Justin Sullivan

Thesis

PayPal (NASDAQ:PYPL) published Q2 2022 earnings on August 2nd and the stock jumped more than 10% following the announcement (after market close). And rightly so. The company recorded record gross booking and delivered a better than expected forward guidance. In addition, the company announced a closer collaboration with Elliott Management, a successful activist hedge fund, which should further push and support PayPal to deliver shareholder value.

PayPal stock is down by almost 50% YTD, vs less than 15% for the S&P. Despite the recent bounce, investors who want to jump on the PayPal train are getting a bargain. Personally, I value PayPal based on a 20x EV/EBITDA multiple, which is in line with GARP considerations, and thus calculate about 25% upside. My 12 months target price is $125/share.

PayPal’s Q2 Results

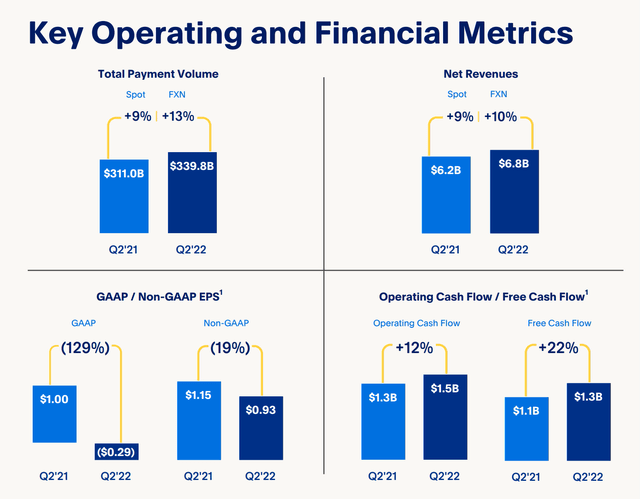

During the quarter from April to end of June, PayPal recorded total payment volume of $340 billion and generated revenues of $6.8 billion, which is an increase of about 9% year over year (10% FX neutral). For the quarter ended June 30, PayPal recorded non-GAAP operating income of $1.3 billion and EPS of $0.93, which represents a decrease of 19% as compared to the same period one year prior. PayPal achieved operating cash flow of $1.5 billion and free cash flow of $1.3 billion, which as compared to the previous period grew 12% and 22%, respectively.

Management positively surprised the market with an above-consensus guidance. For FY 2022, total revenues are expected to be approximately $27.85 billion, based on a TPV of about $1.4 trillion. Thus, net revenues are forecasted to increase by about 10% as compared to 2021 (11% FX neutral). PayPal now expects GAAP EPS between $1.52 to $1.62 and non-GAAP EPS between $3.87 to $3.97. Net New Actives (NNAs) are estimated at about 10 million. But the company noted:

However, as with all of our forecasts, NNA growth could be affected by broader economic factors, given the channels that drive organic customer acquisition, may be negatively impacted by falling consumer sentiment and reduced demand for discretionary goods

PayPal ended the 2Q quarter with cash and short-term investments of $15.6 billion against total debt of $10.6 billion.

PayPal Q2 earnings presentation

Elliott’s Stake Will Unlock Shareholder Value

Most importantly, there are some exciting cross-reads that signal that the company is focusing on shareholder-value creation. With Q2 results, PayPal announced a $15 billion share buyback program (within a timeframe of 4 years), which covers about 15% of the company’s shares outstanding. PayPal announced that Elliott Management had taken a $2 billion equity stake in the company. Management confirmed that PayPal has entered an ‘information-sharing agreement’ with Elliott Management and stated:

commitment to work with Elliott Investment Management L.P. on a comprehensive evaluation of capital return alternatives.

Elliott managing partner Jesse Cohn shared his view on the collaboration as follows:

As one of PayPal’s largest investors, with an approximately $2 billion investment, Elliott strongly believes in the value proposition at PayPal. (We PayPal has an unmatched and industry-leading footprint across its payments businesses and a right to win over the near and long term.

3 Key Initiatives

PayPal highlighted 3 key initiatives: The first is to grow market share, as management claims that many of the company’s competitors are reorienting their business models. Secondly, is focused on reducing the company’s cost basis. In that context, management aims to reduce operating costs by $900 million this year and targets another $400 million for 2023. Thus, investors are promised about $1.3 billion of annual cost savings long term. In addition, the company stressed:

We are also still sharpening our pencils to identify additional areas of productivity improvements across our servicing, marketing and engineering functions, as well as opportunities to rationalize our real estate footprint and shift our hiring to lower-cost geographies.

Third, the company is looking to strengthen its operating model and to recruit ‘world-class talent’ across the company’s product, engineering and technology functions.

Implication and Recommendation

I am very bullish on PayPal as I consider the stock a bargain. Down almost 50% YTD, the stock has likely bottomed, as the price-action following the earnings indicated that buy-side wants to buy the stock at current risk/reward levels.

PayPal currently trades at a one-year forward EV/EBITDA of about 16x. I believe a ratio of 20x would more accurately reflect the company’s value and continued growth potential. Thus, I calculate a fair implied target price of about $125 a share and see about 25% upside from current levels.

Be the first to comment