Oat_Phawat

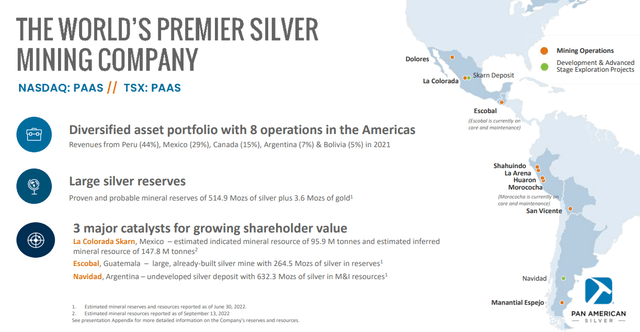

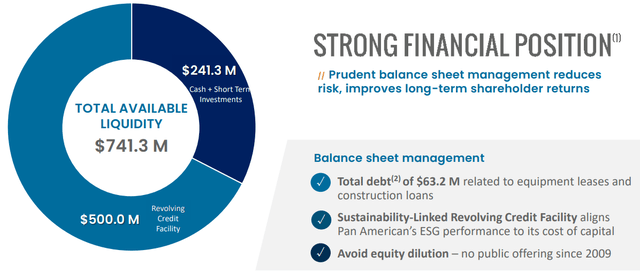

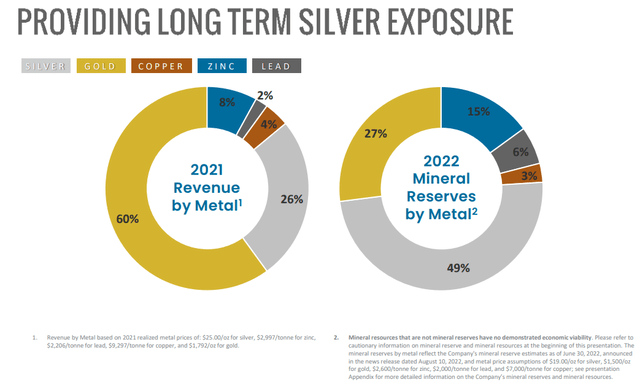

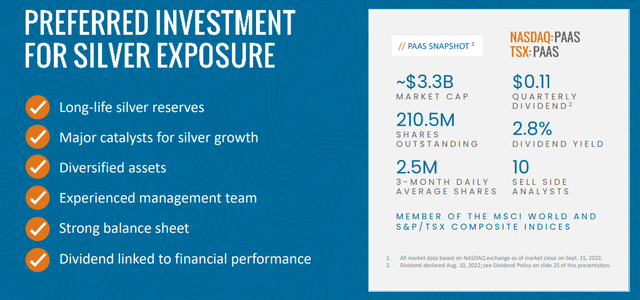

That’s right! Pan American Silver (NASDAQ:PAAS) is one of the best vehicles to leverage a large approaching silver advance. The company’s enterprise value of $3.2 billion ($3.35 billion current equity market cap, plus debt of $60 million, subtracting $240 million in cash) is one of the cheapest readings in the silver-focused mid-tier mining area of Wall Street. When we back out extensive gold and base metal values that can be economically extracted represent about half of the firms’ worth, and divide the remaining ore holdings of 1.8 billion silver ounces in total of proven & probable company reserves, measure & indicated resources, and inferred metals in the ground, investors are only paying around $1 in underlying notional value for yet to be mined ounces.

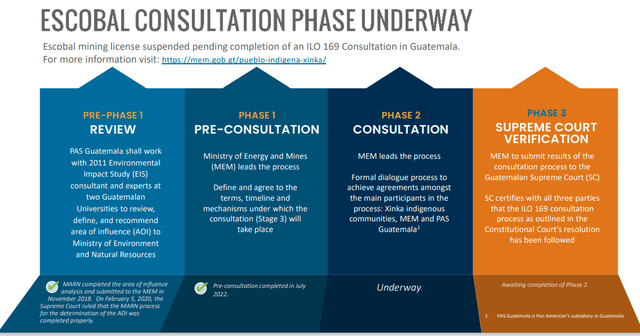

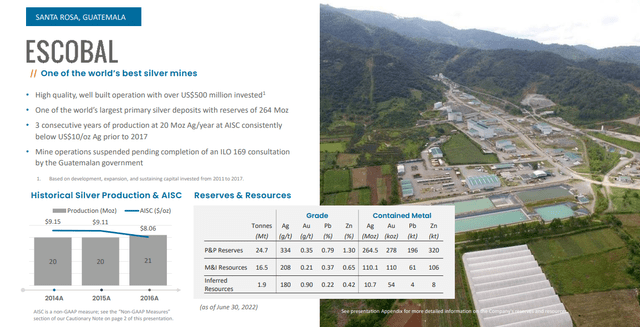

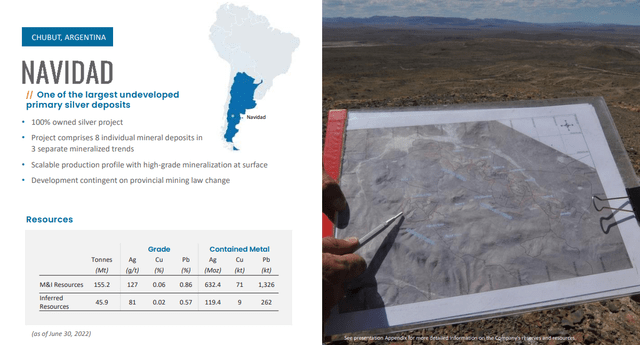

Pan American is a play on future potential mine development and production, pure and simple. The Escobar mine in Guatemala has been shut down for several years, as the government ordered a new plan for sharing the spoils/profits be devised and accepted by local residents and workers. Reopening this already premier, built mining asset would DOUBLE silver production annually from 20 to 40 million ounces. In addition, the massive Navidad resource in Argentina could eventually bring on 20+ million more silver ounces when built, for a potential TRIPLE in annual production 3-5 years down the road.

So, here’s the leverage story in a nutshell. Assuming a best-case scenario, we can multiply the likelihood of 50-60 million ounces mined yearly with a theoretical spot silver price rising from under US$20 an ounce today closer to $100 in 3-5 years, gets you to a not-impossible potential of $3+ billion in annual operating profits (assuming mining costs rise 50% to around $30 per ounce over the same span on inflation/stagflation in the world economy), essentially EQUAL to the whole equity capitalization of issued and outstanding shares at $16 each today.

The Business

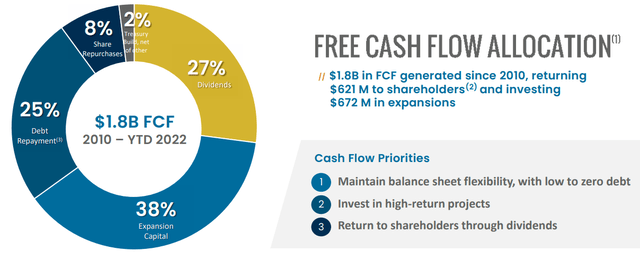

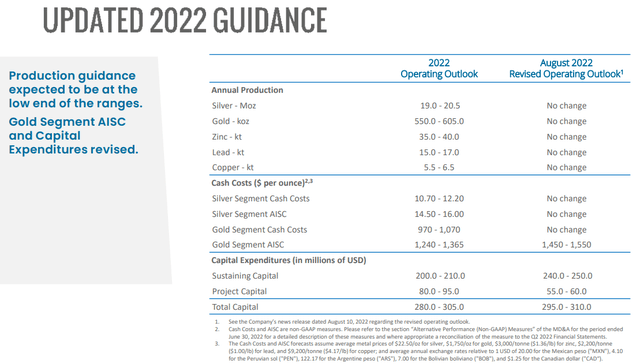

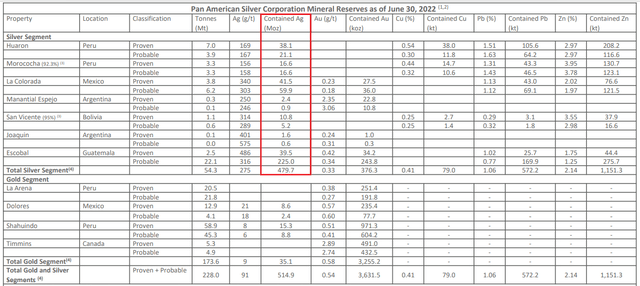

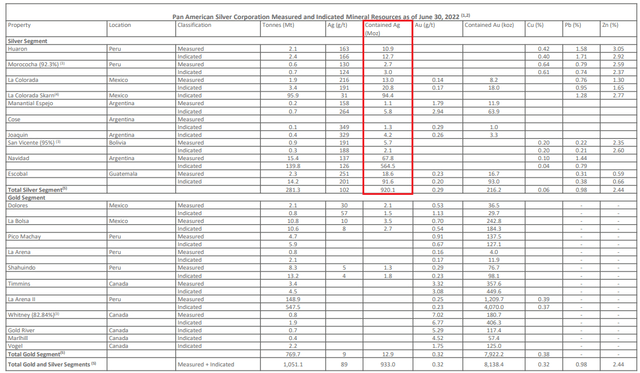

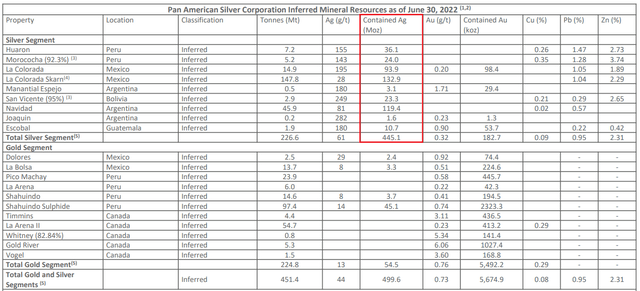

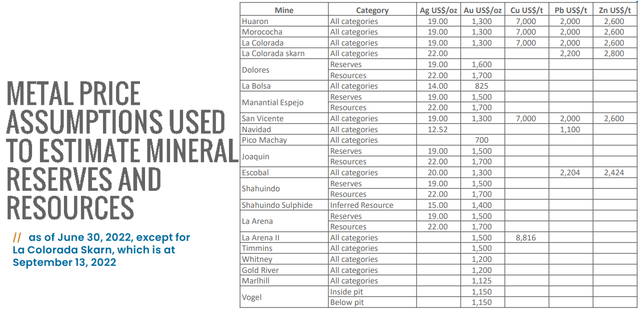

For investors, a simple summary of operations and financials I can find for all of Pan American’s moving parts can be found in its September Investor Presentation. Below are some of the slides explaining current operating results, alongside a superb growth future if silver prices gallop above $30 an ounce in 2023. At the end is a listing of reserves and resources at each property, with silver specifically boxed in red.

Pan American Silver – September 2022 Investor Presentation Pan American Silver – September 2022 Investor Presentation Pan American Silver – September 2022 Investor Presentation Pan American Silver – September 2022 Investor Presentation Pan American Silver – September 2022 Investor Presentation Pan American Silver – September 2022 Investor Presentation Pan American Silver – September 2022 Investor Presentation Pan American Silver – September 2022 Investor Presentation Pan American Silver – September 2022 Investor Presentation Pan American Silver – September 2022 Investor Presentation Pan American Silver – September 2022 Investor Presentation Pan American Silver – September 2022 Investor Presentation Pan American Silver – September 2022 Investor Presentation Pan American Silver – September 2022 Investor Presentation Pan American Silver – September 2022 Investor Presentation Pan American Silver – September 2022 Investor Presentation

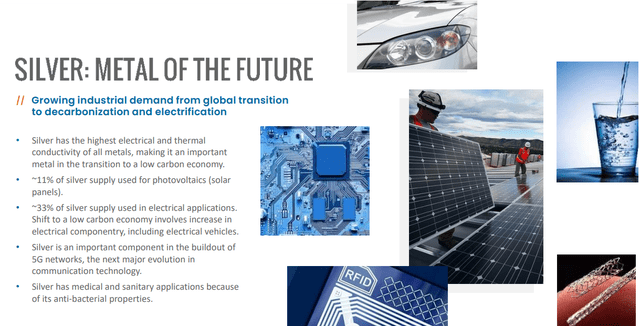

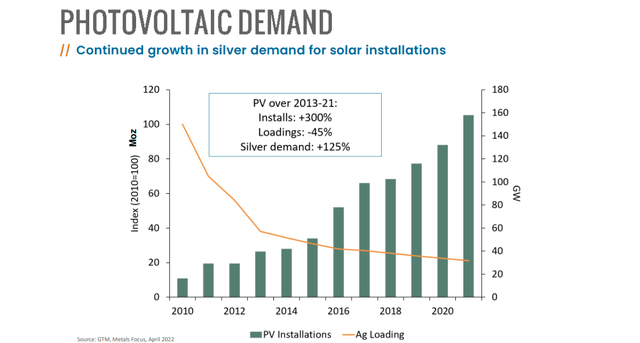

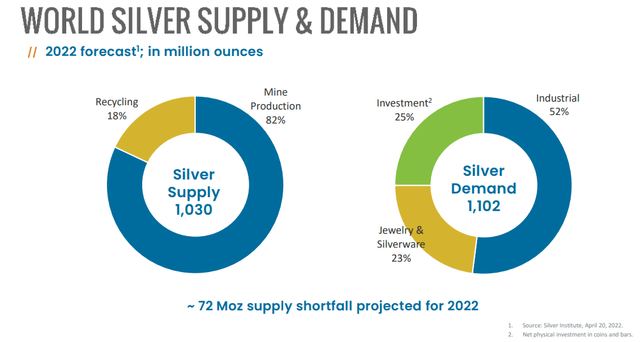

Bullish Silver Outlook

Growing shortfalls of mined supply vs. green energy demand (mostly increasing solar panel and electric vehicle uses) are one reason to be uber-bullish on silver going forward. However, a number of other variables are converging in late 2022 to create a lasting bottom in prices. In August here, I talked about the incredible undervaluation position for silver vs. other metals, skyrocketing liquidity globally (including total debt and M2 supply numbers in America) after the pandemic as an excuse to own monetary hedges, and improving investor sentiment backdrop during the summer, altogether pointing to a major price bottom in the second half of 2022.

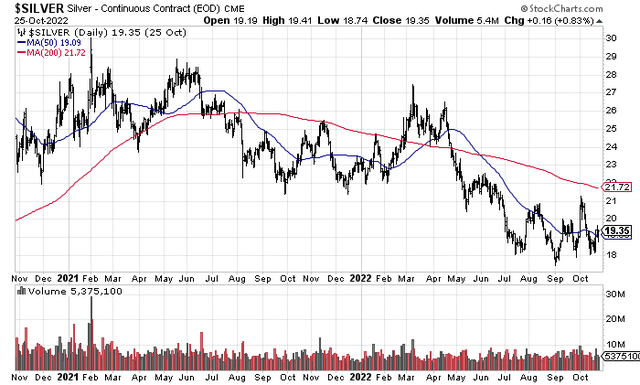

StockCharts.com – Silver Nearby Futures, 2 Years of Daily Changes

Without doubt, the fallout in Wall Street silver confidence during the 2022 period of Fed tightening has washed out all cyclical optimism. Excluding silver bugs and those wanting real-world hedges to political chaos and wild financial-system risk, mainstream financial media outlets and average Joe investors are clearly not interested in poor man’s gold.

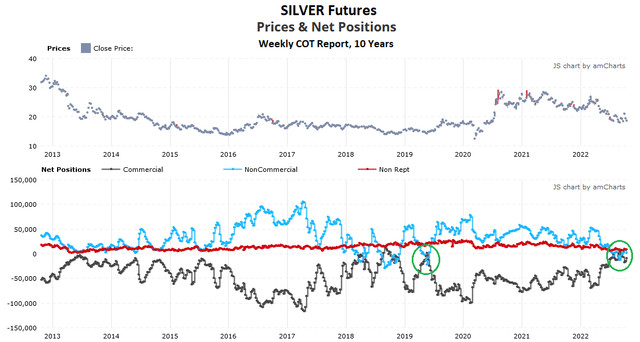

To prove my point, silver futures positioning now indicates an excessive level of bearishness by speculative traders that may support short covering and long buying soon. I have circled in green the last major bottom in silver prices during 2019 (ignoring the liquidation phase of the early pandemic, which lasted weeks and included a new price low). Commercial hedgers like miners, large end-users and refiners reached a net long position several weeks ago, for the first time in 3 years. Plus, retail investors and speculators were net short silver, happening less than 3% of the time measured over the last decade. Looking forward, it will be difficult for the paper futures market to keep a lid on silver prices, just from player positioning.

StockCharts.com – Pan American Silver with Author Reference Point, 2 Years of Daily Changes

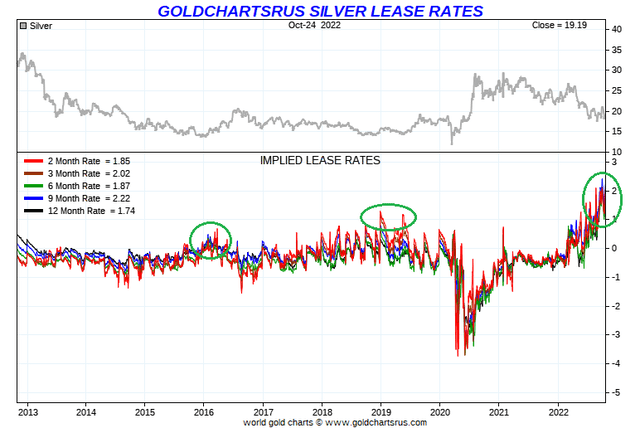

Cracks in conventional wisdom’s silver bearishness are already appearing. Below is a 10-year graph of the lease rate picture, where rates have skyrocketed and inverted since summertime. In the past, when short-term borrowing rates for silver loans between banks and financial institutions are higher than long-term ones, with all rates rising strongly, a physical shortage has arrived. I have circled in green similar occurrences in recent times.

Goldchartsrus.com – Silver Lease Rates with Author Reference Points, 10 Years

Can I guarantee silver will rise in 2023? No, but after trading precious metals for 35+ years, I am confident investors should logically be planning to acquire positions, and avoid selling them. The short-term sentiment setup and long-term undervaluation of silver could easily support a multi-year advance starting any day now. Whether China invades Taiwan, Russia uses a nuke in Europe or invades a NATO country next, or a deep recession requires another round of record money printing in 2023, it’s not hard to imagine a situation where investors of all types flock to precious metals.

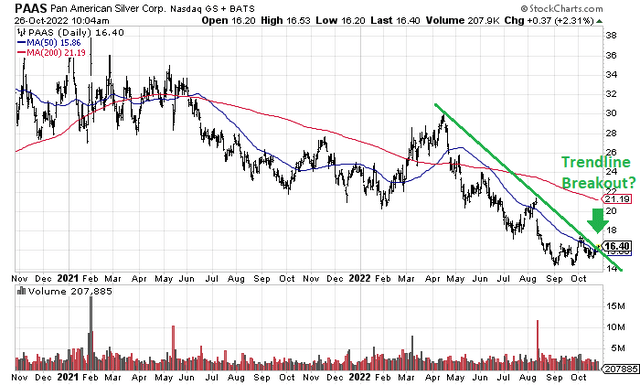

Technical Breakout This Week?

An immediate positive to consider is Pan American’s price appears to be breaking out of a trendline drawn through previous highs since April. To be honest, not much upside momentum exists in the indicators I like to track. Yet, precious metals miners often look messy at cyclical price bottoms.

The first sign of life and a brighter technical future may turn out to be the trendline break occurring as I write this article (drawn in green below). Considering all the bullish variables taking shape for both silver and gold in October 2022, waiting for more evidence of a reversal could cost investors the first 20%-30% of price gain that bottom fishing can achieve. And, because of its hedge characteristics in portfolio design, with unrelated, uncorrelated performance vs. the overall stock market from a statistical perspective, owning Pan American (and plenty of other silver positions) all of the time may be a prudent decision going forward.

StockCharts.com – Pan American Silver with Author Reference Point, 2 Years of Daily Changes

Final Thoughts

For sure, Pan American holds greater risk than many silver miners focused on the U.S. and Canada for assets. Higher-than-normal mining “jurisdiction” risk is found in most every mine and resource location in Central and South America. I estimate this fact accounts for much of the 50% discount valuation on ore in the ground vs. North American-focused silver mining peers Hecla Mining (HL) and Coeur Mining (CDE). [My bullish Coeur article last week is linked here.] But today’s discounted value also brings extra upside leverage if investors start digging for silver plays in 2023-24, while allocating serious dollars to this very small sector.

Total silver supplies easily accessed above-ground in warehouse stocks and company inventories are estimated at 3.5 billion ounces, about $66 billion in value at today’s $19 silver quote. Annual production of 1 billion ounces equals $19 billion in annual value. So, not much of a change in bullish attitudes would be required to create a massive physical shortage of the metal, compared to hundreds of trillions in global debt (per dollar conversions) and publicly-traded business worth closing in on $100 trillion at the end of 2021. ANY return to the use of silver as coin money in the world would prove all but impossible without shooting price well into the 100s of U.S. dollars per ounce.

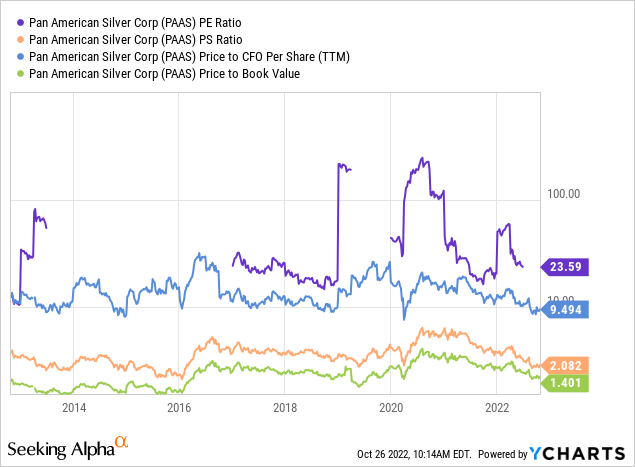

Reviewing basic trailing valuation ratios on business fundamentals, Pan American Silver is trading on the bargain end of decade averages. On price to earnings, sales, cash flow, and book value, new investors are getting a better-than-normal deal, assuming just flat silver/gold prices into next year.

YCharts – Pan American Silver, Price to Fundamental Ratios, 10 Years

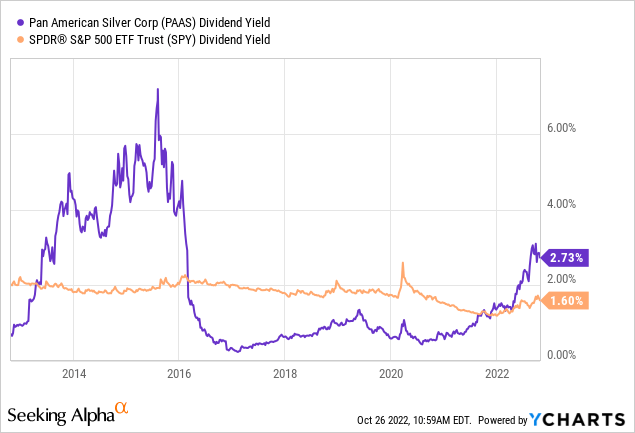

More good news is Pan American is paying a sizable dividend. The 50% price decline in shares from early in 2022 is generating an above-normal yield of 2.7%, almost double the S&P 500 equivalent rate available.

YCharts – Pan American Silver, Dividend Yield vs. S&P 500, 10 Years

In summary, geopolitical problems around the world (including the divisive politics in America, going into a possibly disputed early November election), a major ongoing war in Europe, plus threats of war in Asia from China and North Korea headline flight-to-safety demand potential for silver. Economic turmoil with stagflation appearing in 2022 is historically a great time to own precious metals (think 1970s). And, projections of silver shortages from sharply escalating electric vehicle and solar panel demand needs could spike silver in the near future.

I have a “fair value” calculation for silver in the US$40+ an ounce area today, which has been explained in past articles this summer. If investor demand, industrial demand, and flight-to-safety interest surges next year, silver could morph into one of the top investment performance choices of 2023-24. Buying mining assets on the cheap today is a reasonable and logical decision. My argument is don’t be left behind. Your future wealth may depend on owning precious metal hedges.

I am upgrading my Pan American rating to Strong Buy. Projected potential downside to $10 in a sliding silver environment next year vs. potential upside to $40-$50 a share (given $40 silver in 12 months) suggests a tilted risk/reward balance in favor of bulls. Theoretical total return downside risk of -40% vs. upside of 200%+ is the rationale. If the world falls apart and we get $100 silver in 18-24 months (which would still be far cheaper than the inflation-adjusted US$50 price high of 1980), Pan American could return 10x your investment today. That’s called upside leverage, lots of it.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Be the first to comment