tolgart

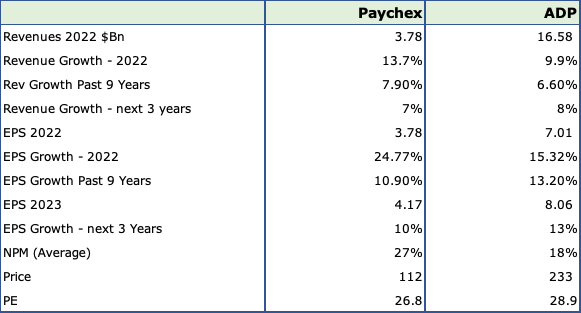

ADP and Paychex Metrics

Paychex, Inc. (NASDAQ:PAYX) has about 730,000 clients and focuses mainly on small to medium size employers. Based on May 2022 revenues, it earned an average of $6,317 per client and had a market share of 8.3% of private employees.

Automatic Data Processing, Inc. (NASDAQ:ADP) is the behemoth, with 940,000 clients and 16% market share of all U.S. employees, earning about $17,638 per client. Its main focus is large companies, but it has a solid presence in smaller, mid-sized segments as well with lower-priced offerings.

ADP and Paychex Metrics (Seeking Alpha, ADP, Paychex, Fountainhead)

Post-Covid Bounce:

Both Paychex and ADP had a great year in Fiscal 2022, growing 14% and 10%, respectively, as the country recovered from Covid and added people to their payrolls. Not surprisingly, growth was much faster than their past 10-year averages of 7.9% and 6.6%. The smaller Paychex, which is about 1/4 of ADP’s size, grew much faster as expected.

Both grew earnings better than their previous long-term averages of 11% and 13% for Paychex and ADP, respectively, with the more profitable Paychex’s earnings jumping 25% compared to 15% for ADP. Paychex’s net margin is phenomenal at 27% – it leverages its fixed costs so much better than ADP in spite of often being labelled as the cheaper alternative.

Looking past Covid:

Both Paychex and ADP should revert to their mean for the next 3 years because: a) the post-Covid bounce is over, b) Non-recurring earnings from governments schemes such as the ERTC are out, and c) Fed tightening will definitely increase unemployment. Based on consensus estimates, ADP will grow revenues slightly faster at 8%, as compared to Paychex at 7%, and earnings at 13% compared to 10% for Paychex.

ADP manages to hold its ground even with a smaller Paychex.

Higher interest rates have one huge positive for both Paychex and ADP. They earn a float on their client’s payroll funds. Payroll companies take their clients’ tax withholdings upfront at each payroll – weekly, bi-weekly or semi monthly and they submit these funds to the local, state, and the Federal governments after a month if the client is a monthly filer or at the end of the quarter, thereby earning interest on the float. Paychex will earn about $90Mn in interest in 2023, about 2% of revenues – modest, but this money goes straight to the bottom line. Similarly, ADP is estimating about $680Mn in interest income in FY 2023.

The Trend Towards Technology

Technology has become very crucial and important for the payroll industry or, as they have branded themselves, the HCM industry (Human Capital Management). Once industry leaders in tech outsourcing, ADP and Paychex are now perceived as the stodgier incumbents. PCMag doesn’t have a single mention of the top two in its listing of top ten online payroll providers. To be sure, the smaller, online platforms are not in the same league when it comes to compliance, process, and human interaction, which are crucial for large companies – but tech solutions are a clear direction for the future. Digital onboarding, self service, recruitment, wage assessment and analysis are becoming necessary platform tools for all levels of HCM companies.

Andrew Nicholas of William Blair brought out a very important point on the Paychex Q1-23 earnings call: “Personally, I was impressed by the number of vendors at the conference and the level of innovation really across the sector.”

I did some primary research across Human Resource managers and recruiters. There is a clear trend towards technology or process technology. Most HR managers would choose payroll solutions that rely heavily on technology for at least two reasons: a) it’s easier on company budgets, and b) it fits in with their own employees’ culture of heavy tech usage.

For example, at even mid-size tech companies with 200 to 500 employees, the culture is to gorge on platforms or software solutions such as Slack, Bamboo, Abacus, Cash, Lattice, Concur, Big Time, Coupa, DocuSign, etc., and any other platform or software that helps them with their work. It has to be digital and it has to be user-friendly to the twenty and thirty-somethings. Tech, communication and media companies have been the biggest employers in the past decade and will choose vendors with the best technology and ease of business to keep their employees happy.

Since people are the most important resources for many employers, Human Resources or People Resources has become the most important department for tech firms and Chief People Officers are naturally more inclined to reject vendors that don’t meet the tech-savvy standards of their employees. A Vice President I spoke to at Robert Half disclosed that resumes are rejected if they don’t have enough software applications usage shown by candidates. A Chief People Officer, I spoke to for a 500-headcount firm rejects documents that don’t come through DocuSign! “How am I going to print and scan this back if I don’t have a printer at home!” A vendor or service’s merits are judged through their tech abilities.

Paychex has committed to improving technology with tie-ups with Google for voice recognition and also honed in on recruitment and applicant tracking with heavy emphasis on mobile usage, which is important for its smaller clients. It also singled out improving Human Resource Management as a key focus area – Employee Appraisals and Assessments, State Compliances and Regulations, Sexual Harassment and Office Policies, PTO etc. critical services, which can be provided through their platform for routine processes and Paychex trained professionals as an additional resource — helping the customer reduce the need for more expensive in house fixed costs.

Similarly, ADP’s technology initiatives are also focused on cloud based platform extensions and improvements, with DataCloud and Wisely for small businesses, cloud based solutions for medium and large sized businesses such as Next Gen Payroll, Next Gen HCM and Workforce Management, plus offerings in the international markets such as Next Gen Tax and Global Payroll. Here, too, the focus is on self-service, digital onboarding, and digital support.

Valuation and Investment Case

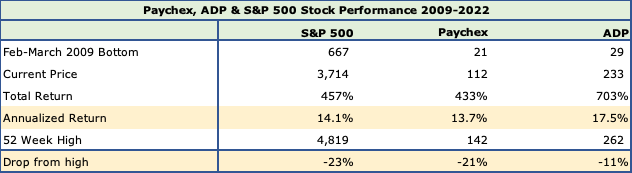

ADP and Paychex Stock Price Performance (Seeking Alpha)

Strengths

Outperforming the index in a bear market: I compared Paychex and ADP to the S&P 500 from March 2009, when the S&P bounced back from its all-time low of 667, the lowest point after the great financial crisis. ADP was the clearcut performer, with an annualized return of 17.5% during those 13 years. The S&P 500 narrowly beat out Paychex, 14.1% to 13.7%. In the current bear market, ADP has also held the fort best, falling only 11% as compared to 21% for Paychex and 23% for the S&P 500.

Here’s an excellent chart provided by Seeking Alpha’s Corey Cramer, highlighting Paychex’s EPS for the last 20 years. In what was called “The Jobless Recovery,” because the economy took very long to recover the jobs it lost due to the GFC, Paychex’s EPS dropped only 5 and 7% each in 2009 and 2010, but grew every year after clearly showing its strength and sustainability.

Switching Costs: Paychex has a retention rate of 84%, while ADP has an even better retention rate of 92%!

Switching costs are a big competitive advantage for payroll providers. The cost of switching providers is prohibitive for the amount of time consumed, the compliance needs, and the pain of onboarding employees onto a new system. Most competitors don’t offer compelling bargains to switch.

Switching becomes even more difficult when you’re bundling Health Insurance, payroll and human resource management together.

It is usually the stickiest when you’re offering PEO (Professional Employer Organization) services, which usually provides cheaper health insurance because of the ability of the PEO to collectively bargain for several hundreds of employers with insurance companies.

ADP earns 32% from its PEO segment, while 24% of Paycheck’s current revenue is from PEO services.

Weaknesses

Wage Inflation: Wage inflation is a key component of the current inflation rate of 6-8% and perhaps the most entrenched. Fed Chair J. Powell and other Fed officials clearly state that there will be pain ahead, the Fed cannot ease or pivot till unemployment climbs to 4.5% to 5%, which clearly hurts payroll growth and ADP and Paychex.

Recession: The other possibility is a hard landing, which is a polite euphemism for recession. That’s even worse and highly likely, with even the doyen of U.S. Banks, Jamie Dimon, calling for a recession in 6 to 9 months

As and when that happens both, ADP and Paychex should revert to their average growth of the last 9 years. Because of their pole positions, both ADP and Paychex will continue to grow earnings, but at slower rates of 13 and 10%, which don’t justify the kind of multiples that they have now. Paychex is overpriced at 27X times earnings and ADP at 29X.

Paychex

Paychex is a great defensive stock to own, if there were a sector called “Tech Staple or Business Utility” it would lead it. Its cash flow generation and 27% net margins are the best in the industry.

Except for the price, there is everything to love about the company, single-digit sustainable earnings, great brand, leader in the mid-size segment, a switching costs moat – I would buy it in a heartbeat around 20-22 times earnings, at about $80 -$85.

However at this price I would rate Paychex a HOLD, simply because I can’t see more than a 10% annual return in the next 5-10 years. If we hurtle towards a recession and the S&P drops to 15 X earnings of 220 to about 3,300, Paychex will likely drop in tandem. I would buy it as a defensive stock for sure.

ADP

ADP has the edge over Paychex in stock price performance – it has lost only 11% from its 52-week high in this bear market; hugely outperforming the S&P 500 and Paychex. And, it spite of being the largest player in the industry, it outperformed the S&P 500 and Paychex, returning 17% from its low of 2009, compared to 13.7% for Paychex and 14.1% for the index.

I would also rate ADP a hold because of the valuation of 29X Forward Earnings and the same reason I gave for Paychex – there’s precious little to earn when you don’t get a bargain. Especially, if the entire market is likely to drop on stagflation and recessionary concerns. It would be prudent to hold and buy on declines around $180-$190.

Be the first to comment