grinvalds/iStock via Getty Images

Investment Thesis

Paycom (NYSE:PAYC) fell over 50% from its 52-week high of $559; however, the stock price is decoupling from the solid financials and growth opportunities for this cloud-based HCM leader. The introduction of BETI helped Paycom to build a moat in the competitive HCM market, which will sustain its durable long-term growth. Paycom targets middle market enterprises with surging demand for outsourcing the HR solutions. The middle market proved less volatile during economic downturns; however, the current stock price reflects an over-pessimistic outlook.

BETI

Paycom’s product innovation differentiates itself from competitors. Paycom core product BETI, a decentralized payroll system, allows employees to submit time cards, reimbursement, adjusted defined benefits, and eventually to approve or edit payroll by themselves. It is an innovation that modernized the human resource function within medium and large enterprises. The interactive experience allows the employees to have transparency on their remuneration; the human resource department no longer needs to be overstaffed to recruit and manage talents. I used Workday (WDAY) in the past, and it is undoubtedly an excellent system. However, the payroll process involves several intermediaries, making the entire process more complicated than it should. HRs spent most of their time managing payroll system in the past, and the number of HRs have to be in proportion to the number of employees in the organization.

The introduction of BETI provides the economy of scale and allows much fewer humans to be involved in the manual payroll work. According to Wolfe Research’s onsite meeting with CEO Chad Richison, BETI contributes to the majority of revenue growth in the past year. BETI also increased the retention rate by 300 bps to 94%. From FY19 and FY20, Paycom’s top line grew at a moderate rate; however, BETI’s rapid product market fit allows its growth to gain momentum again. The current valuation is not fully factored in this catalyst.

BETI User Interface (BETI Demo)

Segmentation

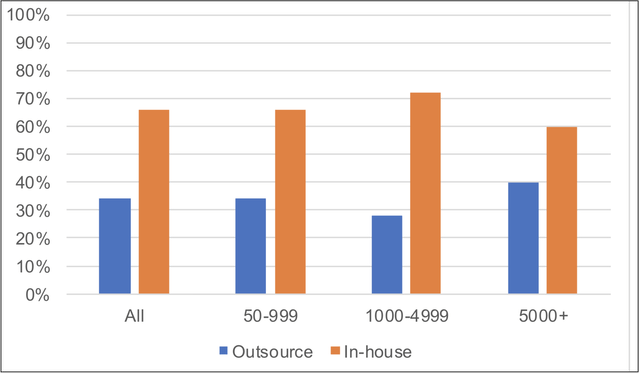

According to IDC, middle market companies with 50-4999 employees have less than 30% of the HR solution outsourced. Most of the in-house HR solutions are close-ended and on-premise. The continuous inflation puts pressure on the middle market companies to lay off employees in the non-revenue generating departments, such as Human Resources. An automated HR system with a SaaS fee model is a great alternative. We shall see a middle market surging demand for outsourcing HR solutions soon.

Enterprises Outsource vs. In-House HR Solution (IDC)

I believe Paycom will be an ideal candidate for this trend. Paycom has an easy-to-adapt system. The system was built under one architecture, HR can monitor the payroll process on one screen, and employees can access all features in one app. In addition, the cloud-based solution enables clients to onboard Paycom seamlessly compared to its peers, such as Key Peoplesoft‘s HCM solution. Furthermore, Paycom offers a portfolio of integrated solutions from hiring to labor management. Paycom offers proprietary software such as E-Verify, Enhanced Background Checks, and Direct Data Exchange. This one-stop shop experience allows Paycom to stand out among its competitors since none of them can offer full service on their own.

Paycom Solutions (Paycom Website)

According to the Harvard Business Review, during the 07-09 financial crisis, when the large enterprises cut 3.7 million jobs, Middle Market gained 2 million jobs. Middle Market companies showed resilience during the economic downturn, and the unemployment rate remained unchanged. US economy is on the edge of recession; the first quarter of 2022 had a -1.6% GDP growth, and the treasury yield curve inverted earlier this year. Paycom received payment based on the headcounts in the enterprises. If the Middle Market employment rate can remain strong, the recent market pullback based on the expectation of recession offers an excellent opportunity to buy Paycom.

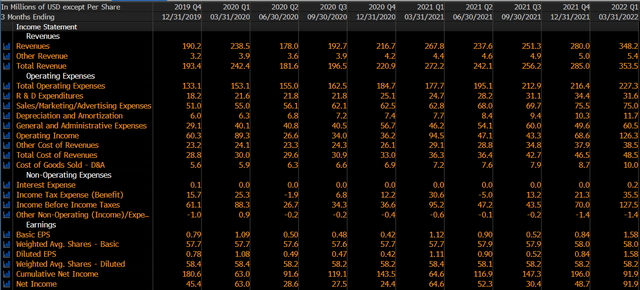

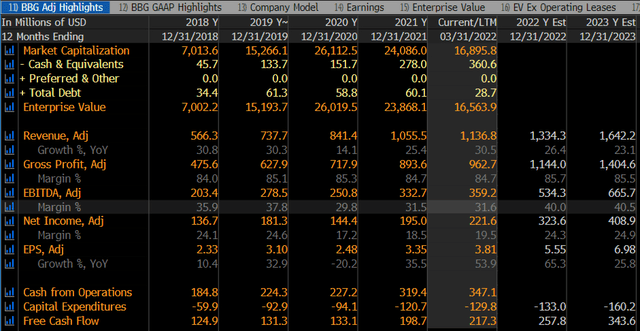

Financials

In Q1 FY22 earnings, Paycom reports $348 million in revenue grew 30% YoY. 86.6% gross margin dominates the HCM industry and is top-class among SaaS companies. Research & Development costs increased from $25 million to $31.6 million or 9.1% of revenue; however, it is still underinvested in a SaaS company metric. SaaS industry average R&D as a percentage of revenue is 24%. With the increasing competition in HCM, we shall see the R&D cost rise in the future. G&A cost increased 31% YoY to $60.5 million due to the rising labor cost and increasing headcount for sales. I believe this number will continue to increase with Paycom’s plan to expand into a new market. The bottom line remains solid; net income increased 43.3% YoY to $91.9 million. This shows the effect of the economy of scale driven by the adaption of BETI. Top line and bottom line performance are also reflected in the Free Cash Flow generation. Paycom reported a record $82.8 million FCF in Q1. It also projects $45.6 million FCF in Q2 FY22, which is a 133% increase from Q2 FY21.

Paycom Income Statement (Bloomberg Terminal)

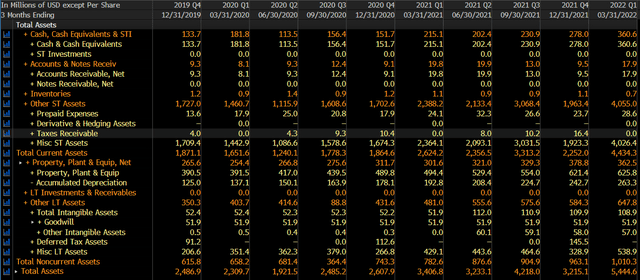

Paycom has a healthy balance sheet, its cash grew 67.6% YoY to $360.6 million, and it has no long-term debt. With the rising cost of capital, Paycom can navigate through degage.

Paycom Asset in the Balance Sheet (Bloomberg Terminal)

Wall Street has a relatively conservative estimate of Paycom’s growth in FY22 and FY23. The projected revenue growth for FY22 is 26.4%, and 23.1% for FY23. I think it is mainly due to the concern over macro uncertainties. However, I believe the product innovation and segment differentiation will help Paycom deliver better than expected results.

Wall Street Consensus (Bloomberg Terminal)

Comparable Analysis

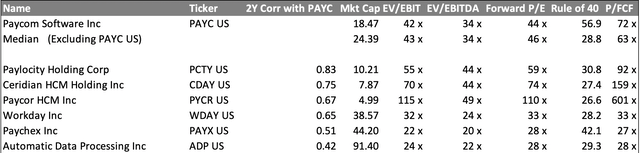

I list six of Paycom’s public competitors here, from a more specialized firm such as Paycor (PYCR) to an HCM conglomerate ADP (ADP). Paylocity and Paycor are similar to Paycom’s offerings, ranging from Payroll, Applicant tracking systems, and performance management. However, Paycom has more advanced innovation, a broader target market (middle market and large enterprise), and superior customer services. Paycor and Paylocity are under pressure to invest more in R&D to protect their market shares. In the payroll business, UKG Pro and Ceridian Dayforce are alternatives to Paycom; however, both per unit are more expensive than Paycom. Ceridian Dayforce’s recent product Dayforce Wallet can be a crucial differentiator in this competition. Dayforce Wallet is a fintech tool that partners with Mastercard, enabling on-demand cash out of salary. ADP has a larger scale and more comprehensive product offerings; however, it is not SMA friendly. ADP and Paycom do not have a lot of overlapping target markets. Workday, in my opinion, is the most competent competitor in the long run. Workday has more advanced technology in machine learning and cloud roadmap than any other HCM company. Workday is growing at a 95% gross retention rate and is expanding into the ERP space. It seems that Workday has a bigger plan outside the HCM market; in the near term, Workday has moderate competition with Paycom. However, in the long run, Workday may become the industry disruptor.

Diving into multiples, Paycom has almost identical EV/EBIT, EV/EBITDA, and Forward P/E to its competitors. Under Rule 40, LTM Revenue Growth Rate+LTM EBITDA Margin, Paycom has the best-in-class performance. With 25% revenue growth and 32% adjusted EBITDA margin, Paycom illustrates the compatibility of top line growth and operating efficiency. Thus, the comparable analysis indicates that Paycom is undervalued.

PAYC Comps (Made by Author, Data from Bloomberg Terminal)

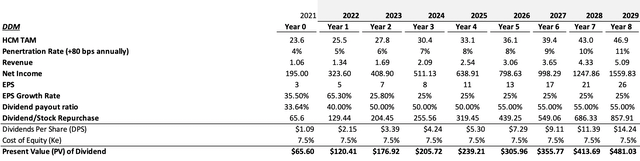

Dividend Discount Model

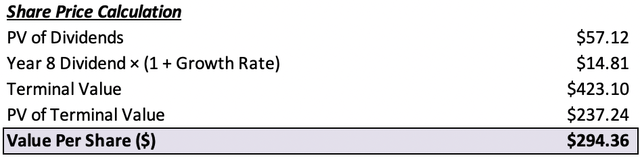

Paycom was profitable with stable growth in the past five years. The future revenue is relatively easy to predict based on its TAM and penetration rate. Therefore, I believe Dividend Discount Model will be a suitable valuation method. Although Paycom did not pay a dividend in 2021, it spent 34% of its net income on stock repurchase. Moreover, this model will treat stock repurchases in the future as dividend payments.

The first step is to estimate the total addressable market of HCM. According to Fortune’s business insight, HCM TAM will grow to $46.85 billion in 2029, or 9.1% CAGR. It is a very conservative estimate since Paycom will expand to other markets, and the TAM should be more significant than this. Paycom currently has 4% of the HCM market penetration. It increased its market penetration by 80 bps annually in the past three years. If we assume this trend will continue, by 2029, Paycom will have 11% of the HCM market share. The model projects the net income by projecting the EPS growth. According to NYU Stern, a mature SaaS company has, on average, 25% of EPS growth. I used 25% from 2024 onward, and FY22 and FY23 data come from Bloomberg Intelligence Estimate. A healthy dividend payout rate range from 30% to 60%; since PAYC has no long-term debt outstanding, I project that the payout ratio will increase over time.

DDM Calculation (Made by Author)

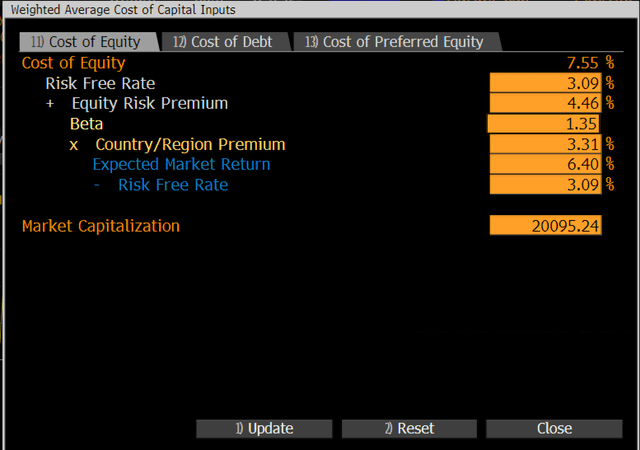

Since PAYC has no debt, the WACC is the cost of equity. I used 6.4% of expected market return per Schwab’s research, 1.35 beta based on Bloomberg Terminal data, and a 3.09% risk-free rate which is the 10-yr US Treasury yield. The discount rate is 7.5%.

Paycom Cost of Equity (Bloomberg Terminal)

The terminal growth rate was set at 4%. Based on the model, the implied share price from DDM is $294.

Risks

The more established competitors such as ADP and SAP have more resources to develop innovative products. The growing competition will force Paycom to invest more heavily in R&D, which can negatively impact the operating margin.

In the Year-End FY21 report, management highlights the five new sales offices opened between September 2021 to January 2022. This aggressive expansion plan was reasonable last year with a prosperous economy. Since the economy is gradually slowing down, Paycom will need to reconsider how to balance the sales channels.

In addition, as highlighted by JP Morgan, Paycom has no long-term contracts. If an event such as a company scandal triggers clients to switch platforms, Paycom can lose revenue rapidly.

Conclusion

Paycom’s unique product offerings differentiate it from other HCM players. BETI changed the industry dynamics and helped Paycom to reach economy of scale. Middle Market showed an all-weather resilience in employment rate; it will sustain the revenue growth of Paycom. Paycom has top-class financials with ~25% revenue growth in the following years and a fast EPS growth rate. Its cash-generating ability significantly improved over the past years as well. Compared to its competitors, Paycom is currently undervalued based on the rule of 40. From DDM analysis using conservative projections, it gives an implied share price of $294, which is 3.5% higher than its current price of $284. If we combined comps and DDM, I believe Paycom should trade at 14x its FY23 revenue or $381 per share. It represents a 34% premium. Thus, I rate Paycom as a buy.

Be the first to comment