kupicoo/E+ via Getty Images

This article is contributed by Jun Hao from our Superstocks Seekers team.

Overview

As far as we can remember, it has been some time since we last released an update on PAR Technology (NYSE:PAR), and least to say, there are a lot of exciting updates happening.

Before we go into the business, here is a short overview of the business:

PAR Technology has a software called Brink, a leading born-in-the-cloud Point of Sale (“POS”) software deployed in over 15,000 enterprise restaurants. These restaurants are some of the largest names in the hospitality industry such as Smoothie King and Dairy Queen. Despite the increasingly competitive industry, PAR has cemented itself as the market leader, particularly in the enterprise segment. More importantly, PAR is incredibly fortunate to have CEO Savneet Singh who is an excellent capital allocator and a great executor spearheading the business.

Now, without further ado, let us first turn to Brink’s performance.

Brink Robust Growth And Improving Unit Economics

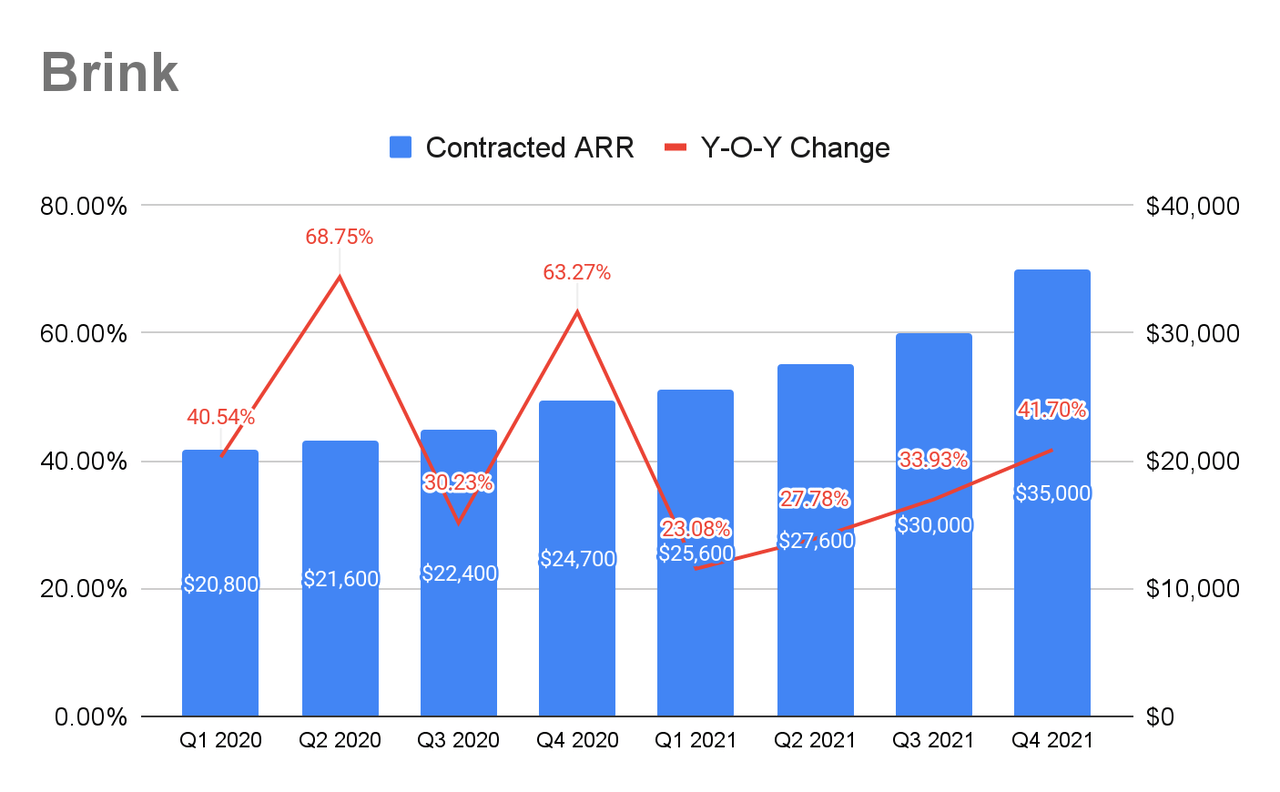

(Source: PAR’s Investor Relations)

Brink’s contracted ARR (“CARR”), referring to sites that were signed but not activated yet, has seen a step-up in growth across FY21. More recently, its Q4’21 CARR grew 41.7% YoY to $35 million.

Next, Brink’s total number of active sites has also increased to 15,897 as of Q4’21, while its ARR per site or Average Revenue Per Site (“ARPS”) has increased to $2,202.

This growth was contributed by the increasing demand for Brink, and the delayed activation of old sites during the COVID pandemic. You would have also noticed that despite the increasing site activation, its ARPS has been growing really slowly. This disparity was because PAR undercharged its old customers back in FY16 to FY17, which were only onboarded during recent years. This pulled down its ARPS.

However, PAR has managed to price subsequent deals at higher prices, providing an uplift to Brink’s ARPS in the coming quarters. This is a positive step towards properly monetizing Brink and providing further margin expansion.

In the previous deep-dive that we’ve published, we mentioned that PAR had intentionally slowed down sales to focus on investing in Brink. Even with minimally incremental investment in SG&A, Brink is able to win and penetrate new and existing logos, accelerating its ARR growth YoY. This shows that PAR is winning market share in the enterprise segments, against the likes of legacy incumbents like NCR Corporation (NCR), and competitors like Toast (TOST) and Lightspeed (LSPD) who both are gobbling up small F&B chains.

CEO Singh’s decision on R&D investments is clearly paying off and it reflects the increasing brand recognition and top-notch product quality of Brink.

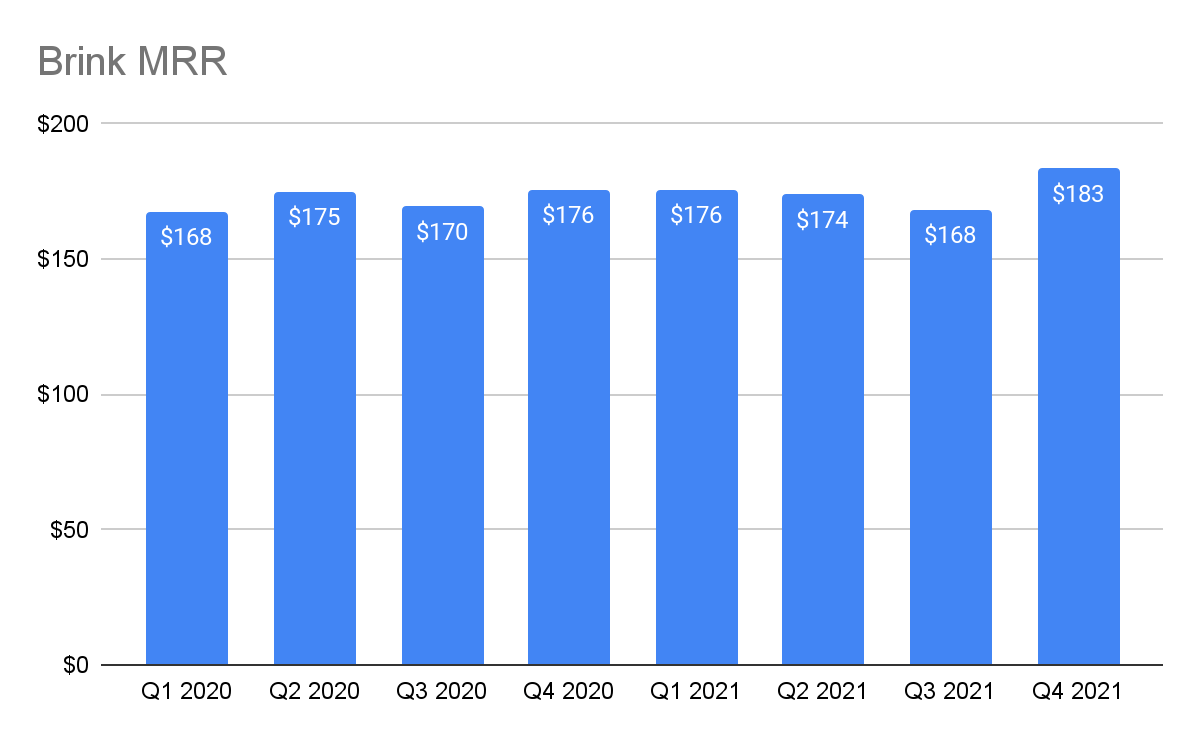

(Source: PAR Investor Relations)

In addition, we have also been tracking PAR’s Monthly Recurring Revenue (“MRR”), which on average, customers are paying $183 per month. In tandem with ARR, we should expect to see it increase as the financials reflect the higher-priced deals.

With that being said, its ARPS is far from being optimized. CEO Singh mentioned how PAR can grow its ARPS to $10,000 when Toast is charging $60,000 to $80,000 per store:

“And so we have taken it up from 2000, we added Data Central, which is about 1500, we added Punchh, which is a 1000 to 1500 and then for now we came out with digital management system, a couple of more of our product enhancements, acquisitions and payments and you can really this is clearly about 10,000.”

Factoring in the increasing site activation and growing ARPS, it is not hard to picture the impact it will have on its ARR growth and margins (i.e. Gross and Operating) going forward.

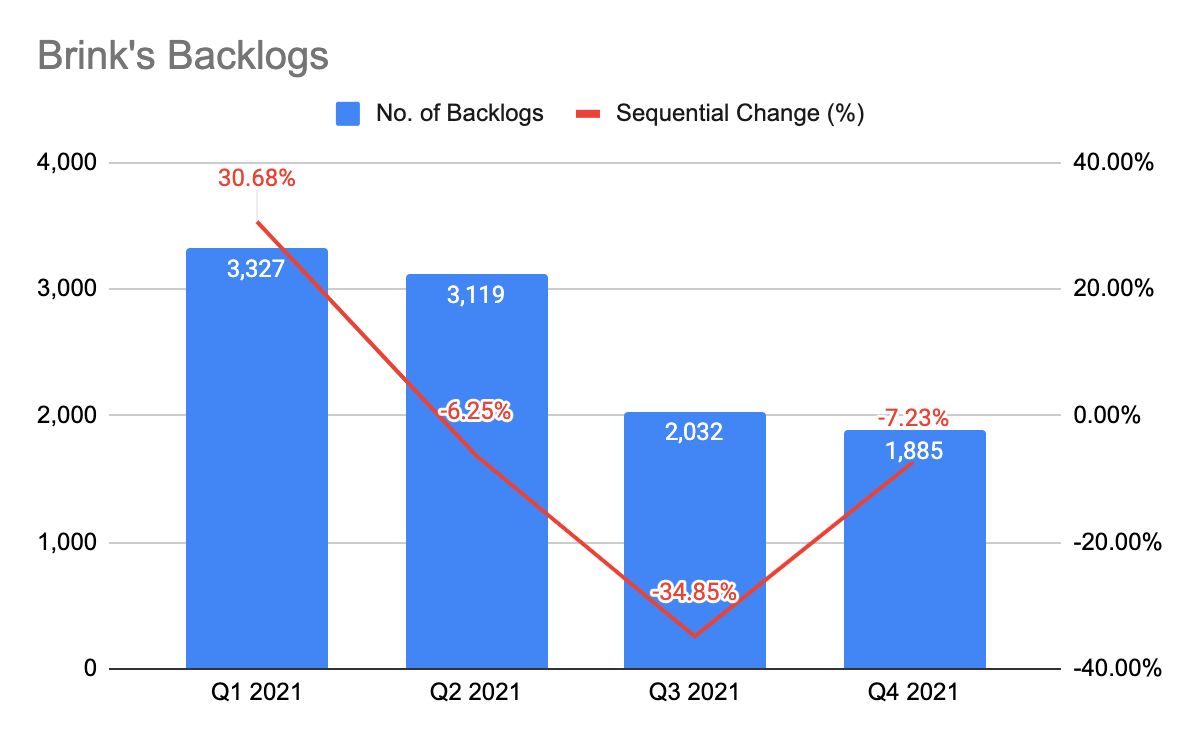

(Source: PAR Investor Relations)

Turning to Brink’s backlogs, we can see that it has decreased over the quarters. Backlogs are crucial as they give us a glimpse into its future revenue. However, in the case of PAR, having large backlogs may not be a positive sign.

Recall that from FY19 to FY20, COVID restrictions have hindered PAR from installing Brink as quickly, which led to delayed ARR. CEO Singh has also mentioned that once the economy reopens, installations can happen at a faster pace, which is what we’re seeing here in FY21.

Ideally, we want to see decreasing backlogs and faster activations, translating into faster ARR growth.

Punchh

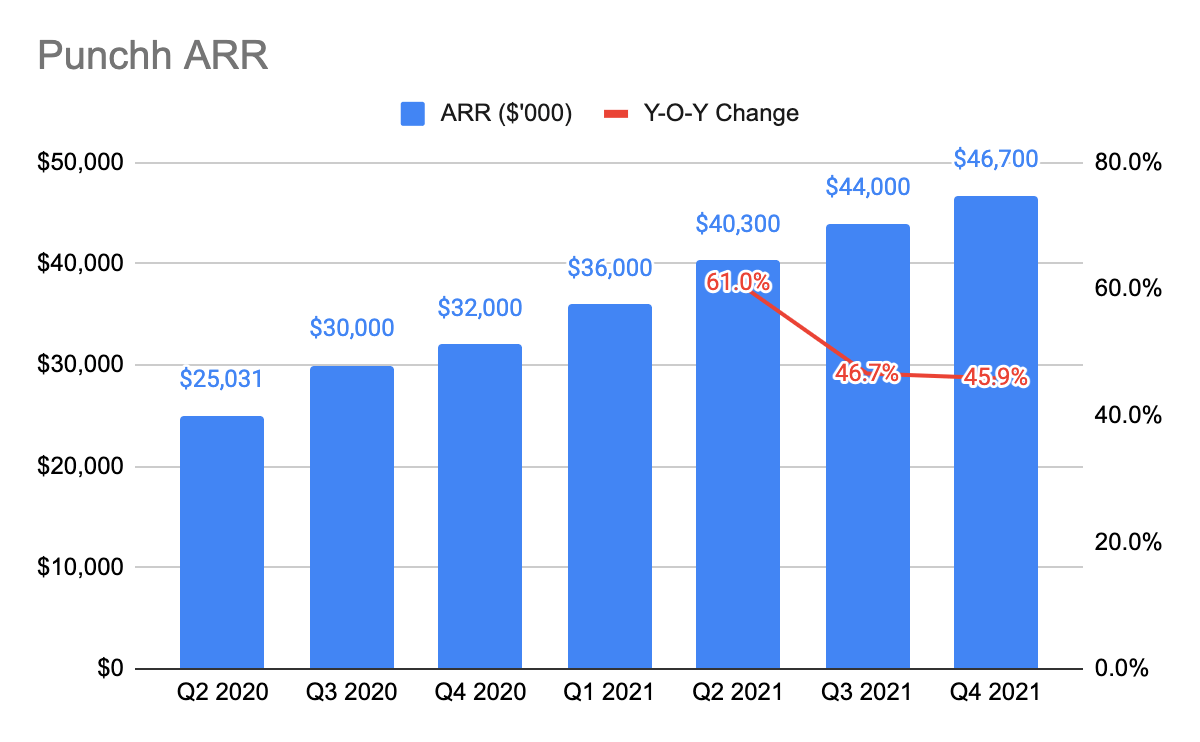

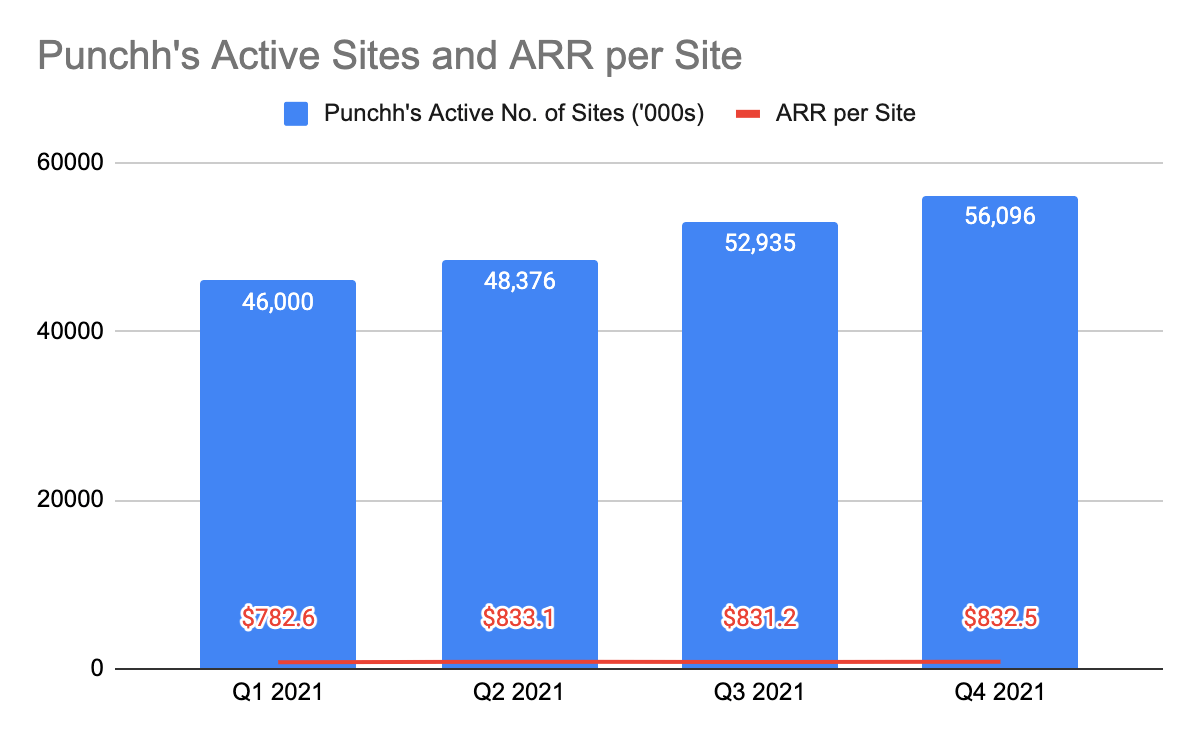

(Source: PAR Investor Relations)

Turning to Punchh, there is a step-down in ARR growth across the quarters. As of its latest Q4’21 quarter, the ARR grew 45.9% YoY.

Looking at its declining ARR growth, there are a few possibilities that we have thought of – It could be that there is a lack of sales execution, or, it could be due to the law of large numbers. On the other hand, it is hard to pinpoint the exact root cause as the management did not provide any further disclosure. We’ve also noticed that Q4 seems to be a seasonally lowest quarter. For instance, Punchh added $2.7 million ARR sequentially in Q4’21 versus $2.0 million ARR in Q4’20. And in Q3’21, Punchh added $3.7 million ARR versus Q3’20 of $4.0 million ARR.

This definitely signals that improvements in sales execution are needed, and we will be closely monitoring its growth trajectory in the coming quarters.

(Source: PAR Investor Relation)

The growth in total active sites, however, continues to be robust, adding over 3,200 new sites in Q4’21 compared to 2,774 in the previous quarter. This includes cross-selling to Brink’s customers. Its ARR per site has increased since Q1’21, reaching $832.5 as of Q4’21.

This result reflects the increasing demand to adopt Punchh’s loyalty program and the synergistic acquisition of Punchh to cross-sell to Brink’s customers.

On top of that, they also see increased interest from the C-store segment.

What comes to mind is the possibility of Punchh going after potential operators like 7-Eleven, Speedway, QuikTrip, Murphy’s USA, etc. This is not implausible as Casey and Huck’s Bucky are currently Punchh’s customers. And more importantly, this demonstrates PAR’s ability to expand into new markets beyond F&B, ensuring that it has a long runway to grow.

Who knows that one day, we might see C-store operators and retailers using Brink POS?

Launch Of ParPay

As many of us have been eagerly waiting for, the ParPay payment service has finally been launched!

This is powered by Infinicept, a company that provides the infrastructure needed for PAR to become a payment facilitator (“PayFacs”).

Customers Win

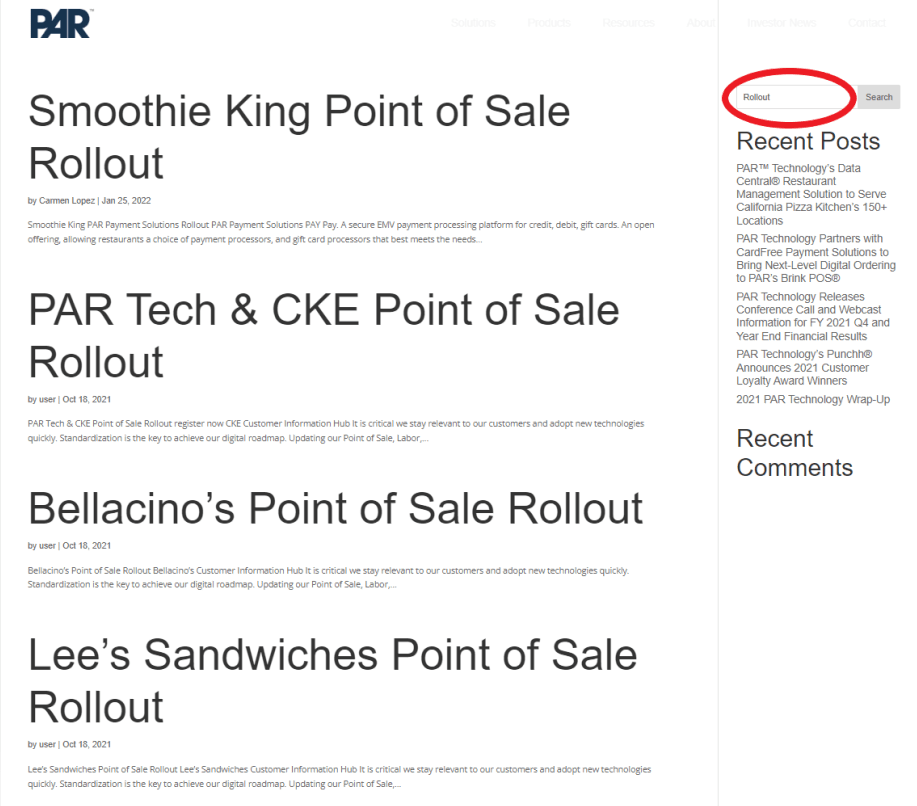

(Source: PAR Website)

Head over to PAR’s website here, you will have noticed that PAR has onboarded several key customers, including Smoothie King, CKE, Bellacino, Lee’s Sandwiches, Scooter’s Coffee, and SweetGreen. ParPay will add $1,000 to $3,000 into Brink’s ARPS, potentially doubling its current ARPS of $2,202.

Given Brink and Punchh’s existing customer base, this is massive for Brink’s growth moving forward.

Value Proposition Of ParPay

Recently, we happened to come across an interesting article on Toast charging exorbitant processing fees on their merchants. By comparison, Lightspeed is charging 2.6% + $0.10/$0.30.

Shoot, how did Toast’s merchants not realize they are being cannibalized?

For the Smoothie King deal, here is an extract from its announcement of its partnership with ParPay:

“As part of a system wide payments processing upgrade, Smoothie King was seeking a single payments partner that provides a streamlined underwriting and approval process, frictionless onboarding, competitive pricing, and centralized support that substantially improved the payments experience for both guests and franchisees.”

The word “competitive pricing” stood out for us. Why you may ask?

Lightspeed and Toast are charging their merchants 2.6% and 3.5% (a ridiculous amount) of payment processing fees. Small restaurant operators are likely to accept it because they (1) lack pricing power, and (2) are less rigorous when it comes to selecting a Payment Facilitator (“PayFac”) partner.

However, this cannot be said the same for PAR’s merchants.

Enterprise restaurants have (1) higher negotiation power as they have huge transaction volume, and (2) have a proper accounting and finance team in place to evaluate the most suitable PayFac partner. In this case, ParPay is likely to offer a more competitive rate, which can result in huge cost savings for its merchants.

If Toast and Lightspeed were to compete in the enterprise segment, they would have to forfeit lots of revenue. This is a gamble they would have to be willing to take. And unlike Toast which attached its payment services to its hardware, thus restricting merchants to only use its payment services, PAR offers the flexibility for both Brink and non-Brink customers to use ParPay. We will not rule out the possibility that frustrated Toast customers may eventually come to ParPay.

Let’s come back to the Smoothie King partnership. We believe most are not aware that Aben was the one who struck the partnership between them and ParPay.

In that news release, it was mentioned that ParPay is offering the payment data for FREE to its merchants. Why is this important? Traditional PayFacs are withholding these data which originally belonged to the merchants, and instead, merchants are charged for access to these data. With ParPay, data are provided free-of-charge, and can therefore be utilized with the help of Aben to understand its consumers’ purchasing behavior and to use them in marketing.

PAR is truly in the business of empowering its merchants, rather than cannibalizing them, helping to build its goodwill in the industry. In our view, ParPay is one of the spotlights in FY23.

Improved Gross Margin

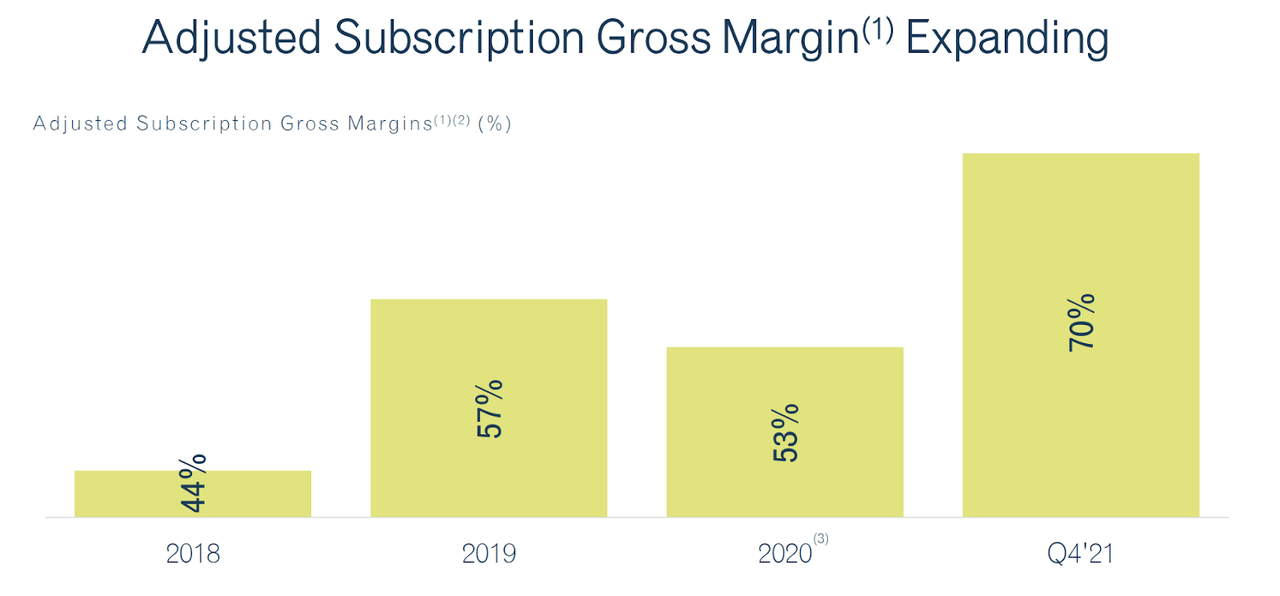

(Source: PAR Investor Presentation)

What is incredibly impressive in FY21 is that PAR has managed to grow its subscription gross margin to 70%, lifted by the acquisition of Punchh.

However, this is not fully optimized yet as the management is expecting higher gross margins in the future and have also guided PAR to break even by FY23. As of Q4’21, its Operating Margin is roughly negative 20%.

Considering where PAR was a few years ago, we’ve seen how CEO Singh has consistently delivered and executed the turnaround story. We trust that CEO Singh will make further accretive and synergistic acquisitions to maximize shareholders’ value.

Valuation

As of 10 April 2022, PAR’s market cap of $1 billion, and with a combined ARR of $91.4 million (including Brink, Restaurant Magic, and Punchh), this gives us a Price to ARR ratio of 10.9x.

There is obviously a disconnection between the valuation and fundamentals. Here’s why:

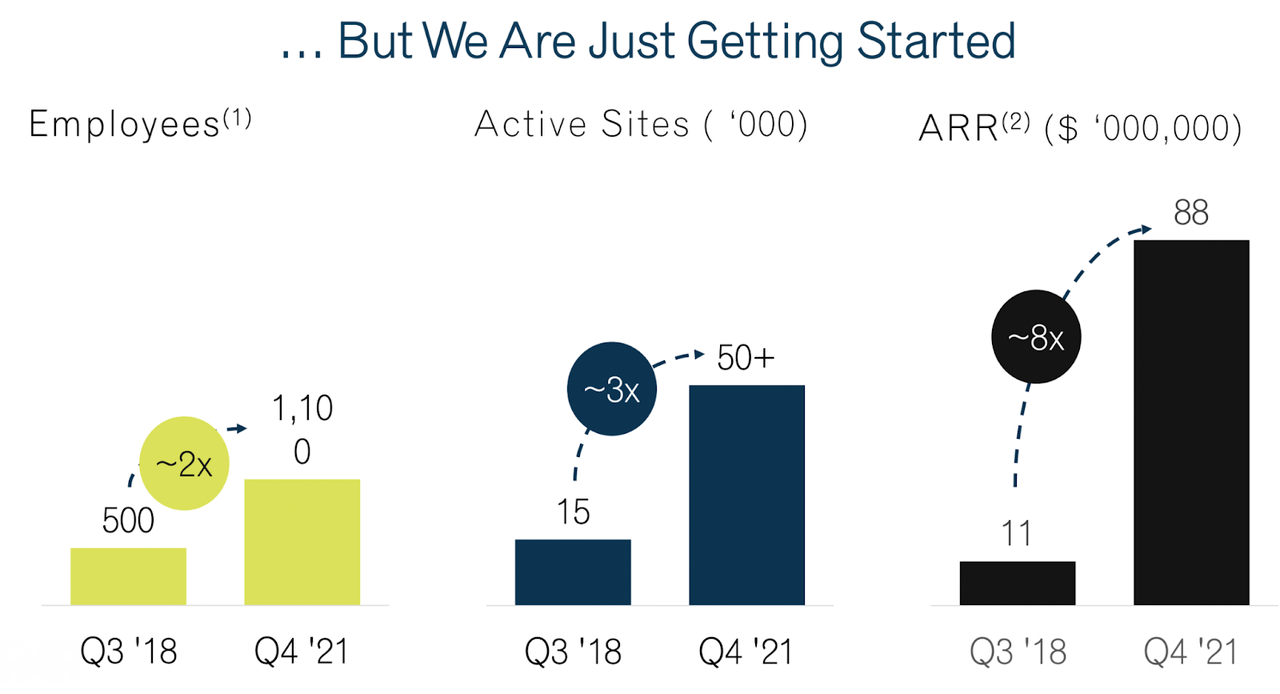

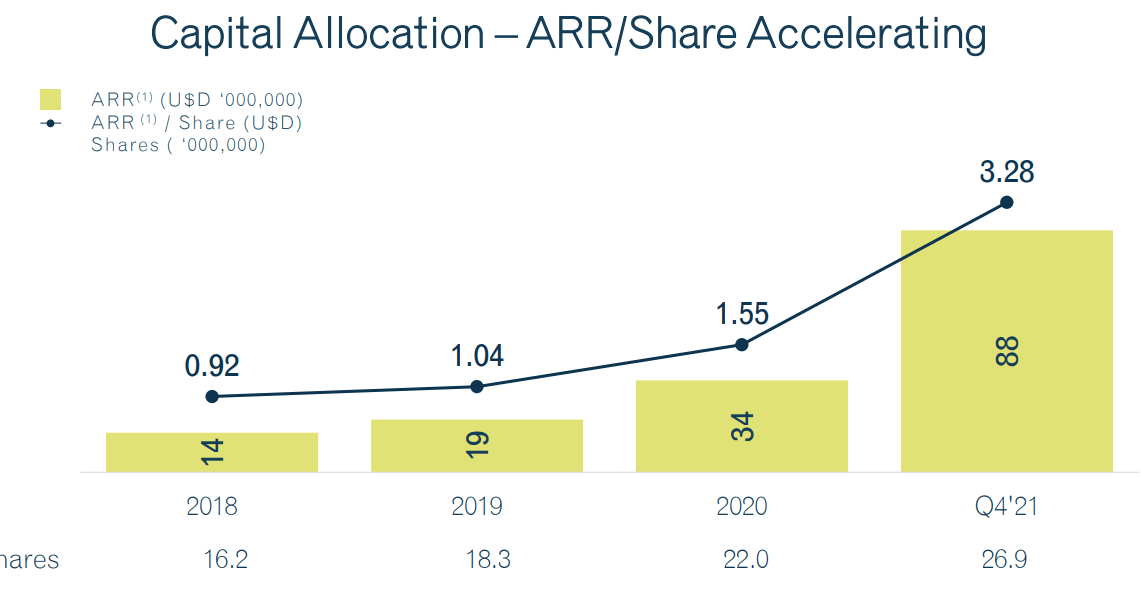

(Source: PAR Investor Presentation)

(Source: PAR Investor Presentation)

This is PAR’s results in totality. A quick look at this will tell you that ARR has 8x while ARR per share has 3.56x in the last 3 years. This is execution at best, even more so that this was done during the challenging COVID period.

Remember that we also talked about how a potential multiple re-rating may occur if PAR could demonstrate that it can grow its gross margin over time? Unfortunately, multiples have contracted even though PAR’s gross margin has successfully grown from 53% to 70% in FY20. And furthermore, we’re not using the contracted ARR figure.

If PAR is to trade at a 15x P/ARR, we will see an upside of 36% in share price. Note that we have not embedded any forward growth rate. Given the massive TAM, we believe PAR still has a long runway to grow.

Our Concerns

Firstly, while we are pleased with PAR’s progress, it has yet to cross the hurdle of having a self-service model. To date, PAR is still required to have installers going to the merchant’s site and having the Brink POS system installed before they can be activated. This led to a slow onboarding process, preventing PAR from scaling faster. Once this hurdle is solved, we believe PAR’s growth can really take off.

Secondly, the ARPS is growing too slowly. There is lots of untapped pricing power in Brink and we like the management to better monetize Brink and position it as one of the best and premium POS products in the industry. This could do wonders for its ARR growth and margin

Thirdly, Brink’s decreasing number of backlogs from Q1’21 to Q4’21. This tells us whether there is demand for Brink, and gives us a glimpse into its future revenue that can be earned. If backlogs continue to decline, this could be damaging to its future growth. This may call for a need for additional and more efficient S&M spending.

Lastly, Punchh’s ARR growth rates have been tapering down across FY21. While we are unsure of the exact reason, this is a possible sign of weak execution, and we will be monitoring its upcoming quarters.

Conclusion

CEO Singh’s vision to build a leading unified commerce cloud platform is coming to fruition, and we believe PAR is in a very favorable position to dominate the enterprise segment. Through his actions, Singh has definitely earned the trust of its shareholders.

Despite these incredible achievements, PAR is just getting started as there is still a massive TAM to go after to realize the goal of becoming the industry leader. For shareholders who are in for the long haul, we believe that you will ultimately be rewarded.

Be the first to comment