jetcityimage

Introduction

I have been assessing the market of late through a lens that the old stalwarts of the US industrial complex are weakening. This led me to my conclusion that 3M (MMM) is unlikely to provide any material returns for many years, and faces a GE (GE) or Sears-like outcome, regardless of how the litigation pans out. Therefore, it is necessary to find alternative investments.

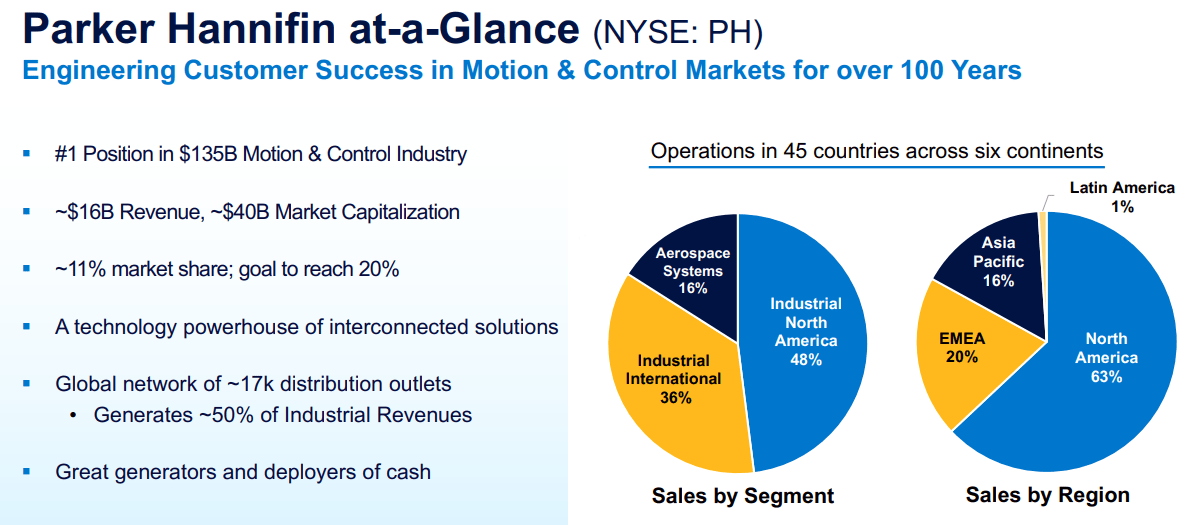

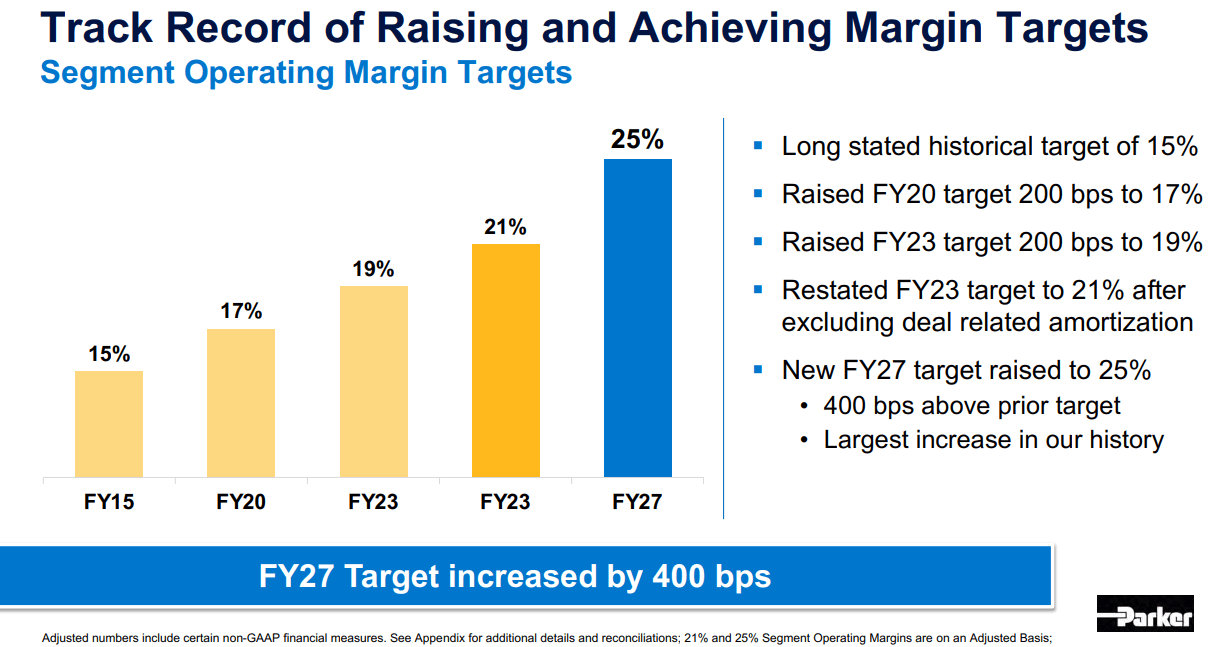

During my research, I also found stalwarts that have been doing well to slowly revitalize their aging operations and find growth. In particular, Parker-Hannifin (NYSE:PH) has done well to improve profitability over the years and provide earnings growth. As a diversified, global, and well-positioned industrial, one would hope that PH offers longevity and continual upside.

PH Investor Presentation

However, as is often the case, macroeconomic factors will always be a temporary issue that investors must overcome. While PH is strong enough to survive past any bear market, I expect opportunities to invest will arise at share prices below present levels. Does that make me bearish or bullish? Perhaps both, and as usual, the smartest investors will continue adding on a regular basis to capitalize on the volatility.

Some of the issues to consider are as follows: currency risks that are brushed over by management, investments in a more favorable revenue split are hurting the bottom line, and increased leverage reduces maneuverability. Although, these issues are temporary rather than secular, and I believe PH is able to survive the poor conditions that they must face.

PH Investor Presentation

Financial Summary

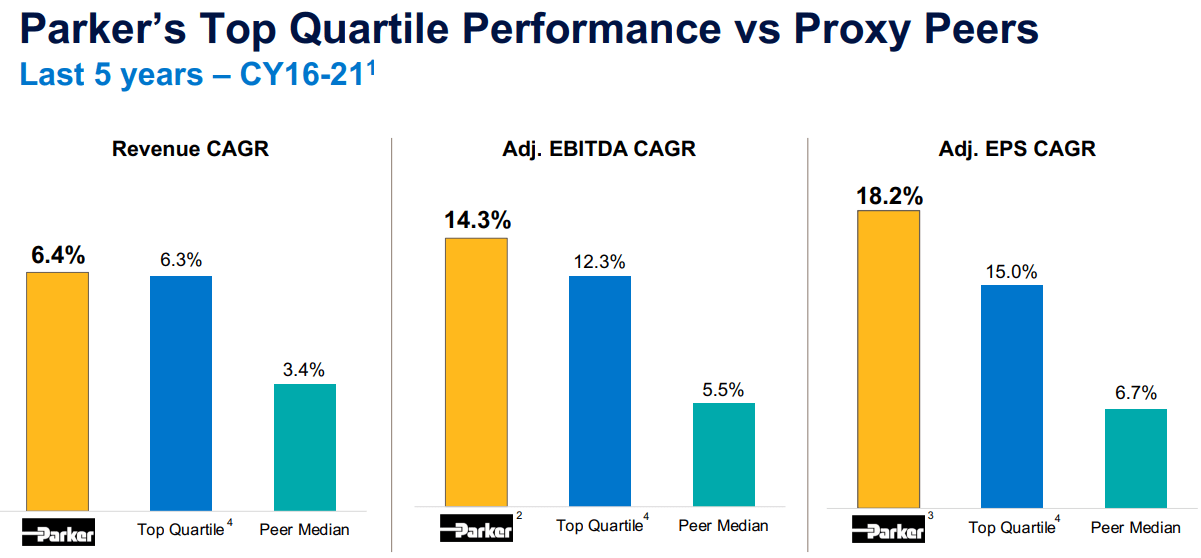

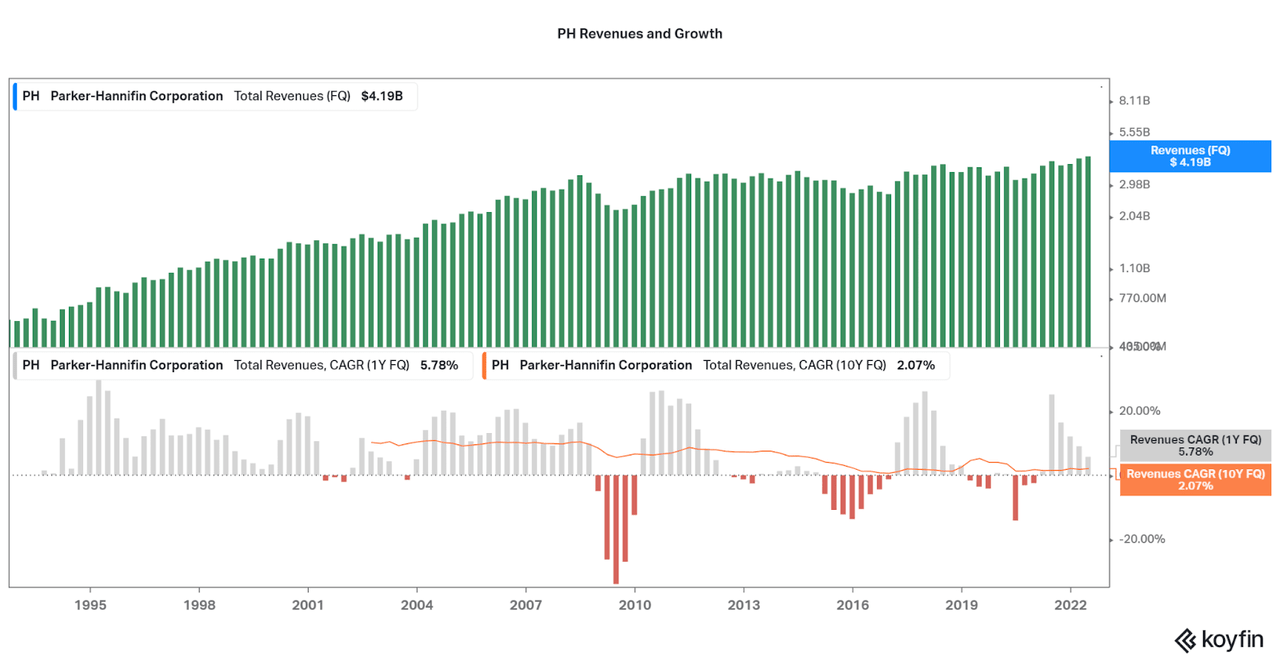

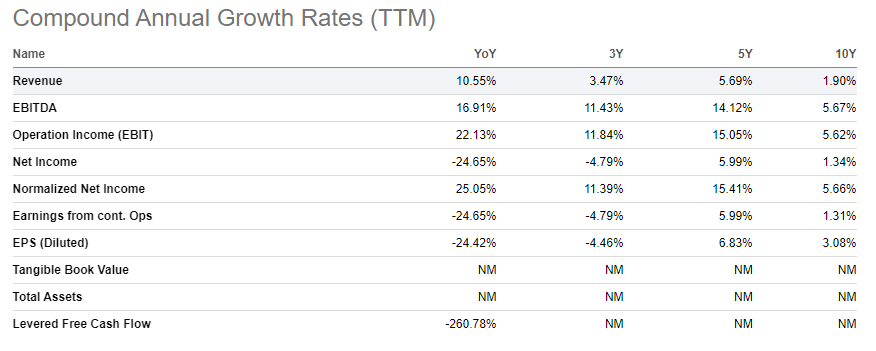

Historical data suggests that Parker-Hannifin is a fairly strong industrial stalwart that has a management willing to upgrade operations in order to survive. Importantly, while the company remains cyclical over the past 15 years upon maturity, revenue drawdowns have not been significant. As a result, the company’s 10-year CAGR has remained positive even when considering negative growth in 2015-16 and the pandemic. While the 2% average 10-year revenue growth rate may seem low, it is better than most large industrials who are barely finding positive momentum.

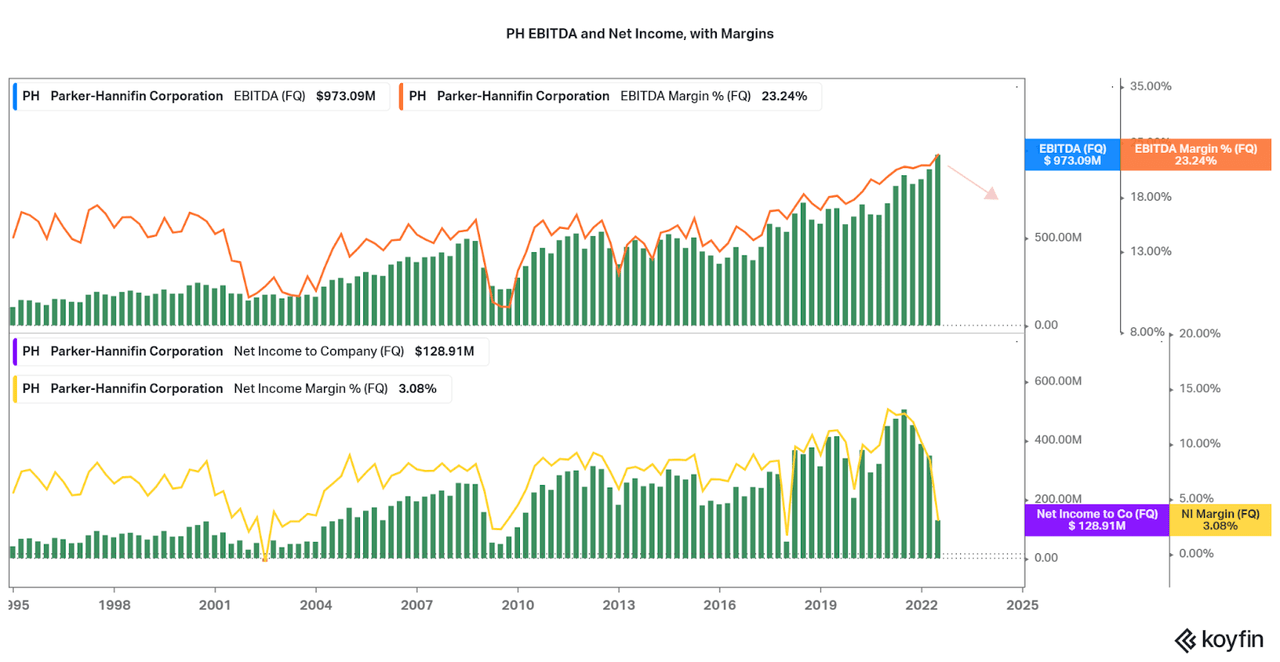

Koyfin Seeking Alpha

By keeping revenue growth slightly positive rather than flat or negative, PH has had room to increase profitability. In fact, this is one of the primary bullish indicators. For 20 years, both EBITDA and net income have risen at a faster rate than revenues. Unfortunately, margins can only increase so far, and the bear case revolves around a reduction in profitability. Depending on how the bear market pans out, I expect that the 10-year CAGRs of PH to fall negative despite the impressive growth of the past 10 years.

Later in the article, I will highlight the main cause of a potential decline in profitability, beyond general economic weakness. Thankfully, the past 10 years of generating profits have established a strong balance sheet and can be leveraged for success moving forward. This makes me feel that Parker is one the better choices for industrial dividend growth stocks to nibble on during the bear market, rather than recommend a sell rating like with 3M.

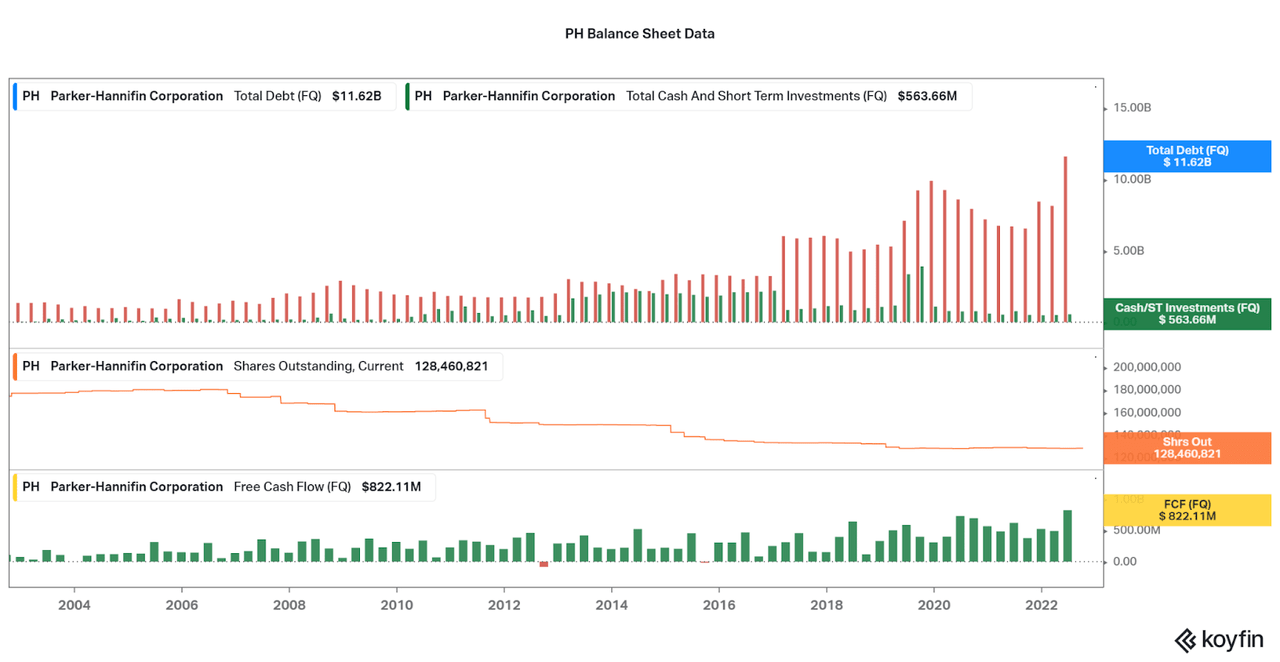

Koyfin PH Investor Presentation

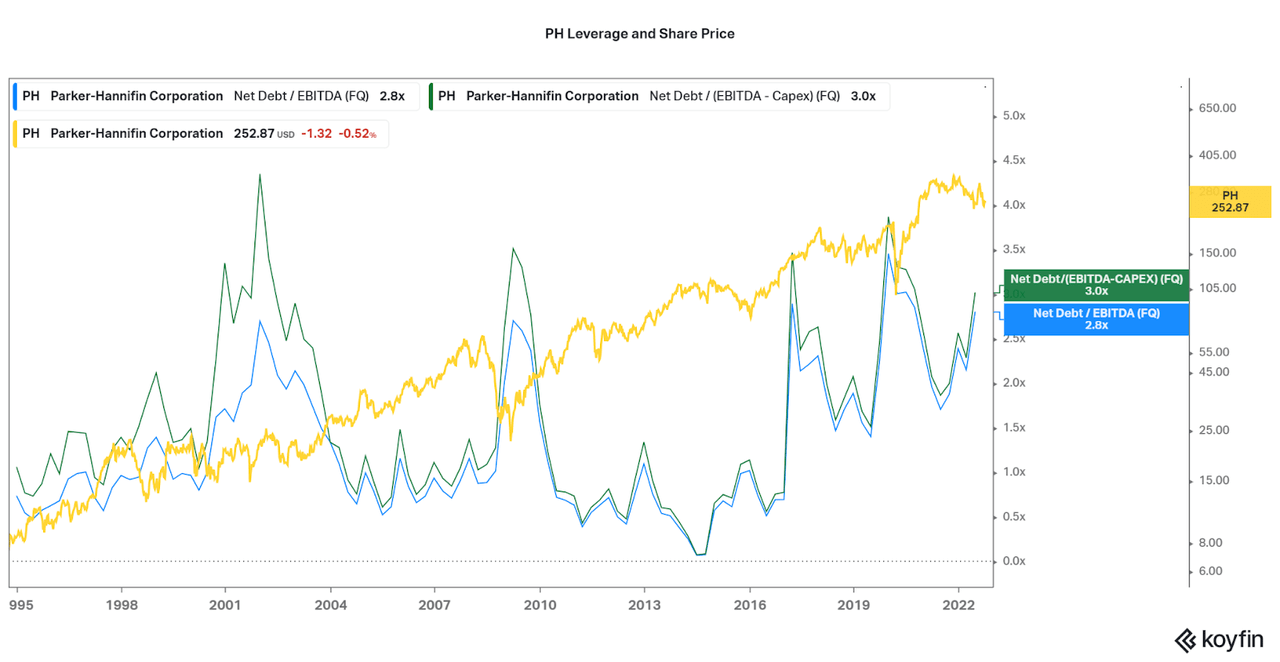

Parker-Hannifin has a strong balance sheet thanks to a stellar trend of positive free cash flows over the company’s operating history. Shareholders are also happy as PH has bought back over 25% of shares over the past 20 years, another contributing factor to EPS growth. While total debt is slowly increasing, actual leverage (net debt/EBITDA) remains less than 3.0x. Credit agencies remain positive on the company and have all rated the company at the upper end of medium investment grade (Baa1 – BBB+), although down one level after debt issuances in 2020.

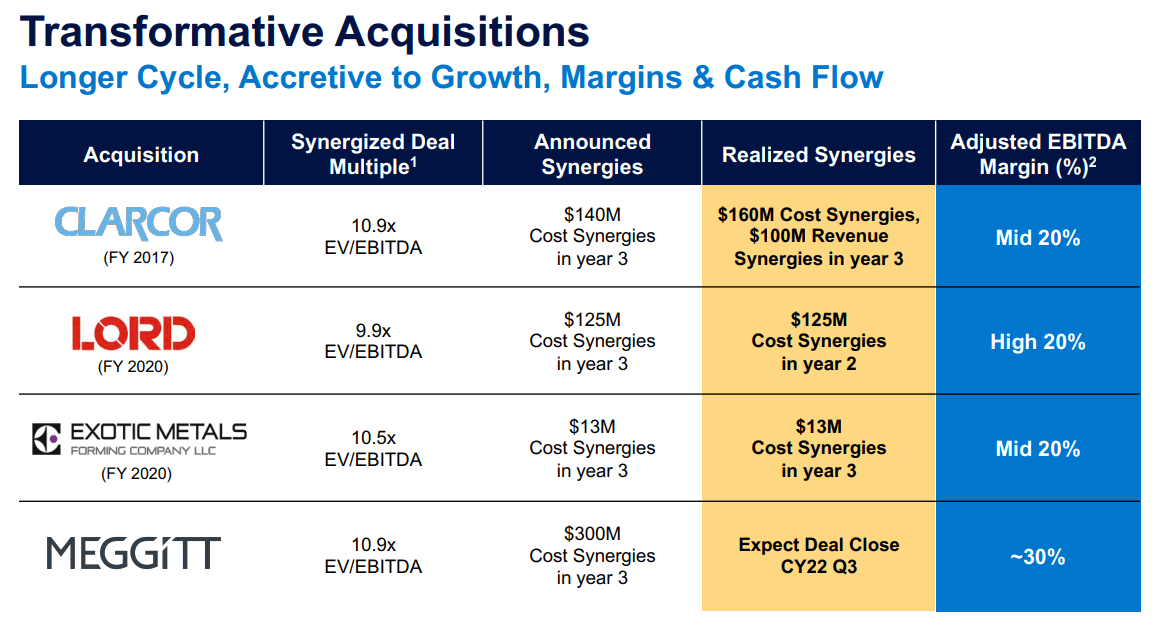

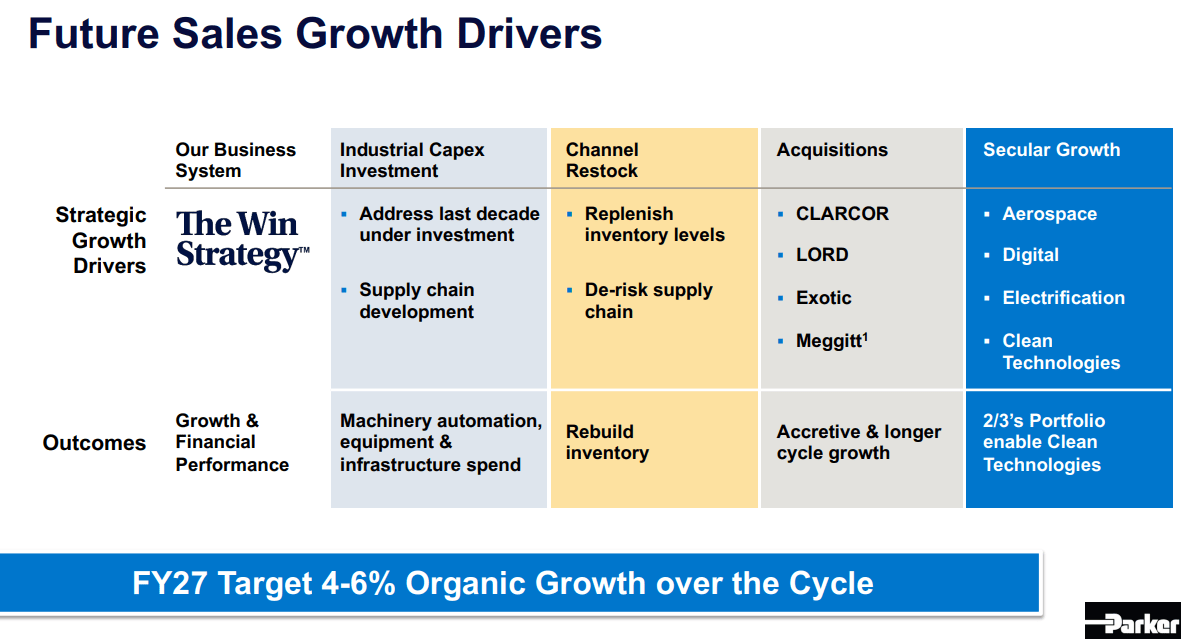

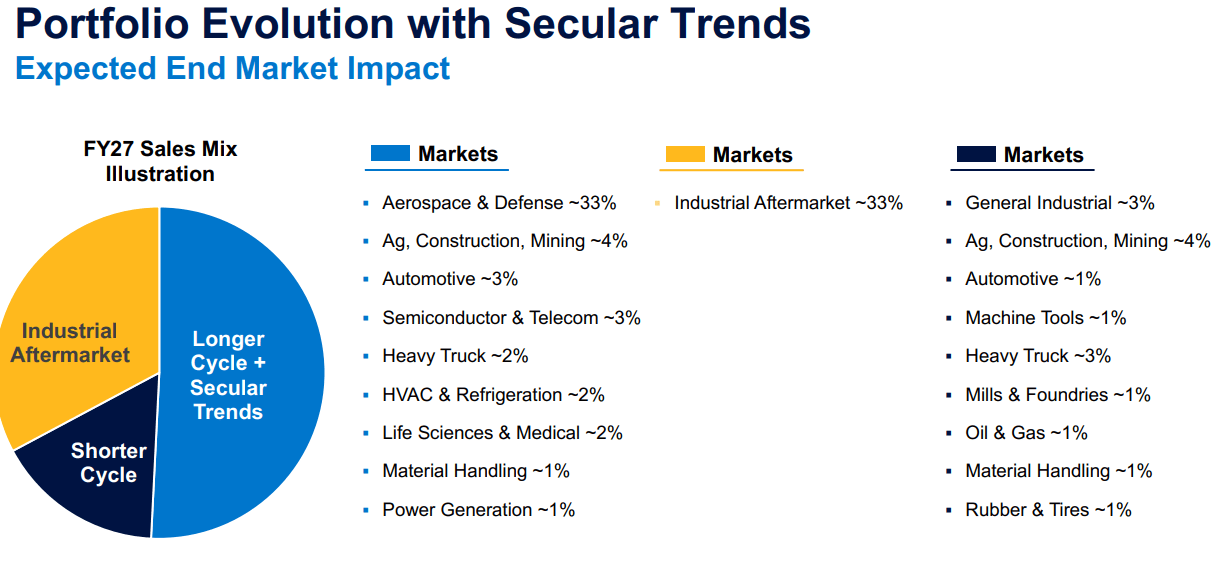

One of the primary reasons for the increased debt over the past few years is that PH has worked hard to diversify their revenue base through acquisitions. While providing inorganic growth, these acquisitions are also important in future-proofing the company by allowing an expansion into higher growth areas rather than remaining stagnant with legacy products. It will just be important to use the profitability of these new assets to restore the balance sheet to allow for the next round of investments.

Koyfin PH Investor Presentation

We can also see that historically high leverage has correlated with bear markets. For investors, this means we have a potential buy signal for the bottom of the market, rather than the top. Typically, it is best to buy during times of temporary weakness rather than when performance looks great. However, elevated debt levels over the past three years are an issue to keep an eye on. If leverage can be reduced back to 2011-2016 levels, then a significant upside is possible due to safety.

Koyfin

Currency Headwinds

While Parker-Hannifin is fairly well-positioned for an old industrial company, the coming economic conditions are unfortunately going to hurt performance. Most importantly is the general lack of demand if a major recession occurs, but PH is offsetting a reduction of growth with their acquisitions. Unfortunately, expanding globally comes with foreign exchange risks as the Euro and Pound reach record weakness when compared to the USD.

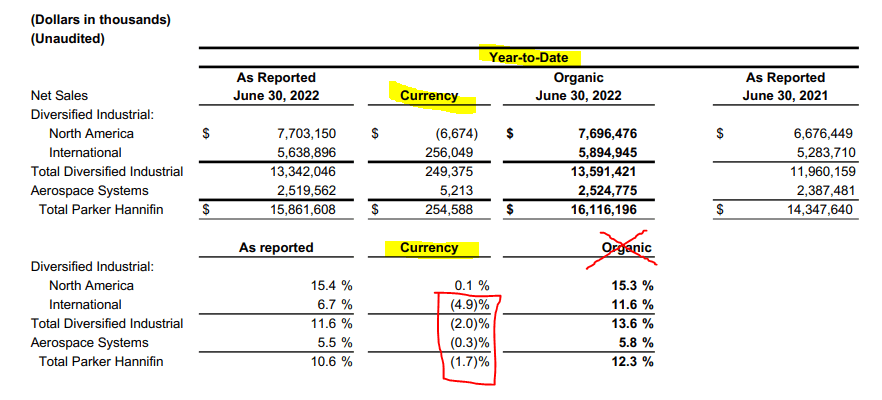

We can already see these effects being reflected in the earnings as a 5% reduction in net sales for the international segment purely from exchange rates. The amplitude of effects is also increasing every quarter, so the next half will continue the negative trend. These impacts will be critical in allowing PH to meet their goals, so watch carefully.

PH Investor Presentation

As long as the USD remains strong, the international segments will continue to underperform and impact both revenue and earnings growth. We also do not know how long the trend of a strong dollar will last, but it will remain an issue as long as the Fed remains hawkish and rates remain high. To offset market weakness and currency effects, continued investments into operations will be necessary. While current plans are vast and effective, I find it hard to expect that current growth and profitability will be maintained over the coming quarters or years. Even with a reliance on secular growth industries and targets for a long-term CAGR of about 5% may not be met.

PH Investor Presentation PH Investor Presentation

Valuation Concerns

While financial performance is strong, albeit with a bit of debt to watch, the current valuation remains quite risky. After a 10x run between 2009 and 2021, Parker-Hannifin has reached a fairly full valuation and this must be considered a major risk point. Even if profitability and growth remain positive thanks to acquisitions, inertia, and operational improvements, a reversion to historical levels is possible. Therefore, the 20% decline YTD may continue, not even considering the poor market momentum.

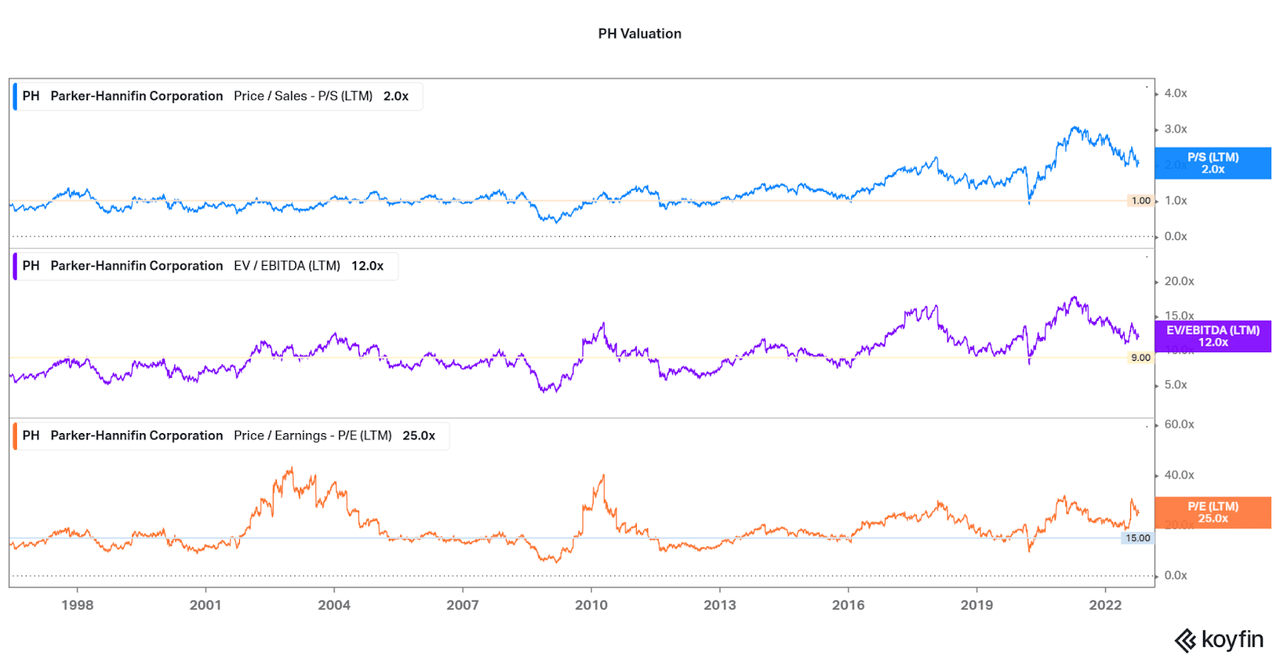

I believe the chart below indicates the risk well, especially since the data goes back to the 90s. First, the current price to sales is 50% higher than other low points of the last 10 years, or the average of the 2000s, 1.0x. However, do not worry about a 50% drawdown in valuations occurring as current profit margins are far higher now than in prior decades. However, from an earnings standpoint, both the P/E and EV/EBITDA values indicate that a further 20-40% drawdown is possible if growth remains flat. However, bad times rarely last and PH is strong enough to ride through the volatility.

Koyfin

Conclusion

Parker-Hannifin is more well suited to be a recurring investment than a cyclical play thanks to the recent history of operational improvements, growth opportunities, and financial health. While I will be watching leverage moving forward, I believe the current valuation may be less risky than it appears. One must ask, is the company stronger now? And to that, I would say yes. Therefore, the valuation may be maintained above the levels indicated in the valuation chart.

Either way, there is no need to gamble on where the share price will be and investors will be best served with recurring investments. They will also be happy with being able to add shares at a lower valuation while keeping a long-minded investment. As such, I believe PH also fits the bill as a capable 3M replacement.

Thanks for reading.

Be the first to comment