David Becker

Panasonic’s (OTCPK:PCRFY) recent quarterly earnings were broadly in line, with strength in the lifestyle business offsetting weakness elsewhere in automotive and connect. While management commentary indicates good progress on the pricing and operational fronts, the company has opted to maintain its FY23 guidance – a sign of conservatism, in my view. With earnings likely to have bottomed out for now and the company well-positioned to build out new revenue streams through the full-scale ramp-up of its new 4680 cell production plant, I see a clear path to further earnings upside ahead. With the stock also priced attractively at ~10x fwd P/E, any upside from the buildout of its battery business presents compelling growth optionality from here. Additional re-rating catalysts include improvements in the competitiveness of all of Panasonic’s underlying businesses, as well as a clear roadmap to unlocking its conglomerate synergies.

| FY24 | FY25 | |

| EV/EBITDA | 3.8x | 3.4x |

| P/E | 9.7x | 8.8x |

Source: MarketScreener (Market Data at 18th August 2022)

Signs of Progress from In-Line Quarter

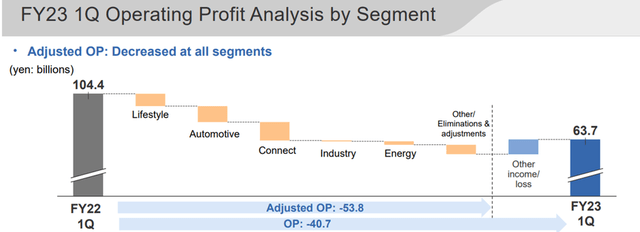

Panasonic’s Q1 headline release was largely status quo, with operating profits declining YoY to ~JPY64bn (~JPY66bn on an adjusted basis). The P&L breakdown shows profits disappointing in the automotive and connect businesses due to auto production headwinds and unfavorable YoY comps for PC-related mobile solutions. This was largely offset by a recovery in avionics and the lifestyle business, which has seen price revisions successfully implemented despite lockdowns in China (almost entirely covered by sales growth). Energy was another bright spot – margins are still holding up well at ~5% in auto batteries as price revisions and increased output at the Gigafactory outpaced pressures from fixed costs and material price hikes throughout the supply chain. One swing factor to watch out for is the intangible asset amortization and other expenses line – the consolidation of software and consultancy acquisition Blue Yonder, for instance, resulted in a massive ~JPY7bn YoY headwind to accounting profit this time around.

Outlook Reaffirmed, Potentially Conservative

Building off the solid battery results, Panasonic again reiterated its path toward production ramp-up and profitability of its 4680 battery at the Wakayama plant. This initiative will see the company also transition to a horizontal model – in contrast to the vertically integrated business model currently adopted by Panasonic Energy. With battery earnings set to receive a boost from the weaker yen, and industrial demand also on the uptrend, the business looks on track for a cyclical bounce in the coming quarters as well. Similarly, Panasonic Connect, which has been weighed down by the lockdowns in Shanghai and higher material prices, is guided for a recovery going forward.

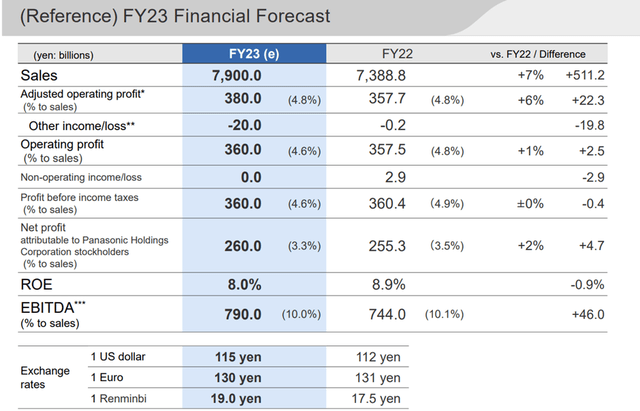

Despite the positive management commentary, the company reaffirmed its full-year adjusted operating profit guidance of JPY380bn – a likely cautious move given the strong adjusted operating profits in the June quarter and the conservative USD/JPY assumption (guidance assumes forex of JPY115/USD, JPY130/EUR, and JPY19/CNY). If the current downward trend in copper and aluminum prices sustains, there could be even more room for beats and raises in the coming quarters. For context, management has penciled in higher costs reducing the full year operating profits by ~JPY150bn YoY, led by the Lifestyle Updates and Panasonic Energy segments. Finally, price revisions are also planned for this month in the key appliances business along with the coming quarters to mitigate higher costs – success here would entail incremental earnings upside well beyond the guidance run rate.

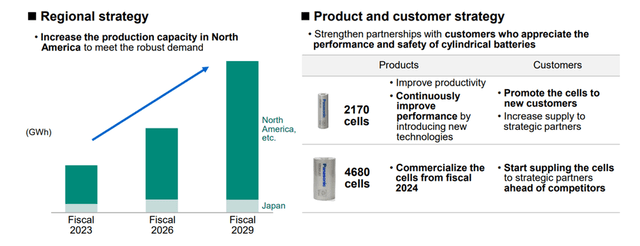

Ramping Up Battery Production Capacity from 2025

Recall that leading up to earnings, Panasonic had issued a press release outlining exciting new plans to construct a new automotive Li-ion battery plant in Kansas via consolidated subsidiary Panasonic Energy. The project will entail a ~$4bn outlay, which, based on its June investor event, will go toward ramping up capacity for automotive batteries to almost double in FY25 and 3-4x in FY28. While a specific timeline on when the new plant will come on stream has not been penciled in, an FY25 kick-off likely makes the most sense, given key customer Tesla’s (TSLA) growth outlook. With Panasonic Energy also targeting a significantly increased production capacity (+200-300% by 2029), further capacity expansion could be on the cards as well – either at an existing plant or via the buildout of new plants down the line.

On balance, the scale and ambition of the company’s latest growth plan is a positive sign, signaling steady progress toward full-scale volume production of its new 4680 cell. For context, the ~$4bn investment (including incentives) and up to 4k new jobs noted in the release implies the new plant could match the scale of its existing Gigafactory facility. Thus, funding will be a key consideration – the allocated investment amount is greater than the budget for strategic growth investments (~JPY400bn) in the mid-term business plan. In the meantime, Panasonic is not short of options – Kansas State has already announced subsidies of ~$829m (~20% of the total investment), and more could be on the way. Given the favorable terms (previously announced subsidies were within the 10-20% range for South Korean manufacturers) and the healthy net cash position, I see limited funding hurdles ahead.

Bottoming Out

Panasonic’s latest earnings report is reason for optimism, as earnings are showing signs of a cyclical rebound, supported by favorable seasonality in the HVAC business and the lifting of the Shanghai lockdown. Meanwhile, planned price revisions could offer a structural boost to earnings, alongside internal streamlining initiatives to boost operating profitability in the coming quarters. Over the long run, the company’s steady progress on full-scale volume production of its new 4680 cell could open up new revenue streams as well. With the market remaining skeptical about the growth outlook at the current ~10x fwd P/E valuation, the re-rating bar is low, and thus, Panasonic stock offers compelling value, in my view.

Be the first to comment