cemagraphics

People are passionate about a wide variety of things, obviously. Some are really into standup comedy. Some are really into sports, or gaming, or music, or computers. Those who know me best know that one of my favorite pastimes is bragging about my luck based, uh, “accomplishments.” I know that this is why my social life is in the state it’s in, but, as the song says “I gotta be me.” I was on a guest list years ago, and I was told at that party that when the host scanned the list, inquired about my name, and was reminded of me, the response was an eye roll followed by a sighed “oh, that guy.” I hope I’m painting a picture. Anyway, with that in mind, please prepare for some industrial grade bragging this morning. The effect of this will be enhanced dramatically if you limit yourselves to this stock only, so please refrain from reviewing those instances where, uh, “the market has not yet caught up with my thinking” about a given stock.

Today I’m absolutely champing at the bit to write about Cross Country Healthcare Inc. (NASDAQ:CCRN). I want to chronicle my history with this stock, and I imagine you’re fascinated by that, too, so allow me to regale you with the story of my Cross Country Healthcare calls. I first wrote about the stock way back in the Summer of 2018, and I suggested that investors would be wise to buy the name. After enjoying a market beating 73% gain, I sold the stock this past February. A mere three months later, I reconsidered my position, bought back in, and the stock is now up about 65% against a loss of about 9% for the S&P 500.

This morning I want to swat away that little voice in my head that’s yammering something or other about “pride goeth before destruction” and get back to the business of working out whether or not it makes sense to buy, hold, or sell this stock. I’ll make that determination by reviewing the most recent financials and by looking at the valuations.

Welcome to the ubiquitous “thesis statement” that I place somewhere near the beginning of my articles. I do this for you readers in order to give you the option to get in, understand the gist of my thinking, and then get out before you’re too irritated by my incessant bragging. The financial performance has been spectacular here, and there’s not much risk in the capital structure in spite of a massive uptick in the level of indebtedness in my view. At the same time, though, the stock is no longer objectively cheap. We’ve very definitely moved out of “screaming buy” territory. For this reason, I’m paring my position, and will be taking half of my “chips” off the table. This is more about capital preservation than anything company specific, though. I still think these shares are much cheaper than the overall market, and still represent value, which is why I’m going to continue to hold. If you’re just tuning in, I would recommend buying in rather slowly, perhaps building a position over six months, mindful of the fact that the shares are trading near a decade high. Thus ends my thesis statement. If you read on from here, that’s on you. I don’t want to read any moaning in the comments section about the bragging that I’ve already warned you about.

Financial Snapshot

As I’m sure you know if you’re reading this, the company has been rather acquisitive over the past seven years, having acquired Mediscan (October 30, 2015), Advantage (July 1, 2017), Workforce Solutions (June 8, 2021) and Selected Inc. (December 16, 2021). Although I see risk in every acquisition for fairly well publicized reasons.

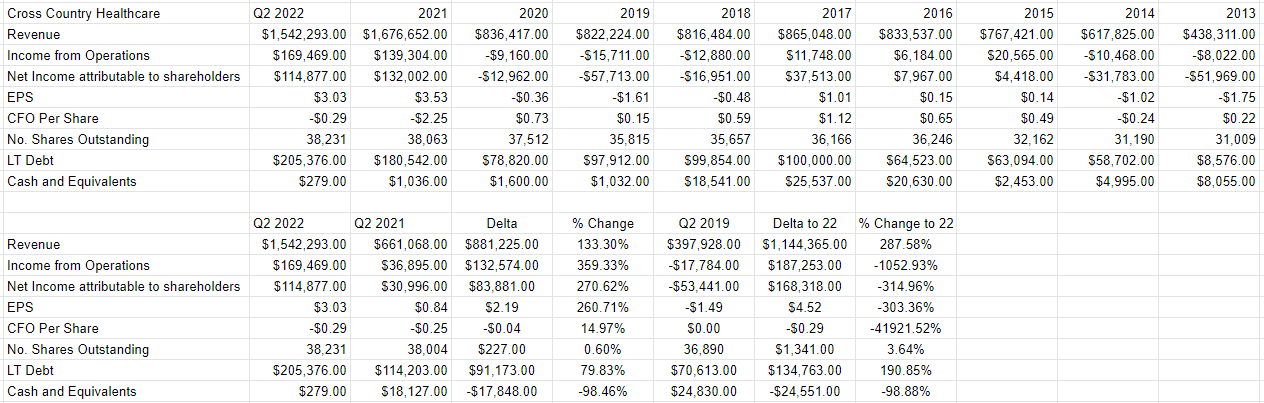

I’ll admit that these have worked rather well, at least from a financial perspective. They have helped the company grow revenues rapidly, most particularly between last year and this. Specifically, revenue for the first half of this year was up by about $881 million, or 133% relative to the same time last year, and net income exploded higher by $83.8 million or 270%. The financial results here have been excellent, which is likely why the stock has done so well recently.

In case you’re worried that I’m only comparing the most recent year to a relatively soft 2021, thus making comparisons “artificially easy”, fret no further. I went to the trouble of comparing the most recent period to the same time in 2019 for your enjoyment and edification, and found that the growth theme is very much intact here. Specifically, revenue for the first six months of 2022 was fully 287% greater than it was in 2019, and net income has swung from a loss of $53.4 million to the current profit of $114.9 million. I think it’s quite remarkable that revenue for the first six months of this year is only about $134 million lower than it was for the entirety of 2021.

Those who know me best know that, in addition to being an insufferable braggart, I’m also very much a “glass half empty” kind of guy. For that reason, I want to write about the deterioration in the capital structure we’ve seen recently. Long term debt is about $91 million or 79.8% higher than it was this time last year, while cash is down massively to under $300k. If this were 2013 this higher debt load may not be a problem, but things are different now. For instance, you may have noticed that interest rates have been rising recently, which obviously increases the risk of higher levels of indebtedness. This is because if the company needs to roll this debt anytime soon, it will be at a higher interest rate, which will crowd out profits.

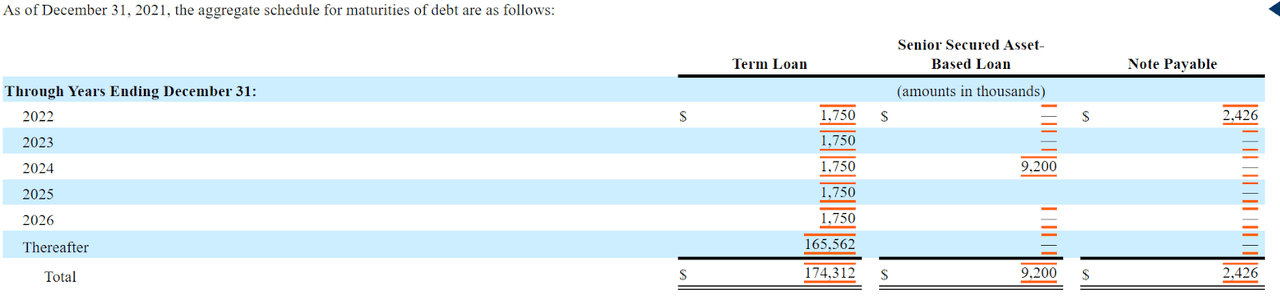

I’ve plucked the following schedule from page F-26 of the latest 10-K, and I’ll share it here with all of you because that’s the kind of hero that I am.

Cross Country Healthcare Debt Repayment Schedule (Cross Country Healthcare latest 10-K)

We see from the above that, apart from a slight uptick of $9.2 million in 2024, there are no significant debt payments and maturities until 2027 at the earliest. This lowers my blood pressure somewhat regarding the capital structure here.

Given the above, I’d be very happy to add to my position at the right price.

Cross Country Healthcare Financials (Cross Country Healthcare investor relations)

The Stock

My regulars know that I’ve talked myself out of some profitable trades with the words “at the right price”, but I’d rather miss out on some gains than lose capital. My regulars also know that I consider the “business” and the “stock” to be quite different things. Every business buys a number of inputs and turns them into a final product or service. The stock, on the other hand, is an ownership stake in the business that gets traded around in a market that aggregates the crowd’s rapidly changing views about the future health of the business. These swings in sentiment may also be influenced by fashionable analysts deciding that “future growth catalysts” are weaker or stronger than once thought, and the stock moves down or up in sympathy.

This is troublesome, but it’s a potential source of profit because these price movements have the potential to create a disconnect between market expectations and subsequent reality. I really hate to bring it up again, but this is what I did with this stock. The crowd drove the shares down to an unreasonably pessimistic level, I determined that they were being a collection of “Debbie Downers”, and bought. So, spotting discrepancies between assumptions and subsequent reality is the only way to make consistent returns with stocks. I think this is an important lesson beyond this particular equity. I’ve also found it’s the case that investors do better/less badly when they buy shares that are relatively cheap, because cheap shares correlate with low expectations. Cheap shares are insulated from the buffeting that more expensive shares are hit by.

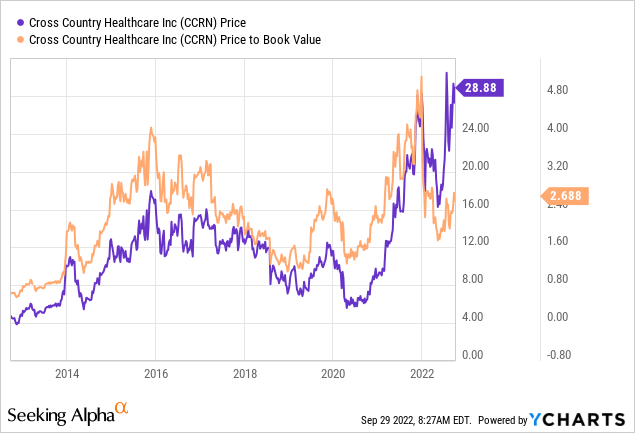

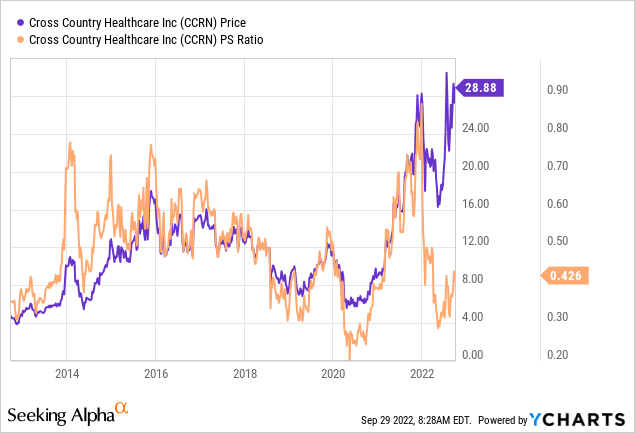

As my regulars know, I measure the relative cheapness of a stock in a few ways. For example, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. I like to see a company trading at a discount to both the overall market, and to its own history. In case you don’t have your “Almanac of Doyle’s Trades” in front of you, I’ll remind you that I plowed back into Cross Country a few months ago in large part because the price to book was at 1.8 and investors were paying only about $.30 for $1 of sales. Shares are between 43% and 44% more expensive today per the following:

I don’t like the fact that the shares are trading near decade highs. This prompts me to wonder how much farther they have to climb.

If you know I like cheap stocks, you also know that I want to try to understand what the market is currently “assuming” about the future of a given company. If you read me regularly, you know that I rely on the work of Professor Stephen Penman and his book “Accounting for Value” for this. In this book, Penman walks investors through how they can apply some pretty basic math to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in this formula. In case you find Penman’s writing a bit dense, you might want to try “Expectations Investing” by Mauboussin and Rappaport. These two have also introduced the idea of using stock price itself as a source of information, and then infer what the market is currently “expecting” about the future.

Anyway, applying this approach to Cross Country at the moment suggests the market is assuming that this company will grow earnings at a rate of ~1.3% in perpetuity, which I consider to be nicely pessimistic. This puts me on the horns of a dilemma. In some ways these shares remain cheap, and in some ways they’re no longer trading at “screaming buy” prices. Because I’d rather preserve capital than try to earn a decent return, I’m actually going to pare some of my gains here. I’m not going to sell out, but in the interests of preserving capital, I’m selling 200 of my 400 shares of Cross Country Healthcare as soon as the market opens.

Be the first to comment