blackdovfx

Introduction

Palo Alto (NASDAQ:PANW) is a cybersecurity company growing strongly in their three business segments. Cybersecurity is an increasingly important topic, and the enactment of the Bipartisan Cyber Incident Reporting Act of 2021 and the CIRCIA Act are strong catalysts to drive Palo Alto’s stock price further upward.

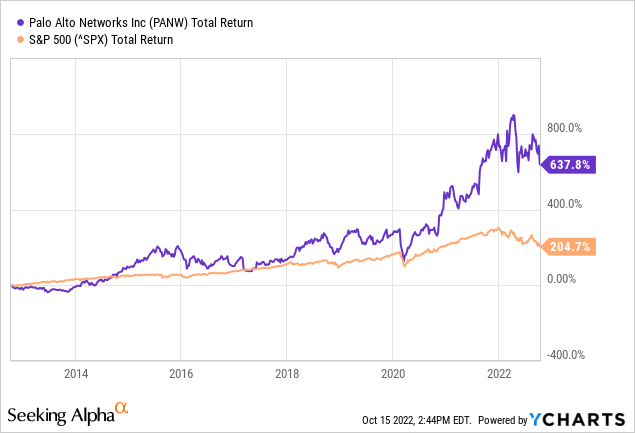

Palo Alto is a good investment; over the past 10 years, its annual average return has been 22%. Compared to the S&P500’s total return of 11.8%, Palo Alto’s return is sublime.

Working from home has become very common since the corona pandemic and requires a more comprehensive cybersecurity solution. Palo Alto offers a broad spectrum of such solutions for all types of businesses. Palo Alto’s stock valuation is in line with the historical average and growth expectations are strong. The 33% free cash flow margin, attractive stock valuation and strong growth prospects make this stock a buy.

Overview Of The Company

Palo Alto Networks is a company specializing in cyber security solutions worldwide and offers the following products and services, specializing for businesses and governments:

- Firewall appliances and software:

- Panorama

- Security management solution for the control of firewall appliances and software

- Virtual system upgrades and extensions

- Panorama

- Zero Trust Network Security (subscription services):

- Threat prevention

- Malware and persistent threat

- URL filtering

- Laptop and mobile device protection

- Firewall

- DNS security

- Internet of Things security

- Threat intelligence

- Data loss prevention

- Threat prevention

- Cloud Security:

- Secure access

- Security operations

- Threat intelligence

- Cyber security consulting

- Secure Access Service Edge:

- Prisma Access

- Prisma SD-WAN

- SaaS Security API and Inline

- Security Analytics and Automation:

- Professional services:

- Architecture design and planning

- Implementation and configuration

- Firewall migration

- Education services

- Certifications

- Online and in-classroom training

- Support services

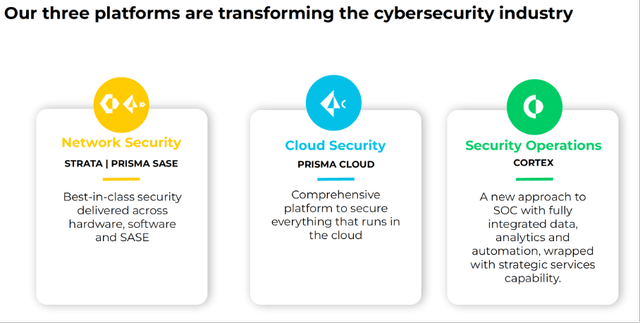

Palo Alto classifies its products and services into the following three platforms.

Three security platforms (PANW 4Q22 investor presentation)

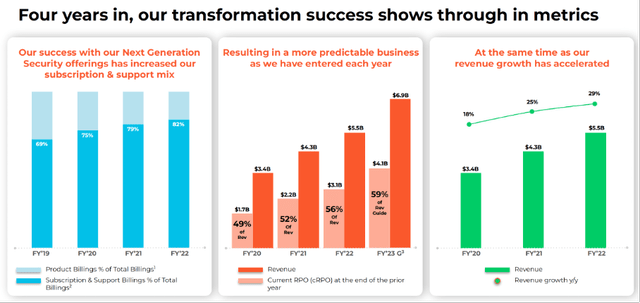

Palo Alto is increasingly transforming itself into a services company because service revenues generate predictable revenue compared to product sales. Product billing still accounts for only 18% of revenue, while in 2019 it accounted for 31% of revenue. Palo Alto is growing into a predictable business as revenue continues to grow steadily.

Palo Alto Transformation (4Q22 Investor Presentation)

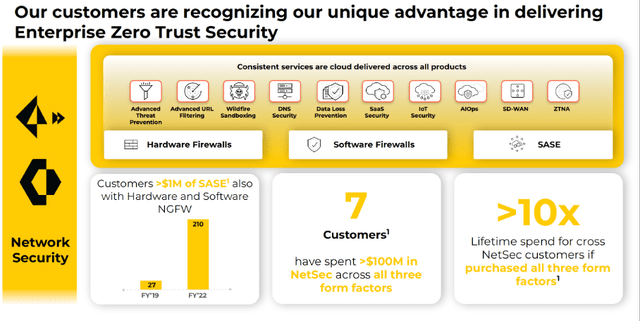

Network security is becoming increasingly important for companies that allow their employees to work from home. Palo Alto’s SASE (Secure Access Service Edge) solution provides security for remote workers that has boomed since the corona pandemic. SASE’s active customers grew 51% year over year in the fiscal fourth quarter of 2022 compared to the same period last year.

Network Security (4Q22 Investor Presentation)

4Q22 Revenue Up 27%, FY’22 Free Cash Flow Margin Is Strong At 33%

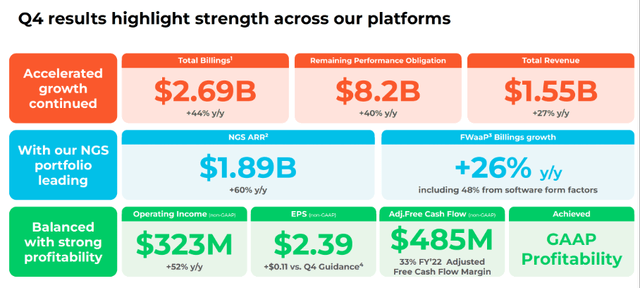

Palo Alto is a strong cash flow generator with an adjusted free cash flow margin for fiscal year ’22 of 33%. Revenue in the fourth quarter of 2022 rose sharply by 27% and operating income by 52%. Earnings per share came in $0.11 higher than expected, with $2.39 earnings per share.

4Q22 Financial Results (4Q22 Investor Presentation)

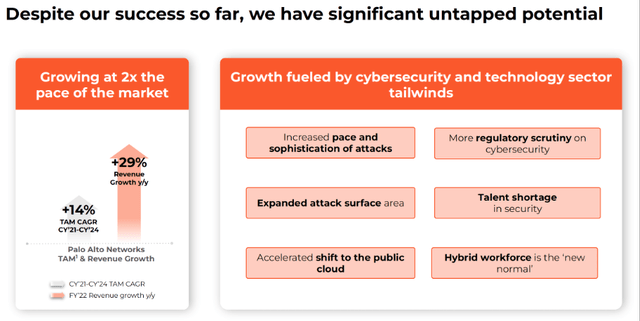

Providers of cybersecurity solutions are in a growth market. TAM is expected to grow at a CAGR of 14% CY’21 to CY’24. Palo Alto Networks is growing faster than 2x than growth in TAM. It shows that the company is a leader in the cyber security space.

The U.S. government is increasing cybersecurity spending with the enactment of the Bipartisan Cyber Incident Reporting Act of 2021 and the CIRCIA Act. Companies are increasingly working in the cloud which increases the likelihood of threats. Recent data breaches, the high-profile SolarWinds hack and the recent cyber-attack on Uber gave the Biden administration the motivation to increase their cybersecurity spending. I see this as a strong growth catalyst for both the stock price and the company.

TAM and PANW Growth Tailwinds (4Q22 Investor Presentation)

Strong Growth Expected In FY’23

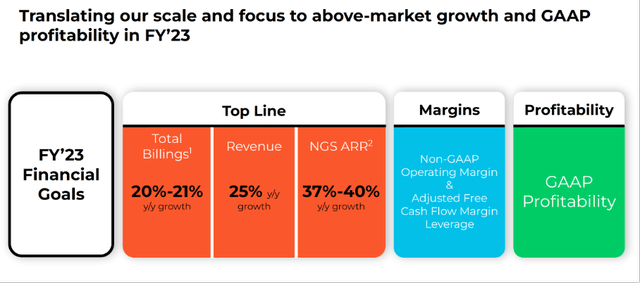

Palo Alto expects strong revenue growth of 25% for fiscal 2023. Total billings are expected to grow 20%-21% and their strong cash flow returns will be maintained. Palo Alto expects to be GAAP profitable for this period.

FY’23 Financial Goals (4Q22 Investor Presentation)

For fiscal ’24, analysts expected revenue growth of 22%. As the company gets bigger, growth will slow down and grow along with TAM. TAM is expected to grow at a CAGR of 14%. This is still strong long-term growth. Palo Alto is clearly in a growth market and will benefit from the Bipartisan Cyber Incident Reporting Act of 2021 and the CIRCIA Act.

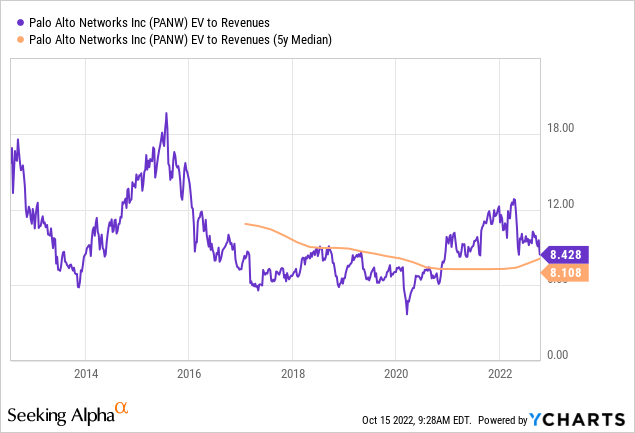

EV To Sales Valuation Metric Near Buying Point

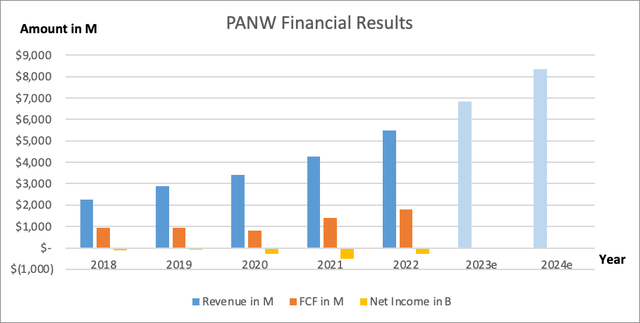

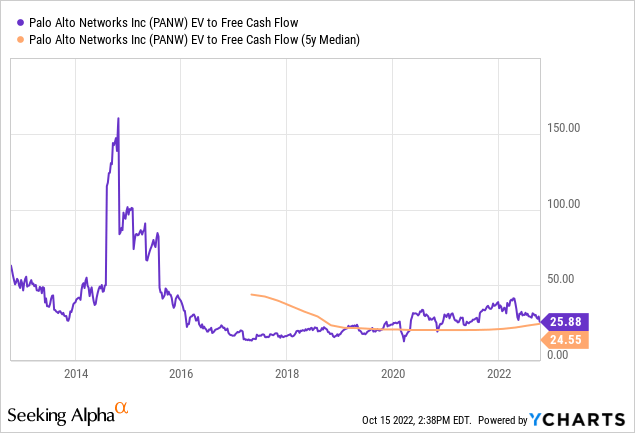

As described earlier, Palo Alto’s growth prospects are strong. The company is not yet making GAAP profits, so I have graphically depicted the free cash flow for the past few years in the chart below.

Graphical Visualization Of Their Financial Results (SEC and Authors’ Own Graphical Visualization)

Palo Alto is a growth stock. Because it is not yet profitable, I choose the EV to Revenue ratio to chart the stock’s valuation. The recent price correction makes the stock valuation attractive; the EV to Revenue is quoted at the 5-year median. And because revenue is expected to rise 25% next year, the stock is very attractively valued.

The company has a high adjusted free cash flow margin of as much as 33%. Also, the EV to Free Cash Flow is an appropriate choice for charting valuation. The chart below shows that the ratio is close to the 5-year median, in line with their historical average.

Conclusion

The enactment of the Bipartisan Cyber Incident Reporting Act of 2021 and the CIRCIA Act are strong catalysts for further growth for Palo Alto. The company is benefiting tremendously from the strong demand for cyber security services and products. The corona pandemic provided the availability to work from home and there was high demand for comprehensive cyber security products. Palo Alto is in a growth market with projected TAM growth of 14%. Palo Alto’s revenues are growing more than 2x the growth of TAM, in the recent quarter revenues grew 27% and operating income grew 52%. Palo Alto is generating a strong free cash flow margin of up to 33%. The favorable stock valuation is based on the EV to Revenue and EV to Free Cash Flow historical average. The stock is a buy because of its high free cash flow margin, strong expected growth, and attractive stock valuation.

Be the first to comment