I wonder if any reading this article are long-term owners of PayPal (NASDAQ:PYPL) stock from its IPO days back in 2015. The original pricing was at $13/share. On July 6, 2015, the IPO came to market and the stock opened at $38. Over the next six weeks it chopped around before finding a low at $30 and has not looked back since.

It would appear though that market conditions and sentiment have provided us with another potential long-term entry point. Should you pay up for PYPL here? What are the macroeconomic factors at play? How can technical analysis augment our view of the current picture and help provide us with a structure that identifies high probability entry and exit points? Let’s dive in.

The Fundamental View: Stock specific and macroeconomic

Our lead fundamental analyst, Lyn Alden, recently provided these comments regarding PYPL as a company:

“With increased competition and slower growth, the company is transitioning more toward a growth-at-a-reasonable-price, “GARP” type of investment, rather than a fast grower. In line with this, the company recently announced a $15 billion multi-year share repurchase program.”

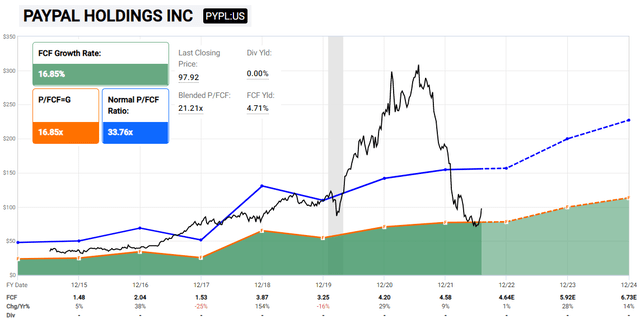

FastGraphs

And she added, “The balance sheet is solid, with an A- credit rating and little net debt. However, the success or failure of PayPal as an investment will mainly come down to one thing – can they improve their per-share growth metrics in an increasingly competitive field?”

There’s also the macroeconomic environment to consider. Please note these further comments from Lyn:

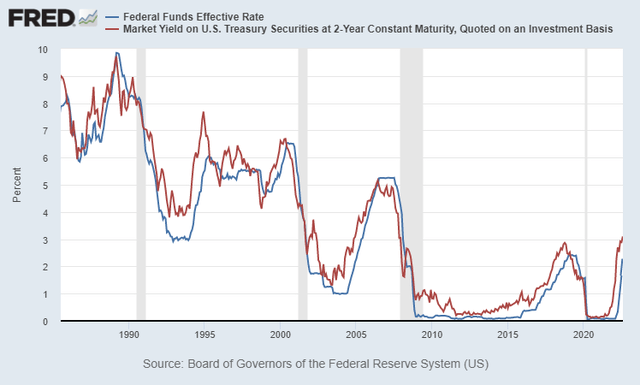

FRED Charts

“Additionally, the two-year Treasury yield has been losing upward momentum recently around 3%. Historically, the two-year Treasury yield is a good predictor of how high the Fed can raise interest rates, since the market begins anticipating and feeling out weakness in financial conditions well ahead of the Fed. See attached. If indeed the Fed runs into trouble raising rates much above 3%, it can let off some of the downward valuation pressure that has been on PayPal and similar companies. The market has already been pricing this into their forward expectations of Fed rate hikes, and I think the turnaround we’ve seen in a number of stock prices is beginning to reflect that.

The key, then, is to find companies who won’t have weaker earnings than analysts expect, but that are also likely past the period of earnings multiple contraction that higher rates and tighter financial conditions have contributed to. I believe PayPal may meet that dual criteria.”

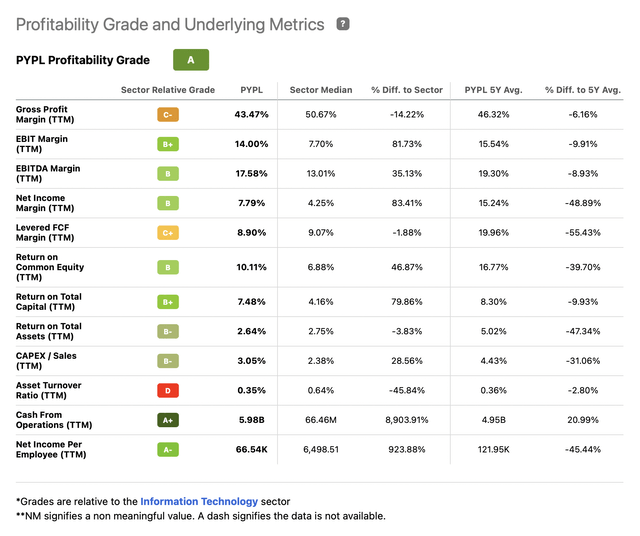

Seeking Alpha

Potential Catalyst(s) for PYPL Stock

Activist Action: It appears that the recent surge from the low of $67 is accompanied by speculation that Elliott Management, a well-known activist investment firm, has recently taken a stake in PayPal and may be advocating for possible changes. For more on this, see here.

Markets tend to appreciate activist input as it can unlock value from lackluster businesses and convince management to make changes they would not otherwise be comfortable with.

Could it be that these possible changes are forthcoming and will generate even more positive sentiment around PYPL stock?

Macro Environment: The other catalyst is what Lyn mentioned and is quoted above. Should the macroeconomic environment continue to improve for companies like PayPal, they will greatly benefit as they’re already favorably positioned.

So, we actually see two potential catalysts for PYPL that are currently not fully appreciated by the market.

The Technical View

Whenever a market or a stock has been in a downtrend, it’s important to have a system to track and then project what’s most probable next. Oversold markets can get more depressed and overbought markets can get more frothy. Irrationality works to both extremes.

While there are many widely used methods for technical analysis, our preferred method is Elliott Wave (this is not to be confused with the activist firm Elliott Management mentioned at the outset).

From the education section on our website, there is this brief explanation of Elliott Wave Theory:

“Elliott Wave theory understands that public sentiment and mass psychology moves in 5 waves within a primary trend, and 3 waves in a counter-trend. Once a 5 wave move in public sentiment is completed, then it’s time for the subconscious sentiment of the public to shift in the opposite direction, which is simply a natural cause of events in the human psyche, and not the operative effect from some form of “news.”

In fact, the former Chairman of the Federal Reserve, Alan Greenspan, understood this fact well. During his tenure, in several hearings in front of the Joint Economic Committee, Mr. Greenspan noted that the idea that the Fed can prevent recessions is a “puzzling notion”… Rather, the stock market is “driven by human psychology” and “waves of optimism and pessimism.”

For a more detailed understanding of this concept and application, I highly suggest reading Elliott Wave Principle, by Frost & Prechter.”

Normally, we’re able to analyze a stock or market at the inception of the first wave up or down and then set a Fibonacci Pinball structure (this is discussed in-depth in several articles here on this website) based on where the second wave retraces to.

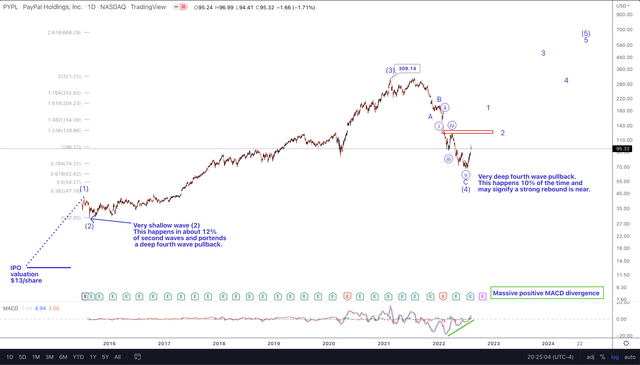

However, in the case of PYPL, to properly analyze the crowd sentiment, we must go back to where the IPO price originated, or rather $13, and not the open of public trading at $38. In doing so, the larger structure now makes much more sense.

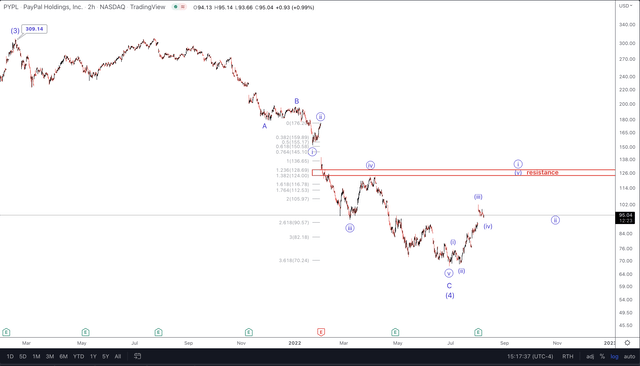

TradingView

Using the overriding principle of a 5 wave progression, it appears that PYPL has completed a major 3rd wave rally at $309. The subsequent pullback was deep and long in duration. When the 2nd wave pullback is short in time and also shallow in depth, this can happen. Although it’s a statistical outlier, shallow 2nd waves and deep 4th waves do happen about 10% to 12% of the time.

For PYPL, what this means is an excellent long-term buying opportunity both from a fundamental and a technical viewpoint. In the near term, here’s what we are looking for to make this an even higher probability.

Inside this larger fifth wave rally, illustrated as possible on the daily chart, there will likely be 5 smaller waves. Once the initial first wave up is in place, a retrace down in circle wave ‘ii’ should allow us to clearly define risk vs reward. For now, we’re looking for a move up to the $150-$175 area over the next several weeks to confirm that the downtrend has indeed been broken. That will be circle wave ‘i’.

TradingView

PYPL and hundreds more stocks are updated on a daily basis for our members. We want everyone here among the readership to understand that markets are fluid, dynamic, non-linear systems. I also would like to take this opportunity to remind you that we provide our technical perspective by ranking probabilistic market movements based upon the structure of the market price action. And if we maintain a certain primary perspective as to how the market will move next, and the market breaks that pattern, it clearly tells us that we were wrong in our initial assessment.

But here’s the most important part of the analysis: We also provide you with an alternative perspective at the same time we provide you with our primary expectation, and let you know when to adopt that alternative perspective before it happens.

Potential Risks

The macroeconomic environment may not prove as favorable as it currently seems for PYPL. It’s also plausible that management will not be able to execute favorable changes and increase investor confidence as well as positive public sentiment of the stock. In our technical view, should PYPL dip below $62 it increases the likelihood that $309 was actually a much more important high than just a third wave rally peak.

Conclusion

Using our comprehensive methodology of the macroeconomic environment paired with stock-specific fundamental analysis, this is a favorable long-term investment with substantial upside. Our technical analysis also confirms this fundamental point of view and is providing us with a structure to track and trade going forward. We have potential catalysts in both potential activist action and the macroeconomic environment. So, Pay up for PayPal? Our answer is yes.

bennymarty

Be the first to comment