hapabapa

Introduction: Why is PYPL Stock Down?

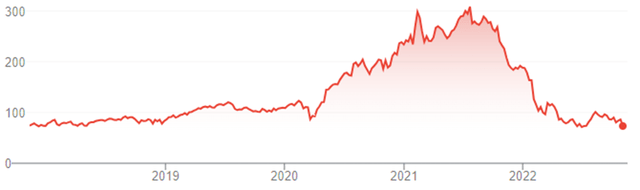

PayPal Holdings, Inc. (NASDAQ:PYPL) is down another 4.2% Friday lunchtime (as of 2 pm EST, November 4) after Q3 2022 results overnight. PYPL stock has now fallen 69% since its July 2021 peak, to a level last seen in 2017:

|

PayPal Share Price (Last 5 Years)  Source: Google Finance (04-Nov-22). |

Compared to when we upgraded our rating on PYPL to Buy in May 2020, shares have basically halved, primarily due to a contraction in its P/E multiple (from 47x 2019 EPS to 18x 2022 guided EPS).

Q3 results showed another quarter of mid-teens underlying volume and revenue growth. However, e-commerce is slowing and underlying revenue growth is expected to decelerate to 10% in Q4. Offsetting this, cost savings are progressing better than expected, and non-GAAP EBIT margin is expected to expand by 70 bps in Q4 and at least 100 bps in 2023. Buybacks are accelerating, with $4.2bn expected in 2022, equivalent to 5% of the current market capitalization. Management now targets Non-GAAP EPS growth of at least 15% in 2023.

Importantly for the medium term, PayPal has reached a new agreement with Apple (AAPL) to gain access to Apple Pay. We believe PayPal can grow its EPS at a mid-teens CAGR over time, and its P/E should return to 32.5x, in which case shares will have a total return of 171% (37.8% annualized) by 2025 year-end. Buy.

PayPal Buy Case Recap

Our investment case consists of the following:

- Payment networks are great businesses, thanks to their mission-critical nature, network effect, recurring revenues, natural pricing power, and operational leverage; there is a structural shift to electronic payments.

- As a two-sided payment platform with visibility over both parties in every transaction, PayPal has key advantages in data, speed, security, etc.

- PayPal also has a long-term vision of building an integrated payments ecosystem that includes both online and in-store purchases, payments (including P2P and B2C), consumer rewards, Buy Now Pay Later (“BNPL”), etc.

- There is significant potential in new geographies, beyond the U.S. and the U.K., which were historically 65% of revenues (in 2019).

- PayPal’s margin expansion potential in future years is not fully appreciated by investors, as management chose to rapidly increase investments.

COVID-19 was a significant boost to PayPal, with Net New Actives of 31.3m and sequential revenue growth of 14% in Q2 2020, the first full quarter after lockdowns in the U.S. and Europe.

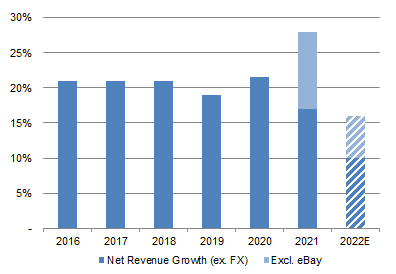

The phased loss of the legacy exclusive agreement with eBay (EBAY), agreed in 2018 but taking effect from July 2020, has been a headwind to PayPal revenues, but is set to be completed during 2022.

|

PayPal Net Revenue Growth (ex-Currency) (2016-22E)  Source: PayPal company filings. NB.2022E figures based on guidance. |

At its February 2021 investor day, PayPal released targets that included a 2020-25 EPS CAGR of 22% and a 2025 Free Cash Flow (“FCF”) of $10bn+. However, these were withdrawn in May due to a slowdown in e-commerce penetration growth and macroeconomic headwinds. Management also admitted they had over-expanded and needed to refocus the company on fewer things. We cut our forecasts correspondingly but saw a mid-teens EPS CAGR to be still reasonable.

Activist investor Elliott has held a $2bn stake in PayPal since August 2022, with an Information Sharing Agreement in place with the company to enable “collaboration across a range of value-creation opportunities.”

Q3 2022 results were generally in line with our investment case, though with a slowdown in e-commerce.

PayPal Q3 2022 Results Headlines

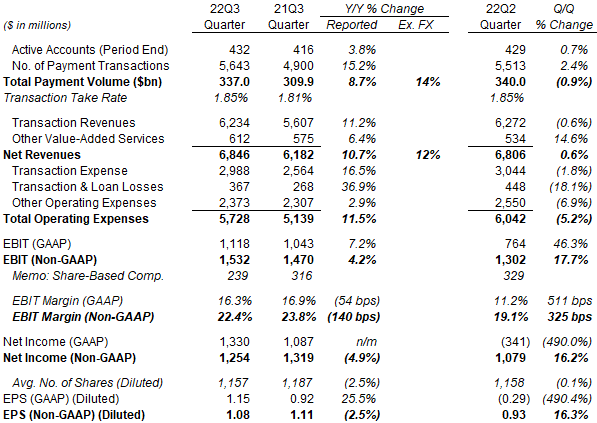

Headlines for PayPal’s Q3 2022 results are shown in the table below:

|

PayPal Key Financials (Q3 2022 vs. Prior Periods)  Source: PayPal company filings. NB. All figures are GAAP unless otherwise stated. |

We discuss key parts of the table in more detail in the rest of the article.

Return to Meaningful Accounts Growth

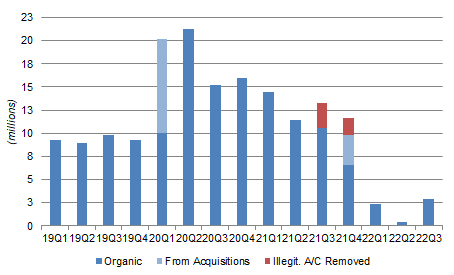

PayPal’s “Net New Actives” (“NNAs”) returned to a meaningful 2.9m in Q3, up from 0.4m in Q2:

|

PayPal Net New Accounts by Quarter (Since 2019)  Source: PayPal company filings. |

Management now expects full-year NNAs to be 8-10m, which implies a Q4 NNA of 2.3-4.3m.

While NNAs are much lower than in 2019, PayPal has had a stated goal of prioritizing user engagement over user count since FY21 results in February, and expects to return to pre-COVID levels of 20-30m only “over time.”

Underlying Mid-Teens Growth in Q3

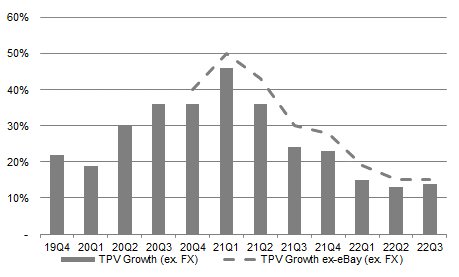

On an underlying basis, excluding currency and eBay, Q3 2022 represented another quarter of mid-teens growth.

Total Payment Volume (“TPV”) grew 14% year-on-year excluding currency, and 15% if also excluding eBay, both roughly stable from Q2 but lower than in Q1:

|

PayPal TPV Growth (Since Q4 2019)  Source: PayPal company filings. |

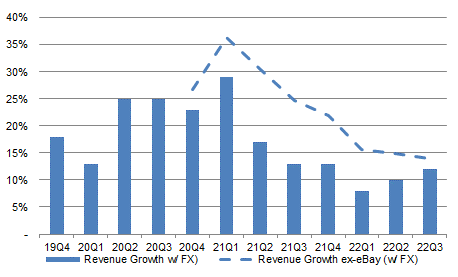

Net Revenues grew 12% year-on-year excluding currency, and 14% if also excluding eBay. The 12% ex-currency figure continued the sequential improvement since Q1, as eBay’s weight in the prior-year comparable fell progressively (from 9% of revenues in Q1 2021 to 4% in Q3 2021 and 2% in the latest quarter). The 14% figure that excludes both currency and eBay decelerated 1 ppt from Q2, which in turn decelerated 1 ppt from Q1, as e-commerce has been slowing:

|

PayPal Revenue Growth (Since Q4 2019)  Source: PayPal company filings. NB. Currency impact was estimated for some quarters. |

E-commerce has slowed further as we enter Q4.

Lower Q4 Growth from E-Commerce Slowdown

PayPal’s underlying revenue growth is expected to slow to 10% in Q4, due to a general slowdown in e-commerce.

PayPal’s growth has been driven by growth in overall e-commerce, which has been growing at roughly 10% annually over time, with PayPal generally growing faster than the latter as it continues to gain share. Its growth rate is therefore not immune from a general slowdown in e-commerce such as the one we now expect to see.

Acting CFO Gabrielle Rabinovitch explained things on the call:

“We saw U.S. ecommerce growing in the low single digits in Q3 with deceleration into the close of the quarter. This trend persisted in October on our platform as well as in third party data. We have not seen the early start to the U.S. online holiday season that we saw in 2021 … and we are seeing weaker performance in the U.K., our second largest market”

Management is especially downbeat about PayPal’s non-U.S. markets. As CEO Daniel Schulman explained:

“The inflation report in the Eurozone was not great … Our view is that we’re still going into winter, energy costs are going to go up. And the low-end income levels and middle-income levels are beginning to cut back on their discretionary spend, they’re spending so much more on food, on energy, on gas, on rent. And we’re beginning to see that impact those segments of the market. The high end of the market, by the way, still spending quite freely. And we’re seeing that also in our results.”

As a result, PayPal only expects to see Net Revenue growth of 7% at spot and 9% excluding currency in Q4 (8% and 10% respectively if also excluding eBay). This means the full-year outlook for Net Revenue growth was also cut:

- TPV to grow 8.5% at spot and 12.5% excluding currency (was 12% and 16%).

- Including eBay, Net Revenue to grow 8.5% at spot and 10% excluding currency (was 10% and 11%).

- Excluding eBay, Net Revenue to grow 12% at spot and 13% excluding currency (was 13.5% and 14.5%).

Management did not provide a 2023 outlook on TPV and revenues, stating it is “too early.”

Regardless of the size and duration of the upcoming slowdown, e-commerce has strong structural growth drivers and plenty of potential still to be tapped, and we expect both its growth and PayPal’s to return to long-term trends over time.

Cost Savings Better Than Expected

More than offsetting lower revenue growth, however, are PayPal’s better-than-expected cost savings.

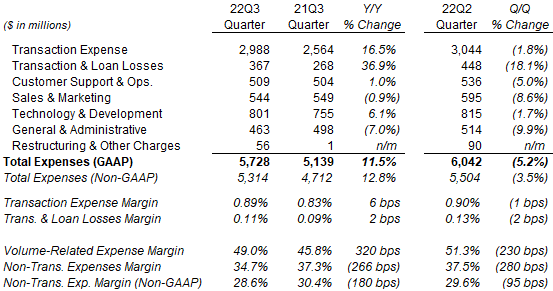

Total Expenses grew just 11.5% year-on-year in Q3 (down from 18.2% in Q2), and they were 5.2% lower sequentially:

|

PayPal Key Expenses (Q3 2022 vs. Prior Periods)  Source: PayPal company filings. NB. All figures are GAAP unless otherwise stated. |

General & Administrative and Sales & Marketing expenses were down 9.9% and 8.6% respectively from Q2. Headcount is now expected to finish 2022 lower than at the start of the year. Transaction Expense was down 1.8% (0.9 ppt more than TPV), despite a mix shift towards predominantly card-funded and thus higher-cost Braintree, as PayPal “began seeing benefits … from leveraging our scale across the network ecosystem.”

PayPal is “on track” to drive delivery in cost savings of “over $900m” in 2022 and “at least $1.3 billion” in 2023, across operating and transaction expenses. As a result, Non-GAAP EBIT Margin is expected to be 22.5% in Q4 (up 70 bps from prior-year Q4’s 21.8%), approximately 21% in full-year 2022 (compared to 24.8% in 2021), and to expand by “at least 100 bps” in 2023.

PayPal Outlook for 2022 and 2023

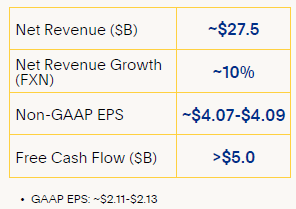

Overall, with more cost savings now expected, PayPal has raised its 2022 outlook for non-GAAP EPS from $3.87-3.97 to $4.07-4.09, despite cutting its outlook for TPV and revenues:

|

PayPal 2022 Outlook (Headlines)  Source: PayPal results presentation (Q3 2022). |

While the guided 2022 Non-GAAP EPS is around 11% lower than actual 2021 Non-GAAP EPS of $4.60, this will be after a 12 ppt headwind in prior-year credit reserve releases and tax items, as well as a significant currency headwind (1.5 ppt for revenues, likely larger for earnings). Underlying Non-GAAP EPS growth is likely to be low-single-digits.

For 2023, while PayPal has not provided a “detailed” outlook, management is targeting a Non-GAAP EPS growth of at least 15%, alongside the 100 bps Non-GAAP EBIT margin expansion they now expect.

PayPal Buybacks are Accelerating

PayPal’s share buybacks are accelerating.

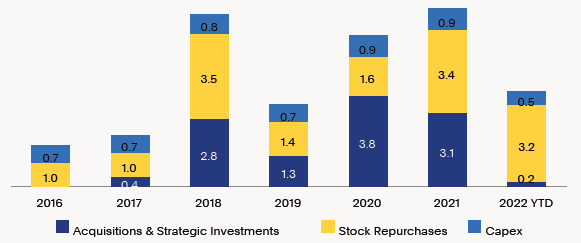

$3.2bn of shares were repurchased in Q1-3, and another $1bn is expected to be repurchased in Q4. The expected annual total of $4.2bn is equivalent to 5% of the current market capitalization:

|

PayPal Buybacks, Dividends & Acquisition Spend (Since 2016)  Source: PayPal results presentation (Q3 2022). |

The benefit of buybacks is partly offset by share-based compensation, and some buybacks were done at much higher prices, but PayPal’s share count was down 2.5% year-on-year as of Q3.

PayPal believes “share repurchase remains an optimal use of capital for our shareholders.” In addition, management has “committed” to securing off-balance sheet funding for “a portion” of its Buy Now Pay Later receivables in 2023, which should generate further cash proceeds. (PayPal had $4.4bn of consumer loans and interest receivables as of Q3 2022, up from $2.8bn a year ago.) We expect buybacks to continue.

New Agreement with Apple

PayPal has reached a new agreement with Apple (AAPL) to gain access to Apple Pay. Under the agreement:

- PayPal consumers in the U.S. can add their PayPal and Venmo credit/debit cards to their Apple Pay, for use anywhere that Apple Pay is accepted from 2023 (likely H1);

- PayPal merchants can “soon” use their iPhone and the PayPal or Venmo iOS app to accept contactless debit or credit cards, and mobile wallets including Apple Pay, without a dongle or other terminals.

- Apple Pay will be added as a payment option to PayPal’s unbranded checkout flows on its merchant platforms, in addition to Braintree where Apple Pay is already included.

Management expects the new agreement to have a meaningful impact over the medium term. We believe it will accelerate its journey to become a ubiquitous method of payment alongside Visa (V) and Mastercard (MA). The addition of PayPal and Venmo cards into Apple Pay (in line with what PayPal already has on Google Pay), in particular, will boost PayPal’s expansion in in-store payments far more effectively than the QR codes used so far.

Separately, PayPal stated that it “continues to ramp Pay with Venmo on Amazon” (AMZN) in the U.S., and “plan to be fully ramped in time for peak holiday shopping.”

Valuation: Is PayPal Stock Expensive?

PayPal’s valuation is attractive for a company we believe can achieve mid-teens EPS CAGR.

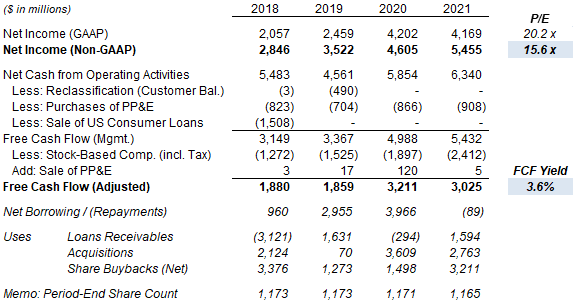

At the current price of $73.32, relative to the mid-point of the latest 2022 outlook, PYPL stock is trading at 18.0 x Non-GAAP EPS ($4.07-4.09) and 34.6x GAAP EPS ($2.11-2.13).

Relative to 2021 financials, PYPL stock is trading at a 15.6x P/E on Non-GAAP EPS and a 20.2x P/E on GAAP EPS; FCF Yield, after deducting share-based compensation costs, is 3.6%:

|

PayPal Valuation & Cash Flows (2018–21)  Source: PayPal company filings. |

Management guided to free cash flow (“FCF”) exceeding $5bn (on their definition) in 2022, broadly consistent with 2022.

PayPal Stock Forecasts

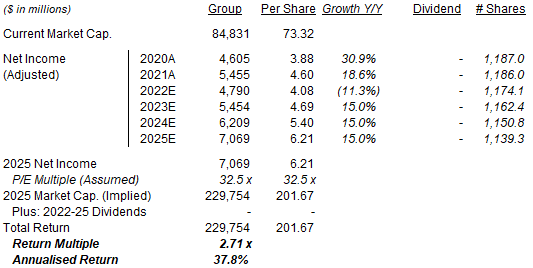

We update our 2022 forecasts in line with the latest outlook, reduce our 2025 exit multiple assumption but keep other assumptions unchanged:

- 2022 EPS to be $4.08 (was $3.92)

- Thereafter EPS growth to be 15%

- No dividends

- Share count to fall by 1.0% annually

- P/E to be at 37.5x at 2025 year-end (was 32.5x)

Our new 2025 EPS forecast is $6.21, 4% higher than before ($5.96):

|

Illustrative PayPal Return Forecasts  Source: Librarian Capital estimates. |

With shares at $73.32, we expect an exit price of $202 and a total return of 171% (37.8% annualized) by 2025 year-end. The exit price is 35% lower than PYPL’s peak of around $310 in July 2021.

Conclusion: Is PYPL Stock a Buy?

We reiterate our Buy rating on PayPal stock.

Be the first to comment