PeskyMonkey/iStock via Getty Images

Introduction

PCB Bancorp (PCB) is a small regional bank with 11 branches in California’s Los Angeles and Orange counties and one branch in New Jersey and the state of New York. According to the balance sheet, almost two thirds of its loan book is invested in commercial real estate which means the bank provides exposure to the CRE sector in those areas.

A decent result in 2021, but this was also fueled by the reversal of loan loss provisions

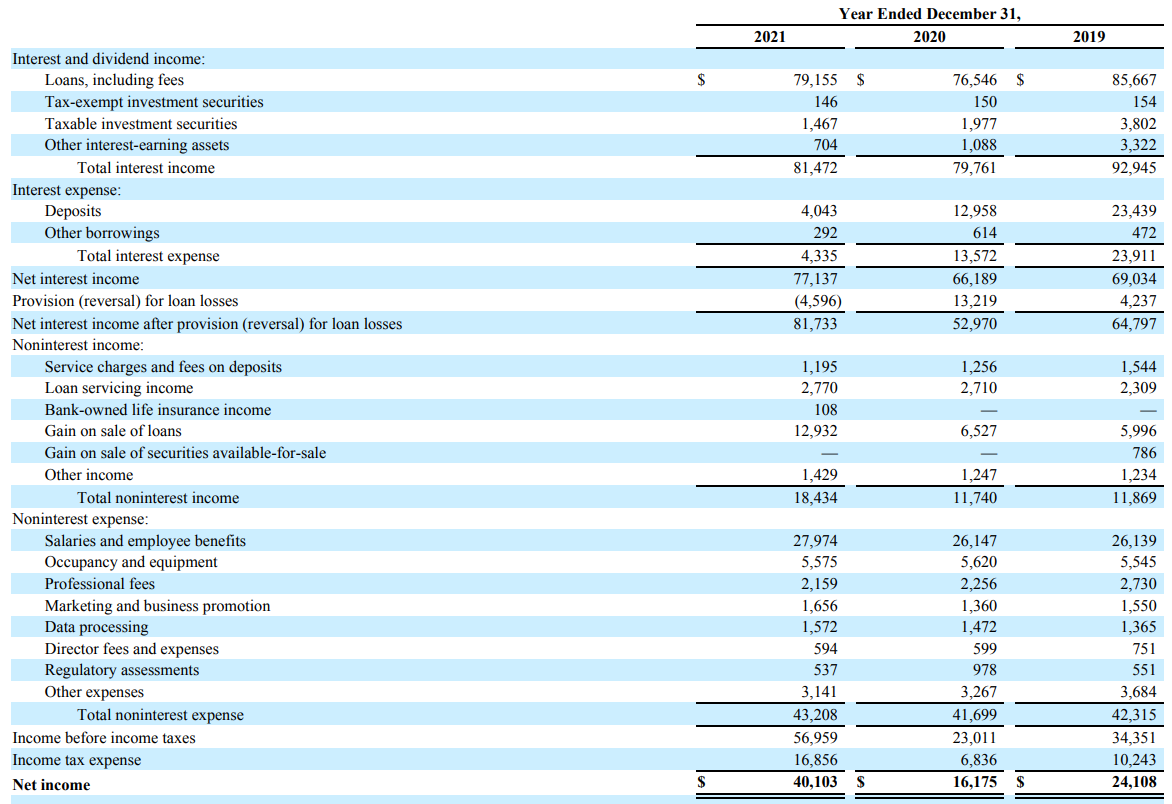

PCB Bancorp saw its net interest income increase again in 2021 after a small decrease in 2020. Thanks to a combination of an increasing interest income and a decreasing interest expense, the net interest income increased to just over $77M.

PCB Bancorp Investor Relations

The bank also recorded a total non-interest income of $18.4M and non-interest expenses of $43.2M resulting in a net non-interest expense of $25M. The pre-tax and pre loan loss provision was approximately $52M. The income statement shows PCB was able to take back in excess of $4.5M in loan loss provisions and this boosted the pre-tax income to $57M and on an after-tax basis, the net income was $40.1M representing an EPS of $2.66 per share.

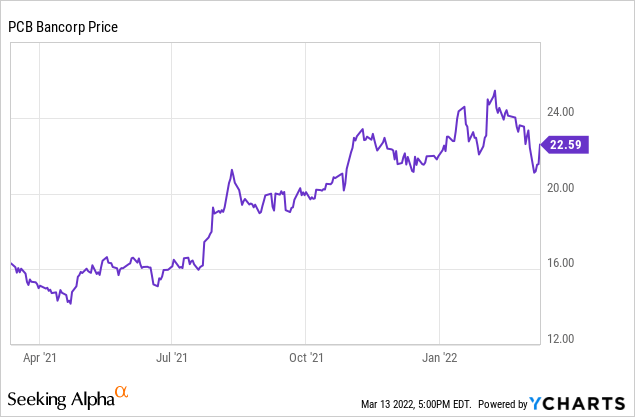

That’s a great result, especially because PCB is trading at just over $22.50 indicating a multiple of just 8.5 times the earnings. That sounds rather cheap but keep in mind the FY 2021 results were boosted by the reversal of historical provisions and if we would use a normalized loan loss provision rate of $4-5M per year, the net income would likely have dropped to just around $35M for an EPS of $2.35/share. So even after taking the boost from the non-recurring element out of the equation, PCB still appears to be cheap.

The bank recently increased its dividend by 25% and currently pays a quarterly dividend of $0.15 per share. On an annualized basis, the $0.60 dividend represents a yield of 2.65%.

The balance sheet contains exposure to commercial real estate

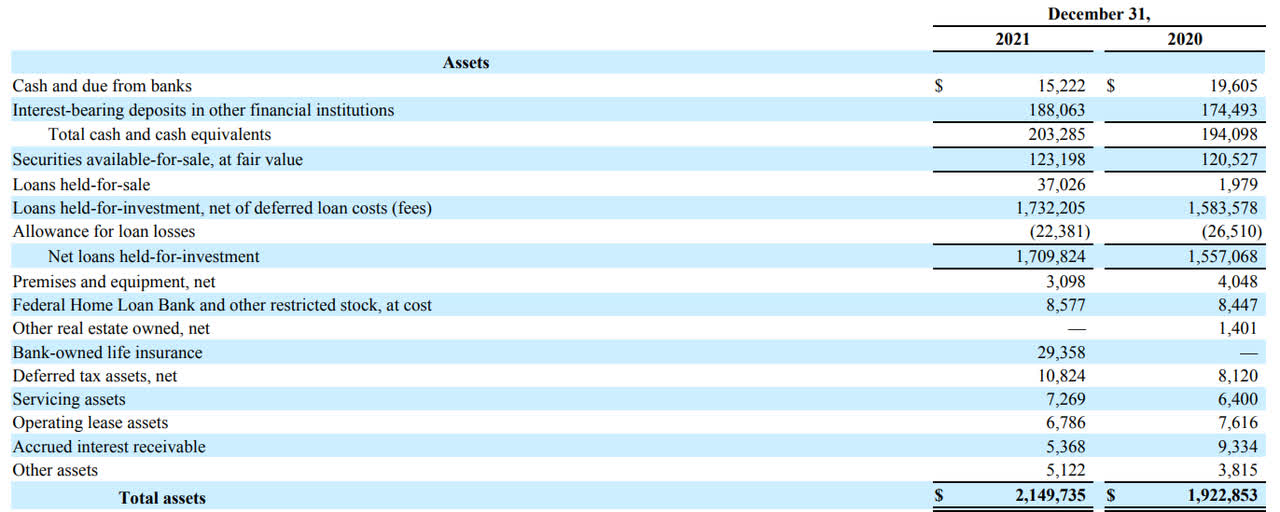

As mentioned in the introduction, the loan book offers exposure to commercial real estate. Looking at the assets side of the balance sheet.

PCB Bancorp Investor Relations

Approximately $200M of the assets is invested in highly liquid assets and with an additional $123M in securities, approximately 15% of the total balance sheet has been invested in rather liquid assets. I’m mainly interested in the $1.7B+ loan book to check on what’s exactly in there, and how the quality of the loans is.

PCB Bancorp Investor Relations

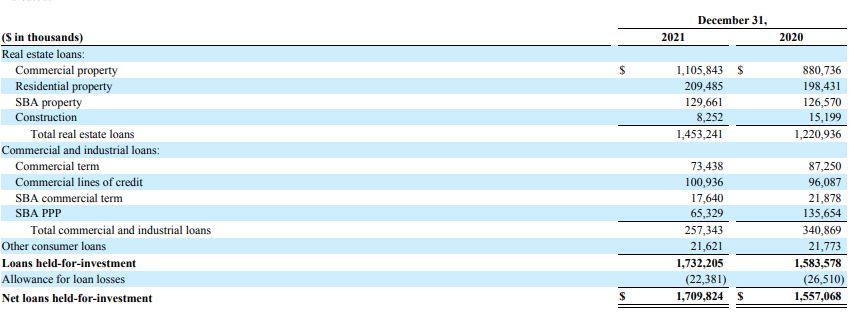

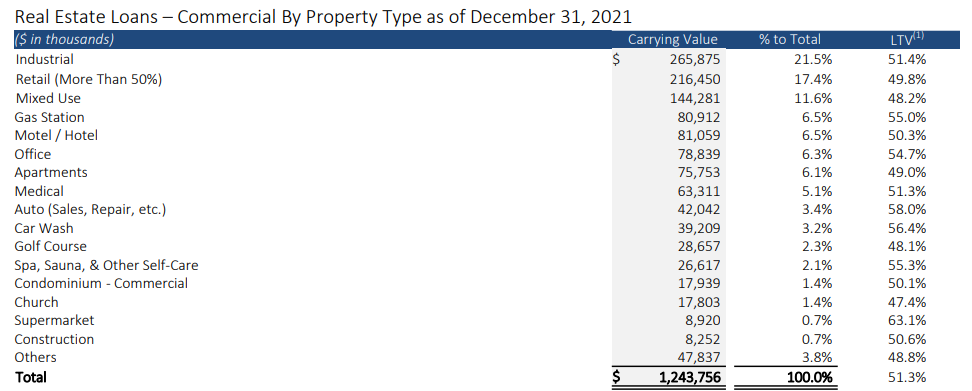

In excess of 60% of the loans is invested in commercial real estate. While this may initially be an issue for investors, PCB Bancorp provides an excellent breakdown of these CRE loans and it’s remarkable to see the average LTV ratio is quite low.

PCB Bancorp Investor Relations

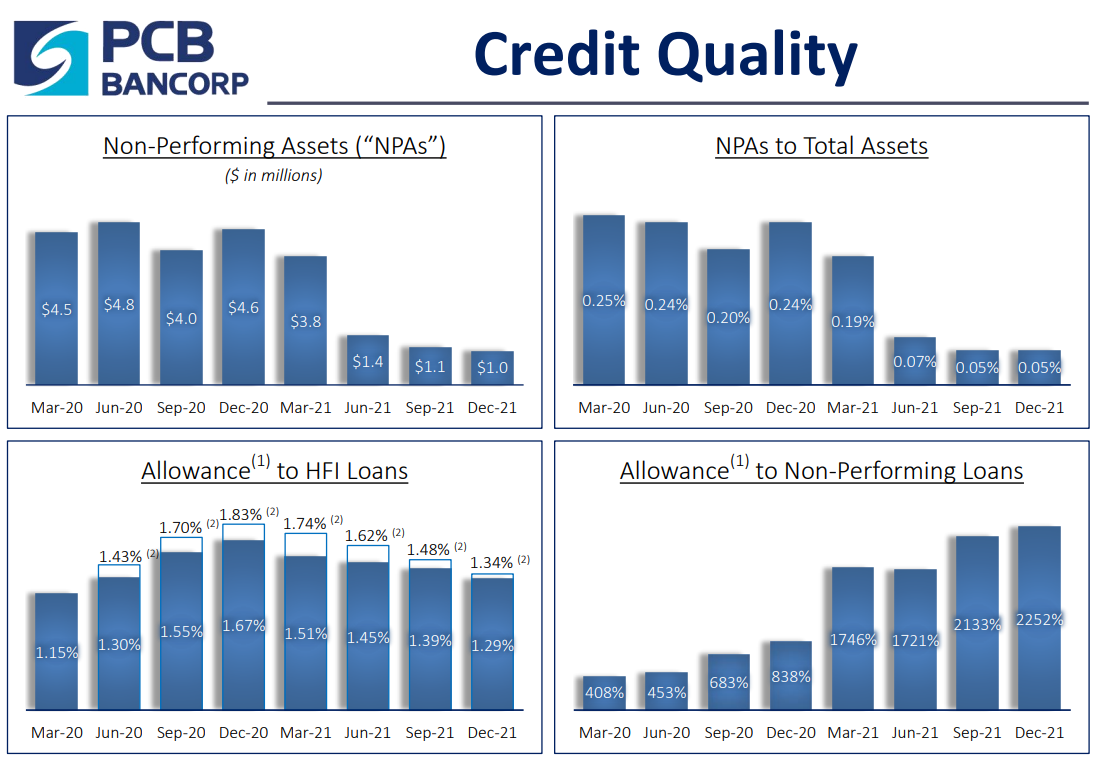

So while I’m not necessarily a fan of a high percentage of Commercial Real Estate in a portfolio, but given the low LTV ratios, I’m not too worried about the quality of the loan book. An additional argument can be found in the (lack of) non-performing assets. As of the end of last year, there were just $1M of loans on a non-accrual status, which represent 0.05% of the total assets. And while the total amount of loans past due is exceptionally low, PCB Bancorp still has a very healthy loan loss provision on its balance sheet, resulting in a coverage ratio of the non-performing loans of in excess of 2,000%.

PCB Bancorp Investor Relations

Investment thesis

PCB Bancorp appears to be still quite cheap as even correcting the reported results for the reversal of loan losses indicates the EPS would still come in firmly above $2/share. The share price is currently trading at a premium of approximately 31% to the book value but considering the payout ratio is just around 25-30%, PCB retains in excess of $1.5/share per year in earnings which means the book value will increase towards $20/share by the end of next year.

On top of that, the bank continues to buy back its stock. The company ended 2018 with a share count of just under 16 million shares and has reduced this to less than 15 million shares despite the continuous exercise of stock options by employees. In 2021, the bank repurchased just over 680,000 shares for less than $11M indicating it paid on average just $16/share. A very solid move as this means the future earnings will have to be divided over fewer shares outstanding.

I currently have no position in PCB Bancorp, but the bank has been added to my watchlist as the higher risk level associated with commercial real estate is mitigated by low LTV ratios.

Be the first to comment