Kati Lenart/iStock Editorial via Getty Images

Investment Thesis

At its core, Mondelez (NASDAQ:MDLZ) is a very strong business. The company is concentrating on its fastest growing segments and acquiring new products. But the company is trading at a high valuation with high leverage. I think this is a decent buy for defensive income investors, but I think that there’s limited long term upside.

Strong Performance In Core Segments

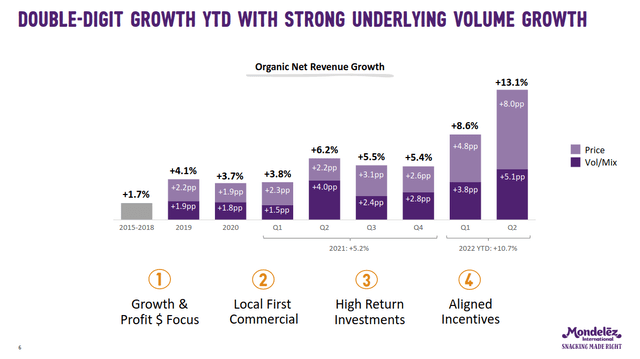

Mondelez’s business is very strong. During the last quarter, the company grew its top line by 13.1% year over year on a constant currency basis. Constant currency EPS grew to $0.72, a 9.1% increase.

Mondelez calls its biscuits segment and its chocolate segment its core businesses. The biscuits segment includes cookies, crackers, and salted snacks. These core segments make up an increasing portion of the business. In 2012, these were responsible for 54% of revenue. Last year, they accounted for 79% of revenue.

Mondelez Q2 2022 Earnings Slides

Mondelez’s core businesses have shown extremely impressive organic growth in recent years. During the last quarter, Mondelez’s biscuit segment grew by 10.4% year over year, including 2% volume growth. Its chocolate segment was even stronger, growing by 30% year over year. 9% of this was volume growth.

The brands in these segments form Mondelez’s strong moat. The company owns many iconic brands, such as Oreo, Triscuit, Cadbury, and Toblerone. Private label products are not very competitive in Mondelez’s core business categories. Even as it raises prices, Mondelez isn’t reporting a decline in volume. Management doesn’t see consumers pulling back or trading down to cheaper brands. This strong brand loyalty makes the company extremely resilient to the current economic headwinds.

Inflation still has a significant impact on the company’s operations. Even as commodity inflation is starting to slow down, labor inflation is now a new headwind. Mondelez has been effective at offsetting inflation with increased prices. The company grew its gross profit by 9.7% year over year. It recently finished its final round of 2022 price increases. Management is planning for another set of hikes in 2023 to offset expected inflation.

This strong performance has caused the company to raise its long term expectations. The company has set its long term target at 3% to 5% annual top line growth. Management expects a high single digit annual EPS expansion. They are on track to hit their free cash flow target of $3 billion.

Mondelez’s Long Term Transformation

In the long term, Mondelez is focusing on its biscuits and chocolate segments. Management is aiming to slowly divest the 20% of its business that is in noncore segments. These segments include gum, candy, cheese, grocery products, and powdered beverages. For example, the company recently announced its plans to divest part of its Trident and Halls brands. At the same time, the company is spending heavily to acquire new businesses in its core segments. Management explained their decision at a recent investor conference.

Yes. Well, maybe I’ll start off with quickly saying why we like those categories so much. Both our categories were brands play a big role. They’re growing quite nicely. Our businesses has been growing around the 6% mark for the last 3 years. private label is very limited in the categories. It’s an expandable consumption, if you want, which makes it interesting. And we still see plenty of opportunities around the world for significant growth in this category. So we like them, and we’ve been doing quite well in them.

So from our perspective, if our business would be only biscuits and chocolate, we would see a much stronger top line and we would see a much stronger bottom line. And we think that’s where we gradually have to move towards — that movement will take place through a balance between acquisition and divestment, I would say. There’s 20% of our business. That’s not in both categories. And that’s really over time, where we will exit and we will try to combine that with a number of acquisitions.

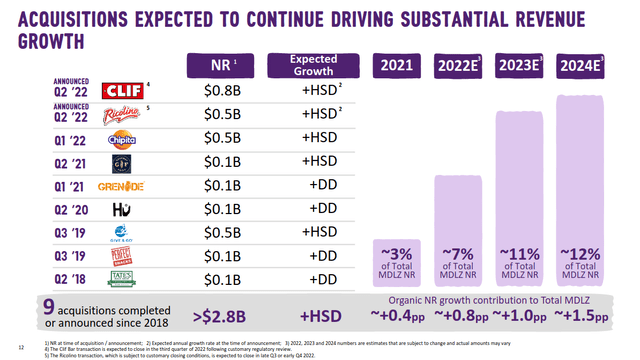

The company has been investing heavily in this strategy. It has spent almost $6.3 billion on acquisitions since the start of the pandemic. These are expected to boost Mondelez’s revenue by $2.8 billion at the time of closing.

In June, the company announced its acquisition of Clif Bar & Company. The brand expands Mondelez’s presence in the snack bar market. Management believes that the brand is also positioned to grow internationally. Today, the category is mostly concentrated in the United States. As it expands to the rest of the world, Mondelez is well positioned to benefit.

Mondelez Q2 2022 Earnings Slides

I like this strategy. Mondelez is focusing on acquiring new brands within its core markets. This is a good opportunity for management to expand into segments it wants more exposure to. These include dark chocolate and premium chocolate brands. By focusing on these segments, the company has the ability to drive higher ROI. The company can leverage its existing manufacturing and distribution network. This drives strong incremental revenue growth, which is an efficient way of boosting profits.

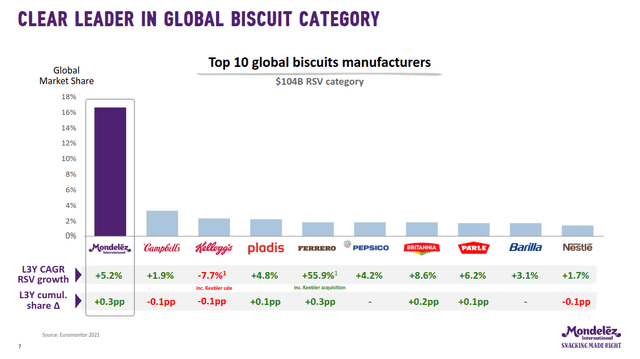

Mondelez is a market leader in each of its core segments. The company is the number one biscuit company in the world with about a 16% market share.

Mondelez 2022 Shareholder Intro Presentation

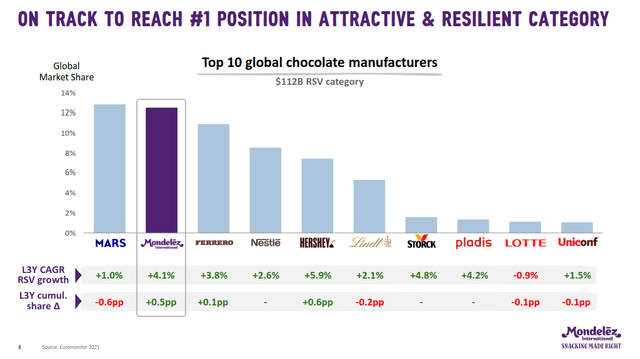

The business is also growing its chocolate segment. It is closing in on Mars’s title as the number one chocolate brand.

Mondelez 2022 Shareholder Intro Presentation

I like Mondelez’s strategy and I think that the company is well positioned to execute on it. But M&A is still expensive and requires a significant use of capital. Since 2019, the company has spent almost 43% of its free cash flow on acquisitions. The company’s buybacks, dividends, acquisitions, and capital expenditures were almost 150% of free cash flow last year. The company will likely have to pull back on shareholder returns or acquisitions. So far, the company has funded this strategy by increasing leverage.

Elevated Leverage, Expensive Valuation

Mondelez is trading at a forward P/E of 19 times and a forward EV/EBITDA of 15.7 times. Its LTM P/FCF is 22.5. At the current valuation, the company has a 4.5% free cash flow yield. I think this valuation is high for a company with a single digit long term organic growth forecast.

The company has strong liquidity, with over $2 billion in cash on hand and $9 billion in undrawn credit lines. It also has almost $20 billion in debt and other obligations. The company’s recent acquisition of Clif will increase this by about $2.9 billion. This combined debt burden is equal to about 4.6 times LTM EBIT. I think that this is high, but the company should be able to manage it. I still want to see Mondelez reduce its leverage in the next few years.

Mondelez also has major equity stakes in other companies. The most important of these are its 6.4% equity stake in Keurig Dr Pepper (KDP) and its 19.8% equity stake in JDE Peet’s (OTCPK:JDEPF). By my estimates, these two investments are worth $6.2 billion. Management is reducing their stakes to fund their M&A strategy.

Mondelez Q2 2022 Earnings Slides

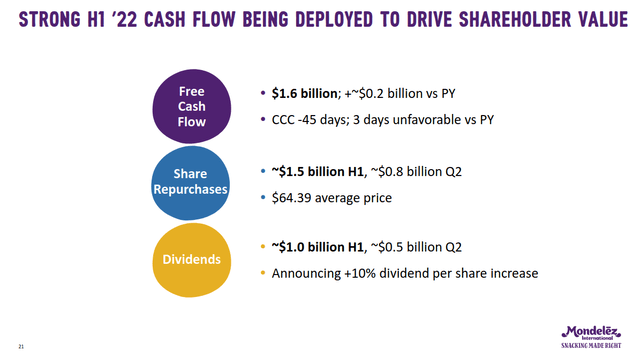

The company pays out a solid dividend, yielding 2.8%. This dividend is well covered by free cash flow and earnings. The company has been doing a good job of boosting this dividend as well. Since it split from Kraft Foods in 2012, Mondelez has hiked its dividend at an impressive 12% CAGR.

During the first half of the year, the company spent $1.5 billion on share repurchases. The business is on track to reduce its share count by 25% between the end of 2012 and 2022. This demonstrates management’s commitment to returning free cash flow to shareholders.

But shareholder returns have often exceeded the company’s organic free cash flow. This is before considering its cash acquisitions. I think that Mondelez will eventually have to choose between reducing leverage, continuing its M&A strategy, and returning cash to shareholders.

Final Verdict

I like Mondelez’s strategy. The company is focusing on the segments where it is strongest instead of trying to expand into unproven categories. The business has solid liquidity and generates strong shareholder returns.

The company’s expensive valuation and increasing leverage are my main concerns. I think that this may be a good pick for income investors. But I’d look elsewhere if your main goal is total returns.

Be the first to comment