LordHenriVoton/E+ via Getty Images

One of the biggest challenges facing most Americans today is the pervasive inflation that has permeated the economy. This inflation has been heavily concentrated in the sectors of food and energy, which has been making it difficult for many people to afford the necessities of daily life. This has naturally forced many to begin taking on second jobs or entering into the gig economy in order to obtain the money that they need to pay their bills. Fortunately, as investors, we do not need to get to this point to increase our incomes, although we do still need to in order to maintain our purchasing power in the face of the inflation epidemic. One possible option to achieve this goal is to purchase shares of a closed-end fund that focuses on income. These funds are a somewhat underfollowed area of the market but they provide investors with easy access to a diversified portfolio that can in many cases deliver a higher yield than pretty much anything else in the market. In this article, we will discuss the High Income Securities Fund (NYSE:PCF), which is one fund that can be used for this purpose. This fund currently yields an impressive 12.83%, which is certainly enough to provide an income boost to any portfolio. I have discussed this fund before but more than a year has passed since that time, so a great deal has changed. This article will therefore focus specifically on those changes as well as provide an updated analysis of the fund’s financial condition.

About The Fund

As I stated in my previous article, the fund’s webpage is quite spartan and provides very little information apart from copies of the fund’s SEC filings. This is, in fact, the only fund that I have ever seen that does not provide a fact sheet or a copy of its objectives on the web page. However, other sites are able to provide a bit more information. The fund has two stated objectives. The first of these is to provide investors with a high level of current income and its secondary objective is to seek out capital appreciation. This is hardly surprising for a debt-focused fund as the fixed-income securities that these funds invest in are not generally great vehicles for capital gains and instead deliver the majority of their investment returns in the form of direct payments to investors. The reason why these securities cannot be expected to generate much in the way of capital gains is that they are not linked to the cash flows of the issuing company and so do not see their payments increase as the issuing company grows and prospers. In fact, most fixed-income securities deliver a payment that does not change with any factor in the underlying economy, which results in them being somewhat linked to interest rates. As interest rates decline, the value of these securities increases and vice versa. This is because the price of existing securities adjusts so that they deliver a similar yield to maturity of similar newly issued securities. As everyone reading this is certainly well aware, the Federal Reserve has been aggressively hiking interest rates over the past several months in an effort to combat the multi-decade-high levels of inflation. This has had the effect of pushing down the fund’s portfolio, which is quite evident in the fact that it is down 21.10% year-to-date:

This fund does have a bit of a twist on it compared to many other closed-end funds that are focused on income. In particular, this fund actually invests in both debt and equity. Admittedly, most equity securities apart from preferred stocks do not have very high yields. There are one or two sectors that do, however. One of these is business development companies, which account for 19.41% of the fund:

| Company | Shares | Value |

| Barings BDC (BBDC) | 99,163 | $988,655 |

| CION Investment Corp. (CION) | 571,482 | $5,514,801 |

| Crescent Capital BDC, Inc. (CCAP) | 229,885 | $4,009,194 |

| First Eagle Alternative Capital BDC, Inc. (FCRD) | 19,841 | $64,483 |

| FS KKR Capital Corp. (FSK) | 374,220 | $8,075,668 |

| Logan Ridge Finance Corp. (LRFC) | 81,300 | $1,624,374 |

| PhenixFIN Corp. (PFX) | 19,193 | $711,152 |

| Portman Ridge Finance Corp. (PTMN) | 198,228 | $4,424,449 |

| Runway Growth Finance Corp. (RWAY) | 110,903 | $1,371,870 |

(all figures as of August 31, 2022)

Business development companies are an interesting and very unique sector of the economy. These companies are essentially a specialized form of closed-end fund that invests in small or financially-distressed companies. Unlike most other closed-end funds, these companies primarily invest in private firms that do not trade on the market. Thus, these companies provide one of the only ways for most retail investors to gain access to private companies. In many cases, these companies are making debt investments and borrowing funds to make additional loans, much in the same way as a mortgage real estate investment trust will borrow money to purchase mortgages. This allows them to pay out very high yields, as evidenced by the fact that the Market Vectors Business Development Company Index (BIZD) currently yields 10.00%.

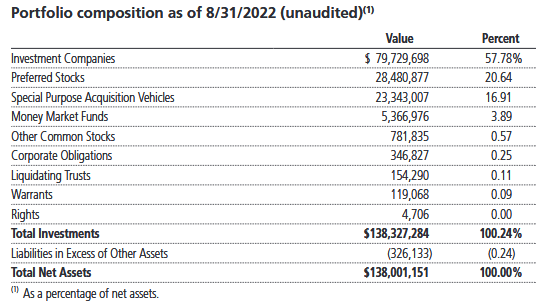

The High Income Securities Fund does not only invest in business development companies, however. It also purchases shares of other closed-end funds. This includes both common equity and preferred stock issued by these funds. This can make the fund’s actual asset allocation somewhat confusing. The fund appears to be invested primarily in common stocks of business development companies and closed-end funds, although it does have 20.64% allocated to preferred stock:

PCF FY 2022 Investor Report

However, the majority of those common stocks are actually issued by entities that are essentially publicly-traded debt portfolios. Thus, this fund is ultimately a fixed-income fund even though it appears not to be. This makes it quite vulnerable to interest rate movements, as already discussed.

As most people reading this know, the Federal Reserve has been very aggressively hiking rates over the past several months in an effort to combat inflation. Economists currently expect that trend to continue in December as inflation still remains at incredibly high levels. However, we have seen the rate of inflation slow up a bit, so markets are expecting that the Federal Reserve will only increase the federal funds rate by 0.5% as opposed to the 0.75% increases that it has been favoring over much of this year. This will likely push bond prices down further and likely apply some downward pressure on the fund’s shares. However, the fund’s actual performance may not decline as much as some people would think because of the business development companies in the fund’s portfolio. This is because many of these companies actually issue floating-rate loans as opposed to standard fixed-rate loans. Thus, the amount of income that they receive when rates increase actually goes up, which helps offset the fact that the business development company has to make higher payments on its own debt. It should also help ensure that the value of the loans held by these companies holds up better than ordinary fixed-income securities would. Thus, rising interest rates may not have as much effect on the fund’s value as they would if its portfolio consisted entirely of high-yield bonds. We can still expect a bit of a decline, though.

Another thing that may help the fund weather any weakness in the economy is the fact that it is quite well diversified. We can clearly see this simply by looking at the weightings of the fund’s largest positions. As my regular readers on the topic of closed-end funds are no doubt well aware, I do not generally like to see any individual asset account for more than 5% of the portfolio. This is because this is approximately the level at which the asset begins to expose the portfolio to idiosyncratic risk. Idiosyncratic, or company-specific, risk is that risk that any asset possesses that is independent of the market as a whole. This is the risk that we aim to eliminate through diversification but if the asset accounts for too much of the portfolio, then it will not be completely diversified away. Thus, the concern is that some event may occur that causes the price of a given asset to decline when the market as a whole does not and if that asset accounts for too much of the portfolio, then it may end up pulling the entire fund down with it. As we can see above, there is only one asset in the portfolio that accounts for more than 5% of the portfolio and even it does not account for much over that limit. Thus, we can conclude that the fund’s portfolio is likely free of idiosyncratic risk, although investors will want to ensure that they are willing to be exposed to the risks of FS KKR Capital Corp. (FSK) individually before making an investment in the fund.

Leverage

As stated in the introduction, closed-end funds are able to use certain strategies in order to generate a higher yield than any of the underlying assets possess. One of these is the use of leverage, which is employed by the High Income Securities Fund. Basically, the fund borrows money and uses it to purchase shares of business development companies, other closed-end funds, and bonds. As long as the yield of the purchased securities is higher than the interest rate that the fund has to pay on the borrowed funds, this works pretty well to boost the portfolio’s yield. As the fund can borrow at institutional rates, which are lower than retail rates, that is typically the case. However, the use of leverage is a double-edged sword since it boosts both gains and losses. Thus, we want to ensure that the fund is not using too much debt since that would expose us to too much risk. I generally do not like to see a fund’s leverage above a third as a percentage of its assets for this reason. As of the time of writing, the fund has a leverage ratio of 1.06% of its assets, so it certainly fulfills this requirement. Admittedly, some of the assets that the fund is invested in have a significantly higher leverage ratio but as we have already seen, the fund does not have significant exposure to individual assets, so the risks here are not particularly high. Overall, the High Income Securities Fund appears to be striking a pretty good balance between risk and reward.

Distribution Analysis

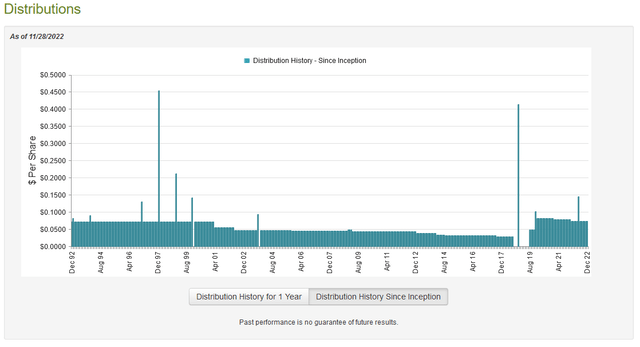

As mentioned earlier in this article, the primary objective of the High Income Securities Fund is to provide its investors with a high level of current income. In addition, the fund invests in business development companies and closed-end funds that boast a very high yield individually. Thus, we might assume that the High Income Securities Fund would have a very high distribution yield. This is indeed the case as the fund pays a monthly distribution of $0.073 per share ($0.8760 per share annually), which gives the fund a remarkable 12.83% yield at the current price. The fund has unfortunately not been consistent with this yield over its history, although it has maintained the current level for more than a year:

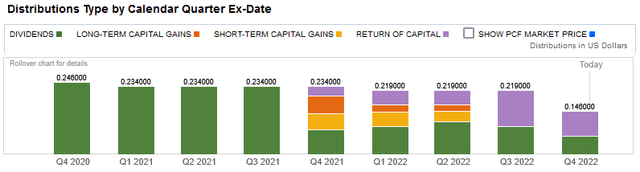

The fact that the fund has not been consistent in its distribution over time is something that may concern some potential investors, such as those looking for a consistent source of income to use to pay their bills. It is important to keep in mind though that the fund has been doing reasonably well since the start of the pandemic. However, over the past year, the fund has been making quite a few return of capital distributions:

The reason that this may be concerning is that a return of capital distribution can be a sign that the fund is returning the investors’ own money back to them. This is obviously not sustainable over any sort of extended period. However, there are other things that can cause a distribution to be classified as a return of capital. The most common of these is the distribution of unrealized capital gains. In addition, the distribution of money received from other closed-end funds can be considered a return of capital in certain circumstances. As such, it is critical that we examine how the fund is paying these distributions so that we can determine how sustainable they are likely to be as well as evaluate our risk of being the victims of a distribution cut.

Fortunately, we do have a very recent report that we can consult for our analysis. The fund’s most recent financial report corresponds to the full-year period ending August 31, 2022. As such, it will give us a pretty good idea of how well the fund handled the first few interest rate hikes that we saw during this year as well as provide us with insight into the source of those return of capital distributions. Over the full-year period, the High Income Securities Fund received a total of $6,451,957 in dividends and other $74,607 in interest from the assets in its portfolio. This gives the fund a total income of $6,526,564 over its most recent fiscal year. The fund paid its expenses out of this amount, which leaves it with $5,111,572 available for investors. This was nowhere close to enough to cover the $14,452,651 that the fund actually paid out over the full-year period. This is something that could be quite concerning at first glance.

However, a fund has other ways to obtain the money that it needs to cover its distributions. The most common of these is capital gains. Unfortunately, the fund was somewhat unsuccessful at this over the year. It did achieve net realized gains of $5,260,182 during the period but this was more than offset by the $13,481,870 net unrealized losses that the fund suffered during the period. The fund overall did fail to cover its distributions, which is certainly concerning. With that said, it did sell more shares during the year which brought in $67,236,052, which allowed the fund to increase its assets by $49,673,285 after accounting for all inflows and outflows. Despite the fund managing to increase its assets under management, it is questionable how sustainable relying on issuing new shares is over the long term. We want to keep an eye on the fund’s income going forward as it is possible that it may have to cut it if the current trends continue.

Valuation

It is always critical that we ensure that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund like the High Income Securities Fund, the usual way to value it is by looking at the fund’s net asset value. The net asset value of a fund is the total current market value of all the fund’s assets minus any outstanding debt. This is therefore the amount that the investors would receive if the fund was immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can acquire them at a price that is less than the net asset value. This is because such a scenario implies that we are purchasing the fund’s assets for less than they are actually worth. That is fortunately the case with this fund today. As of November 29, 2022 (the most recent date for which data is currently available), the High Income Securities Fund had a net asset value of $7.44 per share but shares only trade for $6.91 per share. This gives the shares a 7.12% discount to net asset value at the current price. This is a reasonable price but it is admittedly not as good as the 10.71% discount that the fund’s shares have traded at on average over the past month. Thus, it might be possible to obtain a better price by waiting a little bit but overall the fund is still trading at a discount so the price is still reasonable.

Conclusion

In conclusion, the High Income Securities Fund is one of the more unique closed-end funds in the market due to its portfolio consisting heavily of business development companies and other closed-end funds. This also helps to ensure a high level of diversification since each of these entities is going to be invested in multiple issuers. It appears that our biggest risk here is interest rates, but even that may not be as big a risk as it is for other fixed-income funds. The fund may be forced to cut its distribution should the market keep moving against it though, which is quite disappointing but the price is reasonable. It might make sense to slowly buy in today but assume that the fund may have to cut its distribution a bit. However, even if it is cut by 25% to 50%, it would still have a very high yield, so it might be worth it.

Be the first to comment