metamorworks/iStock via Getty Images

While most fintechs are struggling, Payoneer Global (NASDAQ:PAYO) continues to fire away on all cylinders despite the war in Ukraine impacting revenues. The global payments company has expanded into financial products with higher take rates growing the business without massive payments volume growth. My investment thesis remains ultra Bullish on the stock at only $7 as the business benefits from higher interest rates.

Thriving Tough Times

Payoneer reported Q3’22 revenues grew an amazing 30% to reach $159 million. The global payments company grew the take rate 15 bps from prior year levels to 105 bps. The company has only grown payments volumes by 11% from last Q3 to $15.1 billion, but the business has expanded further into product lines with much higher take rates.

The company has even grown the revenue less the transaction costs by 34% YoY. Transaction costs are now only 17.6% of revenues, down 250 basis points from 20.1% back in Q3’21.

Despite the macro headwinds where a lot of corporations are cutting back, Payoneer grew R&D expenses by nearly 50% and grew sales and marketing expenses by nearly $12 million. The market might want companies to focus on higher profits, but Payoneer has too much grow initiatives to pull back from investing for the future now.

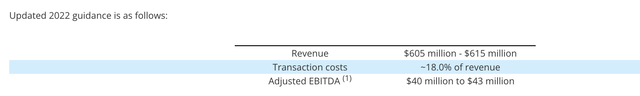

All during this period, Payoneer has seen a hit from Ukraine. The fintech originally guided down the Ukraine business as a $46 million revenue hit for the year with a total revenue guidance of $535 million for 2022. The company has maintained 75% of the original budget for the region while hiking revenue guidance for the year to ~$610 million.

Source: Payoneer Q3’22 earnings release

As revenues head towards $750 million next year (consensus estimates at $725 million heading into Q3 report), the market will definitely focus on the profitability of the business. Payoneer guided to 2022 adjusted EBITDA of up to $43 million with plans for margins expanding in 2023. The global payments company is only generating 7% EBITDA margins now and a boost to 10% margins would nearly double EBITDA to $75 million next year.

A big part of the boost to revenues is the nearly $15 million in interest income Payoneer is now earning from customer balances versus only $1 million last year. The higher interest rate environment is a boom for the fintech and the company should continue to grow customer deposits in the years ahead as the new products like B2B AR/AP lead to higher balances with customer funds at $5 billion.

New Highs Ahead

A lot of SPAC deals ended with companies going public without the necessary cash to fund the business to profitability. This isn’t the case with Payoneer with the company ending September with a cash balance of $508 million.

The company has a fully diluted share count of ~411 million shares placing the market cap at $2.9 billion. Payoneer has another 25 million warrants and 30 million earn-out shares. The EV is only $2.4 billion due to the large cash balance which could get a boost of up to $400 million with all of the stock options and warrants exercised in the future.

Amazingly, Payoneer has achieved most of the original financial results despite the Ukraine war. Despite this achievement, the stock trades around $7, some 30% below the SPAC deal at $10.

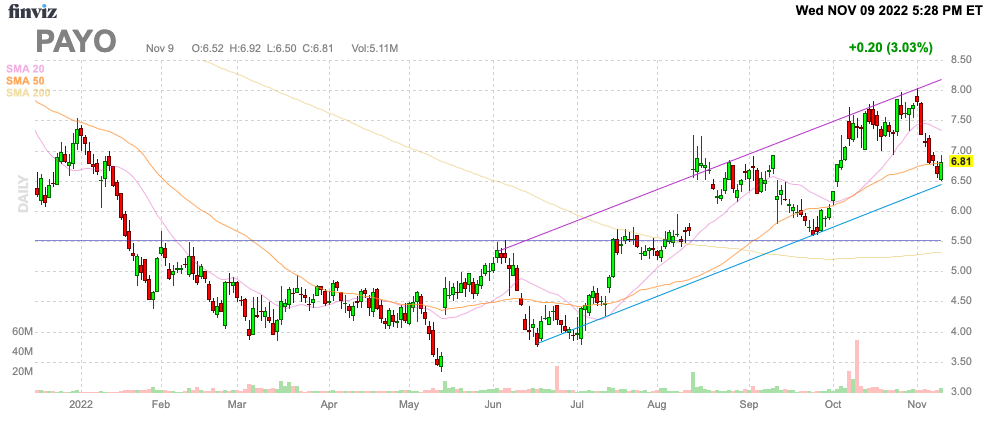

Source: FinViz

The stock only trades at 3x 2023 sales targets even with the impressive looking chart. Payoneer is one of the few stocks recently trading at the yearly highs and the quarterly numbers and guidance support the stock heading even higher.

Takeaway

The key investor takeaway is that Payoneer has had an incredible year considering the original headwinds to the business. The global payments company is only starting with expansion of new products and will continue to ride the demand for global payment options in emerging markets.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market during the 2022 sell off, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.

Be the first to comment