blackdovfx

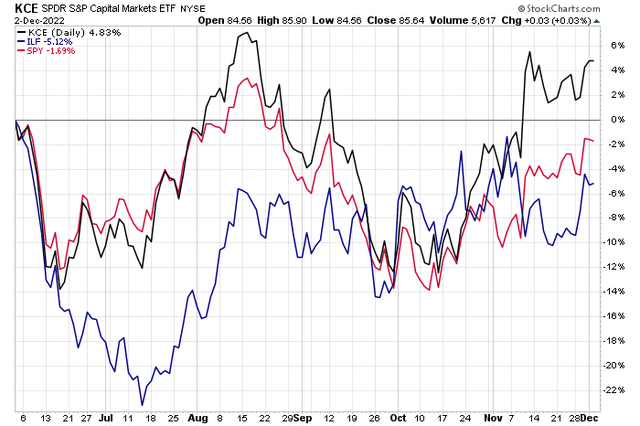

Capital market stocks have performed well in a difficult funding environment over the past six months. The SPDR S&P Capital Markets ETF (KCE) is up about 5% while the S&P 500 is lower by 2%. Latin American equities, on the other hand, are off more than 5% in the span after a hot start to 2022. One firm with exposure to both niches has found its footing lately, but has the situation with Patria improved enough? Let’s take a trip down south to see what’s happening in the private markets area of Latin America.

Strong: Capital Markets. Weak: Latin America.

According to Bank of America Global Research, Patria (NASDAQ:PAX) is the largest private markets asset manager across LatAm with Brazil and Chile being its two largest markets. The firm invests in private equity, credit, infrastructure, and real estate. While the firm is focused on private investing in LatAm, it raises most of its capital from large limited partners in North America, Asia, and Europe.

The Cayman Islands-based $2.0 billion market cap Capital Markets industry company within the Financials sector trades at a high 28.3 trailing 12-month GAAP price-to-earnings ratio and pays an also high 5.1% dividend yield, according to The Wall Street Journal.

There have been some positive developments with Patria since I issued a sell recommendation earlier this year. Since then, the stock has been about flat versus an 8% climb for the broad market. First, the company beat estimates in its Q3 report back in early November and hiked its dividend. More promising news came just last week when it was announced that the capital markets firm would expand into the venture capital space.

PAX features both organic and M&A-sourced growth prospects in Latin America. Some equate it to the Blackstone of Central and South America. Given the uncertainty with some emerging markets in that region, the firm’s valuation is at a discount to many of its peers. A key risk is credit net redemptions that could stymie growth plans, though fundraising activities have been strong lately.

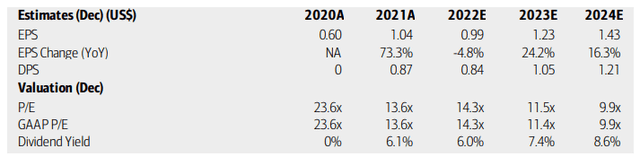

With an improved earnings outlook, bigger dividends, and more reasonable forward earnings multiples, the valuation situation looks better. Analysts at BofA see per-share profits rising by a solid 24% in 2023 before a slight moderation to a still-robust 16% in 2024. Dividends will likely top $1 annualized in the coming quarters while both the operating and GAAP P/E move to attractive levels. Seeking Alpha rates PAX’s valuation with a B+, and I agree.

Patria: Earnings, Valuation, Dividend Outlooks

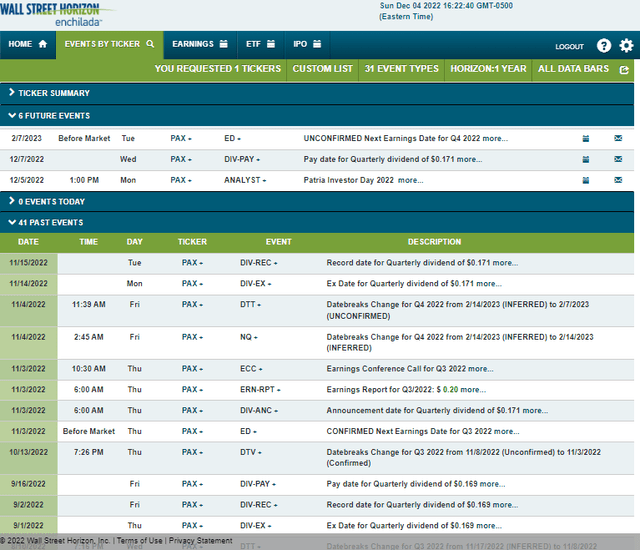

Looking ahead, data from Wall Street Horizon show an unconfirmed Q4 2022 earnings date of Tuesday, February 7 BMO. Before that, PAX has a dividend pay date of Wednesday, December 7. A bigger potential volatility catalyst is Patria’s Investor Day 2022 which begins on the afternoon of Monday, December 5 in New York. Per the firm’s press release, the program includes presentations by the senior leadership team along with insights on Patria’s multi-year growth strategy and outlook along with a Q&A session.

Corporate Event Calendar

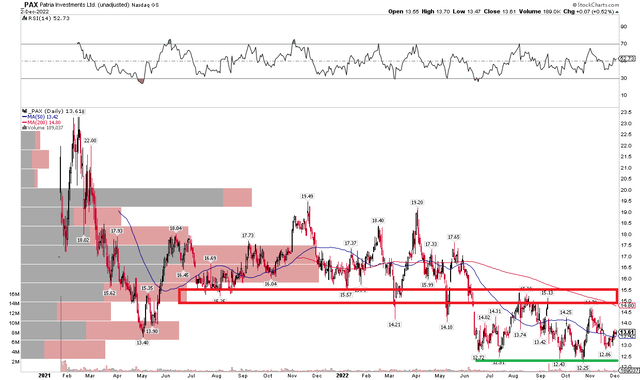

The Technical Take

PAX remains stuck in a range not far from its all-time lows after going public nearly two years ago. I continue to see support just above the $12 level while the $15 to $15.50 zone is resistance. Notice, too, that the negatively sloped 200-day moving average now enters the picture about 9% above the current price. The stock needs to clear $15.30 or so to help confirm a bullish move above this frustrating range for the bulls. A breakdown below $12 would trigger a bearish price target to near $9.25.

PAX: Shares Stuck In A Range Near All-Time Lows

The Bottom Line

I’m more sanguine on Patria shares today versus September. An improved profitability outlook and a dividend hike are bullish factors, but the chart remains suspect and fundamental credit net redemptions should be monitored in the coming quarters.

Be the first to comment