satoshi takahata/iStock via Getty Images

Dear fellow investors and friends,

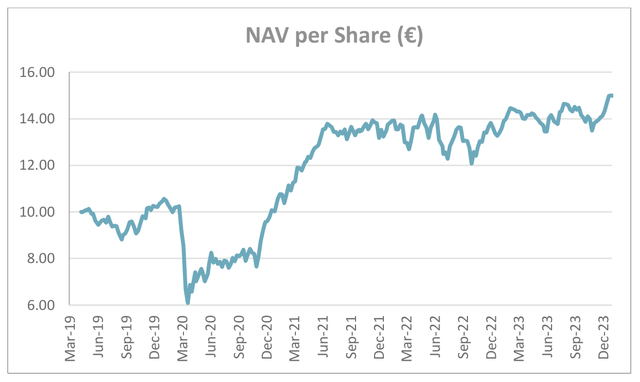

During the fourth quarter the fund gained 6.3% gross of fees 1. We do not have a stated benchmark in our Key Investor Information Document (KIID) and therefore cannot comment on relative performance. We leave it up to you to decide. We note the above number appears similar to European and global benchmarks. Inception to quarter end return was 50.0% or 8.9% compounded annual return. Our last reported NAV at quarter- end was 15.00 (28/12/2023), +6.8% from the closest reported NAV at the third quarter end of 14.05 (28/09/2023). Our full year return was 13.1% gross of fees 1 and our NAV return was 12.0% (NAV of 15.00 on 28/12/2023 versus end of 2022 NAV of 13.39 on 29/12/2022). We are extremely optimistic about our portfolio’s prospects and believe we will reach our compound return aspiration over time. Our fund’s composition is unlike any index, and we are unlikely to perform in a similar manner.

The fourth quarter’s performance was quite the opposite of the third quarter, with a weak start and a strong finish. The fund was down -4.3% in October and then up +3.96% in November and finished +6.9% in December. Ostensibly, the market sell-off in October was linked to higher bond yields followed by the market discounting significant cuts in 2024.

We take no view on the future path of interest rates and make no investment decisions based on their path. We find the fascination the market has with every small change to be somewhat ridiculous. We are quite happy to have positive real interest rates and think there should be a cost of capital. The hope and dream investors who require negative real rates to justify absurd valuations and speculative behavior appear to be the incremental daily buyer or seller and control the market narrative. We hope central bankers keep a cool head and do not return to previous policies, which we believe do little besides massively misallocate capital. We wouldn’t be surprised if inflation remains sticky, albeit at a low level (see our previous commentary), or if the market starts paying attention to the large sums governments need to issue to support their ever-ballooning deficits. It will be interesting to see if the voting population notices that interest expense is becoming one of the largest government expenditures and public borrowing levels are rapidly becoming unsustainable.

Moving on to more interesting topics, let’s discuss Japan. Japan has been one of the cheapest markets in recent years which could be ascribed to low growth, declining population, poor corporate governance, poor capital allocation, unstable monetary policy, and crushing government debt levels (in contrast to robust private savings by consumers and businesses). Many know the widow-maker trade of shorting Japanese government debt as well as the popular, but generally unsuccessful attempt by value investors to capitalize on lowly valued equities. We believe this is changing.

In the past few years, we have found several interesting Japanese companies that we thought might be very compelling investments. However, we chose not to invest in many of them due to the complications of doing the type of deep due diligence that we like to do and the fact, most are cheap for a good reason: poor capital allocation. Smaller Japanese companies generally do not have English filings, and many do not have investor relations or management contact information. If you managed to get in touch, calls are done via translator (even if they speak English) in which an hour of time spent serves less than a quarter of the information typically garnered. There is no sell- side coverage, little on Google, websites look like they are from the 1990s and generally lack useful information. Therefore, unless they have a US listed peer – it is a painful experience. Often, it quickly becomes evident why it is cheap: the topline is often stagnant and the company simply builds cash on its balance sheet in a zero-interest rate environment. Do they invest more in the business? Not really. Do they expand abroad via M&A? Nope. Do they buy back shares? Hahaha. Do they increase their dividends? Nope.

We made only one Japanese investment at PHC up until 2023, C Uyemura (OTCPK:CUYRF), which we exited in the fourth quarter with 157.5% gain (204.3% in yen). We wrote about our thesis in our second quarter 2021 letter. The main point was a change in their attitude towards shareholders. They started allocating capital for growth while adopting friendly shareholder remuneration policies through increased dividends and buying back shares. They even linked management compensation to the share price! They had a reasonably well-thought-out mid-term plan. However, we had researched dozens of companies before finding it. Most of the rest fit our criteria outside of this crucial capital allocation area and we saw no change that would recognize the value.

Things have been improving in recent years, but this came to a head in 2023. While the government has put soft pressure to improve boardroom behavior, with more independent board members and reduced crossholdings, a new leader emerged in this fight. The new CEO of the Japanese Stock Exchange (‘JPEX’), Hiromi Yamaji2, has openly criticized the corporate establishment. He has targeted any company trading below book value (think of all those cash piles and cross equity holdings) with low returns on equity. The stock exchange now requires companies to disclose capital efficiency improvement plans and if they are trading below book value, how they plan to improve their ratio above one. Furthermore, the exchange added more pressure in December by requiring disclosure over the rationale for having listed subsidiaries and how they plan to keep them independent. Mr. Yamaji has demanded that they engage with shareholders and listen to their ideas. Further, the stock exchange is now posting a “name and shame” 3 regime to point out those that are not complying (in typical Japanese fashion they are actually listing those that are complying but none-the-less I doubt many CEOs want to NOT be on the list).

We have been busy in the past few months and indeed companies have been more willing to speak with us and answer our questions than previously. We now have over 8% of the portfolio in Japan and would not rule out that this might increase in 2024. It is possible, although by no means certain, that there might be a multi-year bull market for value stocks in Japan. Indeed, none other than Warren Buffett made large investments in Japan in August 20204, which he increased in 20235.

We see the potential for a positive self-reinforcing cycle as balance sheets are cleaned up and corporates use their cash piles to invest in their businesses or increase shareholder remuneration. The capex of one company is the sales and earnings of another thus: the stagnant cash piles should therefore help encourage growth of the economy. Likewise, distributing the cash to investors will boost the wealth effect and increase spending throughout the economy. All of this will boost tax receipts enabling the government to lower its debt and boost spending. We think this could be a major growth driver for what has been a rather stagnant economy. This might be a watershed moment for Japanese corporates to grow abroad and to open the economy to foreign investments. We think this might also strengthen the Japanese yen as the economy strengthens and allow monetary policy to normalize. Furthermore, the government has revamped their NISA6, or the Nippon Individual Savings Account, which is a Japanese government tax-free stock investment program for individuals which is set for a big overhaul in January. It aims to turn the trillions of yen held in cash by households into investments in stock markets 7 and which is great timing as shares will likely rerate in the coming years as Japanese corporates begin to look at efficiencies and capital allocation more like their US counterparts.

Another part of our portfolio in which we have been very active is our special situations bucket. Following the successful spins of Telekom Austria and Companhia Brasileira de Distribuição (CBD), we are also very excited about a new opportunity in the spin-off of Syensqo from Solvay (OTCQX:SVYSF), which occurred in December, and we will detail later in this letter. Another of our long-term holdings, which has morphed into a special situation is OCI (OTC:OCINF), the Dutch nitrogen fertilizer and methanol producer, introduced in our second quarter 2019 letter and further updated in our fourth quarter 2021 letter., We had lowered exposure substantially over the course of 2022 and the first quarter of 2023 after a bumper 2022, in which we received €8.9 per share in dividends in the course of 18 months. We once again began increasing our stake as Jeff Uben of Inclusive Capital (formerly of ValueAct) wrote to the board demanding they unlock value. Chairman and majority owner Nassef Sawiris, ever the dealmaker, obliged and instigated a portfolio review. The outcome of which was revealed in December, with the complete sale of their 50% stake of Abu Dhabi listed Fertiglobe to ADNOC for $3.6 billion plus earn-outs followed rapidly by the sale of Iowa Fertilizer Company to Koch Industries for $3.6 billion8. While the market re-rated the shares from horribly depressed levels, it is still more or less valuing the company close to the value of the two deals, leaving the Texas blue ammonia plant, the methanol business as well as the entire European nitrogen business for free.

We exited a small position in Canadian listed Logistec (OTCPK:LTKBF). We purchased the shares after the company announced a strategic review of the business. We thought that the assets were of very high quality and that their future cashflow potential was higher than that ascribed by the market. However, the strategic review concluded with a buyout at levels only slightly above our entry point, which we think was a very good deal for the buyer but left us with a meagre return.

Another portfolio reshuffle that we undertook with a slight special sits angle was our sale of a UK based oil and gas company for a new position in a London-listed Greek- Israeli oil and gas company which had sold off massively from an already cheap valuation in early October.

We exited several positions to make room for our Japanese basket. These included Bayer (OTCPK:BAYRY), which was becoming increasingly problematic, Great Eagle (OTCPK:GEAHF), which is suffering from the downturn in the Hong Kong real estate market, MDU Resources, which completed the spin-off of Knife River (KNF) and was trading near fair value and an undisclosed fertilizer company.

At quarter-end our portfolio had more than 109% upside to our estimated NAV and was trading at a weighted average P/E of 8.1x, FCF/EV yield of 16% and a return on tangible capital of 30%.

|

Contributors |

Detractors |

||

|

Solvay |

116 bps |

IGT |

-68 bps |

|

Ocean Wilsons Holding |

107 bps |

LNA Santé |

-67 bps |

|

Telekom Austria |

94 bps |

Bayer |

-59 bps |

|

RHI Magnesita |

59 bps |

[Undisclosed] |

-28 bps |

|

Almacenes Éxito |

58 bps |

Melco International |

-24 bps |

The top contributor during the quarter was Solvay (+56.4% +116 bps), the Belgian chemicals conglomerate, which we introduce later in this letter. We note the performance is overstated as it spun off Syensqo, its specialty chemicals business, which was a slight detractor with -19 basis points. Syensqo was spun-out of Solvay during the quarter at the rather arbitrary price of €90. The spin-off split the legacy Solvay into value and growth units and has created two different investment opportunities.

Despite the spin-off-related value realization, we remain invested in both legs since they offer interesting upside.

The second largest contributor was Ocean Wilson (+23.8% +107 bps), the Bermuda-based investment company with port and tugboat operations in Brazil, which we introduced in our third quarter 2023 letter. Third quarter revenues of Wilson Sons were in line as the increases in container terminal, towage and offshore base revenues were offset by the decline in logistics revenues driven by lower freight rates. However, EBIT increased by 10%, driven by cost reductions. The offshore vessel joint-venture also contributed positively as we outlined last quarter. During the fourth quarter of 2023, Wilson Sons (PORT3 BS) share price increased by 24.8% (27.6% including dividend) while the latest reported portfolio value was roughly steady. As a result, the sum-of-parts value increased accordingly, keeping the discount at 52%. Ocean’s Wilson RNS reiterated that the strategic review of the Wilson Sons asset remains ongoing and that they have received several indicative non-binding offers. Given that the Wilson Sons market value (£19 per share at quarter-end) is above the value of Ocean Wilson (£11.85), the holding company, and the market assigns zero value to the investment portfolio (£5). We remain confident in the downside protection while waiting for management to close the discount.

The third significant contributor was Telekom Austria (+15.9% +94 bps), the Austrian and Eastern European telecoms group, introduced in our first quarter 2023 letter. During the third quarter, sales increased by 2.6% driven mainly by service revenue, while EBITDA increased by 0.6%, despite adverse foreign exchange, higher restructuring expenses and one-offs. Management reported an adjusted EBITDA growth of 6%. The impact of the spin-off on the third quarter numbers was rather limited since it was completed just a few days prior to the quarter-end. Hence, we are yet to see the standalone numbers for both entities. Management confirmed guidance for 2023 with sales growth around 5% and capex (excluding spectrum investments) around €950 million. For 2024-26, management confirmed their mid-term expectations for revenue growth at 3-4% and EBITDA growth at 4-5% with capex remaining around current levels. The base dividend wasn’t affected by the spin-off and management implied potential increases during the latest Capital Markers Day. We continue to believe that strong cash flow generation leaves ample room for dividend increases hence we see a significant upside potential ahead.

The fourth largest contributor was RHI Magnesita (OTC:RMGNF, +14.9% +59 bps), the Austrian-Brazilian refractories company, which we introduced in our second quarter 2019 letter. RHI reported a solid third quarter with a better-than-expected EBITA margin based on more resilient pricing and accretive M&A. Volume performance reflected normal seasonal factors and was consistent with market expectations given market weakness in Europe, China and South America. However, we note that based on world steel data, November was the first month that most recent twelve-month EU steel production volumes increased after 23 consecutive declines. Finally, during the quarter, Rhône Capital completed the acquisition of 19.9% of RHI’s shares at £28.5 per share dividend adjusted, becoming the second largest shareholder. We think their presence on the board should have a positive influence and their overall involvement implies significant upside. According to the management, the order book remains at normal levels with limited signs of a recovery in demand volumes in 2024, as global construction activity continues to be weak and demand in the auto market remains below pre-pandemic levels. M&A has increased net debt to approximately €430 million, but management expects leverage to remain in line with the target range of 2.0-2.5x. We continue to see significant upside based on our free cash flow projections.

The fifth contributor was Almacenes Éxito (EXTO, +24.6%, +58 bps), the leading supermarket player in Colombia, which we mentioned in our third quarter 2023 letter. Éxito was recently spun-off from Companhia Brasileira de Distribuição (PCAR3 BS), which controls the Grupo Pão de Açúcar supermarkets in Brazil and a 13% stake in Éxito. Both Éxito and CBD are controlled by the indebted French supermarket Casino which owns approximately 41% in each. We said in our third quarter letter that Casino would want to realize the value quickly – but even we were surprised by the speed. After rejecting two offers from a Colombian billionaire, Casino agreed to sell its stake in Éxito to Grupo Celleja, a leading grocery retailer in El Salvador. The offer valued Éxito at $1,175 billion ($0.9053 per share or approximately R$18.4 per share). We subsequently exited our position, which contributed 69 basis points in a relatively short period of time.

The top detractor was International Games Technology (IGT, -13.1%, -68 bps), the Italian- American lottery and gaming machine technology provider, which we introduced in our first quarter 2020 letter. In the third quarter, IGT reported both sales and EBITDA above consensus mainly due to strong performance in the Gaming and PlayDigital segments. The fundamentals remain strong, while leverage reached a historical low level. Management confirmed the upper end of previous guidance and maintained the margin outlook. Possibly the lack of an update regarding the strategic review pushed the share price lower. The management stated their frustration about the current valuation levels and their willingness to unlock value. We continue to believe that IGT is trading at a significant discount, irrespective of the conclusion of the strategic review. However, a potential break up would accelerate value realization. We note that 4.2% of the loss was FX due to the weak dollar.

The second largest detractor was LNA Santé (-18.8% -67 bps), the French nursing home and healthcare facilities operator, which we introduced in our fourth quarter 2022 letter. This was the second quarter where LNA was a top five detractor. Operationally, the company continues to perform well. Despite a slow-down in the clinic business in the third quarter, management has already stated that it has picked up again. The sales growth continued to be strong at 4.1% and the company reiterated their full year sales guidance. We noted in our last letter that Clariane (formerly known as Korian) followed Orpea down the restructuring route. We believe this is likely the reason for the poor share performance as investors flee the sector given the extremely poor outcome for equity holders in the two restructurings. We have gone through LNA’s debt and real estate in detail and believe that they have a different business model than their larger peers. Furthermore, they are passing on inflation, albeit slower than the market would like, and we believe their margins will return to normal in the coming year. We remain vigilant and will continue to test our assumptions, but we believe the share price reaction does not reflect the fundamentals of the business and the outlook in the coming years.

The third significant detractor was Bayer (-27.8% -59 bps), the German pharmaceutical, agriculture, and consumer healthcare products conglomerate, which has been often mentioned in our letters as top contributor and detractor. Bayer is composed of three separate businesses that are leaders in their respective areas. A sequence of acquisition related write-offs, litigation, high leverage and an agricultural downturn has penalized the share price. The New CEO came to save the company, signaling his intentions to explore a strategic break-up of the business, which the previous management was reluctant to discuss. While the new management sounds ready to change the status quo, we feel that the management change could be a year too late. Bayer has been a perennial disappointer for us hence we have decided to step aside and wait for further clarity.

The fourth significant detractor was an undisclosed (-22.2% -28 bps) fertilizer company. Following a very strong 2022 in which commodity prices skyrocketed and farmer economics improved substantially, there was a fear of scarcity which led to over- stocking in the value chain. This has caused a downturn in pricing during 2023 and with Russian exports unabated it is not clear when the downturn will end. We think the supply/demand balance is likely to improve in the coming years, however, we decided to exit and use the capital in our Japan basket.

The fifth largest detractor was Melco International (-16.3%, -24 bps), the holding company of a Macau casino operator. Macau continued to see improving casino gross gaming revenue (‘GGR’) momentum, reaching MOP183.1 billion in 2023, up 333.8% year- on-year as Covid restrictions were still in place throughout 2022. Macau’s cumulative GGR is still yet to fully recover particularly due to the structurally changed junket/VIP market and the slower than expected China recovery. S&P Global forecasts that mass- segment GGR will be 5-15% above the pre-Covid trading in 2024, implying 20-30% year-on-year growth, almost fully compensating for the permanently lost junket business. Based on that, they expect the six concessionaires’ EBITDA to reach 95% of 2019 levels in 2024. Management recently restated their intention to pay down debt. Hence, the expected mass-market growth should allow for lower leverage going forward. On a positive note, this was the second quarter of debt reduction after 12 consecutive quarters of increasing net debt due to the expansionary capital expenditure during the COVID downturn. We believe despite the apparently slower Chinese economy, that Macau will continue to recover and that as debt is paid down, the equity will benefit accordingly.

Solvay is a diversified chemicals group with 160 years of history since its founder invented a synthetic soda ash production process. Prior to the spin-off in December 2023, Solvay was among the world’s top ten largest chemical players. The split was orchestrated by its CEO Ms. Kadri, who was appointed in March 2019. She has led a successful turnaround of the business by focusing on efficiencies, free cash flow and balance sheet repair. Under her leadership, Solvay delivered double-digit EBITDA growth and 18 consecutive quarters of positive cash flow. Once the company was in better shape, the board, led by the founding family through their holding company Solvac, decided to realize the sum-of-the-parts value, which was heavily discounted, by splitting into two businesses. The separation of the commoditized from the special chemicals business bundles together units with similar characteristics and strategic priorities allowing for reduced complexity and more focused capital allocation.

The new Solvay will be focused on the essential chemical arena and will be comprised of five business units. Soda ash is the largest unit, accounting for 42% of sales and the majority of earnings. Solvay is considered a global leader in soda ash, a widely used industrial ingredient, used mainly in glass production as well as detergents, electric vehicle batteries and solar panels. Soda ash is considered an attractive cash generator, and the company is present in both naturally occurring soda ash as well as the leading synthetic producer using the Solvay process. The other units of the new Solvay include peroxides, silica, Coatis and Special Chemicals. The peroxides business is considered stable in a relatively consolidated end-industry with Solvay being the largest player. Silica and Coatis businesses are influenced by the supply-demand dynamics in auto tires and phenolic chemicals, respectively. Solvay is a global leader in Silica and a Latin America leader in Coatis. All businesses are considered decent cash generators given strong market shares and well-depreciated asset bases, which require limited capital expenditures. End-market exposure to cyclical industries add some volatility, as do globally traded commodity prices. The new Solvay intends to use its cash to maintain its asset base and reward shareholders primarily through a stable-to-growing dividend.

The newly formed growth-focused specialty chemical company, Syensqo, is divided into two businesses with materials representing 52% of sales and Consumer & Resources 48%. Syensqo produces high-performance polymers, carbon-fiber composite materials and surfactants for a range of stable and growing end-markets such aerospace, autos and electronics with 90% of sales generated from markets where the company holds a top-three position. They are also leaders in Battery Materials, Green Hydrogen, Renewable Materials and Thermoplastic composites. Syensqo is the growth story of the spin-off, hence cash generation will be primarily used to fund growth projects and bolt-on M&A.

Prior to the spin-off, Solvay was trading at a significant discount to the sum-of-parts value and a high free cash flow yield, given its growth outlook. We agreed with the board’s assessment that there was a substantial discount to the sum-of-parts value. In fact, Solvay was trading below our assessment of Syensqo alone, hence we were getting legacy Solvay for free. Our initial involvement was targeting that value realization. Post spin-off, the separation into value and growth units has created two different investment profiles and we believe both to still be undervalued, despite substantial value already having been released. At quarter-end, we remained holders of both companies, since we believe they continue to offer an interesting upside, both trading at mid-cycle free cashflow yields of over 10%.

As stated in our previous letter, we are currently not charging a management fee until the fund reaches a larger size. The founder’s class management fee will then be only 1% of assets. We do not charge entry or exit commissions despite our KIID saying it is theoretically possible.

Our focus is and remains on the portfolio, but we do need to grow our assets to a sustainable level. Please feel free to share this letter with any potential investors.

We now have a commercial agreement with Cobas Asset Management to distribute our fund in Spain. You can now open an account and place orders with them. For more information, please contact them via phone or email. In the future, we hope it will be possible via their website. You can reach the Cobas team at +34 91 755 68 00 orinternational@cobasam.com

Our fund can be invested through both European international central securities depositories: Euroclear and its FundSettle clearing platform and Clearstream through the Vestima fund clearing platform. Our fund is registered for distribution in the UK, Spain and Luxembourg including for retail distribution.

Currently the following financial institutions in Spain are distributors: Renta 4 (you may need to contact them – it is not offered on the website yet), Ironia, Lombard Odier, Banco Alcala as well as many other institutions working through the main platforms in which the fund is available upon request: Allfunds Bank and Inversis.

In the UK we are offered on the AJ Bell low-cost platform ajbell.co.uk and can be part of an ISA or pension.

Our fund is also available on SwissQuote swissquote.com where almost any nationality (ex-USA) can open an account without local Swiss taxes being an issue.

If you have any issues finding our fund or wish to get more information about us and our process, please contact us atIR@palmharbourcapital.com

Our fund is being offered as part of a Spanish pension value-orientated fund of funds. If interested in investing in a Spanish pension scheme, please contact us.

We thank you for your ongoing support. We continue to believe this is a great time to be a value investor and are very excited about the medium-term prospects for the current portfolio.

Yours faithfully,

Palm Harbour Capital

|

Footnotes 1Our NAV is calculated weekly by FundPartner Solutions, a subsidiary of Pictet & Cie and does not align with monthly or quarterly reporting. The gross return stated is net of taxes and fees but before fund expenses, which are currently running at approximately 15 bps per quarter at current AUM. We project this to decline significantly as AUM grows. Please see our comment on management fees. 2FT 3FT 4FT 5 FT This information is being communicated by Palm Harbour Capital LLP which is authorized and regulated by the Financial Conduct Authority. This material is for information only and does not constitute an offer or recommendation to buy or sell any investment or subscribe to any investment management or advisory service. In relation to the United Kingdom, this information is only directed at, and may only be distributed to, persons who are “investment professionals” (being persons having professional experience in matters relating to investments) defined under Articles 19 & 49 of Financial Services and Markets Act 2000 (Financial Promotion) Order 2001 & Articles 14 & 22 of the Financial Services and Markets Act 2000 (Promotion of Collective Investment Schemes) (Exemption) Order 2001 and/or such other persons as are permitted to receive this document under The Financial Services and Markets Act 2000. Any investment, and investment activity or controlled activity, to which this information relates is available only to such persons and will be engaged in only with such persons. Persons that do not have professional experience should not rely or act upon this information unless they are persons to whom any of paragraphs (2)(a) to (D) of article 49 apply to whom distribution of this information may otherwise lawfully be made. With investment, your capital is at risk and the value of an investment and the income from it can go up as well as down, it may be affected by exchange rate variations, and you may not get back the amount invested. Past performance is not necessarily a guide to future performance and where past performance is quoted gross then investment management charges as well as transaction charges should be taken into consideration, as these will affect your returns. Any tax allowances or thresholds mentioned are based on personal circumstances and current legislation, which is subject to change. We do not represent that this information, including any third-party information, is accurate or complete and it should not be relied upon as such. Opinions expressed herein reflect the opinion of Palm Harbour Capital LLP and are subject to change without notice. No part of this document may be reproduced in any manner without the written permission of Palm Harbour Capital LLP; however recipients may pass on this document but only to others falling within this category. This information should be read in conjunction with the relevant fund documentation which may include the fund’s prospectus, simplified prospectus or supplement documentation and if you are unsure if any of the products and portfolios featured are the right choice for you, please seek independent financial advice provided by regulated third parties. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment