megaflopp/iStock via Getty Images

Over the past year, shares of Papa John’s International Inc. (NASDAQ:NASDAQ:PZZA) are down about 37%, and this has me intrigued. I’m of the view that Pizza is a relatively recession resistant foodstuff, and I’m of the view that we’re on the brink of a recession, and therefore the product that these people sell should hold up relatively well in my view. It doesn’t hurt that my former employer has recently characterised this company as a “favourite idea to capitalise on potential consumer-trade down effect with restaurants.” I’ll decide whether or not it makes sense to take a position in this business by looking at the financial history, paying particular attention to the sustainability of the dividend. In addition, I’m going to look at the valuation, because, as we should all know by now, a great business can be a disastrously bad investment if you overpay for it.

Welcome to the “thesis statement” portion of my article. It’s here where I present you with the “gist” of my thinking. I do this for a few reasons. First, you may have missed the title and the bullet points, above. This will give you one more opportunity to glean the highlights of the article before you wade into it. Second, I offer the thesis statement paragraph in a heroic effort to potentially save you some time. You’re welcome. Finally, I know that my writing can be a bit tough to take for some. For example, some may be bothered by the fact that I spell words like “labour” and “favourite” properly. Whatever the reason that rings most true for you, I think we can all agree that there’s no doot aboot the fact that the “thesis statement” is a handy addition to every article. I’m of the view that Papa John’s is a great business with a sustainable dividend. I don’t like the addition of debt, but I’ll admit that it’s been worse in the past, and that future contractual calls on cash aren’t egregious in my view. The problem for me is that the stock is neither cheap nor expensive at the moment, so this isn’t a very compelling investment at current levels. Just because I don’t want to buy the stock, though, doesn’t mean that there’s nothing to be done here. I think investors can earn a reasonable, though not huge, premium from selling relatively deep out of the money put options. As I think I’ve demonstrated on many occasions on this forum, these are a great way to enhance returns while reducing risk.

Financial Snapshot

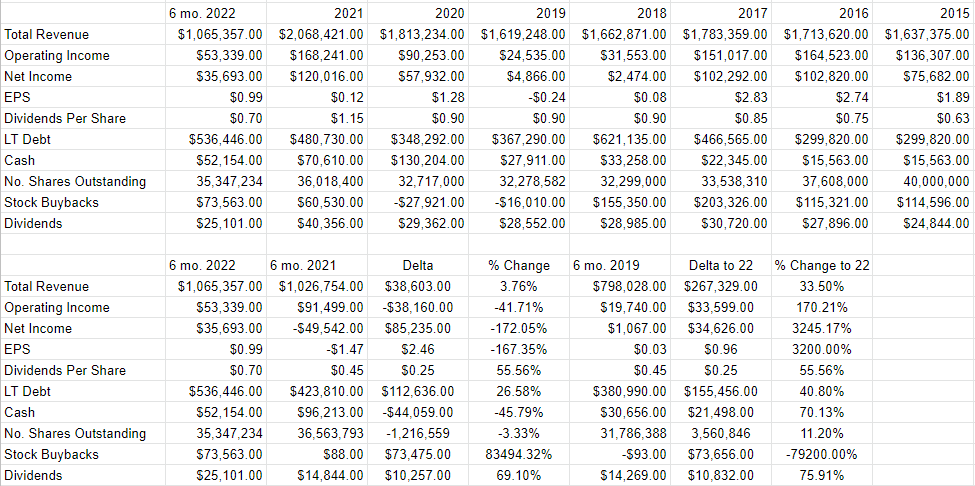

I’d characterise the long term financial history here as “choppy.” I describe it thus because both revenue and net income have moved around fairly dramatically over the years. For example, revenue reached $1.783 billion in 2017, and crashed to $1.619 billion two years later. Over the same time span, net income crashed from $102.3 million to $4.87 million. An investor who buys this stock should not expect a smooth ride, or consistent upward growth. That written, the company has remained consistently profitable over the years, with the exception of 2021, which was negatively impacted by a $109.85 million dividend on redemption of Series B Convertible Preferred stock.

The one thing that does disturb me somewhat is the fact that the level of indebtedness has grown dramatically over the past few years. For example, it’s up about 26.6% over the past year alone. That written, it has been higher (in 2018), and the company is sitting on a relatively large cash hoard of $52.15 million, which represents about 9.7% of total indebtedness. Thus, I don’t worry about a solvency crisis here anytime soon.

Dividend Sustainability

I’m as interested in financial history as the next finance nerd, but investors are particularly interested in a company’s financial future for obvious reasons. In particular, people may be interested to learn about the level of dividend sustainability for two reasons. First, the cash flows received from dividends help smooth investor returns, and they obviously make planning your financial future much easier. Second, a sustainable dividend is obviously supportive of stock price. So, readers may be curious about what goes on with the dividend. If you readers have an itch, I’m absolutely committed to scratching it, so I want to spend some time writing about the dividend.

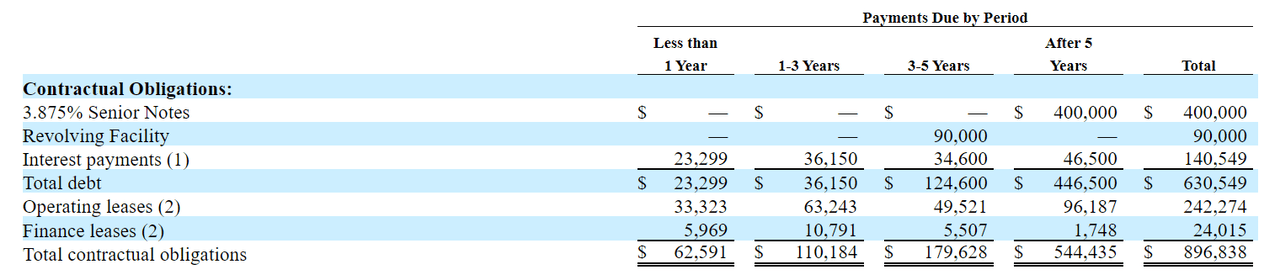

When it comes to tracking the sustainability of a given dividend, I look at cash. I specifically want to compare the size and timing of future cash obligations to the current and likely future sources of cash. Let’s start with the obligations. I’ve taken the liberty of clipping the size and timing of future debt payments from page 41 of the latest 10-K for your enjoyment and edification. We see from the table below that the company is “on the hook” for ~$62.6 million this year, and an average of about $55 million over the next two years.

Papa John’s Contractual Obligations (Papa John’s latest 10-K)

Against these obligations the company has about $52.15 million in cash and equivalents. Additionally, they’ve generated an average of $144 million in cash from operations over the past three years, while spending an average of about $45.7 million on CFI activities. All of the above suggests to me that the dividend is very well covered. For this reason, I’d be very happy to buy shares at the right price.

Papa John’s Financials (Papa John’s investor relations)

The Stock

My regulars know that I’ve talked myself out of some profitable trades with the words “at the right price”, but I’d rather miss out on some gains than lose capital. My regulars also know that I consider the “business” and the “stock” to be quite different things. Every business buys a number of inputs and turns them into a final product. In this case moderately tasty pizza. The stock, on the other hand, is an ownership stake in the business that gets traded around in a market that aggregates the crowd’s rapidly changing views about the future health of the business, future demand for pizza and other “trade down” food choices. It may also be the case that some analyst decides that “future growth catalysts” are weaker than once thought, and the stock falls in price in sympathy, in spite of absolutely no change at the company. The stock also moves around because it gets taken along for the ride when the crowd changes its views about “the market” in general. So, in some sense, the stock is “doubly buffeted” by the crowds’ rapidly changing views about a given company, and the crowd’s rapidly changing views about the overall stock market.

This is troublesome, but it’s a potential source of profit because these price movements have the potential to create a disconnect between market expectations and subsequent reality. In my experience, this is the only way to generate profits trading stocks: by determining the crowd’s expectations about a given company’s performance, spotting discrepancies between those assumptions and stock price, and placing a trade accordingly. I’ve also found it’s the case that investors do better/less badly when they buy shares that are relatively cheap, because cheap shares correlate with low expectations. Cheap shares are insulated from the buffeting that more expensive shares are hit by.

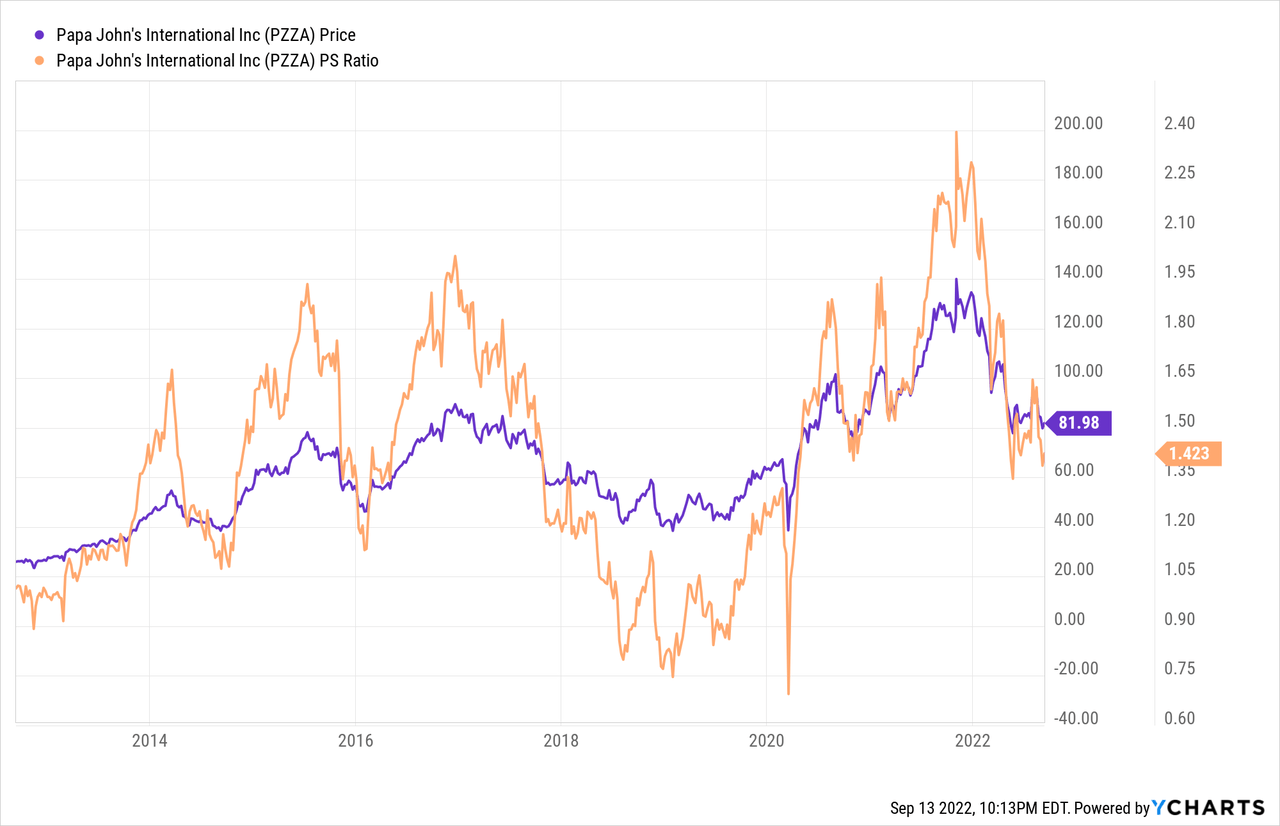

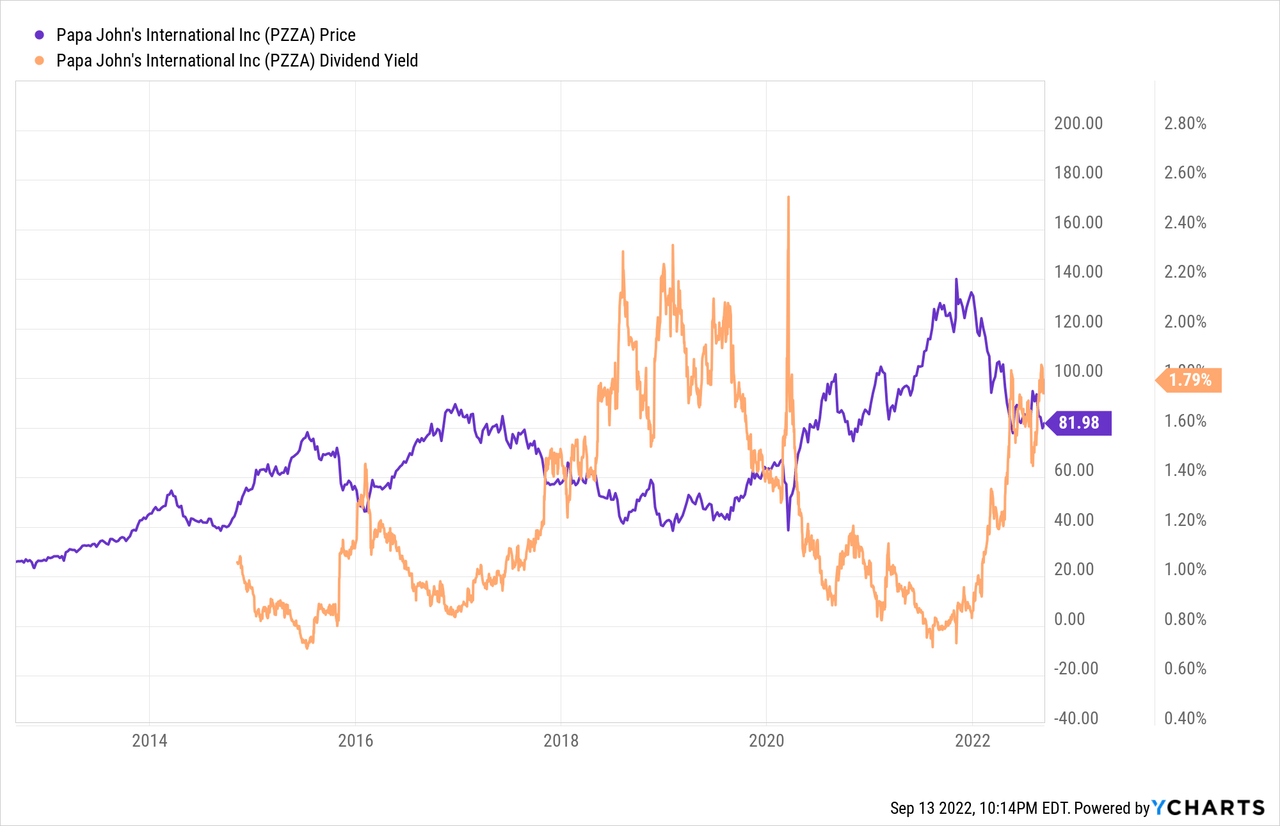

As my regulars know, I measure the relative cheapness of a stock in a few ways. For example, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. I like to see a company trading at a discount to both the overall market, and to its own history. At the moment, the company is trading near the middle of its valuation range, per the following:

While the shares are neither cheap nor expensive, I think it’s noteworthy that the dividend yield is on the high side. So, while investors may be paying an average price, they’re getting an above average income stream from this stock.

In addition to looking at simple ratios, I actually use a large number of other, more complex valuation measures, one of which involves trying to understand the assumptions currently embedded in price. If you read me regularly, you know that I rely on the work of Professor Stephen Penman, and increasingly Mauboussin and Rappaport to do this. This approach uses the stock price itself as a source of information. It involves “reverse engineering” the assumptions that cause the current price. When I apply this approach to Papa John’s, it seems the market is assuming growth of about 4% going forward at the moment. Just like the stock price itself, this is neither overly attractive, nor unattractive. Given that I’m in the mood to preserve capital rather than buy companies that are “neither cheap nor dear”, I’ll pass on Papa John’s at current prices.

Options As Alternative

Just because I don’t want to buy at the current price, doesn’t mean I think there’s no way to make money here. Given the sustainability of the dividend, I’d be happy to buy Papa John’s at the right price. I have a choice in how I might do this. I can wait for the shares to fall in price. Not only is this boring, but the shares may never fall sufficiently in price. Alternatively, I can generate some income today by selling put options with strike prices that I’d be willing to pay. I’ve characterised these as “win-win” trades because the outcome is great no matter what happens. If the shares remain above the strike, I’ll simply pocket the premium, which is never a hardship. If the shares fall, I’ll be obliged to buy, but will do so at a price that I determined to be a good one. Additionally, I’ll be “less badly off” than the people who bought at today’s market price, which is also a decent outcome.

In terms of specifics, I like the April 2023 short put with a strike of $60. I’d be happy to buy at this level, because it lines up with a relatively cheap price to sales ratio of about 1.05. This price also lines up with a nice 2.05% dividend yield. These are currently bid at $0.60 So, if the shares don’t happen to drop 27% over the next seven months, I’ll pocket this premium. If the shares fall below $60, I’ll be obliged to buy, but will do so at a net price of $59.40. This is also a very positive outcome in my view. This is why I characterise these as “win-win” trades.

It’s that time again. Welcome to the point in the article where I get to indulge in my semi-sadistic tendency to spoil people’s moods by pointing out that the phrase “win-win” is really just a bit of rhetoric. This trade, like all others, comes with risk. I consider the risks associated with these instruments to fall into two broad categories: the economic and the emotional.

Starting with the economic risks, I’d say that the short puts I advocate are a small subset of the total number of put options out there. I’m only ever willing to sell puts on companies I’d be willing to buy, and at prices I’d be willing to pay. So, I would never advocate that people simply sell puts with the highest premia. In my view, that strategy would lead to disastrous results. So my first bit of advice is to only ever sell puts on companies you want to own at (strike) prices you’d be willing to pay. Take my word on this one, as it’s informed by painful history.

The two other risks associated with my short puts strategy are both emotional in nature. The first involves the emotional pain some people feel from missing out on upside. To use this trade as an example, let’s assume that Papa John’s stock price goes parabolic and hits $100 per share between now and the third Friday of April 2023. Obviously my puts will expire worthless, which is a great outcome in some ways. I will not catch any of the upside in the stock price, though. So, short put returns are capped by the premium received. This is emotionally painful for some more hopeful souls than me. Thankfully for me, my expectations have been lowered dramatically over the decades, so this isn’t really an emotional hardship for me.

Secondly, it can be emotionally painful when the shares crash below your strike price. So far whenever this has happened to me, things have worked out well over the long term, because I insist on only ever writing puts at “screaming buy” strike prices. That said, it has been emotionally stressful in the short term on occasion. If you’re going to sell puts, please be aware of this phenomenon.

If you understand these risks, and can tolerate them, I would recommend that you sell puts. I think short puts offer at least some risk adjusted return here, and so we should sell them.

Conclusion

I think Papa John’s is a great, consistently profitable franchise. My difficulty relates to the fact that shares are neither cheap nor expensive at the moment. I’m not in the mood to “buy a good company at an average price”, so I’ll hold off on the shares at this time. That written, I think there’s obviously value here, and I’d be willing to be “forced” to buy at a price about 27% below the current level. This would represent a great outcome in my view. If the shares aren’t “put” to me over the next several months, I’ll at least enjoy earning a small premia on put options, which is not a hardship.

Be the first to comment