bennymarty/iStock Editorial via Getty Images

Honey; I Shrunk the PEG

For the first time in the last decade, PayPal Holdings Inc, (NASDAQ:PYPL) actually sports a forward PEG (Price to Earnings Growth) ratio of 0.84. At $88, PayPal is just priced at 18X 2023 earnings of $4.79, with a projected growth of 22% next year. PayPal had reached a high of $308 in July 2021, before falling on growth concerns to a low of $68 in July 2022. At $88, I believe the rebound has just started and a PEG of 0.84 is too good to pass up for a company that still has a very bright future.

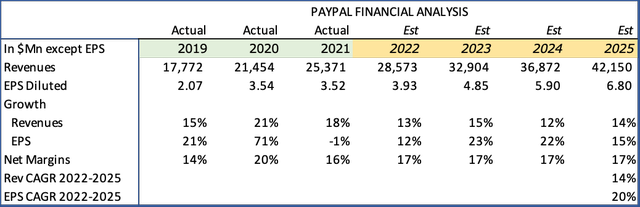

What used to be a tearing growth story has now evolved into a more mature company still growing revenues at 14% and earnings at 20%. Very formidable and given the opportunities abroad, fairly sustainable.

PayPal Financial Analysis (Fountainhead, PayPal)

For those looking for a steadier ship without the destruction of overpaying for growth, this is ideal. The story gets even better as Seeking Alpha consensus earnings estimates climb to $10.09 in 2027, reflecting a continued CAGR of 20% for the next 5 years.

The PayPal Flywheel

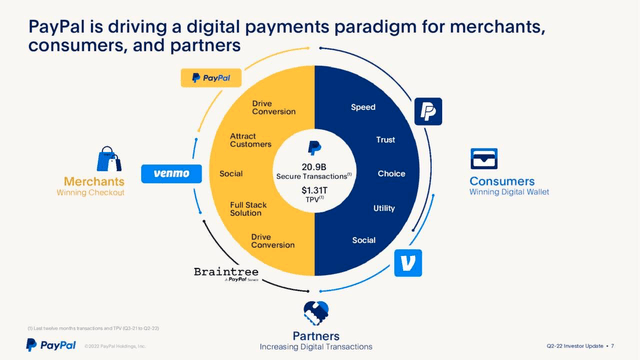

PayPal has a unique position in the global payments industry, it being a strong contender in both the customer and merchant segments, besides having the first mover advantage in peer to peer payments with Venmo.

It is a network like Visa (NYSE:V) and Mastercard (NYSE:MA) with the added advantage of owning the end user. Visa and Mastercard earn network fees for processing credit card transactions from card issuers. That is, for every swipe that costs the merchant about 3%, Visa and Mastercard take a percentage – they don’t issue cards themselves. Because PayPal started as an internet based e-commerce player, it is the network, the issuer reaching the end customer, and the merchant providing a payment option to the seller. In addition, they provide credit to their customers through their tie-up with Synchrony Bank, besides offering branded Venmo and PayPal credit and debit cards. Additionally, merchants also get other valued added products such as credit, loans and access to working capital, the same as most of the other providers such as Block (NYSE:SQ) and Shopify (NYSE:SHOP).

Both Block and Shopify have strong merchant bases and Block with its Cash app also competes with Venmo, but it doesn’t have the same customer base as PayPal. As of Q3-2022, PayPal had about 400Mn customer accounts, and 35Mn Merchant accounts.

Sticky Customers

PayPal accounts are sticky; the likelihood of closing your PayPal account is pretty low, the switching costs are high in terms of convenience and time, and often times are not worth it. The biggest advantages PayPal has are a) the convenience of never having to enter new credit card information and b) safety, even if Chrome or another browser stores your credit card information, you still have to enter the CVC code. In the words of PayPal CEO Dan Schulman “Consumers trust and know the PayPal brand. If you do a consumer survey, there is one that was just done externally, where 60% of consumers would prefer to use PayPal to do an online Checkout. The next closest digital wallet was 8%. “

Venmo’s increasing reach

Venmo should be available on Amazon (NASDAQ:AMZN) in Q4-22, which is a huge win for PayPal. One of PayPal’s biggest challenges was monetizing Venmo because there was no way to charge fees for peer to peer transactions and Venmo wasn’t accepted in most places. With the Amazon deal this will change significantly. Venmo is estimated to have about 90Mn accounts with 55Mn monthly users; this is a huge boost for both Amazon and PayPal. More importantly, this will bring in other e-commerce websites who were not previously accepting Venmo and lead to further growth.

Challenges

The US Market is penetrated

The US market for PayPal may be fully penetrated because PayPal and Venmo combined already have more than 50% consumer penetration. However, the international markets are mostly under penetrated and growing faster.

Growth at a Price

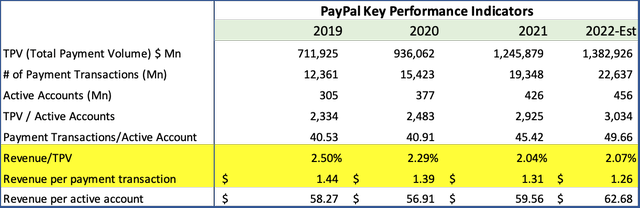

In 2021, Total Payment Volume (TPV) grew 33% to $1.25Tn and the number of transactions grew 25%, but total revenues grew only 18%. Growth from new accounts are coming at a price. Venmo’s transactions are mostly peer to peer and cannot be monetized easily. It’s only merchants who pay when a customer uses Venmo to pay for transactions. In Q3-2022, Venmo had an estimated 90Mn accounts and $230Bn in TPV, about 22% of total accounts and 18% of TPV.

PayPal Performance Indicators (PayPal, Fountainhead)

TPV grows well per active account from $ 2,334 in 2019 to $3,034 in 2022, but, revenue decreases as a percentage of TPV from 2.5% to 2.07%. As the payments space gets more crowded, bigger merchants pay less for high volumes and as more peer to peer accounts are added, these margins will continue to remain tight.

Stiff Competition

Besides Block and Shopify and several other Fintech companies, PayPal also competes with the big money center banks. Zelle, owned by JPMorgan Chase (NYSE:JPM) and used by many other banks is a huge competitor. Zelle’s usage has spread to the mainstream. In 2021 at $490Bn, Zelle had more than double the TPV of PayPal’s $229Bn, while Block came in third with $167Bn.

Little Product Differentiation

For most customers, there is little product differentiation, no bells and whistles, it’s only convenience. There are no financial incentives to switch.

Slower Growth Post COVID

COVID accelerated e-commerce shopping and online transactions in 2020, which led to PayPal’s revenues growing 21% but only 18% in 2021 and is now expected to reduce to 15% in 2022 and grow steadily at 14% for the next 3.

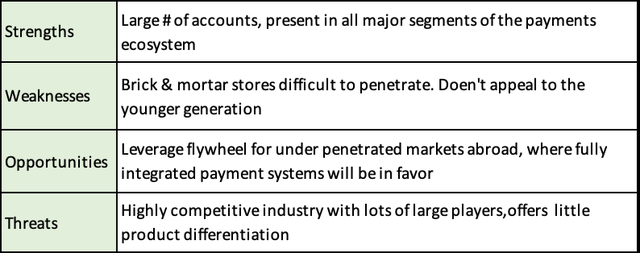

SWOT Analysis

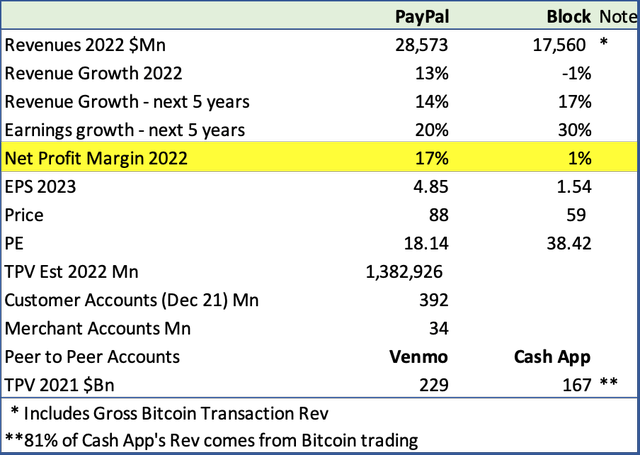

Competitor Analysis

Squaring Up: PayPal and Block (Business of apps, PayPal, Block)

PayPal stacks up well against its smaller and faster growing rival Block. Sure, Block’s 5 year earnings growth is much faster at 30%, but I believe it carries far more risks. Block’s merchant business is solid and will continue to grow. It’s the Cash app, which worries me – 81% of Cash App’s revenues come from Bitcoin trading, which carries its own share of risks and cyclicality. Block includes Bitcoin trading revenue in its total revenues. While revenues soar, net margins at 1% are way below PayPal’s or other global payment competitors.

Investor Takeaways

I own PayPal and plan to buy more after the Seeking Alpha waiting period.

PayPal’s ubiquity, flywheel and valuation are major reasons to buy this stock. This company is an absolute bargain at a forward PEG of 0.8, a forward P/E of 18, and an estimated 3-5 years growth of 20%.

Activist investor Elliot Management’s stake brings in discipline, focus and cost savings, and prevents the company from overpaying for growth.

PayPal also has a $15Bn share buyback program in place, which will goose earnings and set a floor for the stock.

I believe most of PayPal’s challenges are reflected in its current low price of $88 and expect the stock to easily outperform the market over the next 3-5 years.

Be the first to comment