Torsten Asmus

Article Thesis

PayPal Holdings, Inc. (NASDAQ:PYPL) released its third-quarter earnings on Thursday afternoon. The company beat estimates, but its revenue guidance for the current quarter was weak. This made PayPal’s shares drop by double-digits, to new 5-year lows. Business growth is slowing down, and there is some uncertainty about a “delete PayPal” movement. On the other hand, shares are now trading at a considerable discount relative to how PayPal was valued over the last couple of years, which could provide for a compelling entry point for those interested in owning PayPal.

What Happened?

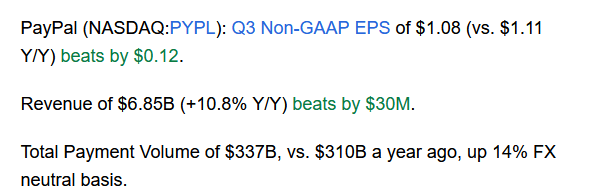

On Thursday afternoon, PayPal announced its most recent quarterly results, for its fiscal third quarter of 2022. The headline numbers can be seen in the following screencap:

Seeking Alpha

At first sight, these results look pretty good. Both revenue and earnings came in above expectations, and the company grew its revenue by double-digits (although only barely), which was better than the growth many other tech companies have reported for the third quarter, including giants such as Apple (AAPL) and Amazon (AMZN). The market was more concerned about PayPal’s future growth, however, as the guidance for the remainder of the current year is where the company underperformed expectations.

The initial market reaction was very negative, as PYPL is down 13% at the time of writing, to $67, which would not only represent a new 52-week low, but a new 5-year low on top of that. Shares will likely remain volatile through the remainder of the week, thus this could change.

Worries About A Slowdown

PayPal’s management has stated that the company would generate revenues of around $27.5 billion this year, which represents a reduction of $300 million or slightly more than 1% relative to what PayPal had guided for earlier. That seems almost negligible, but we have to consider that most of those revenues are already in the books, as there is only one remaining quarter this year. So, when we account for the revenues that have already been recorded, PayPal’s guidance reduction is more meaningful, and Q4 revenue will come in around 5% below what analysts had been estimating. That’s meaningful, and some investors fear that this might be the beginning of a new trend.

After all, between an economic downturn and weakish e-commerce sales growth, the macro environment is not too compelling. Consumers spend more on groceries and energy, where payments are usually not made using PayPal’s tech, which means that they spend less for other goods that are more easily bought online, which could be a headwind for PayPal and related companies.

It’s also worth noting that the market has been jittery about the potential impact of PayPal’s misinformation policy. The company has retracted its fines, but there nevertheless was some brand damage, and some users have left the platform. This could explain some of the weaker-than-expected Q4 revenue guidance, with the inflation impact — shift from e-commerce sales to brick-and-mortar sales where PayPal is not used for payments — being important as well.

Last but not least, PayPal is a global company that is active in many markets around the world. The U.S. dollar has strengthened significantly this year versus most currencies, which means that transactions in euro, yen, etc. are worth less once denominated in U.S. dollars, which hurts PayPal’s revenue growth as well. That’s not a unique headwind for PayPal, however, as many other companies with vast international exposure are experiencing the same issue.

While the business growth outlook is thus not too compelling, PayPal has executed well on another front. Profitability is stronger than expected, despite the weaker-than-expected revenue performance in Q4, which is why PayPal has lifted its earnings per share guidance for the current year. PayPal is now forecasting earnings per share of $4.07 to $4.09, which is up 5% versus what the company had been forecasting before. Better-than-expected profitability naturally is a plus, but it is worth noting that PayPal will nevertheless earn less this year versus what PayPal has earned in 2021. Last year, earnings per share stood at $4.59, thus the current guidance implies that profits will drop by a little more than 10% on a per-share basis.

That’s not a disaster, but not a great look, either, especially for a growth stock such as PayPal. Of course, weaker profitability in 2022, relative to 2021, is a trend that has affected many other tech companies as well. Overspending and rising expenses for employees have also impacted margins at Meta Platforms (META), Alphabet (GOOG, GOOGL), Amazon, and so on. Thus, one could argue that PayPal is just one of many companies that have seen their profitability come under some pressure this year.

That being said, PayPal at least seems to be eager to correct things, which is why the company is forecasting that profitability levels will improve next year. For 2023, PayPal is now forecasting earnings per share growth of “at least 15%.” That could mean many things, but going with the bottom of that range and the midpoint for 2022’s EPS guidance as a starting point, PayPal would earn at least $4.69 next year, which would make 2023 a new record year. The “at least” part suggests that management sees a considerable chance that earnings per share growth will be meaningfully higher than 15%, otherwise they would have phrased this differently, I believe (e.g., “around 15%”). PayPal thus might end up earning considerably more than $4.70 next year.

On the other hand, investors should consider that PayPal could end up underperforming its guidance — management could be too eager in promising growth, and actual results could fall short relative to what execs are promising now. After all, PayPal had been guiding to $4.60 to $4.75 in earnings per share in 2022 at the beginning of this year, as can be seen here. As it turns out, that was overzealous, and the company had to reduce its guidance meaningfully since (although some of that downward revision has been taken back with the Q3 report). PayPal’s track record in forecasting longer-term profitability is thus not great, and investors should thus take PayPal’s profit guidance for 2023 with a grain of salt.

If management executes well and controls costs successfully, 2023 could be a strong year profit-wise. However, some investors may opt to stay less optimistic until the company has proven its ability to execute.

All in all, we can summarize that the Q3 report and the outlook for the foreseeable future included both light and shadow. Q3 growth was better than expected, but Q4 revenue guidance implies a revenue slowdown. 2023 guidance looks strong, but that had also been the case with PayPal’s initial 2022 guidance — and yet, EPS declined, which is why some investors might decide not to put too much value on the EPS guide for the upcoming year.

PayPal: Opportunities And A Low Valuation

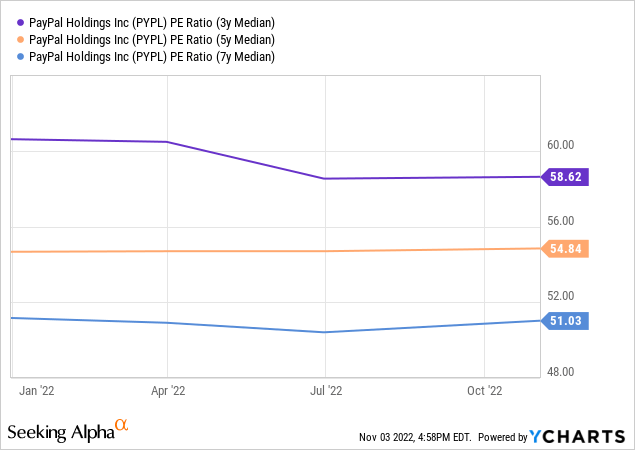

Based on PayPal’s guidance for this year’s earnings per share, the company is currently trading for 16x forward net profit. That’s not a high valuation for a company growing its revenue by double-digit, and it also isn’t expensive (at all) relative to how PayPal was valued in the past:

PayPal’s shares used to trade at 50x earnings and more. In retrospect, that was way too expensive, which is why many that bought PYPL stock over the last couple of years are underwater — those that bought at the highs are down as much as 80%. But still, the current valuation looks very undemanding on a relative basis. I do not see the 50x earnings multiples coming back, but there still is some upside potential.

If PayPal improves its profitability and manages to hit its EPS guidance for next year, shareholder confidence could be restored to some degree, and PYPL could see its valuation expand. A 20x earnings multiple wouldn’t seem outrageously high at all in such a scenario, and based on profits of $4.69 per share, it would result in a share price of $94 — which would make for compelling returns relative to where PYPL trades today. There thus is considerable share price upside potential, although it depends on a solid underlying performance by PayPal. If that does not happen, e.g., due to further revenue misses versus expectations, or due to margins compressing further, PayPal could see its shares decline further.

Takeaway

At first sight, the Q3 report looked very solid. But the macro environment is a headwind, and the boycott and brand damage due to the (now redacted) misinformation policy linger over PayPal in the near term. With profitability being down this year, PayPal will have to prove it is serious about cutting expenses and improving margins.

PayPal has considerable upside potential when it manages to do these things, but I wouldn’t call it a low-risk stock due to the aforementioned uncertainties. For enterprising investors, PayPal could thus be a buy, but others might want to prefer to see the underlying performance improve before thinking about entering a position.

Be the first to comment