Justin Sullivan

PayPal (NASDAQ:PYPL) is continuing its massive growth in number of active users and total payment volume, and Venmo is becoming increasingly popular among consumers. However, the company’s transaction and operating margins are facing issues due to rising costs and headcount. Venmo is proving to be a top payment app among consumers and will likely gain ground on Cash App’s top line as Bitcoin (BTC-USD) continues to fall. Furthermore, PayPal’s Buy Now, Pay Later offerings are becoming top players in the market but could face trouble if a recession comes. These concerns have caused the stock to drop massively and fall below fair value despite having a bright long-term future, causing it to become an attractive pick in the market.

PayPal’s Metrics Are Growing, and Management Will Likely Improve Margins

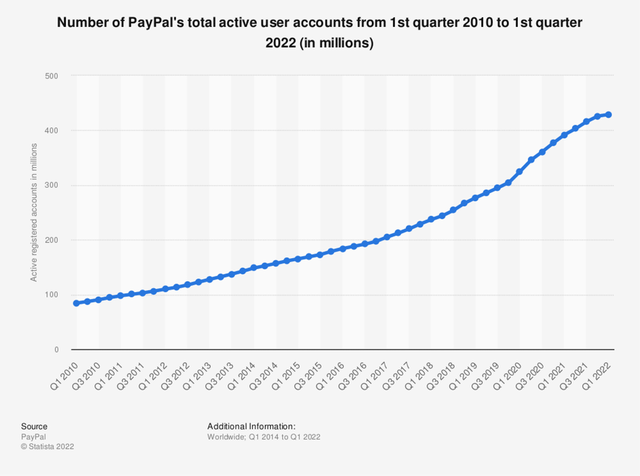

Despite PayPal stock being down over 60% YTD, the company’s user base and total payment volume continue to grow. Its total number of active user accounts has grown from 84.3 million to 429 million over the past 12 years. This represents a CAGR of roughly 14.5%. This trend continued into PayPal’s first quarter report where the company added a net of 2.4 million active accounts.

PayPal Active User Accounts, 2010-2022 (Statista)

Along with the total number of active accounts increasing steadily, PayPal’s total payment volume has been on the same trend. The company’s TPV saw a Y/Y increase to $322.98 billion, up 15% on a currency-neutral basis. This is due to the total number of transactions increasing by 18% Y/Y to 5.2 billion, as well as the transactions per active account improving by 11% to 47 million. Another large reason for this growth is due to Venmo’s 12% increase in TPV to $57.8 billion in the quarter.

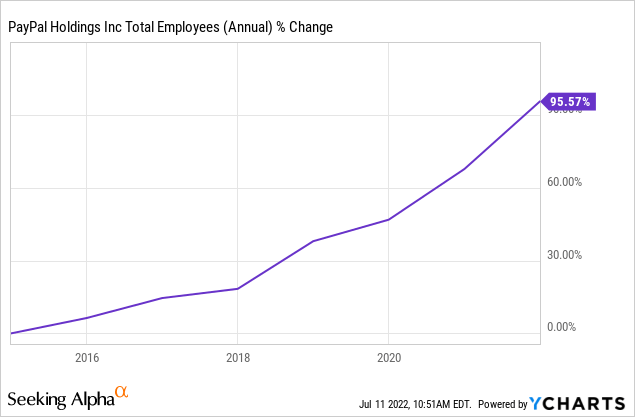

Although PayPal’s active accounts and TPV are rising significantly higher, the company’s margins are experiencing issues. Operating expenses were up 15.6% to $5.8 billion in the first quarter. This represents a 630 basis point expansion since last year. This caused the company’s operating margin to fall to 20.7%, contracting 700 basis points Y/Y. Its transaction margin also fell 690 basis points since last year to 50.9% due to rising transaction expenses and credit losses. The biggest issue the company needs to face is its rising administrative costs, which rose 16% Y/Y largely due to the labor market. Furthermore, its total headcount has nearly doubled over the past 10 years. Recently, management has begun reducing its staff to cut costs and this could help the company improve its margin in the long-run.

Venmo Has Better Metrics Than Cash App But Needs to Generate More Revenue

As mentioned before, a large growth driver for PayPal has been the rising popularity of Venmo. From 2015-2021, Venmo’s total number of users has grown from 3 million to over 70 million. This calculates to a CAGR of 69% and shows the app’s ability to gain new users. This incredible growth in users has led to its TPV growing from $7.5 billion to over $230 billion in the same time period. The rising number of users and TPV have allowed Venmo to increase its revenue by a CAGR of 52% in the past 4 years from $160 million to $850 million.

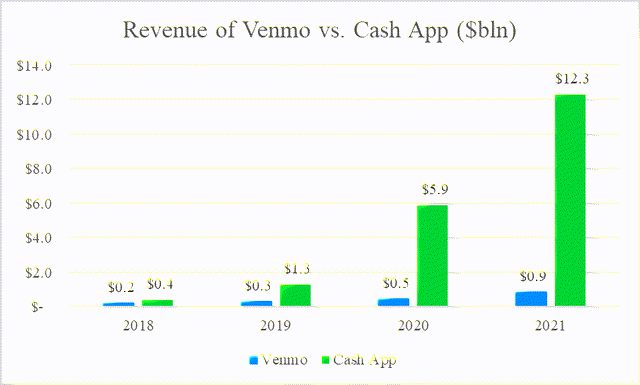

Venmo also outperforms its biggest competitor, Cash App, in terms of users and TPV. In 2021, Cash App reported to have about 44 million users and a TPV of $167 billion. Despite these lower metrics, Cash App has far outperformed Venmo in terms of revenue. Since 2018, the app has increased its revenue from $400 million to $12.3 billion, calculating to a CAGR of 213%.

Revenue of Venmo vs. Cash App, in Billions (Created by Author)

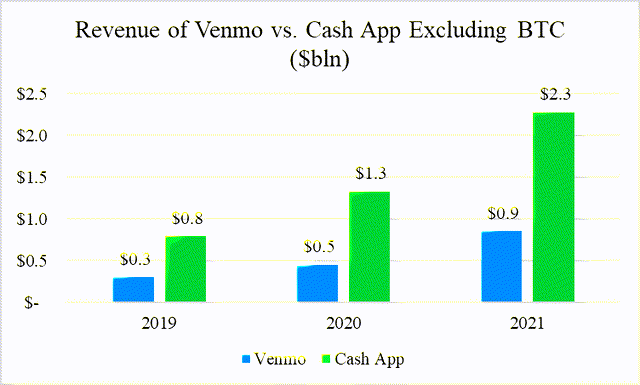

Although it appears Cash App far outperforms Venmo, it is important to discuss why. In 2021, Cash App generated just over $10 billion in revenue due to Bitcoin transactions. This represents roughly 82% of Cash App’s total revenue. Without Bitcoin transaction revenue, Cash App’s revenue becomes much more comparable to Venmo but still outperforms.

Revenue of Venmo vs. Cash App Excluding Bitcoin (Created by Author)

Since the beginning of this year, Bitcoin’s price has dropped by nearly 60% and this is drastically hurting Cash App. In Block’s (SQ) first quarter report, Bitcoin revenue dropped by 51% Y/Y due to consumers being less interested in the cryptocurrency. However, Venmo is not nearly as reliant on Bitcoin transactions as Cash App. Therefore, the app is set to see steadier revenue in the upcoming periods. However, Venmo now offers cryptocurrency transactions. With more users than Cash App, Venmo could begin to outperform if Bitcoin recovers and consumers regain their interest.

PayPal is Becoming a Top Player in the Buy Now, Pay Later Industry

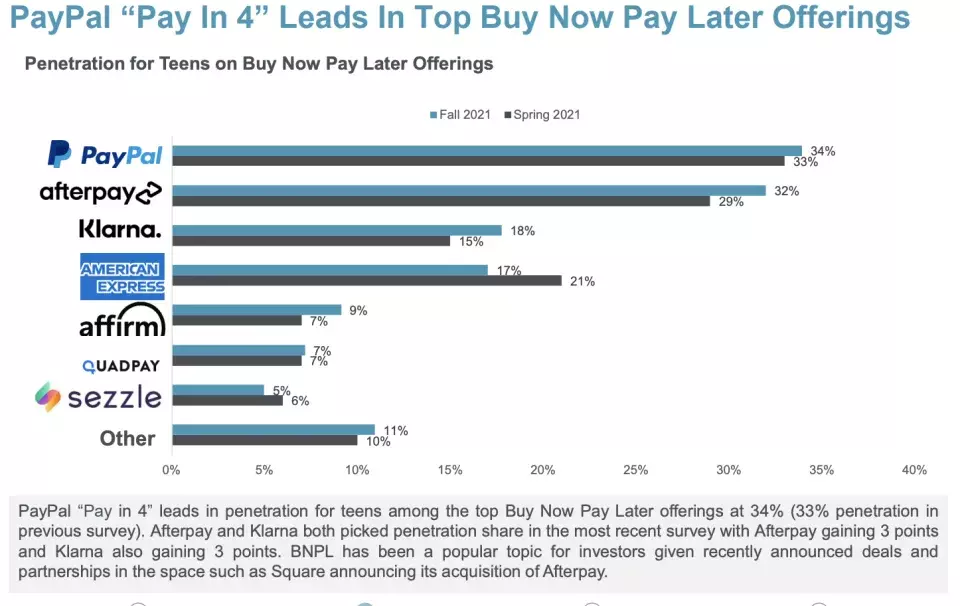

Buy Now, Pay Later (BNPL) services have become incredibly popular over the past few years and PayPal is becoming a top player in the industry. The company created its own BNPL service named Pay in 4, unlike Block who acquired Afterpay to enter the industry. This allows an immediate advantage because of saving costs. Along with these savings, Pay in 4 has one of the largest penetrations among its competitors at 34% and is seeing huge growth. On Black Friday of 2021, Pay in 4 experienced a 400% Y/Y rise in volume.

BNPL Industry Penetration (Piper Sandler)

PayPal also recently launched an expansion to its BNPL services with Pay Monthly. This new offering allows users to make larger purchases and for longer time periods. Now, approved consumers can make purchases between $199-$10,000 and pay it off in 6-24 months. The service generates revenue by using a risk-based APR ranging from 0%-29.99% depending on the consumer’s credit. Pay Monthly is another way for the company to capitalize on the growing BNPL industry and become a top player.

Although PayPal will likely be a top player in the BNPL market, the industry as a whole may face issues in the upcoming future. Rising interest rates are increasing borrowing costs for many BNPL companies and lowering margins. Furthermore, delinquency and loss rates are on the rise. Afterpay’s losses from total payment dollars increased from 0.9% to 1.17% since last year. Affirm (AFRM) is also facing issues with 3.7% of its outstanding loan dollars being at least 30 days late. With more issues rising in the general BNPL industry, PayPal could also begin to see problems in upcoming periods.

How Would PayPal Do In a Recession?

With the Atlanta Federal Reserve’s GDPNow showing a decline is coming, the United States is likely currently in a recession. Therefore, determining how PayPal may perform in a recession is vital. Since the company generates revenue mainly through taking cuts from transactions, consumer spending is vital to the business and management is saying it will likely drop heavily. In fact, personal consumption expenditures (PCE) only increased by 0.2% in May, which is its smallest increase this year. The reasoning for this slowdown in consumption is due to rising inflation. On top of consumers having less purchasing power, consumer sentiment hit a record low in June. With consumers having an incredibly low sentiment, consumption will likely take a huge hit. This will directly lead to lower transactions through PayPal, causing lower revenue.

The slowdown in e-commerce could also mean trouble for PayPal. In a recent Mastercard SpendingPulse report, e-commerce transactions dropped 1.8% while retail transactions grew by 7.2%. In-store sales also grew by about 10%. This hurts PayPal because e-commerce is one of the most common uses for the service. As pandemic tailwinds continue to fade and in-store shopping continues to rise, PayPal will likely complete less online transactions. This directly hurts the company’s top line.

Valuation of PayPal Stock

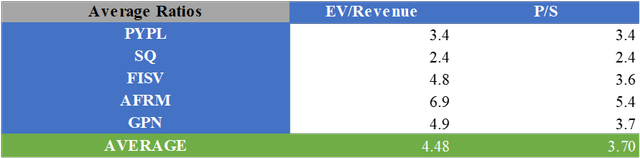

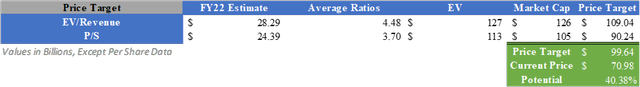

To value PayPal stock, I created a relative valuation and a DCF. For the relative valuation, I multiplied consensus analyst estimates for FY22 by the average valuation multiples for EV/Revenue and P/S of PayPal and its competitors. After adjusting for net debt, a price target of $99.64 can be calculated, implying an upside of 40.38%.

Average Multiples of PYPL & Competitors (Created by Author) Relative Valuation of PYPL (Created by Author)

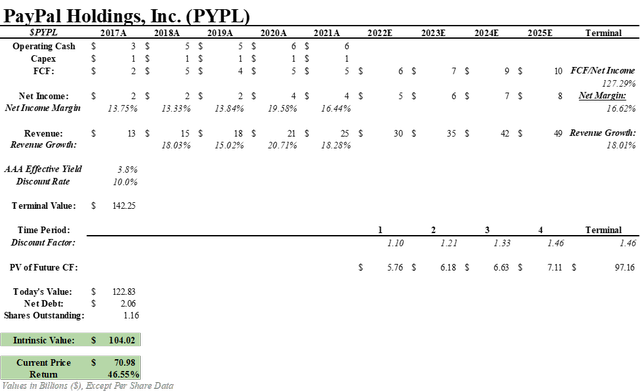

For the DCF, I first projected out future revenue by using PayPal’s average annual growth rate in revenue of 18.01%. I then found the future net income by multiplying the projected revenue by the company’s average net income margin of 16.62%. After multiplying the net income by the company’s average FCF/Net Income ratio of 127.29%, the future free cash flows can be found. I then used a discount rate of 10% to give a premium over AAA corporate bonds. After applying this discount rate to the future free cash flows and adjusting for net debt, a fair value of $104.02 can be calculated. This implies an upside of 46.55%.

DCF of PYPL with 10% Discount Rate (Created by Author)

What Does This Mean for Investors?

PayPal continues to improve its user and volume metrics and is beginning to address higher administrative costs. Furthermore, Venmo’s rising popularity combined with Bitcoin’s crash could allow it to better compete with Cash App and possibly outperform it in the long-run. The company’s BNPL offerings are also becoming industry leaders and will help it capitalize on the growing demand for the industry. However, the likelihood of a recession could drastically lower consumer spending and hurt PayPal’s top line. These issues have caused the stock to drop far below fair value and give a great margin of safety. Therefore, I believe applying a Buy rating is appropriate at this time.

Be the first to comment