Devrimb/iStock via Getty Images

After a period of low cryptocurrency volatility, the price of Bitcoin (BTC-USD) fell sharply from $21,400 to $17,150 and is currently trading in a narrow price range of $18,100-$18,500 after a slight recovery. As described in my previous Bitcoin article, the key reason for the fall below the psychological threshold of $20,000 per Bitcoin is the Fed’s fourth consecutive increase in the Fed’s interest rate to a record high in the past sixteen years. Investors continue to massively withdraw from risky assets, which only increases the tension in both the stock and cryptocurrency markets, while more conservative participants with significant financial resources seek to wait out the period of macroeconomic instability in assets that bring dividends or coupon payments.

Source: N_Aisenstadt — TradingView

This article will present factors that indicate continued downward pressure on the price of Bitcoin, but at the same time, some of them begin to indicate the appearance of the first glimpses of hope for the end of the bearish trend in the medium term.

Bears control the situation in the cryptocurrency market

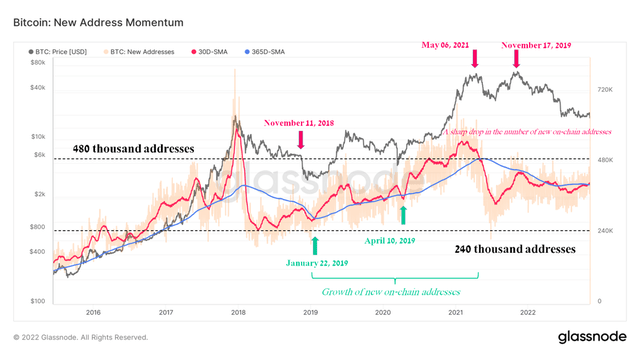

One of the most effective tools for tracking and modeling changes in trends in the cryptocurrency market and sentiment among Bitcoin users is the analysis of on-chain activity. The dynamics of new on-chain addresses continue to decline from multi-year highs reached in May 2021, when mass euphoria swept almost all markets and new participants opened wallets and invested in “digital gold”. However, even then, the first signals of a decrease in interest in Bitcoin appeared, as the average monthly rate of new addresses fell below the 365-day simple moving average marked in pink in the chart below. Moreover, a similar situation was observed in February 2018, after which the price of Bitcoin collapsed by 73% in less than a year. At the moment, the momentum of New Addresses is close to another upward spurt, as it happened in November 2018 after a multi-month period of low volatility and marked by a revival of hopes for the start of a new cycle of growth in demand for Bitcoin. However, this was a vain hope, as the price of Bitcoin collapsed from $6,600 to $3,300, and thus finally discouraged the majority of potential investors from buying “digital gold”. Moreover, at times of maximum stress among market participants and the subsequent formation of a bottom, the number of new addresses always reached a value of 240 thousand, which we still have not seen. As a consequence, this once again indicates that the current price range is not a bottom before a new up cycle begins.

Source: Author’s elaboration, based on Glassnode

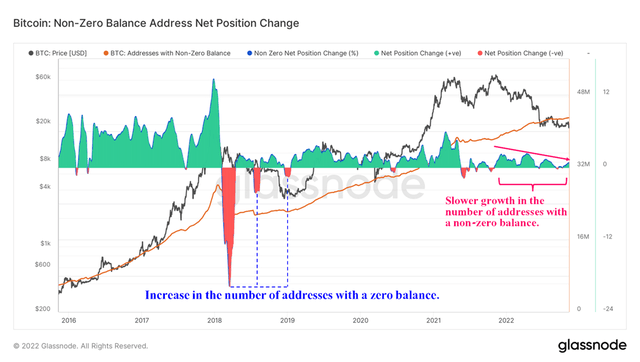

The logical consequence of the slowdown in the opening of new crypto wallets is a slowdown in the growth of the number of addresses with a non-zero balance, as most investors continue to exchange Bitcoin for fiat money and reinvest it in financial assets with less risk. A similar situation could be observed in the first three quarters of 2018, when the price of Bitcoin, after a sharp fall, remained in a narrow price range of $3,200-$4,000 for several months, while the S&P 500 (SPY) and Nasdaq 100 (QQQ) continued their upward movement.

Source: Author’s elaboration, based on Glassnode

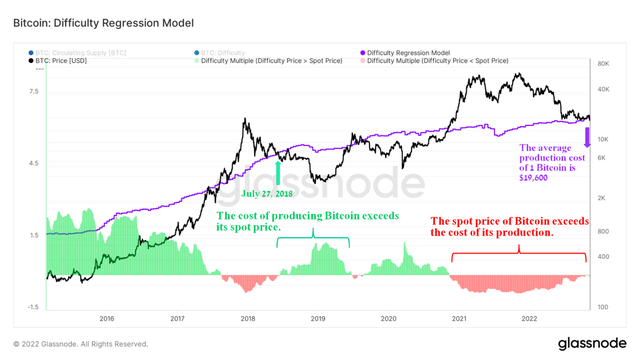

Miners continue to experience the hardest times

In my previous article, “Anticipating Crypto Crisis: Bitcoin Price Might Drop 35%”, I pointed out the continued dire situation in the mining industry, with hashrate and network difficulty setting new records and thereby provoking companies to sell off more coins to continue their activities. As of November 9, 2022, Bitcoin’s average production cost is $19,600 while the spot price has fallen below $18,000. The last time a similar situation happened was four years ago and eventually led to a mass capitulation of miners. At the moment, miners earn only 3.47 BTC per day for every Exahash, or 62.5 thousand in dollar terms, which is 25.2% less than last quarter. Increased competition among such mastodons of the industry as Riot Blockchain (RIOT) and HIVE Blockchain Technologies (HIVE) does not lead to the recovery of the cryptocurrency market, but only aggravates the situation and the longer this happens, the longer the period of its recovery will continue. I expect the sideways trend in the $12,700-$13,600 price range, in which more patient investors will accumulate coins in their wallets, to last a little longer than before. As a consequence, this will lead to a significant decrease in the investment interest of those who try to make a quick profit in this market and will also maintain downward pressure on the share prices of crypto miners.

Source: Author’s elaboration, based on Glassnode

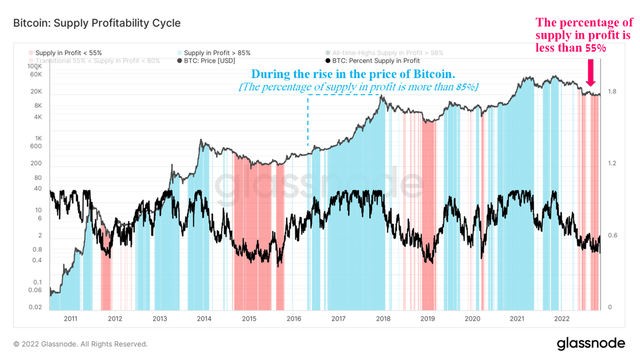

A period of apathy among crypto market participants due to a sharp drop in the profitability of their investments leads to the transition of Bitcoin from more impulsive investors to those who understand the value of cryptocurrencies. These trends can be analyzed using the percent of supply in profit, which provides information about the state of the market cycle. At the moment, this indicator continues to be in a downward trend and thus demonstrates the dominance of the share of supply in losses and, as a result, the preservation of bearish sentiment in the cryptocurrency market.

Source: Author’s elaboration, based on Glassnode

Holders continue to accumulate Bitcoin

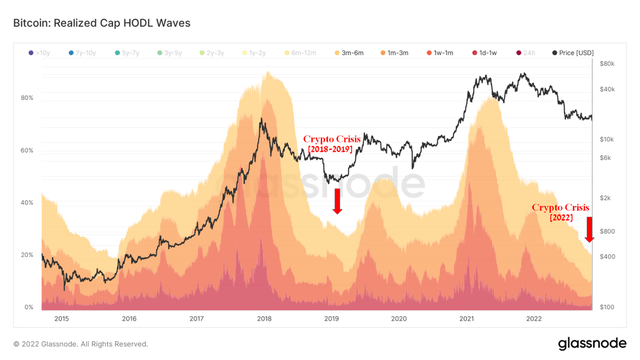

Despite the decline in interest and confidence in cryptocurrencies, long-term investors do not lose optimism about the future of Bitcoin and continue to accumulate it. The share of U.S. dollar wealth held in BTC that hasn’t moved in the last six months has hit a multi-year low. In previous Bitcoin cycles, such extremely low values were marked by the formation of the bottom of the main cryptocurrency and, in my opinion, a similar situation will repeat in 2022-2023.

Source: Author’s elaboration, based on Glassnode

Conclusion

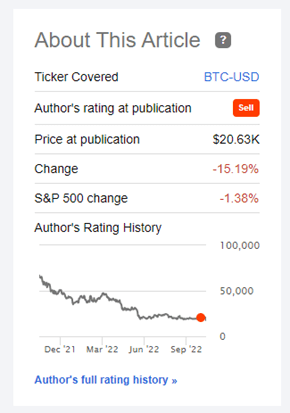

Since writing my last bearish article in October 2022, the price of Bitcoin has fallen by more than 10%, which is consistent with my expectations for the behavior of the cryptocurrency market, which is experiencing capital outflows to less risky assets.

Source: Nathan Aisenstadt — Seeking Alpha

The panic among high-risk assets, including those traded on the stock market, does not contribute to the transition of Bitcoin from a bearish trend to a bullish one. The network difficulty sets new multi-year records and thus reduces investment in the mining industry, which is in dire need of additional funding to buy more efficient equipment. Moreover, the increase in downward pressure on the price of Bitcoin comes at a time when one of the global crypto-currency exchanges, namely FTX (FTT-USD), is facing a liquidity crisis and thus only increasing the likelihood of a domino effect on other market participants.

On the other hand, prerequisites for the end of the bearish trend are beginning to appear due to an increase in the number of long-term holders who are confident in the bright future of cryptocurrencies. In addition, I expect a slowdown in the Fed rate hike in 2023 due to the slowdown in U.S. inflation and the victory of the Republicans in the elections to the House of Representatives. As a result, the Democrats will not be able to promote all their ideas, which required multibillion-dollar investments with the subsequent rise in inflation, and as a result, this will lead to an easing of the Fed’s monetary policy. As a result, investors will begin to consider investing in high-risk assets such as Bitcoin, Dogecoin (DOGE-USD), Ethereum (ETH-USD), and Cardano (ADA-USD). From the point of view of technical analysis, as in the previous article, I expect the price of Bitcoin to decline to the range of $12,700-$13,600, after which there will be a multi-month period of accumulation and the cycle will start again.

Be the first to comment