imaginima

Introduction

When last discussing PBF Logistics (NYSE:PBFX), they were seeing underlying improvements, which I was hoping would lead to higher distributions, as my previous article discussed. Since ten months have elapsed, the recent speculation of a potential takeover by their parent company, PBF Energy (PBF) makes it timely to provide a refreshed analysis to assess the alternative outlook for investors should this easy payday not eventuate. Thankfully, it appears that investors win either way because takeover or not, they still have the potential to provide higher distributions coming in 2023 that would boost their already high yield of 7.31%.

Executive Summary & Ratings

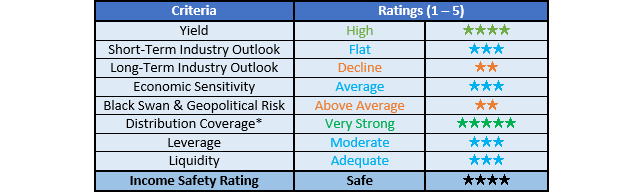

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings, as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing distribution coverage through distributable cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

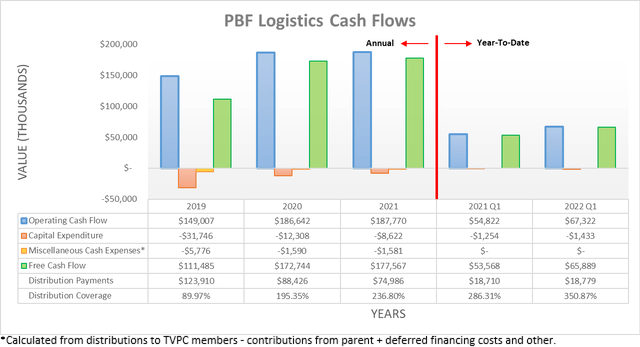

It was positive to see their cash flow performance continued performing strongly during the second half of 2021 following my previous analysis, with their operating cash flow ending the year at $187.8m and thus essentially the same as their previous result of $186.6m during 2020. Subsequently, the first quarter of 2022 saw a solid start with a result of $67.3m sitting an impressive 22.80% higher year-on-year versus their previous result of $54.8m during the first quarter of 2021. Admittedly, this was skewed by their temporary working capital movements that most notably resulted in a large draw during the first quarter of 2022. If removed along the smaller working capital draw during the first quarter of 2021, their underlying operating cash flow was $47.1m and thus essentially flat year-on-year versus their previous equivalent result of $48.7m.

Even after removing the boost from this working capital draw, they would still have produced $45.7m of free cash flow during the first quarter of 2022, which more than doubled their distribution payments of $18.8m. Given this very strong coverage, it naturally saw an analyst asking about the outlook for higher distributions, which thankfully remain possible, as per the commentary from management included below.

“And today, we’re continuing to pay debt. And once we get to that point where all the revolver debt will be repaid, we can evaluate other opportunities. But good operations and focusing on paying down debt is where our focus is today.”

-PBF Logistics Q1 2022 Conference Call.

Whilst management was not necessarily committed to higher distributions, realistically, their ample excess free cash flow and subsequently discussed healthy financial position make these quite probable once their credit facility is repaid, especially as they previously paid considerably higher distributions before the Covid-19 pandemic. Thankfully, investors should not have a particularly long wait, as their credit facility only had $75m drawn when the first quarter of 2022 ended. When circling back to their free cash flow excluding working capital movements of circa $45m, this leaves circa $26m per quarter of excess free cash flow after distribution payments and thus, it should only take until the end of 2022 to reach this goal, thereby meaning that barring a takeover, 2023 potentially sees higher distributions.

I expect investors will get clarity on the potential takeover next week when they release their results for the second quarter of 2022 and in the meantime, the lack of publicly available information makes it difficult to ascertain its probability of proceeding or the price unitholders can expect. Anecdotally speaking, there seems to have been quite a few master limited partnerships acquired by their parent companies during the last year, such as Shell Midstream Partners (SHLX), Sisecam Resources (SIRE) and Phillips 66 Partners just to name a few, which in my eyes, lends credence to the idea they will be acquired.

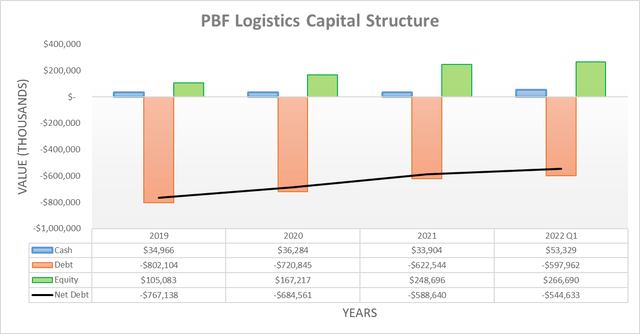

Their capital structure continued improving thanks to their continued steady and strong free cash flow, which now sees their net debt down to $544.6m and thus significantly lower than the $767.1m where it resided at the end of 2019 before embarking upon this deleveraging mission. Even if looking less far in the past, their net debt is still materially lower than the $588.6m and $684.6m where it ended 2021 and 2020 respectively. When looking ahead, their net debt should decrease by another $75m by the end of 2022 as they clean up the last remains of their credit facility before hopefully lifting their distributions.

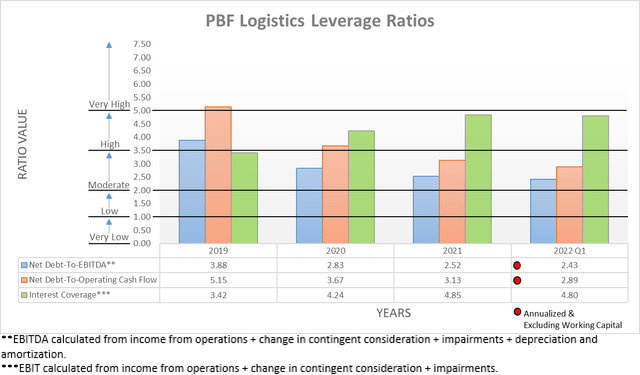

Quite unsurprisingly, their steadily decreasing net debt saw their leverage follow in tandem with their net debt-to-EBITDA now down to 2.43, which shows consistent improvements versus their previous results of 2.52 and 2.83 at the end of 2021 and 2020 respectively. Meanwhile, their net debt-to-operating cash flow also followed this same path with its latest result of 2.89 marking improvements versus its previous results of 3.13 and 3.67 at the end of 2021 and 2020 respectively. Whilst these both have fallen towards the lower half of the moderate territory of between 2.01 and 3.50, when looking ahead, they should end 2022 at approximately 2.09 and 2.49 respectively once they trim away another $75m of net debt, assuming their financial performance tracks the first quarter.

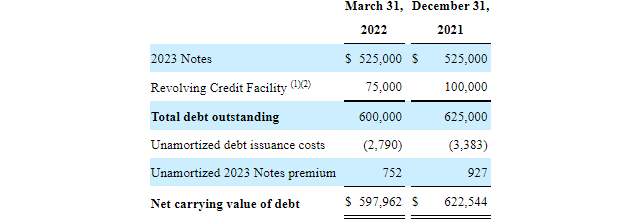

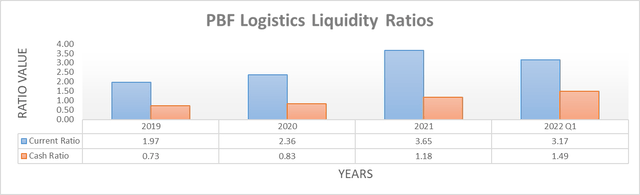

On the surface, it was also unsurprising to see their strong liquidity persisting with their current ratio of 3.17 and cash ratio of 1.49 pushing towards new heights, although when looking ahead, this will temporarily change after their next results are released. Once repaying the remainder of their credit facility, they will have to consider refinancing their $525m of senior notes maturing in May 2023, as the table included below displays. These will be listed as a current liability upon the release of their second quarter of 2022 results because the maturity is less than one year away from June 30th, which as a result, will send their current and cash ratios tumbling. Despite pushing their liquidity back to only adequate levels, thankfully this should only be temporary, as their continued deleveraging and otherwise healthy financial position should make refinancing a simple process.

PBF Logistics Q1 2022 10-Q

Conclusion

Whether investors see an easy payday from a takeover remains speculative, although they can still win either way since they should begin providing higher distributions in 2023 as their credit facility is repaid, which is supported by their ample free cash flow. Since the outlook for higher distributions is only strengthening with this catalyst in sight two years after their reduction, I believe that my strong buy rating remains appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from PBF Logistics’ SEC filings, all calculated figures were performed by the author.

Be the first to comment