PashaIgnatov/iStock via Getty Images

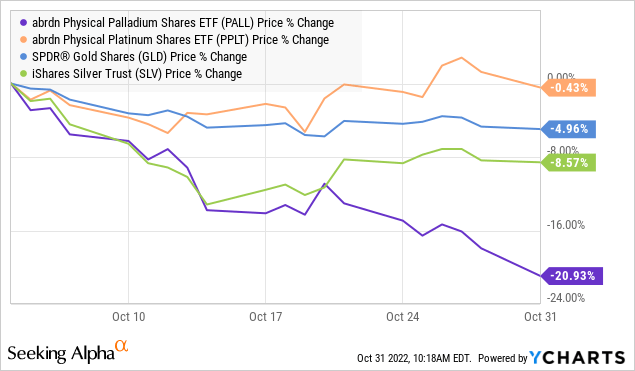

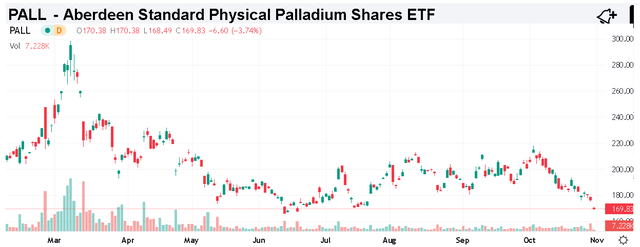

Aberdeen Standard Physical Palladium Shares ETF (NYSEARCA:PALL) offers targeted exposure to the price performance of the palladium commodity. The metal is facing increasing pressure, down nearly 20% over the past month amid several macro headwinds including a strong dollar, rising interest rates, and global growth concerns. The challenge here is palladium’s connection to the automobile industry as a critical component of catalytic converters against signs of weak vehicle production. While tight global supplies represent an underlying measure of pricing support, we expect volatility to continue and see room for palladium to underperform its precious metals peers going forward.

What is the PALL ETF?

The PALL ETF is based on a physical investing strategy with an allocation of palladium bars secured across vaults in London, United Kingdom, and Zurich, Switzerland. The idea here is to provide a greater level of transparency with each bar numbered and tracked daily compared to a financial derivative or futures contracts-based strategy.

As of September 30th, PALL held 162k ounces of palladium, which corresponds to a net asset value of nearly $300 million at the current market price. With 1.75 million shares outstanding, each unit of PALL represents approximately one-eleventh of an ounce of palladium.

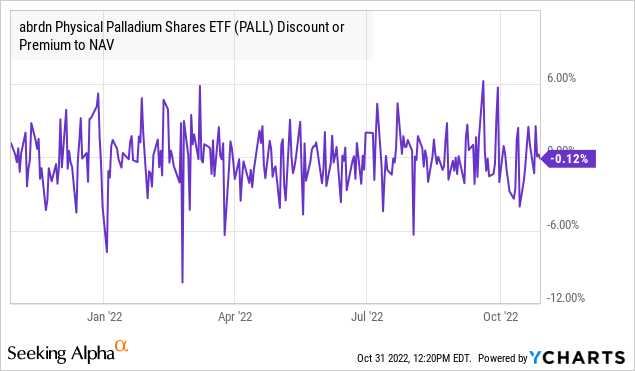

An important dynamic of the physical-backed structure is that PALL can trade at a spread to its net asset value compared to its share price. This is simply based on the supply and demand market trends, with strong momentum in palladium often adding to the fund’s buying pressure, resulting in a small premium. On the other hand, it’s also possible investors can pick up shares at a discount, particularly at times when sentiment is poor.

The spread has ranged between a +6% premium down to a -10% discount. With today’s data, PALL is trading near parity, but it’s an important metric to watch and published on the fund manager’s website.

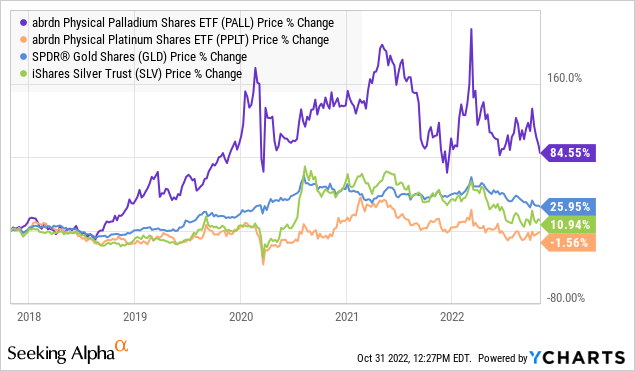

While palladium often takes a back seat next to more high-profile precious metals like gold and platinum, it’s worth noting that beyond the current selloff, the metal has still outperformed over the last several years. Over a 5-year timeframe, palladium has climbed 85% compared to 26% for gold (GLD) and 11% silver (SLV) while platinum (PPLT) is around 2% lower over the period.

Palladium Market Outlook

We mentioned the ongoing market deficit, with demand outpacing new supplies every year since 2016. The key here is to recognize that between 80-85% of palladium is directed toward the automobile industry.

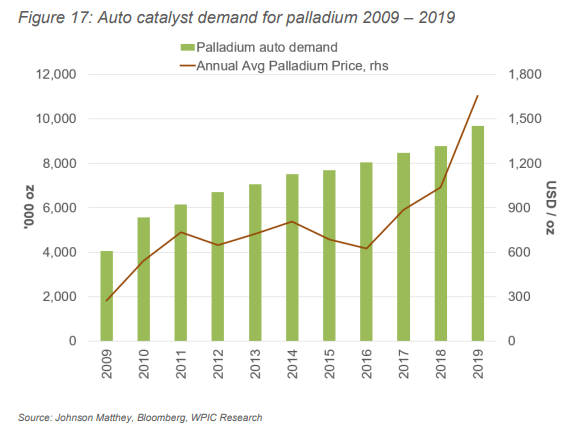

Over the past decade, stricter emissions standards have meant that more palladium is being used in catalytic converters for gasoline (and diesel) powered vehicles. Indeed, the demand for palladium between 2010 and 2019 more than doubled, which helped drive the metal price from under $600 to over $1,500 during the decade.

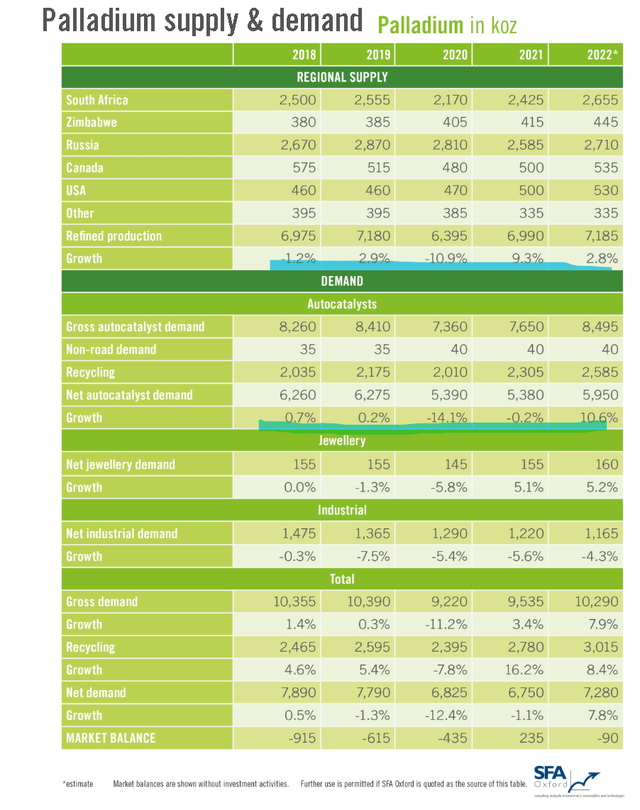

World Platinum Council

The setup since 2020 considers the significant disruption with both global output and demand crashing that year, while 2021 was highlighted by a strong recovery in production, although still below peak 2018 levels. Coming into 2022, the market baseline was for a strong rebound in autocatalyst demand as automobile production recovered, surpassing the expected 2.8% supply-side production growth. At the start of the year, there were also concerns that the Russia-Ukraine war would further create shortages, as Russia represents more than two-thirds of global output.

Fast forward, a couple of factors explain the weakness in palladium this year. The first point is the fears of further supply disruptions from Russia have largely faded, with the country still exporting supplies and not subject to any metals or mining ban. We mentioned the macro headwinds, including the Dollar Index that has climbed to a two-decade high, simply pressuring commodities priced in Dollars lower. With inflation as a global trend, the result is that the impact on broader economic conditions is limiting growth. GDP estimates have been revised lower all year as a further headwind.

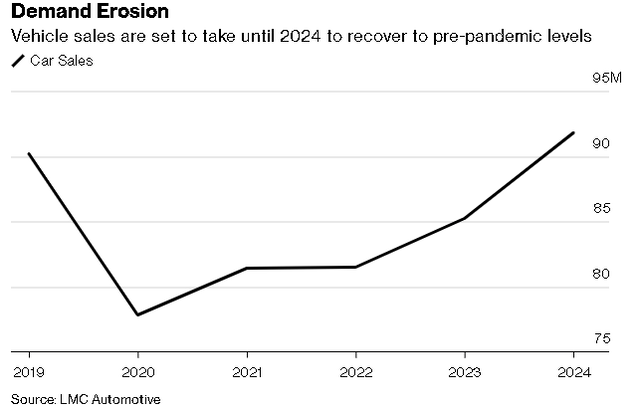

As it relates to autocatalysts, the headlines suggest weaker demand sputtering compared to loftier expectations back in Q1. For context, the forecast is that sales into 2023 will still be below 2019 levels. High-interest rates for auto loans are also hitting the industry. Energy rationing in Europe may also impact vehicle production in the region, limiting the demand for palladium. Major automakers are slashing targets, citing ongoing supply chain shortages. Putting it all together, the demand side for palladium is facing downward revisions.

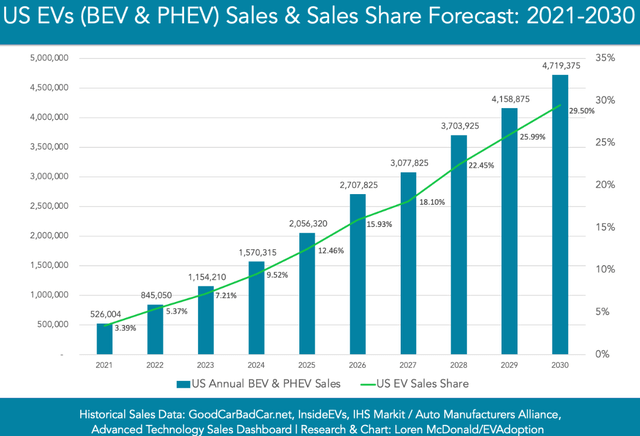

The other side to the discussion that is more structural considers the shifting landscape with the accelerating adoption of electric vehicles. While EVs may technically incorporate some palladium, the lack of a catalytic converter limits the demand for the metal as a longer-term headwind. With forecasts for EVs to represent nearly 30% of all new vehicles sold in the U.S. by the next decade, palladium may lose its place as a critical input for the industry with similar trends worldwide.

PALL Price Forecast

With the PALL ETF trading near its low of the year, there are plenty of reasons to expect a further breakdown. A deterioration of global economic conditions trending toward a recession would open the door for a deeper correction. Automobile industry data is a key monitoring point here. We can also consider another leg higher in the U.S. dollar, adding to weakness in all commodities.

To the upside, what needs to happen is a shift toward a more positive market sentiment. Looking at the U.S., confirmation inflation is trending lower can provide the Fed some flexibility to slow down its rate-hiking trajectory, which would in turn allow the dollar to pull back as supportive to global growth.

The call we’re making is to simply avoid palladium, which is in a tough spot, facing a challenging auto industry. Even with a bullish view that precious metals can rally higher from here, palladium would likely underperform to the upside as a more industrial-type metal while lacking the strong investment qualities of gold, platinum, and silver.

Be the first to comment