PixelCatchers

Introduction

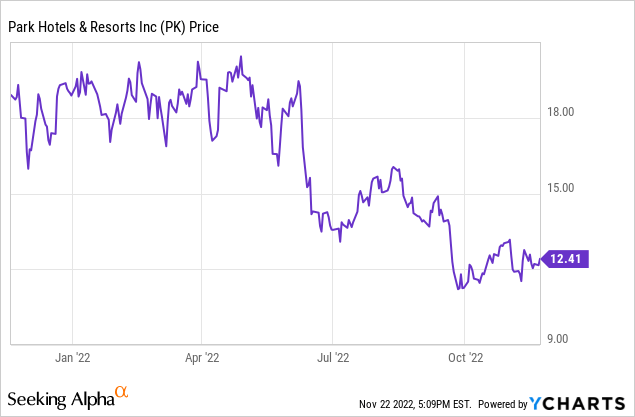

Hotel REITs benefited after the post-pandemic reopening of the economy but the uncertainty caused by inflation and the correlated decreasing consumer confidence level may put some more pressure on the sector. I have been keeping an eye on Park Hotels & Resorts (NYSE:PK) as the REIT is trading at just over 8 times its anticipated FFO for this year. Some authors here on Seeking Alpha were worried about the REIT’s debt level, but I’ll explain why it’s not something I’m too worried about right now.

The hotel sector is picking up again, and Park is benefiting

As this article will mainly focus on the balance sheet of Park, I will just briefly discuss the REIT’s FFO and AFFO performance.

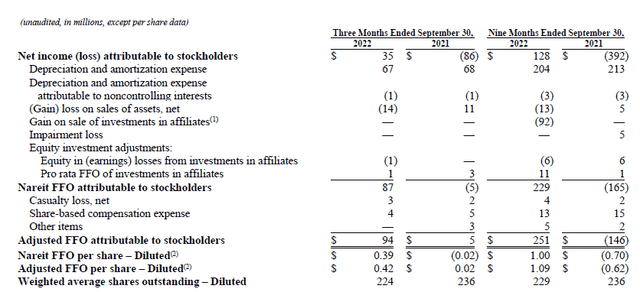

The REIT performed well as it benefited from a renewed interest in travel, while travelling to the USA has gotten easier since the start of the pandemic. In the third quarter of this year, Park reported an FFO of $87M and an AFFO of $94M resulting in a FFO and AFFO per share of $0.39 and $0.42. This pushed the total FFO and AFFO per share performance to respectively $1.00 and $1.09 in the first nine months of the year.

Despite the shaky markets and the high inflation rate, Park was/is pretty upbeat about the current quarter. According to the Q4 guidance which was published when Park announced its third quarter results, the REIT is expecting an AFFO per share of $0.35 to $0.43 which means the full-year result should come in at $1.45-1.52 and that’s pretty strong. Given the current share count, Park should thus generate north of $300M in AFFO.

Additionally, Park’s dividend is pretty low. The REIT currently pays a dividend of just $0.01 per quarter but has been guiding for a year-end dividend of $0.21-0.26 based on the expected operating result and the gains on sold properties. This means in excess of $1/share in generated AFFO stays in Park’s treasury, allowing it to hoard in excess of $200M in cash this year. This also means Park will likely be able to hoard additional cash to reduce the pressure on its balance sheet.

Why I’m not too worried about the debt position of Park

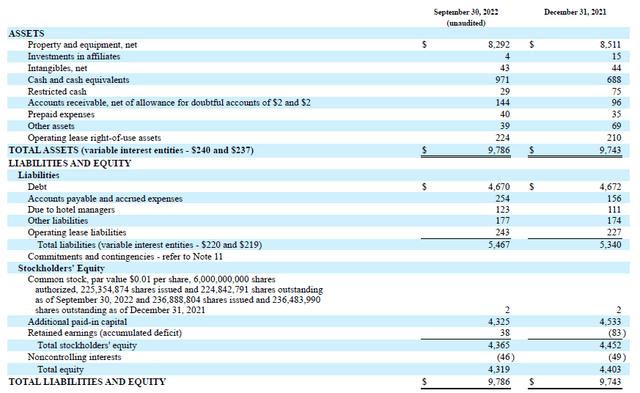

In a September article, author Yannick Frey mentioned the debt position of Park Hotels as main reason to avoid the stock. He continuously quoted the debt level exceeding $4.5B and how that is a frightening high number. In absolute terms, he is right. The gross debt position as of the end of September of $4.67B definitely sounds like a frightening number. But when you talk about gross debt, you also need to look at net debt. As of the end of September, Park had about $1B in cash on the balance sheet, of which $971M was unrestricted cash. Even when we ignore the restricted cash balance, the net debt is $3.7B.

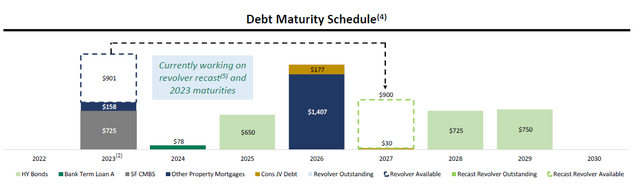

I also don’t see any near-term issues. As you can see below, the debt repayments are relatively ‘low’ over the next few years, and the current cash balance is actually sufficient to repay all debt coming due until the end of 2024.

This means the refinancing and/or repayment of debt only becomes an issue from 2025 on. And keep in mind that if Park is indeed able to extend its $900M revolving credit facility to 2027, it can also already cover the $650M due in 2025.

So yes, the gross debt level sounds frightening, but Park Hotels has plenty of cash on its balance sheet which could be used to lower its gross debt level in an attempt to reduce the interest expenses.

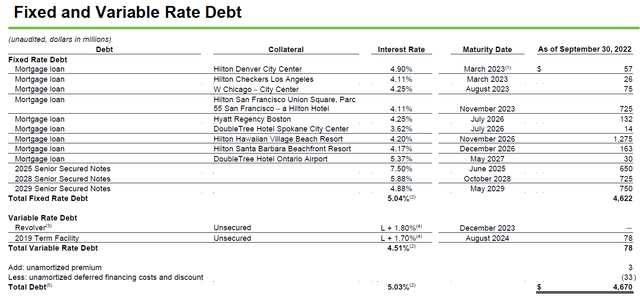

Secondly, almost all of Park’s debt is fixed rate debt. As you can see below, in excess of 98% of its debt has a fixed interest rate which means there should be no interim surprises. The interest expenses will only increase as debt gets refinanced. This also means Park can be quite selective with how it refinances its debt: secured debt will be cheaper than unsecured debt, and I bet that even in the current interest rate circumstances, Park would be able to refinance its 7.5% 2025 senior secured notes at a lower cost using a traditional mortgage financing.

Additionally, another important element is time. Basically, Park has three years before a higher interest rate will be noticeable assuming the REIT will use a portion of its cash balance to repay some of the debt that needs to be refinanced between now and YE 2024. This means that Park can try to hike prices in order to boost the revenue, and it can do so without being too abrupt. Just as an example: increasing the room rates and ancillary revenue including food & beverage at 3% per year and assuming all cash operating expenses will increase by 2% per year (I am indeed assuming a lower inflation rate going forward) should increase the net operating income by just over $100M which would basically mitigate the impact of a 200-250 basis point increase in the cost of debt. Again, this is a theoretical example but it shows how important ‘time’ is for Park. And of course, being able to hike prices completely depends on the consumer confidence level and the willingness to pay.

And finally, let’s also not forget the LTV ratio is actually very reasonable. Looking at the balance sheet, the $3.7B in net debt represents just 45% of the $8.3B book value of the assets.

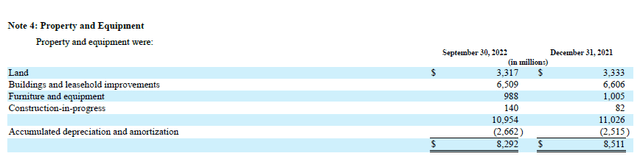

And as you know, the book value of the hotel assets includes the accumulated depreciation. Looking at the footnotes to the financial statements, the $8.3B book value includes almost $2.7B in accumulated depreciation. The acquisition cost of the land and buildings was almost $10B.

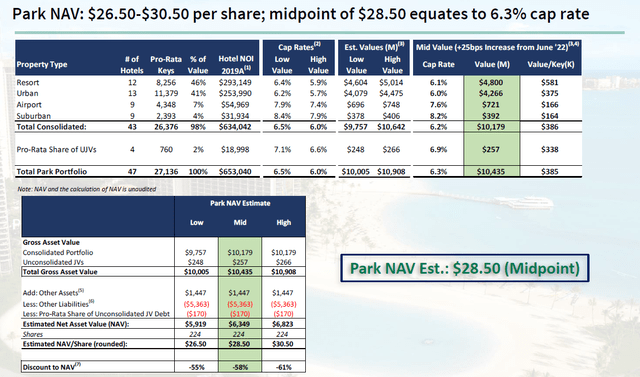

These numbers are also backed up by the company’s own NAV analysis and calculation. Using a 6.3% capitalization rate based on the net operating income, Park estimates the fair value of its assets to be $10.4B. Which means the LTV ratio based on the fair value of the assets is just around 35% and that is very reasonable.

The perceived undervaluation explains why Park Hotels has been buying back its own shares, but I think it would be a better signal to the market if Park also would start buying back some of its notes at a discount to par value on the open market. Fortunately, the majority of the share purchases happened in Q1 and Q2 and I am very happy to see the REIT only repurchased just over 300,000 shares in the third quarter of this year after announcing the $300M buyback approval in February.

Investment thesis

I don’t see Park’s debt level as a problem, but the new interest rates upon refinancing are the main risk here. But even that risk should be manageable as Park can reduce its gross debt by using its cash position and reducing the gross debt from almost $4.7B to $3.7B would already mitigate the impact of a 165-basis point interest rate increase.

While I currently have no position in Park Hotels & Resorts, I have been writing put options with a strike price of $12.50 with a first expiry date in December. I would be happy to take delivery of the shares at that price level. I am also keeping an eye on the notes as the yield to maturity is pretty attractive with for instance the 4.875% 2029 notes trading at 86 cents on the dollar for a yield to maturity of approximately 7.6%.

Be the first to comment