rarrarorro/iStock via Getty Images

Introduction

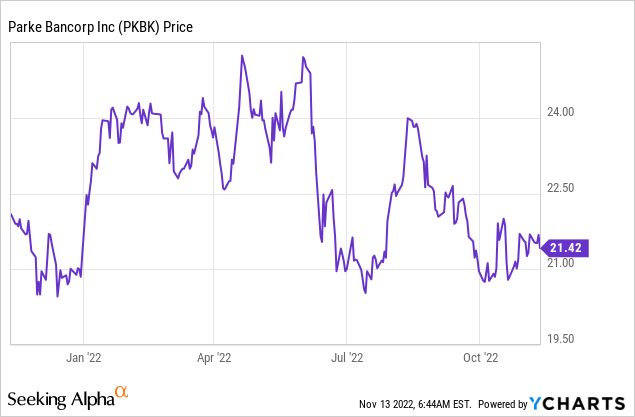

I have been following Parke Bancorp (NASDAQ:PKBK) for over 1.5 years now and despite posting strong financial results, the share price is currently trading just about 8% higher than what the stock was trading at in April 2021. The total return (including the dividends) since my first article is 13.6% and while this outperforms the S&P by almost 17%, I think Parke is still being underestimated by the market. After Q1, the bank was trading at just 8 times its earnings and just 10% higher than its tangible value and now Parke has released its Q3 results, I thought this is a good time to follow up on this local bank in New Jersey.

The bank is still attractively priced as the earnings profile remains robust

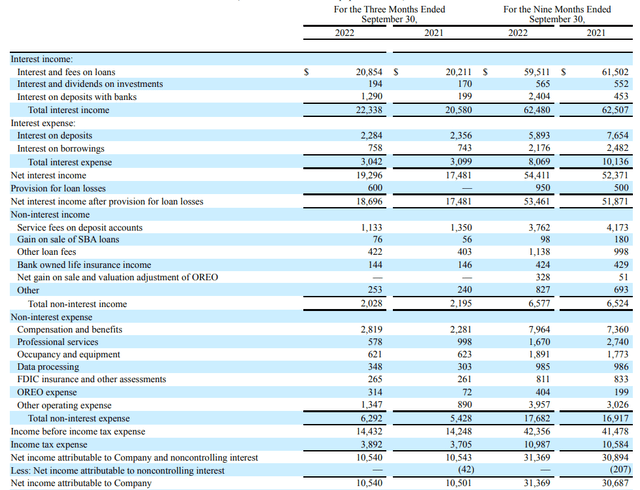

We are slowly seeing the positive impact from increasing interest rates as despite seeing a shrinking balance sheet, Parke saw its interest income increase to $22.4M. Additionally, the interest expenses actually decreased as the total amount of cash on savings accounts and deposit accounts decreased. This caused the net interest income to increase by approximately 10% compared to the third quarter of last year. And seeing how the net interest income in the first semester was just around $35M, the increase to $19.3M in Q3 (and likely exceeding $20M in Q4) clearly shows there is some momentum.

The bank also kept its net non-interest expenses relatively stable although we do see an increase in the ‘compensation and benefits’ category. That being said, the net non-interest expenses increased from $3.2M in Q3 2021 to $4.2M. An increase of $1M but considering the net interest income increased by almost $2M, Parke’s results are slightly better than a year ago.

And despite recording $0.6M in loan loss provisions, the bank was able to keep its net income virtually unchanged compared to the third quarter of last year. The reported EPS was $0.88 (and $0.87 on a diluted basis) which brings the 9M 2022 EPS to $2.63. And barring any unforeseen circumstances, this means Parke will likely report a full-year result exceeding $3.50 per share which means the stock is now trading at just over 6 times its net income.

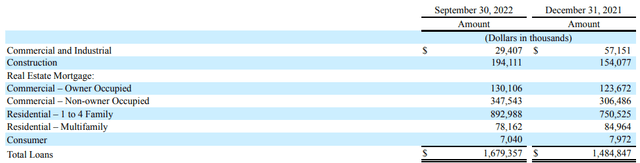

I’m not too worried about the quality of the loan book. As of the end of September, the bank had about $1.68B in loans issued (up from just $1.48B as of the end of last year as Parke made the smart decision to reduce the size of its deposits with other banks and used the proceeds to expand its loan portfolio). And as you can see below, the vast majority of the loans re real-estate backed with about 30% of the loan book consisting of commercial real estate.

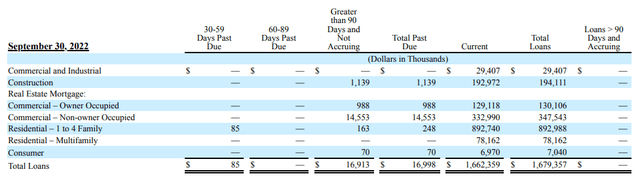

And looking at the breakdown of loans that are past due, just over 1% of the loan book is currently classified as past due and virtually all of those loans are non-accruing.

That sounds like a lot, but there are two mitigating factors here. First of all, the majority of the non-accruing loans are backed by real estate. While Parke Bancorp did not disclose the average LTV ratio of the commercial real estate assets, I think the odds of losing the entire investment are pretty close to zero. Parke will (or at least, should) always be able to recoup a (potentially sizeable) portion of its investment.

Secondly, including the recently added loan loss provision, the bank has now set aside just under $31M to cover future losses. This means that even if Parke would not recoup a single dollar of the non-accruing loans, the existing provisions provide excellent coverage. The one caveat here is that here has been a noticeable increase in the amount of non-accruing loans in the third quarter and according to Parke Bancorp, this was mainly related to two CRE loans going sour. I am looking forward to seeing how the bank will be dealing with this as it will be an important test case.

Investment thesis

Parke Bancorp is trading at a very attractive earnings multiple and the increasing net interest margin should be beneficial to the bottom line as well. It is important to deal with the non-accruing loans and find an elegant solution, so it will be very interesting to see how the bank deals with this situation. As those loans are backed by real estate I expect the impact to be relatively limited but it is a situation that has to be dealt with.

As of the end of September, Parke’s common equity value was $257M and divided by 11.92M shares outstanding, the [tangible] book value per share was approximately $21.55/share. That’s the current share price which means Parke is no longer trading at a premium to its book value. This, in combination with the low earnings multiple could potentially spark the interest of a larger financial institution to consider an M&A deal.

That’s obviously not my main reason to be interested in Parke Bancorp as the earnings multiple and the lack of premium versus the book value are enough arguments to go long. And as Parke has recently hiked its dividend to $0.18 per quarter, the stock is now yielding approximately 3.3% with a 20% payout ratio.

Be the first to comment