bombuscreative

PayPal (NASDAQ:PYPL) ticked lower after releasing third quarter earnings. The results showed real progress on their ongoing cost-saving initiatives, though the headline numbers masked that progress. PYPL maintains a cash-rich balance sheet and is buying back stock. While the company’s growth prospects have admittedly slowed down post-pandemic, the stock is trading cheaply and can generate attractive shareholder returns as the company continues buying back stock. I expect accelerated earnings growth to pave the way for multiple expansion, providing light at the end of this tunnel.

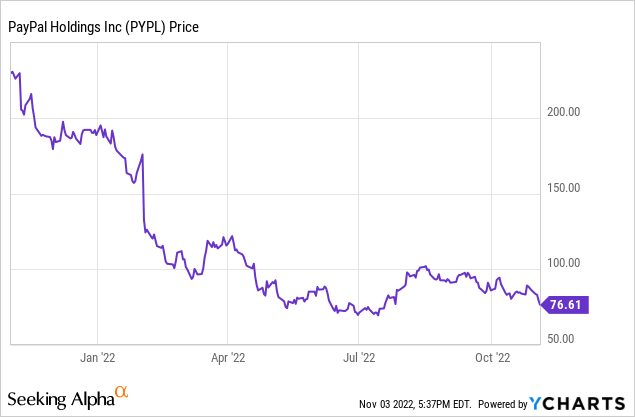

PYPL Stock Price

While PYPL briefly ticked higher in August upon an investment from activist investor Elliott Management, the stock has since struggled.

I last covered PYPL in August where I rated it a buy on account of the renewed focus on profit margins. The stock has since slid another 20%, which has only made the value proposition more compelling.

PYPL Stock Key Metrics

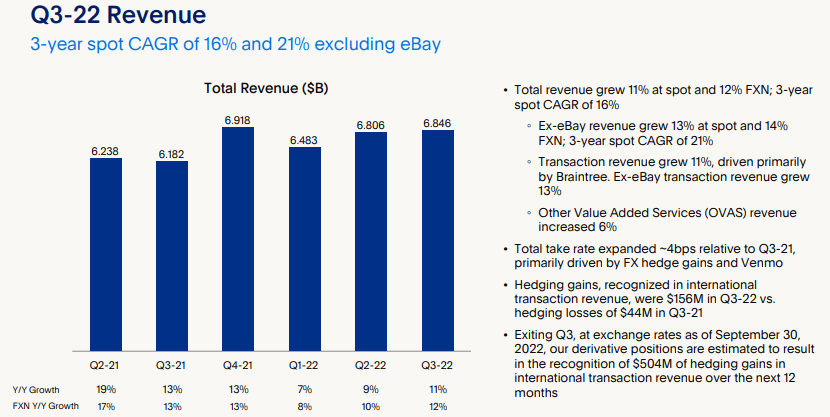

The latest quarter saw revenue grow by 11% YoY to $6.85 billion. Excluding eBay, revenue grew by 13% (14% currency neutral). Some of the growth was driven by 4bps of take rate expansion due to currency hedge gains and at Venmo.

2022 Q3 Presentation

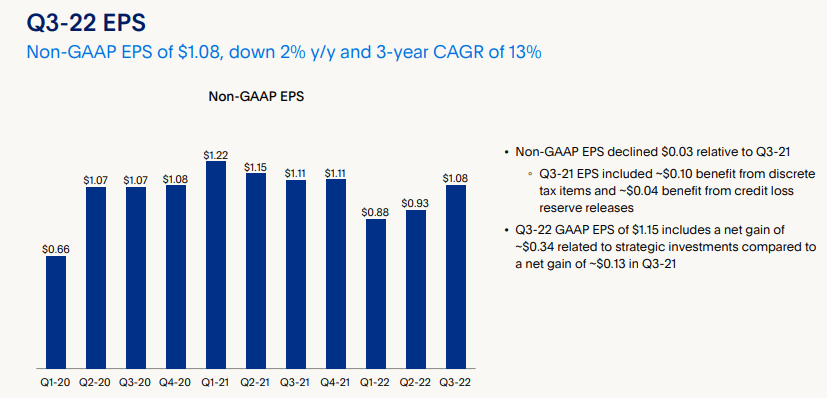

Non-GAAP EPS declined 2% year over year, but we must make further adjustments. The 2021 comparable quarter included a $0.04 boost to EPS stemming from a release of credit reserves. That alone is enough to show $0.01 per share of growth, but there’s one more adjustment to be made. PYPL paid a 15.7% tax rate this quarter versus 6.7% tax rate in the prior year’s quarter – excluding these two factors I estimate that non-GAAP EPS would have grown by 10.2%.

2022 Q3 Presentation

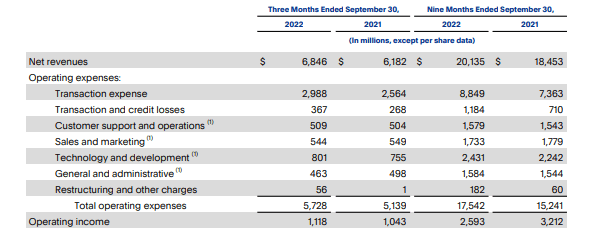

Key to that growth was the fact that PYPL has already made significant progress on reducing operating expenses, showing solid sequential declines in S&M, T&D (other companies call this R&D), and G&A expenses.

2022 Q3 Presentation

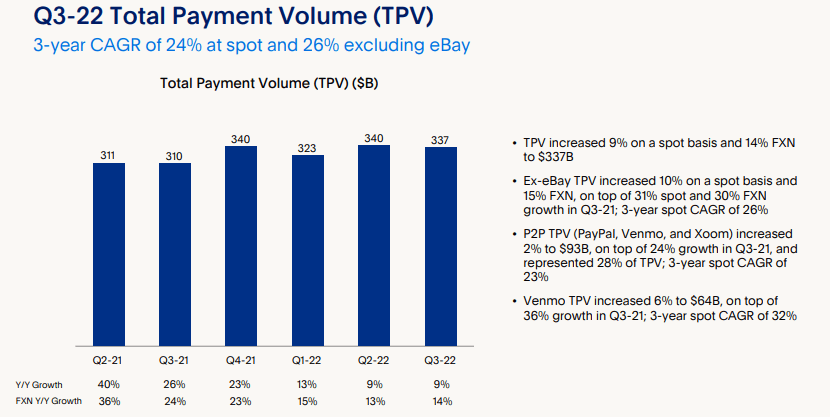

Total payment volume (‘TPV’) grew by 9% – a respectable rate considering the tough pandemic comparables.

2022 Q3 Presentation

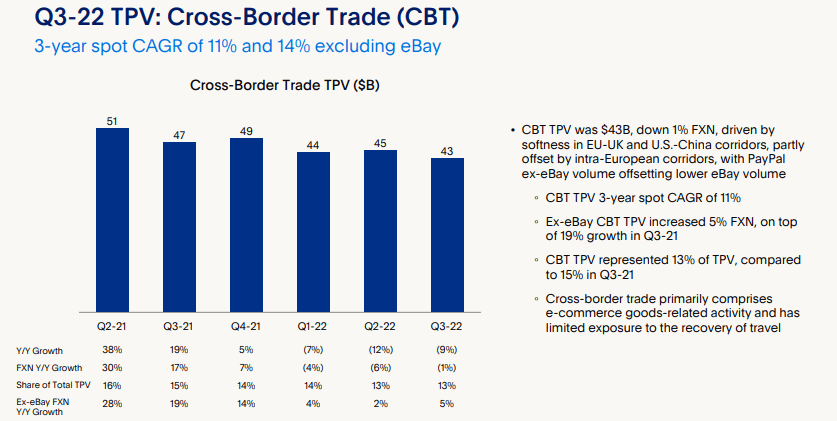

It appears that growth rates are still held back in part by cross-border trade, as Chinese tourism remains limited due to the pandemic and the Russia-Ukraine war has had some impact.

2022 Q3 Presentation

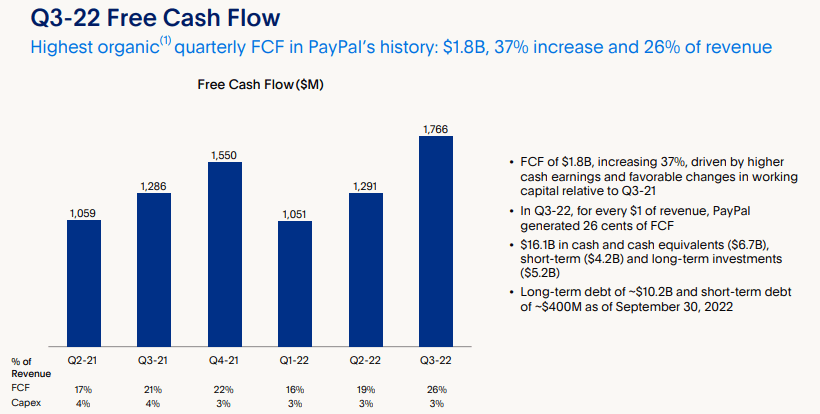

PYPL did generate $1.788 billion of free cash flow in the quarter, a 37% year over year increase. PYPL ended the quarter with $16.1 billion in cash versus $10.6 billion of debt.

2022 Q3 Presentation

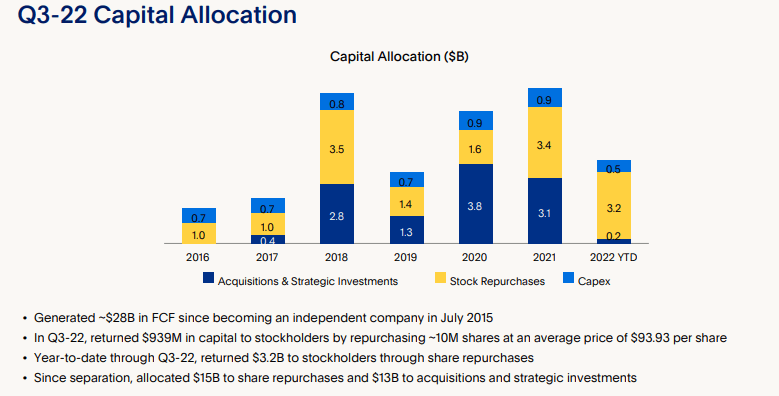

PYPL repurchased $939 million of stock in the quarter, bringing its year-to-date total to $3.2 billion. I am pleased to see that PYPL has prioritized share repurchases amidst a plunging stock price whereas it had prioritized M&A in the past.

2022 Q3 Presentation

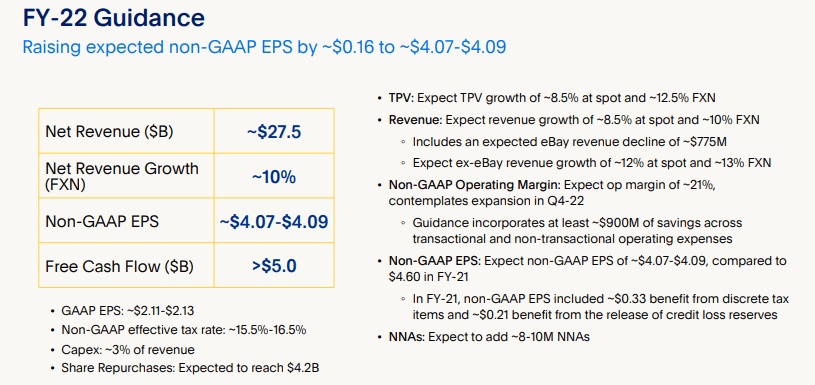

Looking ahead, PYPL lifted full-year non-GAAP EPS guidance to up to $4.09, an increase of $0.16 from prior guidance. PYPL expects to repurchase another $1 billion of stock by the end of the year.

2022 Q3 Presentation

PYPL has not yet officially issued 2023 guidance, but has given a preliminary framework calling for at least 100 bps of non-GAAP operating margin expansion leading to at least 15% non-GAAP EPS growth.

Is PYPL Stock A Buy, Sell, or Hold?

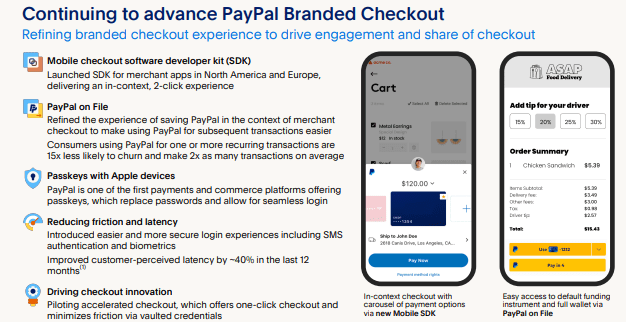

These were strong results from the company and this is a good moment to remind ourselves of the long-term thesis. While many investors might think of PYPL as being an e-commerce play, that is not entirely accurate. Instead, I think of PYPL as reducing friction for e-commerce. In short, PYPL makes it easier for consumers to checkout because payment information (credit card, addresses, etc) are saved to the PayPal account.

2022 Q3 Presentation

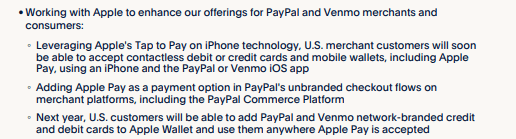

That means that PYPL can theoretically grow faster than the pace of e-commerce if it wins market share among payment processors. It also means, however, that PYPL faces competition from the likes of Apple Pay (AAPL). Regarding that last threat, PYPL announced that customers will be able to use Apple Pay through PayPal. It is unclear to me why a consumer would ever want to do this, but I am no shopping expert.

2022 Q3 Update

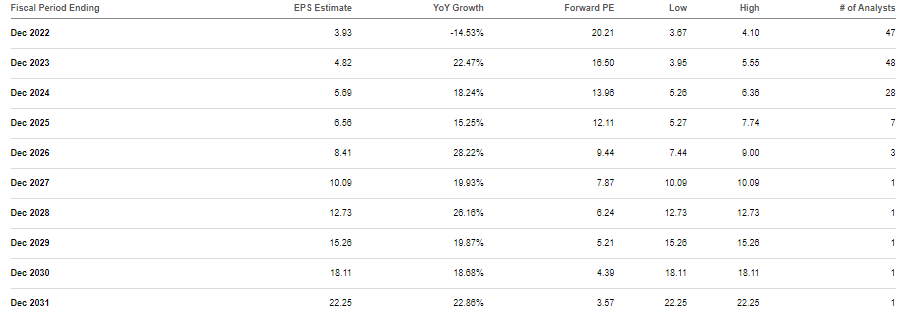

Consensus estimates call for strong double-digit earnings growth over the coming decade. That makes the 20x earnings multiple look attractive here.

Seeking Alpha

I view consensus estimates to be reasonable due to the high potential for operating leverage. If PYPL can generate 13% to 15% revenue growth annually, then it stands within reason that profits should grow in the 18% to 23% range as the company is mainly a payment processor.

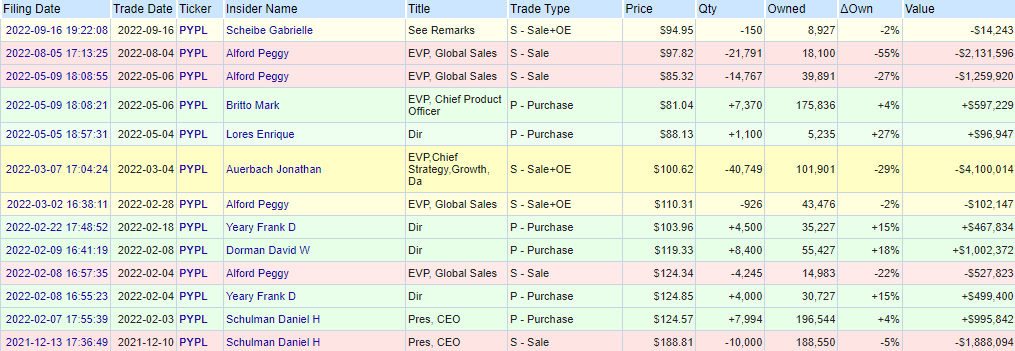

What are key risks? Some investors may have noticed the lack of material insider buying. This is true – while there has been some buying, there also has been enough insider selling to muddy the picture.

Openinsider

What’s more, the management team does not appear to own a material stake in the business.

2022 DEF14A

It is often said that stock with strong insider ownership can outperform due to greater alignment with shareholders – I would however not call the lack of insider ownership a red flag though.

The bigger risk may be that of competition. While I anticipate e-commerce growth to tick up in 2023 after the slowdown this year, PYPL may face payment processing competition from the likes of AAPL, Shopify (SHOP), and Amazon (AMZN) to name a few. While PYPL can be considered the incumbent in e-commerce payments, there are various reasons why all the competitors named above may be able to take market share. For instance, iPhone users may already be using Apple Pay for in-person checkout, while Shopify website merchants may find Shop Pay to be highly competitive.

Yet with the stock trading at discounted valuations, the stock can arguably be considered more of a share-buyback story than one of great innovation. As long as the company can continue driving operating leverage, I can see the stock delivering market-crushing returns over the next few years. I have discussed with subscribers to Best of Breed Growth Stocks my view that a diversified basket of beaten-down tech stocks may be an attractive way to take advantage of the tech stock crash. I rate the stock a strong buy as a higher quality allocation in such a basket.

Be the first to comment