SeregaSibTravel/iStock Editorial via Getty Images

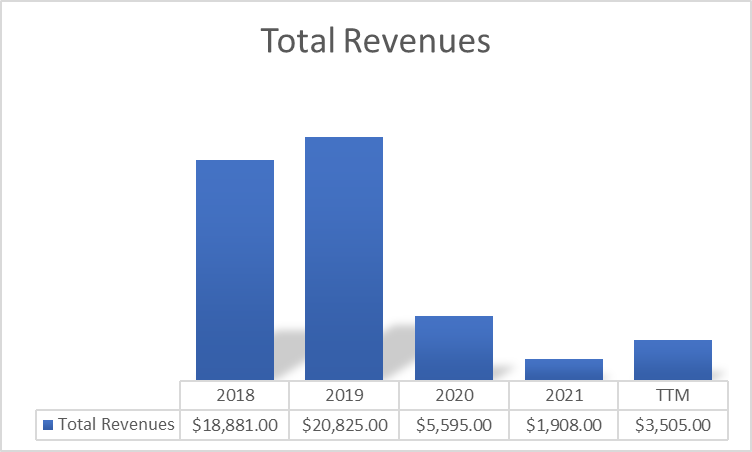

Carnival Corporation & plc (NYSE:CCL) is a multinational cruise company with operations throughout the world and a sizable portion of its total revenue generated in North America and Europe. Due to the pandemic, CCL suspended guest cruise operations in March 2020, slashing its price by more than 60% from its peak in 2021. As of this writing, CCL has an improving trailing twelve months top line of $3,505 million. However, this remains below its pre-pandemic level. Even with a disrupted operation, CCL has demonstrated its resilience by forecasting that the bottom line will resume positive territory in Q3 2022 and occupancy rate will continue to grow and eventually reach its historic level in 2023.

Unlike other companies who sold the majority of their assets to survive the pandemic and as a source of cash flow, CCL managed to maintain a growing capacity trend. It enjoys a strong forecast starting in 2023 with lesser pressure on inflated input cost and a positive outlook about its continued recovery from the pandemic. Uncertainty surrounding the pandemic is beginning to ease, with new cases of Covid-19 hospitalization declining in the US and the CDC lifting its risk advisory for cruise travel.

CCL is cheap at its forward EV/Sales multiple of 3.61x and will provide new investors a good risk reward ratio at today’s price.

Effects of the Pandemic

CCL: Improving Revenue (Source: SeekingAlpha.com. Prepared by InvestOhTrader. Amounts in Millions)

Due to the pandemic, the company’s trend of growing top line revenue was disrupted. This has been a source of concern for investors, as the company has significant fixed expenses such as interest payments and depreciation and amortization that continue to accrue even when the company ceases operations. This snowballed to a declining trend of its net income, which affects its retained earnings as well. With its growing debt level, I am not surprised that CCL received a highly speculative rating of B1 as of April 2021.

However, the company successfully managed their obligations as quoted below.

At the same time, we also managed down operating costs, reducing our monthly adjusted EBITDA losses by 40% since mid-2020; completed a continuous stream of capital raising, exceeding $29 billion; refinanced more than $9 billion of debt, improving interest rates; amended over 100 different lender agreements; and successfully addressed our maturity tower out through 2024, all of which culminated in a consistent liquidity position exceeding $7 billion, an integral part of reinforcing stakeholder confidence. Source: Q4 2021 Earnings Call

Additionally, despite its paused operations, the company managed to actually improve its current ratio level to 0.74x higher than its 5 year average of 0.57x, and with its higher cash and cash-equivalent $6,414 million higher than its pre pandemic level. I believe there is a chance that we might see an improvement on its current credit rating, especially with the lesser restriction as of today and uninterrupted growth in its capacity level.

Temporary Headwinds

Despite a good catalyst from the cruise travel industry, CCL continues to face temporary headwinds from inflated fuel cost pressure and adjusted cost without fuel per ALBD because of unusual maintenance costs such as dry dock and other related expenses regarding health and safety protocols. This resulted in a declining gross margin, which is the company’s first negative gross margin in its history.

Additionally, despite the strong outlook by the management that the company will start incurring a positive bottom line in its Q3 2022 report, it still expects a negative figure for its full fiscal 2022. The management assures that this temporarily inflated cost will not recur in their next fiscal report.

We anticipate that many of these costs and expenses driving adjusted cruise costs without fuel per ALBD higher will end during 2022 and will not reoccur in 2023.

Like with other companies, CCL also showed its support for Ukraine and has fully withdrawn its operations in Russia, leaving a small portion of its capacity at stake.

Now concerning the invasion of Ukraine. For the 4.6% of our capacity that was expected to call on Russian ports in the remainder of the year, we have decided to totally withdraw from Russia and have found attractive alternatives.

Despite That, CCL Enjoys a Growing Top Line Forecast

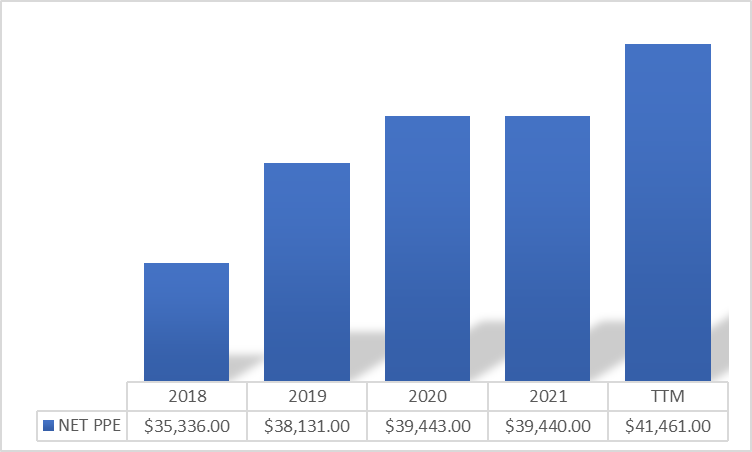

Despite the idle period during which ships were not sailing, CCL managed to avoid significant impairment charges. It rather surprisingly managed to improve its ships’ book value.

CCL: Growing Net PPE (Source: SeekingAlpha.com. Amounts in Millions)

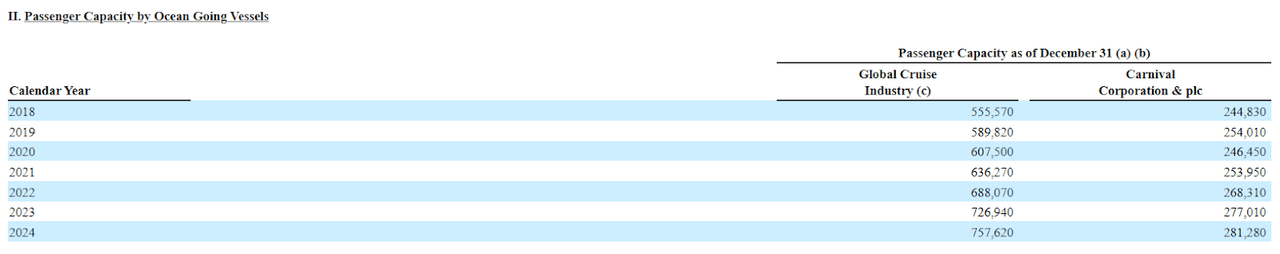

On top of that, despite the uncertainties from the pandemic, the company continues to invest on improving passenger capacity.

CCL: Growing Passenger Capacity (Source: Q4 2021 Report)

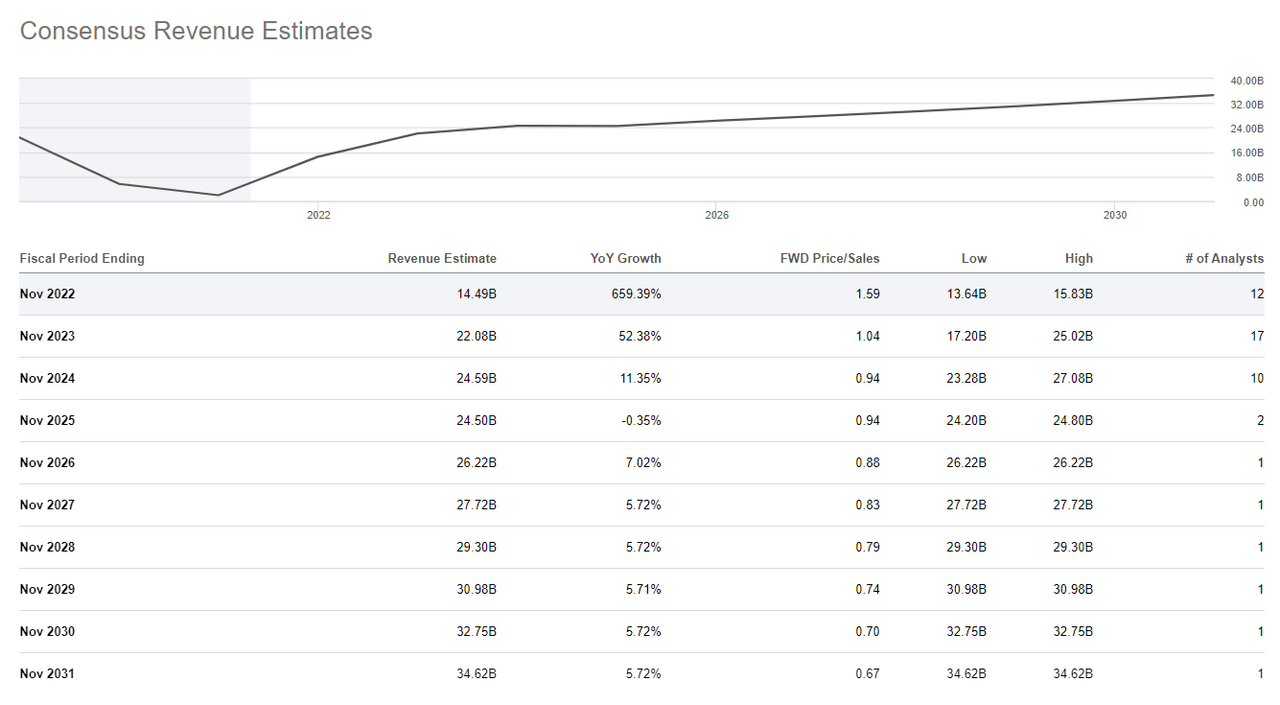

With this growing passenger capacity and improving booking guidance from the management, on top of the lesser restriction from the government, there is no doubt that analysts’ 2022 and long-term revenue forecast is achievable.

CCL: Consensus Revenue Estimates (Source: SeekingAlpha.com)

Another bullish catalyst is the revenue forecast by analysts for CLL’s 2023 which is higher than its 2019 figure of $20,825 million. The management anticipated a higher EBITDA than in 2019, which was $5,457 million with a 26% EBITDA margin in fiscal 2019. With $20.08 billion in forecasted total revenue in fiscal 2023 and forecasting EBITDA level to at least 26% each year, CCL will generate meaningful growth in its EBITDA. This may snowball to a growing cash flow if properly capitalized.

CCL is Undervalued

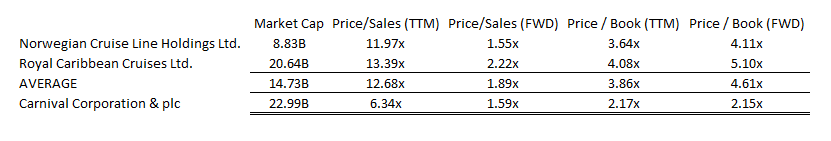

On top of its improving EBITDA outlook, CCL is trading at a huge discount against its peers.

CCL: Relative Valuation (Source: Data from SeekingAlpha. Prepared by InvestOhTrader)

CCL is extremely cheap compared to its peers with a trailing P/S ratio of 6.34x compared to its peers’ average of 12.68x and forward P/S ratio of 1.59x. No doubt, CCL has a better balance sheet and has a safer capital structure than its peers with its trailing P/B ratio of 2.17x and forward P/B ratio of 2.15x. At a trailing BV per share of $9.05, I believe that CCL is cheap as of this writing and a $38 target price is achievable.

Trading At A Strong 2008 Support Zone

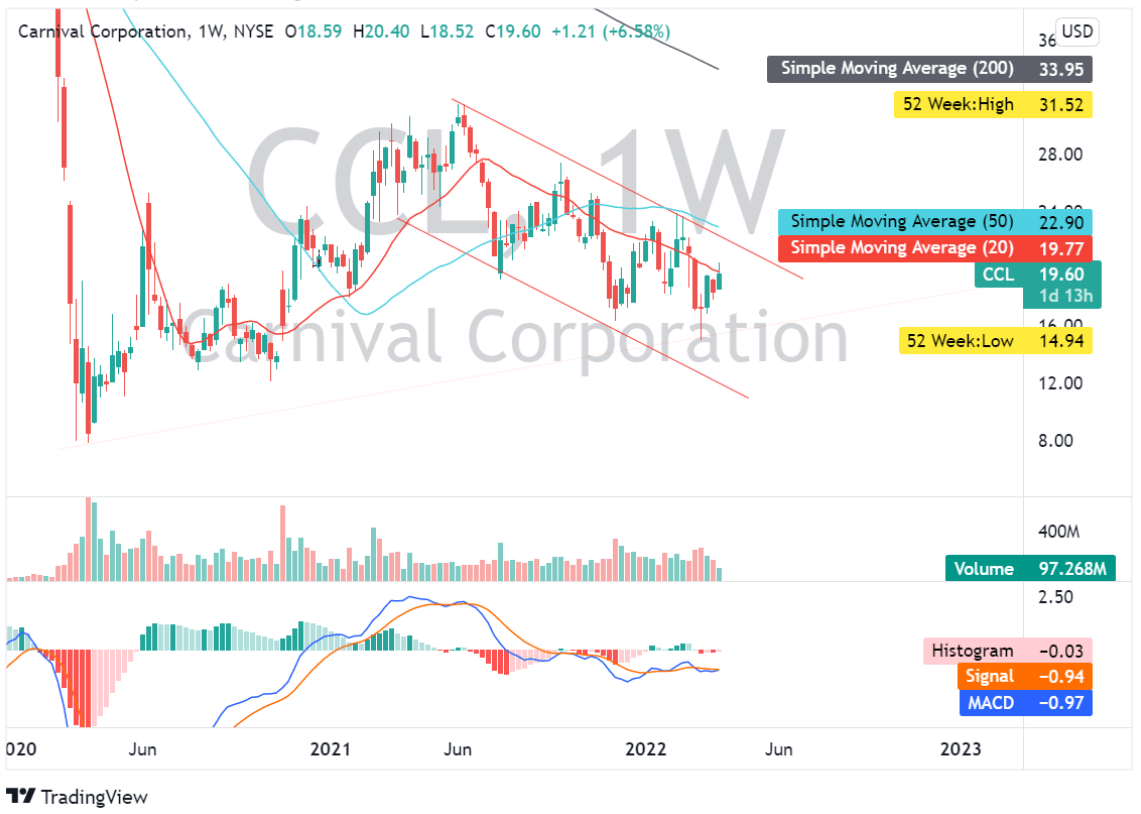

CCL: Weekly Chart (Source: TradingView.com)

CCL is currently trading at its 2008 great recession level which implies strong potential support if respected. According to its current financial status and growing capacity level, I believe today’s support level is strong and will provide investors with a good risk reward ratio compared to its current 52 week low and 2020’s high. A break of structure or its 50-day simple moving average will provide additional confluence in my bullish thesis and investors should monitor this. Its MACD indicator shows bullish sentiment as we might see potential bullish crossover in the next trading week.

Conclusive Thoughts

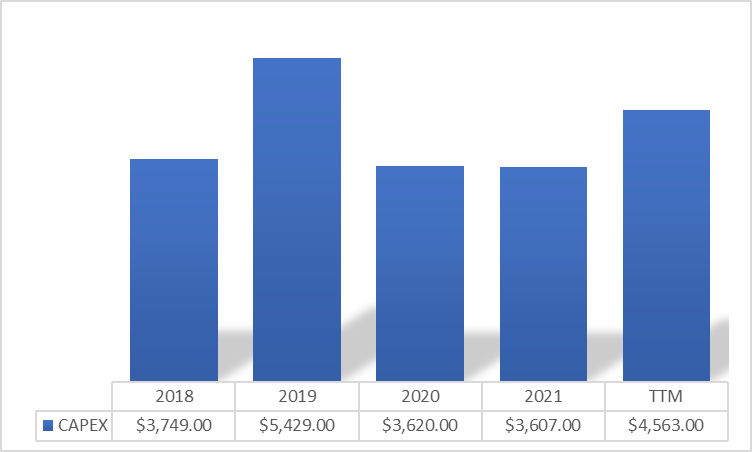

CCL’s punished FCF is mainly due to its continued CAPEX spending. Its negative trend should return to the pre-pandemic level.

CCL: CAPEX 5 Year Trend (Source: Data from SeekingAlpha. Prepared by InvestOhTrader. Amounts in Millions)

In my opinion, CCL maintains its liquid balance sheet with only $1,580 million in maturing debt obligation in 2022 and is now manageable at the current level of its forecasted revenue in fiscal 2022. This temporary weakness will slowly ease and revenue might fluctuate further, but its solid growth in its capacity makes this stock worth taking a risk on.

Thank you for reading and I hope everyone had a great month of March!

Be the first to comment