Jack Gao

Paramount Group, Inc (NYSE:NYSE:PGRE) is a real estate investment trust (“REIT”) that owns a portfolio of Class A office buildings in New York City (“NYC”) and San Francisco that are leased to tenants primarily in the Legal, Financial Services, and Tech industries.

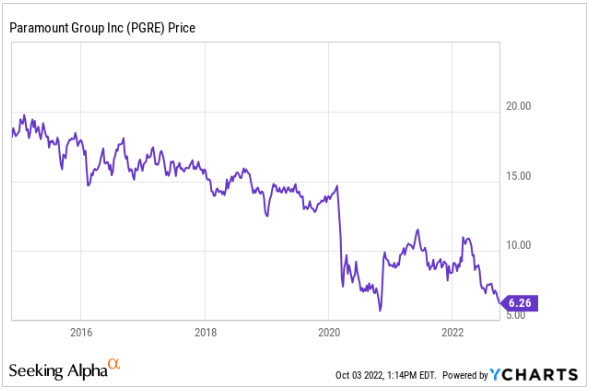

Over the years, the stock has performed poorly, even during the periods prior to the start of the COVID-19 pandemic, with shares continually exhibiting a steady downward spiral.

YCharts – Share Price History Of PGRE

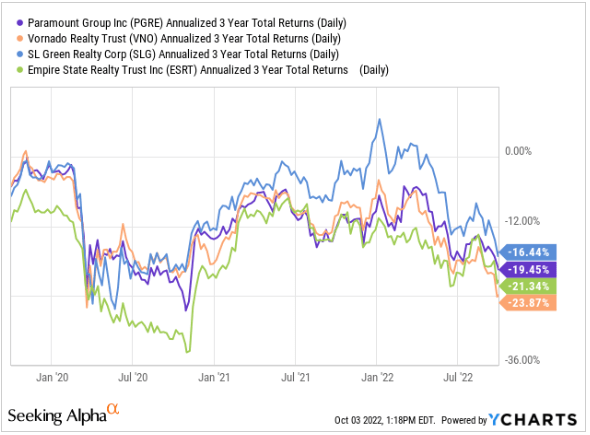

Despite its underperformance, it has held up better than both Vornado Realty Trust (VNO) and Empire State Realty Trust (ESRT), two related peers that operate in the NYC market, who have each yielded negative 3-YR returns of over 20%.

YCharts – 3-YR Returns of PGRE Compared To Competitors

Still, 3-YR negative returns encroaching on the 20% mark is still painful for many long-time holders. But with shares down nearly 30% YTD, the stock is likely due for a rebound aided in part by improving fundamentals in the sector and increased earnings potential on higher occupancy levels. Though any rebound could mitigate some of the losses experienced by existing shareholders, new investors would be better off remaining on the sidelines until there is further stabilization in the overall market environment.

A Highly Concentrated Portfolio In Two Top Markets

PGRE’s portfolio is comprised of just 19 total assets located in select central business district (“CBD”) submarkets within New York City and San Francisco. These assets include 14 core properties and five managed assets. While there are a balanced number of core properties in each operating region, the NYC market accounts for approximately 70% of the company’s business.

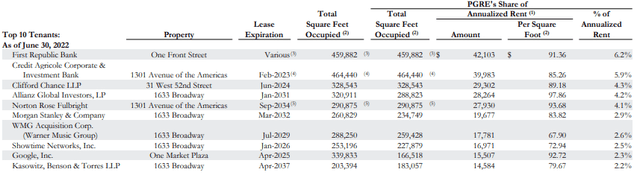

Furthermore, 60% of consolidated revenues are generated from three properties, 1633 Broadway and 1301 Avenue of the Americas, both of which are in NYC, and One Market Plaza in San Francisco. Some key tenants within these buildings include Allianz Global Investors, Morgan Stanley (MS), Credit Agricole Corporate & Investment Bank, and Alphabet, Inc (GOOG), to name a few.

Among their top ten tenants, First Republic Bank and Credit Agricole are the only two that represent over 5% of total annualized base rents (“ABR”). Together, the two represent approximately 12% of ABR. The overall top ten, on the other hand, collectively account for nearly 40% of ABR.

Q2FY22 Investor Supplement – Summary Of Top 10 Tenants

While PGRE does serve a variety of industries, they are concentrated in the Legal, Financial Services, and Tech sectors, who in total represent about 80% of total ABR.

All considered, PGRE’s overall portfolio is characterized as being in two of the strongest commercial real estate submarkets in the United States due to their high barriers to entry, constrained supply, and strong economic characteristics that includes a large pool of tenants that have historically demonstrated a strong demand for quality Class A office space.

Disruptions in the office sector from teleworking (“WFH”) arrangements have increased the inherent risk premium in the portfolio, but the outlook appears to be improving. Entry card swipes have continued to increase following the Labor Day holiday and companies continue to implement policies that require employees to be on-site for at least part of the week.

A bigger risk than current WFH trends is the company’s market concentration. Their presence in just two core operating markets with three properties driving most of their revenues warrants an elevated degree of concern. Should either of these markets experience a disproportionate economic downturn, PGRE would consequently be exposed to greater losses than other peers within their sector. In addition, if operations paused at any of their top three buildings, whether voluntarily through redevelopment activities or involuntarily because of an external shock, then net operating income (“NOI”) and other property-level metrics would be materially affected.

Healthy Portfolio Metrics But Further Improvement Necessary

At present, occupancy levels are holding at acceptable rates at their three largest buildings. In fact, at 1633 Broadway, their single largest building by gross asset value (“GAV”), occupancy stood at 99.6% at the end of June 30, 2022.

While leased occupancy is still down 370 basis points (“bps”) from pre-pandemic levels at One Market Plaza, the rate of occupancy is still strong at 94.7%, especially when compared to current levels at 1301 Avenue of the Americas, which is at a leased rate of 88.1%. This is significantly lower than the 99.4% rate the building commanded prior to 2020.

As a top driver of NOI, occupancy growth in 1301 is likely to be a key driver of the company’s future earnings potential. As it is, there is 390bps of opportunity embedded in the spread between the building’s leased and occupied rates. As the space is eventually occupied, PGRE will benefit from the increased cash flows. And in later periods, overall earnings can get a material boost if leased rates return to their 2019 levels.

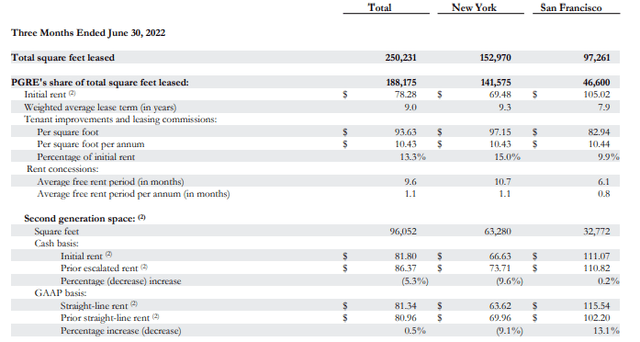

One positive indicator of 1301’s potential is the 380bps increase in its leased rate from the first quarter, driven by a 70K square foot (“SF”) expansion by SVB Securities, representing about 30% of the company’s total leasing activity during the quarter, which was about 50K more than the first quarter and slightly higher than last year as well. Furthermore, signings were completed at a weighted average lease term (“WALT”) of 9.3 years. This is indicative of the confidence companies have in office space despite the increasing permanency of WFH arrangements.

The strength in leasing should carry into future periods as companies increasingly prioritize a flight to quality in their leasing decisions as they bring employees back into their workspaces. This is likely to be more pronounced in PGRE’s San Francisco market due to its greater exposure to the tech sector, an industry that has lagged others in returning to in-person work.

Positive Trends Are Offset By Declining Rent Spreads And Elevated Near-Term Lease Expirations

Improvements in occupancy and the leasing landscape are offset by declining rent spreads and elevated near-term lease expirations. Through the first six months of the year, cash rents are down 2.5%, following a 5.3% decline in the current quarter, led by a nearly 10% decline in New York.

Q2FY22 Investor Supplement – Summary Of Quarterly Leasing Activity

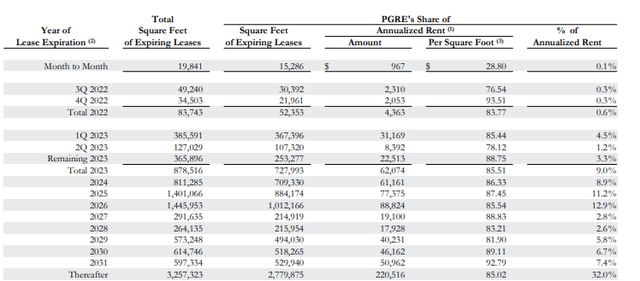

This is especially concerning when considered in the context of their upcoming expirations, which total 0.6% through the remainder of the year and 7.3% per annum through 2024. Even if they can renew the space, revenues would be significantly impaired if spreads continue to decline.

Q2FY22 Investor Supplement – Lease Expiration Schedule

Though spreads are down, it’s worth noting that SVB’s expansion wasn’t included in the company’s defined population. The lease itself, however, had a positive spread of 3.1% on a cash basis. It’s also possible companies are signing extended WALTs because they expect rents to rise from current levels in the medium term. By signing the longer terms, these companies are hedging their rent risk with the uncertainty associated with their long-term office needs.

The combination of favorable spreads on a major expansion and the implications associated with longer WALTs may bode positively on the future leasing environment. Still, prospective investors should continue to monitor the status of the upcoming expirations on future earnings results. In particular, Credit Agricole’s expiration in 2023 is worth special consideration, as that amounts to 300K SF of space and will surely affect PGRE’s numbers if the space remains vacant.

Increased Guidance And Stable Financial Position, Despite Uncertainties

Despite several near-term uncertainties, management still increased their guidance following better-than-expected performance in Q2. In addition, the company is in a solid liquidity position to whether any setbacks in the macroeconomic environment.

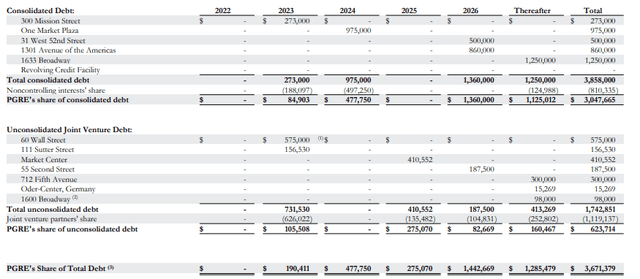

Liquidity stood at over +$1.0B at period end, over +$500M of which was in the form of cash and equivalents. While the weighted average maturity of their debt is on the shorter end of the ladder, at 4.6 years, they are not overly burdened with upcoming maturities, with just 5% of their total stack due in 2023. It’s not ideal, given the rate environment, but existing liquidity and cash flows are sufficient to meet any upcoming maturities.

Q2FY22 Investor Supplement – Debt Maturity Schedule

PGRE Is Not A Compelling Enough Investment For New Investors

PGRE is a lightly traded REIT with a small portfolio of Class A office properties in New York City and San Francisco. Though they are smaller in size, they still have an established presence in two of the hardest to enter markets in the United States, with a tenant base that includes well-known companies operating in the Legal, Financial Services, and Tech industries.

Improving portfolio metrics that includes continued leasing strength through uncertain market conditions and steadily increasing occupancy figures have produced results in recent periods that have come in at the top end of initial estimates. Opportunities for further occupancy gains also provides visibility into future earnings growth.

Offsetting some of these positive trends is their market concentration to just two core operating regions. And of these two regions, the NYC market accounts for 70% of the business. Furthermore, over 50% of their revenues are derived from three buildings. This exposes the company to elevated vacancy and market-related risks. Sizeable near-term expirations are another variable that must be considered by prospective investors.

Despite the uncertainties, PGRE is in a solid financial position to weather any potential setbacks. Their current liquidity and cash flow position is adequate to address their reoccurring obligations, which includes their quarterly dividend payout of $0.0775/share. Though the annualized yield of 5% is unappealing in today’s environment, it’s fully covered and not at risk of being cut. This should provide some solace to investors that are already sitting on steep YTD losses approaching 30%.

While prospective investors would be better off seeking alternatives elsewhere in the sector, existing shareholders may find it better to hold on to their positions. Positive commentary on their leasing efforts in their next earnings call may be one catalyst that sends shares higher from their current 6.5x valuation. Even if shares were to increase by 10%, that would bring their current multiple to just 7.4x, which would still be a significant discount. Though that may not be enough to recover all its losses, it would be a step in the right direction.

Be the first to comment