gorodenkoff

Paychex, Inc. (NASDAQ:PAYX) is a New York-based human capital management solution provider, mainly for SMEs in the US. Its cloud-based solution includes functionality and data analytics for HR management from application to retirement. Some notable capabilities are applicant background checks, employee time and attendance management, and payroll. Since its foundation over fifty years ago, it has become one of the most durable companies in the industry.

Today, Paychex sustains solid revenue growth and margin expansion. Despite its already robust historical growth, it was able to go up some more amidst inflationary pressures. Moreover, its solid and intact fundamentals remain evident as cash and borrowings remain stable. Indeed, it is a flourishing and conservative company, allowing it to continue beating its previous guidance. However, it must be cautious of the looming recession, which may hurt its performance.

Even so, it appears to be a resilient company with its stellar Balance Sheet. It is not overleveraged, and cash inflows are adequate to sustain dividends and cover borrowings. Meanwhile, the stock price continues to move sideways. It is not too cheap but way better than the peer average.

Company Performance

The unprecedented events in the last two years have led to drastic changes. Border closures and restrictions hit the operating capacity, supply chains, and human resource management of businesses globally. But through these challenges, more growth drivers emerged for Paychex, Inc., one of the largest HCM solution providers. Its FY 2020, 2021, and 2022 remained fruitful, making it a thriving company. Indeed, it was one of those companies that capitalized on prudent acquisitions to stimulate growth. It paid off as more opportunities entered the market, making it more capable of catering to them.

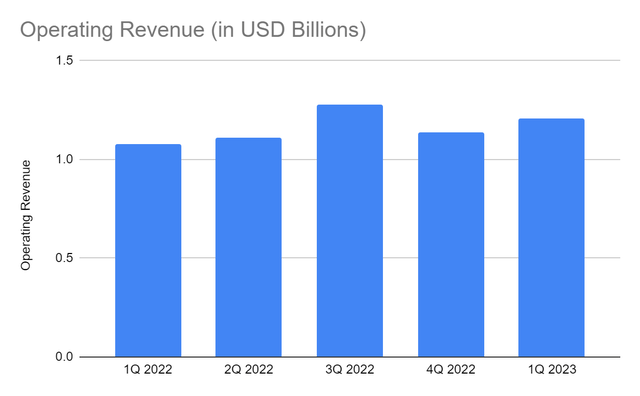

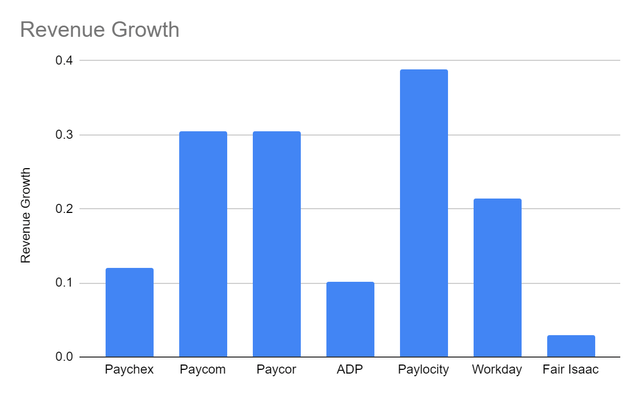

This year, Paychex remains unfazed despite inflationary pressures. It started the year with another impeccable performance, with its revenue reaching $1.21 billion, a 12% year-over-year growth. Many thanks to the uptrend in demand for HCM solutions that added more companies and clients to its service stream. The value of HCM continues to resonate and increase with digital transformation, more SMEs entering the market and the prevalence of hybrid work setups.

Operating Revenue (MarketWatch)

As more businesses utilize technology to streamline processes, such as workforce management and financial transactions, HCM solutions become a staple. More businesses implement remote and hybrid work setups, which require solutions to manage employees virtually. Also, it maintains a solid customer base with its excellent reputation, which helped it capture more demand. This attribute allowed it to maintain price flexibility as inflation peaked from April to August.

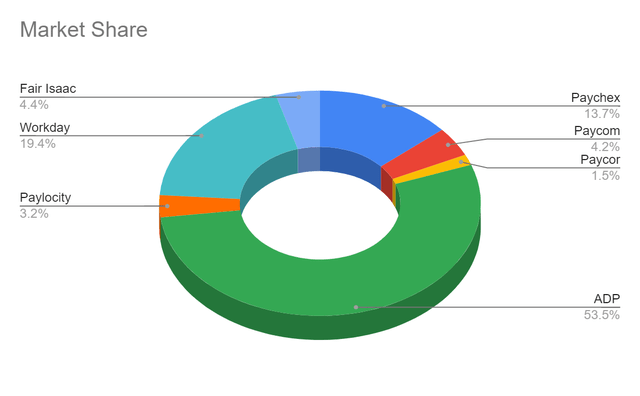

With regard to its competitors, Paychex, remains a strong contender. Although its revenue remains lower than ADP (ADP) with $4.2 billion and Workday (WDAY) has $1.5 billion, it remains a giant. Even better, it is one of the most enduring and viable companies with sustained revenue growth. Also, it maintains prudent asset management at a larger operating capacity. It is visible in its costs, having the same year-over-year growth. Likewise, operating expenses rose, but the growth rate was lower. As such, its prudent strategies matched the robust market demand and cushioned the blow of inflation.

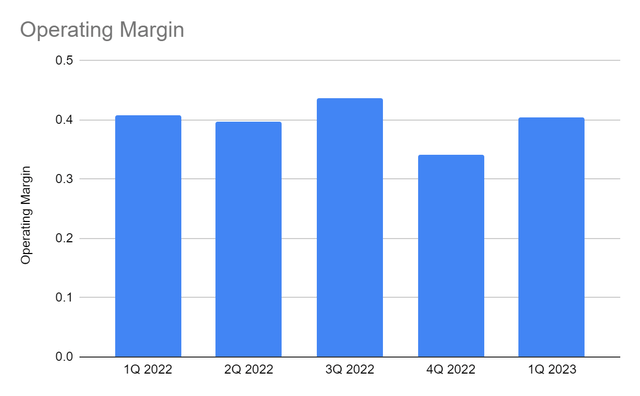

Paychex, Inc. stays consistent with its product goal to enhance efficiency and productivity. It is evident in its operating margin of 40%, the same as in 1Q 2021 but way higher than in 4Q 2021. Its operating margin is also better than the peer average, making it an attractive stock to watch. Meanwhile, its net profit margin of 31% is a bit higher than in the comparative quarter. Its impressive viability demonstrates the consistency between the core and non-core operations. It also shows it can stay stable by keeping extraordinary expenses zero amidst economic volatility. The margin is also better than the market average, making it one of the best companies in the HCM industry. Increased income further fortifies its already sound fundamentals and maintains its capacity.

Operating Margin (MarketWatch)

Potential Market Risks, Opportunities, and Core Competencies

Paychex must be more careful today despite its impressive market positioning. Market volatility remains intense, which may pose more threats to its operations. Although inflation has been cooling down in recent months, it must not be complacent. The most recent inflation rate of 7.7% shows a more stable economy, but it remains elevated. Also, it must beware of the high-flying interest rates. In its latest meeting, the Fed set another 75 bps increment. So from the previous projections of 3-3.25%, interest rates may be as high as 4-4.5%. This scenario may lead to higher yields on its client funds, which is over 30% of its assets, but valuation may drop. Recession may stretch further than expected, so its growth may become sluggish this fiscal year. Higher interest rates mean lower borrowings and less expansion and investment prospects. If it persists, businesses may cut their production and labor force, leading to lower demand for HCM solutions. Hence, Paycom must enforce flexibility in its pricing and enhance efficiency to remain viable.

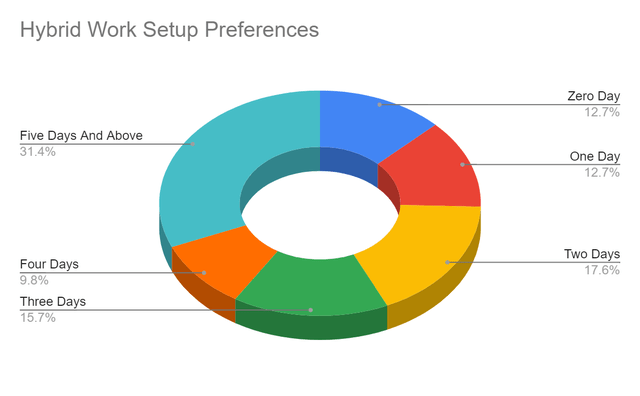

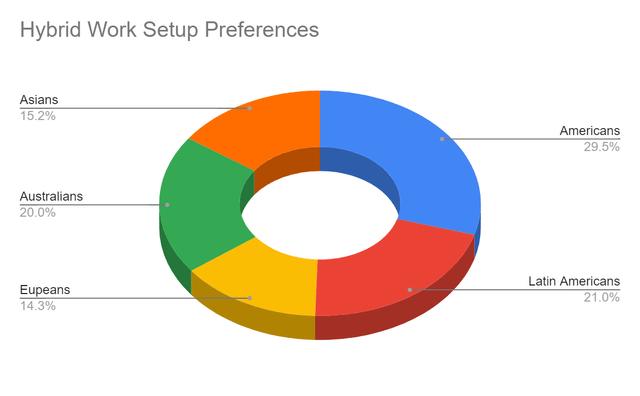

Even so, there are still a lot of market opportunities to maximize. For instance, remote and hybrid work setups dominate the labor market. Despite easing restrictions and RTOs, many businesses across regions are still geared toward these setups. One of the primary factors is The Great Resignation, which is still far from over. To avoid employee turnover, many companies implement remote and hybrid work setups. It is consistent with a recent study that showed 87% of employees embracing the new work setups. A massive chunk of the respondents, or 31.4%, want a remote work setup for five days or more. It is equivalent to 100% remote work. Even more essential is that 31% of these respondents reside in North America, the primary market of Paychex. Hopefully, inflation will continue to go into a lull so the economy may become more stable. In turn, Paychex, Inc., can take advantage of these potential opportunities.

Hybrid Work Preferences (McKinsey & Company)

Hybrid Work Preferences (McKinsey & Company)

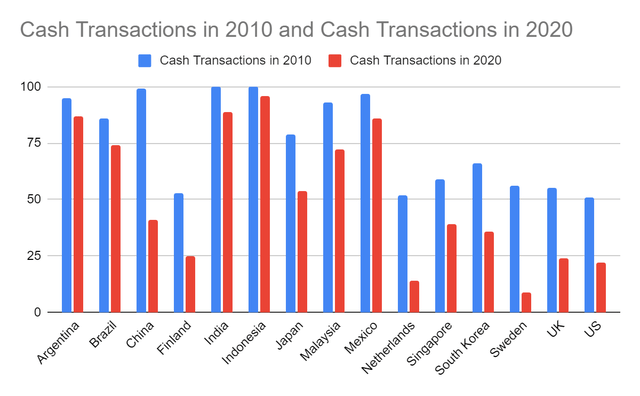

Another potential growth driver is the fintech revolution. As mobile wallets and VCCs dominate financial transactions, more businesses adapt to them. Whether in emerging or mature economies, cashless transactions have become more appealing to the market. In the US, for example, cash transactions were only 22% in 2022. Hence, it will not be a surprise to see more employee-related transactions will be automated. Given the continued enhancement of the company, it remains ahead of these market changes.

Cash Transactions (The Straits Times)

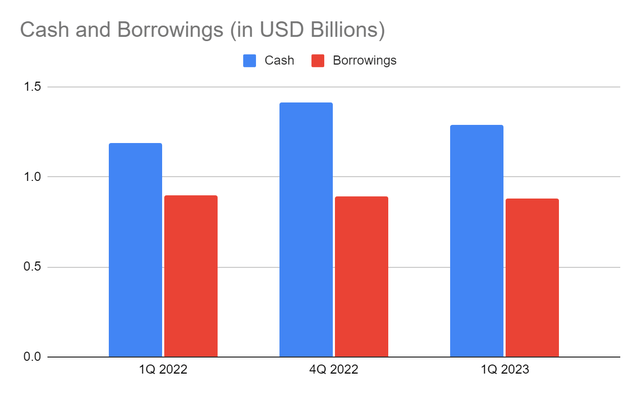

But what makes it a solid company starts from the inside. Its stable fundamental condition is visible. It has an excellent liquidity position, which can be seen in its current ratio. Also, cash can cover all borrowings and accounts payable, even in a single payment. Cash and cash equivalents and receivables comprise almost 30% of the total assets, proving its liquidity. Meanwhile, borrowings are in a downtrend, which is already 3% lower than in the comparative quarter. It is an excellent move amidst interest rate hikes.

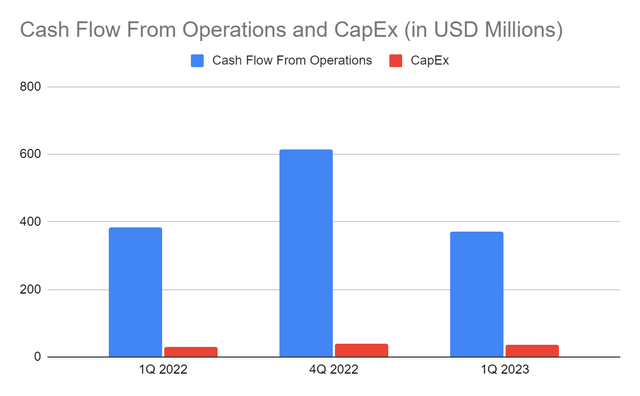

Moreover, PAYX shows adequacy in covering its transactions in the Cash Flow Statement. Its cash inflows from operations remain stable and ample even if it continues to replenish its operating assets and reduce its liabilities. Even if we do not adjust the cash items, such as depreciation and amortization, net income is more than enough to cover its working capital and CapEx. It is also proof of its consistency since its viability, liquidity, and sustainability are intact. It shows that PAYX is generating ample returns to sustain its operations. Likewise, FCF is stable at $334 million, so FCF/Sales Ratio is 28%. The ratio remains high in the last two years, showing the impressive ability of the company to turn revenues into cash. It is an excellent preparation for potential market lows and rebounds.

Cash and Cash Equivalents and Borrowings (MarketWatch)

Cash Flow From Operations And CapEx (MarketWatch)

Stock Price Assessment

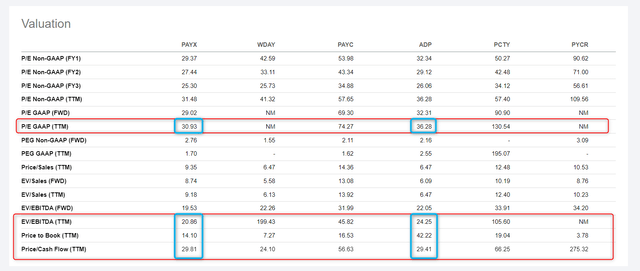

Since the start of the year, the stock price of PAYX has been moving sideways. Although it had a slight rebound last month, the downtrend has remained visible. At $122, it remains 7% lower than the starting price. It is traded at a 30x price-earnings multiple. It is higher than the S&P 500 10-year average of 29x. If we check the historical trend, the stock price remains at its peak, although it has dipped in the last year. We can see that its revenues and income are still hitting highs and beating estimates. Also, it is way better than all its peers, even ADP at 36x. The other price metrics highlighted show similar observations. A potential opportunity is its seasonality, which may derive more revenues and income.

Stock Price Assessment (Seeking Alpha)

Meanwhile, its dividends are pretty impressive. Payments are consistent, although growth paused in 2020. It made up for its austerity in the last two years as dividend growth reached 16%. Its dividend yield of 2.57% is better than ADP, with 1.91%. It is even better than the S&P 500 and NASDAQ composite average, with 1.82% and 1.18%. Also, it still appears sustainable, with a dividend payout ratio of 75%. Although it seems high, it stays reasonable. It is relatively lower if we plot the historical dividends per share and EPS with a five-year average of 79%. Given these, PAYX is the optimal choice on the list. To assess the stock price better, we will use the DCF Model.

FCFF $1,696,000,000

Cash and Cash Equivalents $1,290,000,000

Borrowings $880,000,000

Perpetual Growth Rate 4.8%

WACC 9%

Common Shares Outstanding $360,401,000

Stock Price $122.89

Derived Value $124.98

The derived value agrees with our supposition that the stock price is reasonable. There may be a 2% increase in the stock price in the next 12 months. So, the fundamentals justify the trend, and investors must keep watch of the stock.

Bottom Line

Paychex, Inc. is still a promising company despite the pessimism brought by economic volatility. Its sound fundamentals demonstrate its capacity to withstand the stormy market environment. It also remains adequate to sustain dividends and keep its financial leverage stable. Meanwhile, the stock price is still moving sideways, although it is starting to be consistent with the fundamentals. As one of the industry leaders, the recommendation is that Paychex, Inc. is a buy.

Be the first to comment