PATRICK T. FALLON/AFP via Getty Images

Introduction

My thesis is that Paramount (NASDAQ:PARA) has a bright future if competitors can be rational.

Citing Antenna’s September 2022 Report, Paramount’s 3Q22 release said Paramount+ was the #1 streaming service in the US in sign-ups and gross subscriber additions. The release also said Pluto TV is the first ad-supported streaming TV service to be named in Nielsen’s Gauge report. Yellowstone isn’t just a hit in the US; the 3Q22 release says it is a top acquisition driver for Latin America.

Profits Over Subscribers

Netflix (NFLX) has always been rational as they focus on engagement, revenue and profit. Warner Bros. Discovery (WBD) was irrational under AT&T’s tenure but CEO David Zaslav mentioned changes in the 3Q22 call saying they won’t chase “subs” blindly anymore on the DTC streaming side the way people irrationally used the “clicks” metric in the 90s. Instead, WBD’s Zaslav is looking at free cash flow (“FCF”). Disney (DIS) CEO Bob Iger recently returned to the company and a November 28th Reuters article reports that he is making changes to their DTC streaming approach such that they’ll be chasing profits as opposed to subscribers:

“Instead of chasing (subscribers) with aggressive marketing and aggressive spend on content, we have to start chasing profitability,” Iger told a town-hall meeting on the company’s Burbank, California, lot, according to a transcript of remarks seen by Reuters.

If Paramount and competitors can be logical such that they price their services to make money then the future is bright. This sounds obvious but not all competitive environments work out to be as rational as the breakfast cereal business. Sometimes competitors go crazy over market share such that all the companies in the space end up suffering. The media companies seem to be getting more reasonable now and I’m optimistic that regulators will encourage big tech companies like Amazon (AMZN) and Apple (AAPL) to stay in their lane.

Valuation

Looking back a year ago, the 4Q21 release showed that unadjusted 4Q21 operating income was lumpy due to the non-recurring gain on sales of $2,227 million. This was mainly from gains on the sales of CBS Studio Center and 51 West 52nd Street. As such, the 2021 10-K operating income was skewed in terms of the ongoing numbers we should expect in the future.

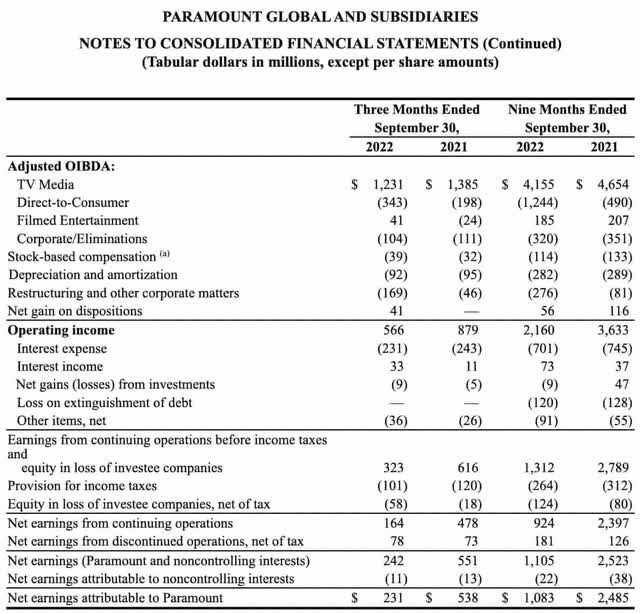

I like to look at the notes to the consolidated financial statements in the 3Q22 10-Q when thinking about Paramount’s valuation. Excluding the DTC segment and restructuring, the operating income went from $1,123 million for 3Q21 down to $1,078 million for 3Q22 and it went from $4,204 million for 9M21 down to $3,680 million for 9M22. Much of this decline is from the “TV Media” segment:

Notes to statements (3Q22 10-Q)

At the November 2022 RBC Conference, CFO Naveen Chopra said annual DTC streaming revenue should be over $9 billion in the years ahead:

We’re very focused on the long-term goals that we previously announced, which include achieving more than 100 million D2C subscribers by the end of 2024, along with streaming revenue in excess of $9 billion. And I think we’re on a good trajectory as far as both of those goals go. And of course, having topline scale is sort of the first ingredient to getting to profitability on streaming.

I believe Paramount is worth more than $30 billion if five developments take place:

1. Competitors act rationally such that the operating margin for DTC streaming improves across the board. I expect Netflix to stay 5% higher than the others and Netflix is at about 20%. I’m optimistic that the other companies can go from negative margins all the way up to positive 15% or so.

2. Paramount can continue to increase DTC streaming revenue up to an annual level of $9 billion in the next few years.

3. The legacy businesses at Paramount don’t decline as quickly as skeptics project such that substantial cash flows come out of those segments for many years to come.

4. The advertising business reaches new levels of prosperity soon as we start a new cycle.

5. A high percentage of the operating income gets converted to FCF in the near future.

At similar levels of streaming revenue, Netflix showed an advantage over Paramount and everyone else with respect to sales and marketing because Netflix started first and they had little in the way of competition. What this means is that Netflix has a continued advantage with respect to operating margins. We see that Paramount, Warner Bros. Discovery and Disney all have negative DTC operating margins right now, but Netflix had positive operating margins back when they had the same level of revenue. I believe this advantage is enduring such that Paramount does not warrant as high a P/E ratio or as high an Enterprise Value to EBIT ratio as Netflix:

|

Paramount DTC in millions |

Netflix in millions |

|||||||

|

Quarter |

Adj. OIBDA |

Revenue |

Subs |

Quarter |

Op. Income |

Revenue |

Subs |

|

|

Jun 2022 |

-$445 |

$1,193 |

64 |

Dec 2013 |

$82 |

$1,175 |

33.4 |

|

|

Sep 2022 |

-$343 |

$1,226 |

67 |

Mar 2014 |

$98 |

$1,270 |

46.1 |

|

|

WBD DTC in millions |

Netflix in millions |

|||||||

|

Quarter |

Adj. EBITDA |

Revenue |

Subs |

Quarter |

Op. Income |

Revenue |

Subs |

|

|

Jun 2022 |

-$560 |

$2,410 |

92.1 |

Sep 2016 |

$106 |

$2,290 |

86.7 |

|

|

Sep 2022 |

-$634 |

$2,317 |

94.9 |

Dec 2016 |

$154 |

$2,478 |

93.8 |

|

|

Disney DTC in millions |

Netflix in millions |

|||||||

|

Quarter |

Op. Income |

Revenue |

Subs |

Quarter |

Op. Income |

Revenue |

Subs |

|

|

Jun 2022 |

-$1,061 |

$5,058 |

confusing |

Jun 2019 |

$706 |

$4,923 |

151.6 |

|

|

Sep 2022 |

-$1,474 |

$4,907 |

confusing |

Sep 2019 |

$980 |

$5,245 |

158.3 |

DTC Streaming is less than 25% of overall revenue for Paramount, Warner Bros. Discovery and Disney but it is pretty much 100% for Netflix:

|

For the quarter through September 2022 ($ millions): |

|||

|

Company |

DTC Streaming Revenue |

Other Revenue |

DTC Streaming % of Revenue |

|

Paramount |

$1,226 |

$5,690 |

17.7% |

|

Warner Bros. Disc. |

$2,317 |

$7,506 |

23.6% |

|

Disney |

$4,907 |

$15,243 |

24.4% |

|

Netflix |

$7,890 |

$35 |

99.6% |

Paramount’s 3Q22 10-Q shows 649,174,411 shares as of October 28th from 40,704,664 A shares + B shares 608,469,747 so the market cap is $13.5 billion based on the January 24th share price of $20.83. The enterprise value is around $28 billion which is $14.4 billion more than the market cap due to $15,638 million in long-term debt, $1,468 million in long-term lease liabilities, $196 million in short-term debt, $492 million and noncontrolling interests which are partially offset by $3,383 million in cash and equivalents.

The WBD 3Q22 10-Q shows 2,428,396,015 shares as of October 21st such that the market cap is $31.6 billion based on the January 20th share price of $13.02. The 3Q22 release shows gross debt of $50.4 billion including $268 million in finance leases. This is face value which is a little different from the balance sheet which is net of premiums or discounts. This is partially offset by $2,513 million in cash and equivalents such that the net debt is $47.9 billion. There is also $318 million in redeemable noncontrolling interests plus $1,245 million noncontrolling interests for a sub total of $1.6 billion such that the enterprise value is $49.5 billion more than the market cap. As such, the WBD enterprise value is about $81 billion.

Disney’s fiscal year ends in the fall and their 10-K through October 1st shows 1,823,591,988 shares outstanding as of November 16th such that the market cap is $193.3 billion based on the January 24th share price of $106. The enterprise value is nearly $247 billion which is $53.4 billion more than the market cap due to $45,299 million in long-term debt, $3,239 million in long-term lease liabilities, $3,070 million in short-term debt $9,499 million in redeemable noncontrolling interests and $3,871 million in regular noncontrolling interests which are partially offset by $11,615 million in cash and equivalents.

Per the 3Q22 10-Q from Netflix, there were 445,020,494 shares as of September 30th such that the market cap is about $152 billion based on the January 20th share price of $342.50. Due to net debt, the enterprise value for Netflix is about $8 billion more, coming in at about $160 billion.

The market caps are summarized in billions below. It is important for us to look at the enterprise values below as well seeing as the relative amounts of other considerations like debt are substantial for Warner Bros. Discovery and Paramount:

|

$ billions: |

|||

|

Company |

Market Cap |

Other Considerations |

Enterprise Value |

|

Paramount |

$14 |

$14 |

$28 |

|

Warner Bros. Disc. |

$32 |

$50 |

$81 |

|

Disney |

$193 |

$53 |

$247 |

|

Netflix |

$152 |

$8 |

$160 |

Again, if the right developments take place then I think the enterprise value is more than reasonable such that Paramount could be a good buy for long-term investors.

Forward-looking investors should keep an eye out for the Q422 release and the 10-K filing. In addition, the 1Q23 results should be studied closely. Management has said 2023 will be peak losses for DTC streaming so investors should continue to check to see how quickly operating margins can start to move upward after the worst part of the year.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Be the first to comment