aapsky

In July, I had a look at the earnings of Park Aerospace (NYSE:PKE) and what I pointed out at the time was that the present results are not impressive, but there are significant opportunities over the longer term. What I could appreciate at the time was how willing Park Aerospace was to provide information. The company had a slide deck that was extremely big, showing their willingness to share details with investors and analysts. After analyzing the Q1 results, I marked shares of Park Aerospace a buy, a speculative one, but still a buy. In this report, I discuss the Q2 results and guidance and explain why I believe shares of Park Aerospace are a hold or speculative buy at best for the long term.

Park Aerospace: A Tiny Advanced Materials Expert

Park Aerospace is not a huge company measured by market cap or headcount so a brief introduction is in place. When going through the slides and the transcript, I found that it contained a lot about how “We at Park” do things and also a clear message for corporate America. I wouldn’t say it was hostile, but it had things you normally don’t see in earnings discussions. The headcount of the company likely has to do with it. Park Aerospace is a company with just 99 employees, it is a company that takes pride in the products they produce, and given the pressures that are faced today, meeting targets requires the workforce to. If you run a company with 99 employees in a complex and competitive aerospace industry, I understand why Park Aerospace takes much pride in the way they conduct business.

The company specializes in developing and manufacturing advanced composites materials, used on aircraft structures, radomes and rocket nozzles as well as light weight assemblies and low volume tooling.

Shares of Park Aerospace are currently trading at $10.50 per share giving it a market cap of a little over $225 million. There is no meaningful price target for the company set by analysts as there is only one analyst who issues a buy rating and a $26 price target. Since the last time I covered earnings of this tiny aerospace supplier, shares have depreciated by 13% underperforming the broader market.

Q2 Results Are Underwhelming

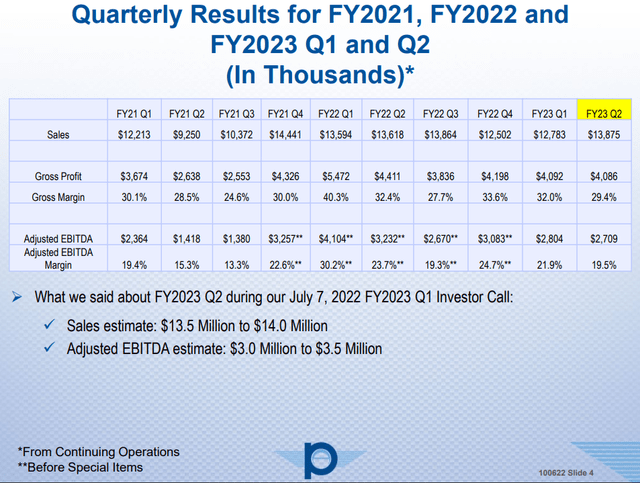

FY 2023 Q2 Results Park Aerospace (Park Aerospace)

The Q2 2023 results were not impressive. In July, Park Aerospace guided for $13.5 million to $14 million in sales and what Park Aerospace achieved was $13.875 million so the top line figured looked good. However, on gross margins, Park Aerospace failed to deliver. Gross margins fell shy of the minimum level of 30% and Adjusted EBITDA was below the 22% to 25% that we are looking for.

So, revenues are increasing but profits are falling and came in below expectations including that of Park Aerospace itself. Park Aerospace marked a $250,000 EBITDA pressure related to a customer bankruptcy and a customer item. Reality, however, is that even when we add back those numbers there would still be a miss on EBITDA level driven by inflationary costs on labor, shipping and materials and logistical challenges. The fact that some suppliers are not honoring purchase orders does not help either as lower margins cannot be offset by higher volumes for that reason. During the second quarter, Park Aerospace had $750,000 in missed shipments. Putting it all together, with or without customer bankruptcies, Park Aerospace is facing inflationary costs and delays that result in their production to run less efficient than desired, and in the second quarter, this was further amplified by a negative product mix leading to lower margins. The company did not anticipate this when guiding for the second quarter and signalled that the current environment is so challenging that they are working with what they can get in terms of material shipments. So, if a purchase order that they placed is not coming in, they simply don’t make what they expected to when making the planning. It is not a pretty thing, but likely it is the reality for tiny suppliers such as Park Aerospace.

We At Park Aerospace… Are Losing Employees

One thing that I already noticed during the first time I listened to an earnings call from Park Aerospace is that they do things differently. They have a huge slide deck and they mark how they do things differently than corporate America. For a listed company that was quite special to see and hear. However, the second quarter earnings call had a bit of a bitter undertone lashing out to corporate America. Park Aerospace pointed out that its headcount was down to 99 employees signalling a headcount reduction of 8 people while 115 people are able to comfortably produce. The CEO pointed out that larger companies are recruiting Park Aerospace employees and that these companies in earlier stages of the pandemic had accepted government money and are now recruiting employees from Park Aerospace. The CEO questions whether this is a fair practice. The CEO makes a big deal about not having taken any government money during the pandemic and now questions whether this is how capitalism is supposed to work. I do understand that it might feel like unfair practice that Park Aerospace is now being “robbed” by companies who took government aid.

However, there are a few things to consider. The first thing is that if you are losing your employees to other parties, then there is something that is making leaving more attractive than staying and there can be many reasons for that. A few examples of that are wages, hours, balance between work and personal life, appreciation by management and effective communications. So, when the CEO said they are losing employees to the competition, I looked at the reviews of the CEO as well as the company itself and the CEO has an 8% approval rating while I have read employee reviews pointing out the hours they have to make and lack of communication from management.

Now, I do recall that the CEO said the following in July:

So, how were we able to make our Q1 sales and EBITDA numbers with such a severely reduced workforce? Was it a magic? I don’t think so. Our people have been working very long hours, in some cases, 70-hour weeks, week in and week out. Nobody really ask our people to do it, they just do it. So, there are plenty of others out there who let go many, many people and maybe thousands of people, and now they need the people to work extra hours for them. And my comment is good luck with that. You just — you [let go] of 10 or 12 or maybe 100 of my pals. Now you want me to work hard for you? Why would I want to do that? Because you obviously don’t care about me, so why should I care about you. So, my comment would be good luck with that. Do you understand how very fortunate and lucky we are to have the wonderful people we have, understand why we love our people. As it turns out, loving our people is a good business. Because our people are willing to do what’s needed for our business to be successful, this for all part of this business, we’re all part of it. We’re not like dressing them. We don’t do that. But their love has to be sincere. If it’s not sincere, then it doesn’t count.

The CEO made a big thing about losing employees but still meeting the target and that makes me wonder, if you are losing employees and you have people doing overtime and 70-hours workweeks… it might be the case that as a company you are failing to provide certain elements that employees are looking for and some people make overtime because they simply need the money. Sometimes doing overtime has nothing to do with love, but people not being able to make ends meet if they don’t. If to employees the grass is greener on the other side and the CEO complains about that, he should also keep in mind that the grass is greener where you water it.

So, instead of complaining and bragging with shareholder returns since 2005 which are over $500 million, no government handouts and no long-term debt, the CEO should try to find out why people are leaving and how to counter that. Park Aerospace pointed out in its presentation that they implemented an inflation pay premium because “while they don’t have to and did not cause this inflation” they don’t like to see their employees having to choose between gas or food. I think you have your problem right there; if your employees have to choose between gas and food while working 70 hours per week in some cases, the pay is not nearly as attractive as management thinks and there is a certain disconnect mostly visible in management’s impression that overtime is being done by employees for love, while instead it is a necessity for some to make ends meet. The issue of high turnovers was also something I found in company reviews as far back as 2017.

It is an alarming thing, and while I do see a lot of potential for Park Aerospace, I do fear a disconnect with the workforce and a realistic assessment on how attractive their offers for employees really are. Meanwhile, the CEO keeps pointing fingers at other companies without whom Park Aerospace might not even have managed as a company. Even while short on staff, when financial targets are not met, Park Aerospace cuts the bonus for its employees. The company can already not manage at the current level and still made a big deal about being one of the few companies that was committed to supporting Airbus’s (OTCPK:EADSF) (OTCPK:EADSY) production rate increases to 75 per month by 2025 while other companies point out it cannot be done. The CEO made a big deal about that, but maybe he should be wondering whether this is the right way to do things. Cutting bonuses for hard working people in a challenging environment and simultaneously committing to production rate increases while current rates already cannot be supported. There is a big disconnect that is not being seen or addressed by the CEO.

Guidance Leaves Much To Be Desired

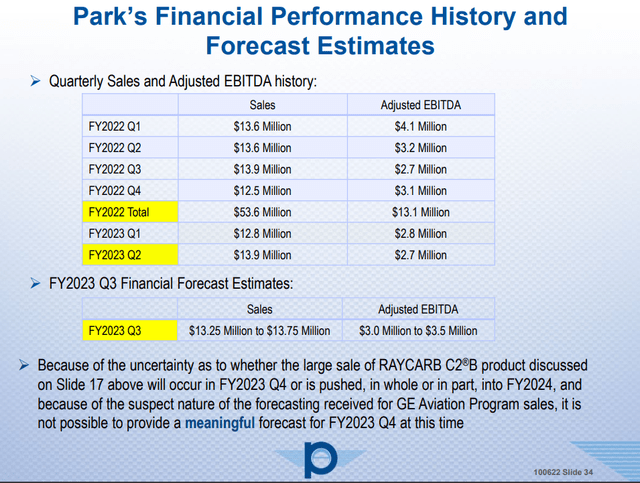

FY 2023 Guidance Park Aerospace (Park Aerospace)

So, the guidance for Q3 is lower than the previous quarter and also year-over-year things are trending down. The main issue for Park Aerospace seems to be that from former GE Aviation programs the revenue is expected to fall from $6.4 million to $4.25 million to $4.75 million due to downstream inventory challenges. Again, there was some finger pointing at others and I once again do understand that it is frustrating for Park Aerospace, because they are seeing revenues fall because other parties have not managed things well. However, one could also wonder why Park Aerospace has no agreement set for a minimum amount of production in the range of $6 million. Park Aerospace did $28.9 million in GE Aviation program sales in FY2020, $26.5 million last year. They could have tried setting a minimum that would guarantee work.

In missile defense, there seems to be a tailwind but some related orders for ablative materials and RAYCARB C2®B product might slip into 2024. As a result, the sales for that product have been decreased from $10 million (and actually over $13 million) in FY2023 to $6 million meaning that currently two-thirds of the demand is expected to slip. The reality is that in any normal year the product would generate $5 million to $6 million in revenues. For FY2023, $13 million was expected and in the most recent update all that upside to that product has been shifted to next year. The CEO wants to be candid, but he was not candid enough to say that the complete upside, as was previously guided, is completely out of the picture for this year as suggested by their guidance.

One thing I want to hear is about where Park Aerospace can grow. The missile defense business provides one opportunity, but we have seen the guidance for ablative and the RAYCARB C2®B product fall and shift into 2024. Also, on a promising product for drag reduction for which Park Aerospace is the sole source of material, the company will stop providing updates on the request of its customer. That doesn’t help with providing a look on growth. The growth drivers that were discussed are production rate increases for the Airbus A320neo in the coming years and the Bombardier Global 7500/8000. That upside remains for the years to come. The company also revealed how it would be using some factory space, they basically had the factory space but not the project. They have now revealed that it will be an additive manufacturing project if they decide to continue with it. However, they also marked the project as a “build-it-and-they-will-come” project, meaning they have no customers for it now, but they believe if they proceed with it, the customers will come. That is a huge gamble for a company that currently is unable to provide accurate plannings.

Conclusion: Ouch, Park Aerospace… Stock is Now A Long Term Speculative Buy

As pleased as I was by the presentation during the first quarter, the disappointment with the way the CEO discussed the second quarter was equally big. I read a lot of finger pointing, headcount reductions, backtracking from earlier growth drivers and an unbacked project reveal. The reality for aerospace companies right now is not pretty, Park Aerospace is no exception and their small size make them prone to fluctuations. However, with a candid presentation style the CEO has, it would have suited the CEO to reflect on their own functioning as a company and explain how they address certain difficulties, but the company’s mitigation plan seemed non-existent, and while addressing supply chain “chaos” repeatedly he did not provide any word on streamlining and that is disappointing for stakeholders including employees and shareholders. Aerospace manufacturing is difficult and if you don’t implement risk mitigating measures, you are going to end up being the weathervane of the supply chain chaos and that seems to be happening to Park Aerospace as it has not presented anything to improve turnover among employees or plans to stabilize GE Aviation programs. Instead, there was finger pointing… a lot of it. The CEO gave a 1-hour presentation and did not discuss risk mitigations for one second or dedicated even a single slide out of the 50 he had to discuss anything on how Park Aerospace would attempt to get things under control. Park Aerospace is like a tiny boat in the rough sea of supply chain chaos but instead of trying to steer the boat and explaining how to navigate these rough seas, the CEO complained about how rough the sea is. That is not helping anyone.

I grew a lot more cautious about Park Aerospace’s attractiveness for investment and currently I do not see the value in this company due to the lack of active steering from management and they are just taking things as they come and mostly that is on the chin only to complain about it later. There is a lack of proper planning and assessment it seems and also on growth drivers they seem to be shooting in the skies. The only bright spots at this time are the Airbus A320neo programs and Global 7500/800, but are projects that will ramp up and from which Park Aerospace should benefit. The big question will be whether they will have found the golden nugget of wisdom to make their employees stay to support those rate increases instead of management supporting rate increases while already being understaffed for the current rates.

Be the first to comment