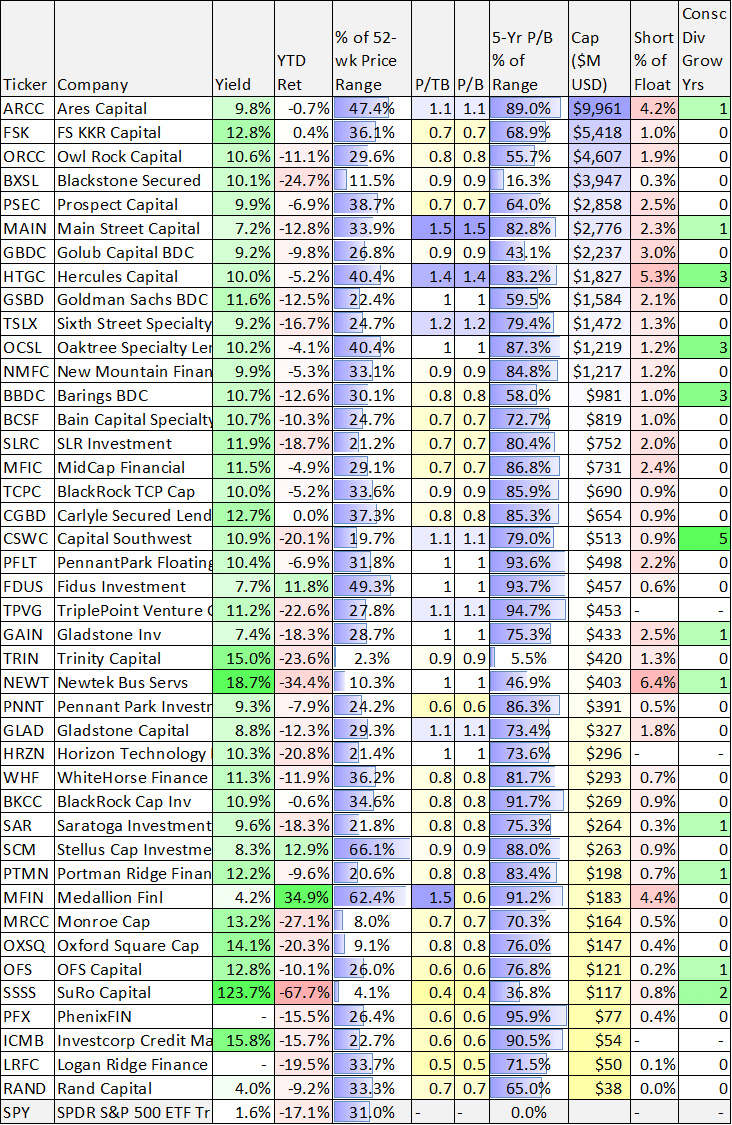

BDCs also are eligible for RIC tax treatment for U.S. federal income tax purposes (meaning they can basically avoid corporate income tax if they pay out their income as dividends), and their dividends can be ordinary or qualified (a good thing for tax purposes). Here is a look at a variety of important data points on over 25 big-dividend BDC, including Main Street Capital (the table is sorted by market cap).

data as of Fri 28-Oct-22 (Stock Rover)

In addition to Main Street, you likely see at least a few names you are familiar with on the list. The list also includes important data on price-to-book value, market cap, year-to-date returns, dividend yield and more.

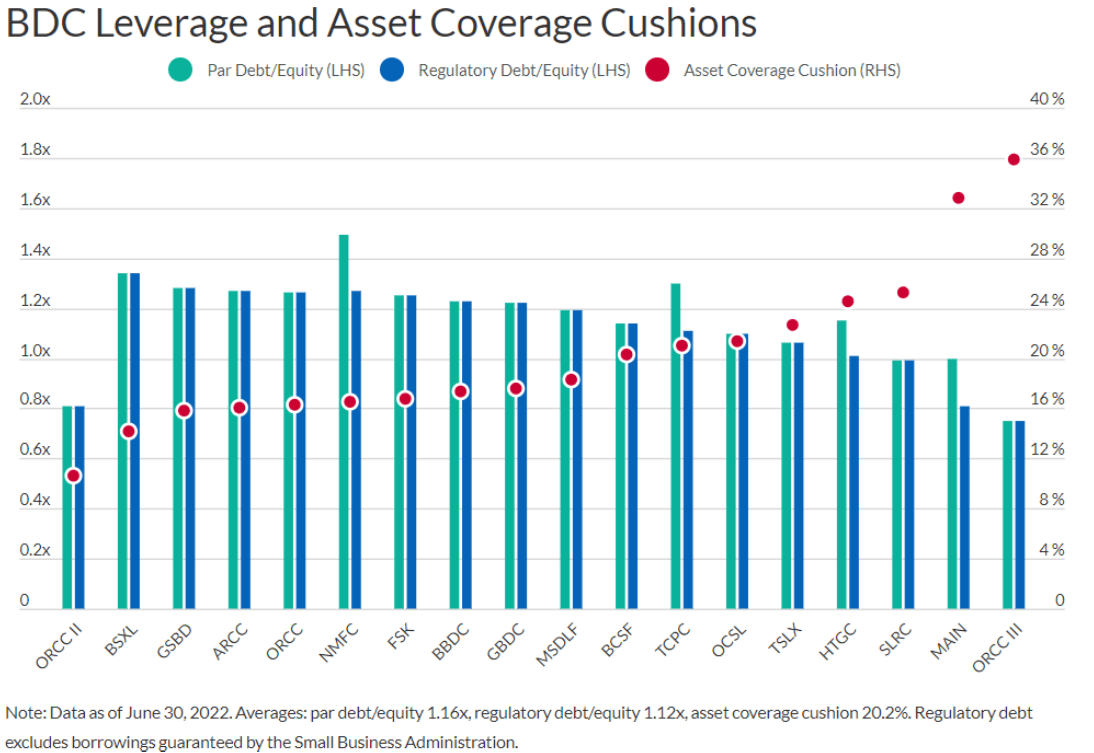

Also important to note (and similar to Bond CEFs), BDCs are subject to regulatory leverage limits. Specifically, the debt-to-equity limit was raised to 2x in 2018, but as you can see below most BDCs remain well below that limit (especially Main Street).

Fitch Ratings

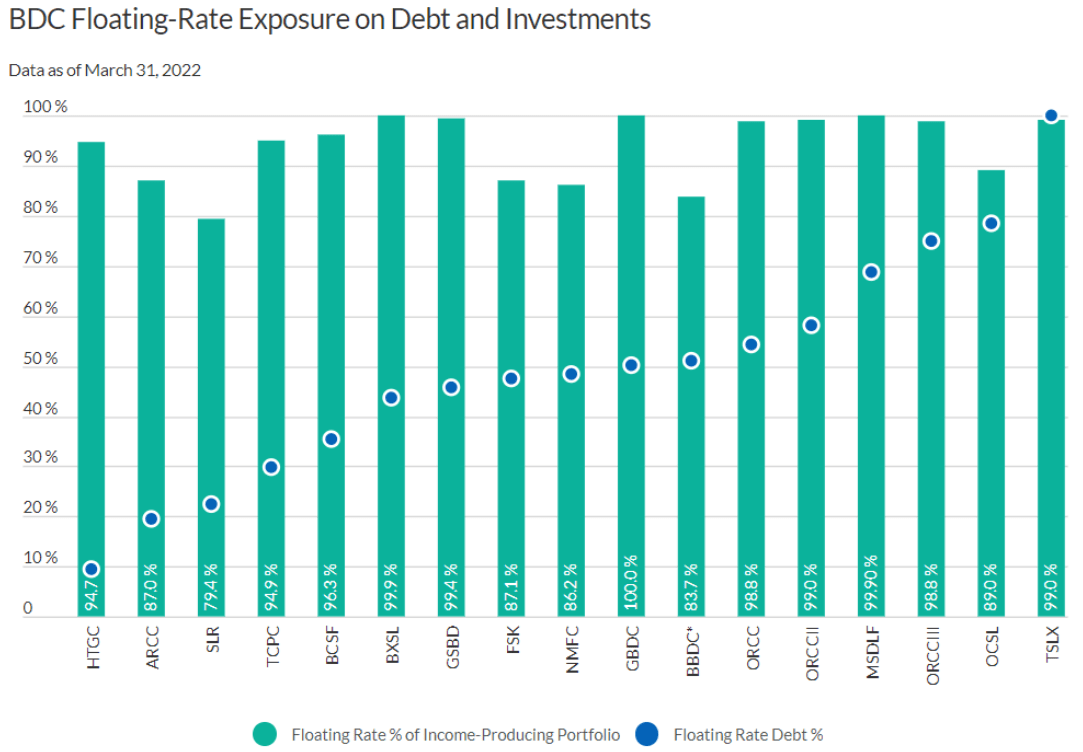

Another important BDC consideration is how much of their investments are fixed or floating rate, and how much of their own debt is fixed or floating rate. This makes a very big difference as interest rates keep rising. And you can get some perspective for the differences among BDCs in the following graphic from earlier this year.

Fitch Ratings

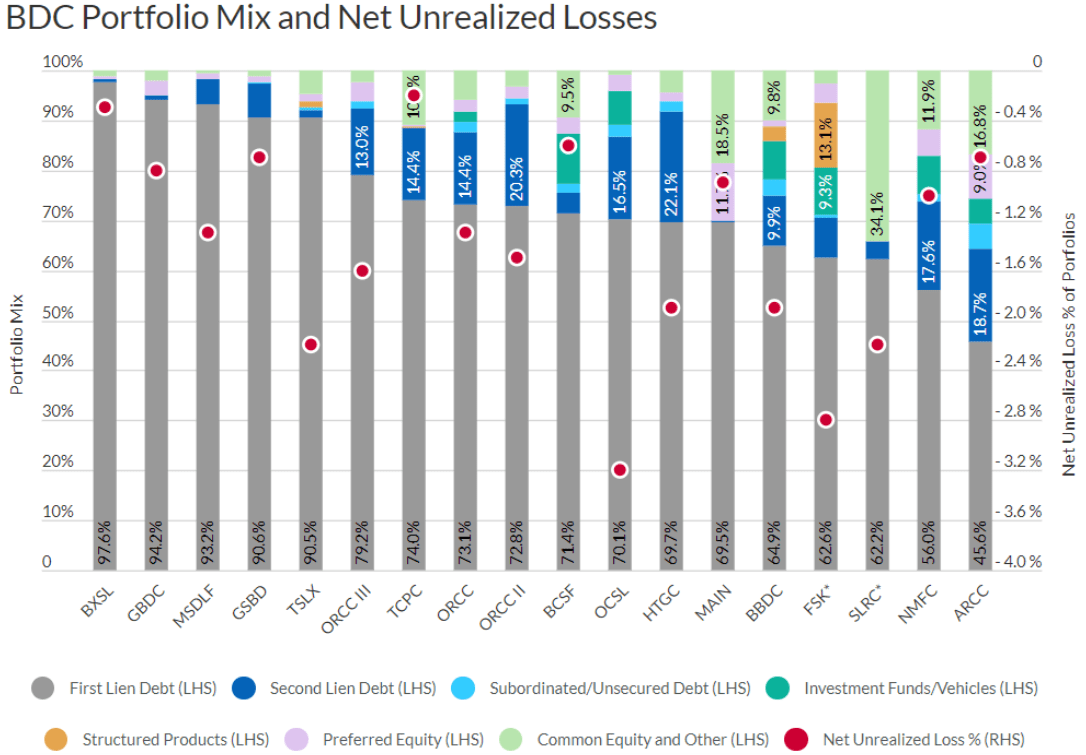

Also critical to understand is how moving interest rates (and market conditions) can impact the book value of a BDC. For example, this next chart shows the type of debt and financing different BDCs have, as well as giving you an idea of how this impacts losses in challenging market conditions (this data is as of the end of Q2, but still provide important perspective).

Fitch Ratings

Importantly, BDCs and Bond CEFs are very different investment vehicles, and within each group there are very different sub-categories. However, they are cousins in the sense that they are both basically invest in lending, they are both impacted dramatically by interest rate changes, and they have both sold off very hard this year.

3. BlackRock Multi-Sector and Credit Allocation (BIT) (BTZ), Yields: 10.4%, 10.3%

Returning to CEFs, some investors view BlackRock as “second class” to PIMCO (especially considering BlackRock’s growing firmwide tilt toward “ESG” investing and away from their actual fiduciary responsibility to protect investor assets). However, and nonetheless, we view both of these BlackRock funds as highly attractive. BlackRock has massive firmwide resources to support the strategies, and the funds both trade at an attractive discount to NAV (something we like) and have negative z-scores (another thing we like).

And despite this year’s terrible returns for fixed-income and bond funds, we believe these funds are both positioned to benefit as interest rate hikes cease, considering they’ve been able to add new investments to the strategy that offer higher yields. BlackRock is a bit more conservative on the use of leverage (versus PIMCO) which some investors prefer. We have owned both of these funds in the past, but sold them (earlier this year and late last year) as the Fed ramped up its interest rate hike trajectory. BTZ offers a little higher credit quality, and a bigger discount to NAV, but it also has a bumpier distribution payment history-something some investors don’t mind, but others simply cannot tolerate. Both funds are attractive here.

The Bottom Line

If you enjoyed the ideas in this report, we offer a couple more interesting ones here: Top 10 Big-Yield Bond CEFs and BDCs. Just know that the market could still get worse before it gets better, and that these opportunities should be included as part of a prudently-diversified, long-term, goal-focused portfolio.

Disciplined long-term investing is a winning strategy (it has been over and over again throughout history) and owning things that offer big steady income payments can make it much easier to wait for the eventual rebound to come.

Be the first to comment