gevende

Investment Thesis

In September, I called attention to a tactical buy opportunity in Invitae (NYSE:NVTA), advising investors to consider the stock’s potential upside highlighting Q3 results as a catalyst likely to offer clarity over management’s restructuring plan announced in July. I also stressed the tactical nature of this trade opportunity, drawing attention to the company’s medium-term and long-term concerns. In the following weeks after the report’s publication, NVTA’s shares spiked to a high of $3.6 per share, representing nearly a 50% increase, hitting our initial price targets.

Once the investment thesis played out, and the window of opportunity closed, I published a Sell rating report in November underscoring NVTA’s structural weakness, outlining several key reasons for a bearish stance. Since then, shares declined substantially lower, reaching a low of $2.3 last week as the market digests the challenges previously masked by the initial bullish rally.

I think it is only a matter of time before further disappointments emerge and trigger further share-price declines. Pivoting to profitability will likely require painful asset write-downs and costly investments, which will be challenging to fund given the uncertain timeline for commercial launches and increasing competition in the genetic-testing space.

A considerable portion of NVTA’s proforma cash burn is tied to mandatory spending, including obligations tied to its R&D projects incorporating multiple clinical trials with thousands of patients who trust NVTA to continue funding the programs where they have enrolled.

Management also expects $170 million in restructuring costs, from severance payments to facility closures, employee relocations, and voluntary terminations, in addition to the tens of millions of dollars it has already spent in the past two quarters. The company barely has enough money to get through the next 12 months.

Adding insult to injury is the rollout of Illumina’s (ILMN) new gene sequencing platform, NovaSeq X, priced at $1.7 million, which is expected to cut turnaround times, a critical market differentiator in the molecular diagnostic space. This is ILMN’s first new product launch in five years, increasing the pressure on existing competitors in the molecular diagnostic space to ramp up capital spending. This is why, despite its liquidity challenges, NVTA is allocating $200 million for CAPEX in 2023. For these reasons, I am reiterating NVTA’s sell rating.

Market Position

Before acquiring ArcherDx in October 2020, NVTA’s primary business was focused on predictive genomics, which remains its primary source of income to this day. For those new to NVTA, here is an example of a typical predictive diagnostic test sale cycle. After a liquid biopsy sample (saliva, blood, etc.) is collected from the patient, NVTA analyses the sample using a Next Generation Sequencing “NGS” device before saving the patient’s DNA sequence data on its servers. The company then runs its proprietary algorithm to detect genetic variants associated with increased cancer risk. The report is shared with the patient’s healthcare provider via a chatbot (last week, NVTA settled with OptraHealth over this chatbot after the latter counter-sued NVTA’s initial claim over an underlying patent. Under the terms of the settlement, NVTA now pays license fees for the chatbot from OptraHealth. At least management was serious when they said they plan to cut legal expenses.)

The diagnostic report allows individuals and physicians to develop personalized healthcare plans to help reduce risk, including lifestyle changes (eating healthy, losing weight, etc.), periodic screenings to catch problems early, and in some cases, taking preventive medicines, e.g., tamoxifen, raloxifene or anastrozole for women with BRCA mutation. I believe that NVTA is currently the market leader in the predictive genetics screening market.

NVTA has, since its inception in 2010, pursued the ambitious goal of integrating genetic data into standard healthcare practice. It is a leading contributor to ClinVar, the National genome library funded by the Federal Government (The impact of NVTA’s data contribution to ClinVar on its competitive position is complex and will be covered in a separate piece.) For now, it is enough to understand that NVTA’s goal is to build a genetic network where patients’ genetic information can help inform their medical decisions and empower them to take an active role in their care. In the long run, it hopes to reside at the center of this genomic ecosystem, managing and analyzing its data flow.

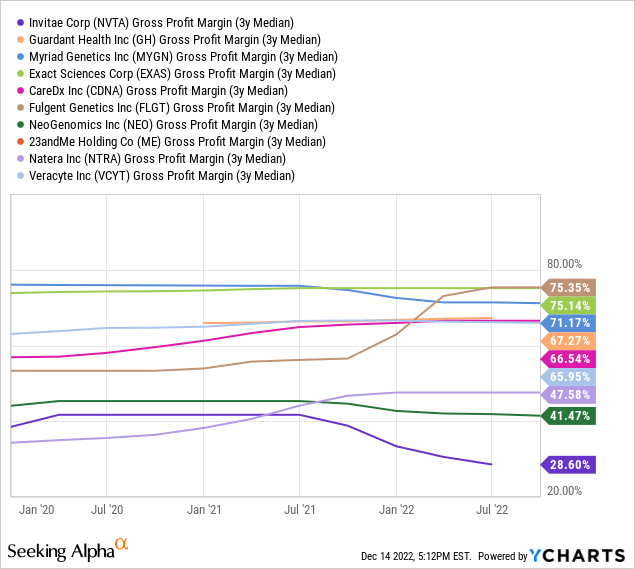

Developing this ecosystem is an expensive commitment for the company. Here is an example. Suppose a physician requests a BRCA 1 test for a woman worried about getting breast cancer after her auntie developed the disease. For many insurance companies, more is needed to categorize the patient as having average risk (unless the auntie undergoes genetic profiling after her diagnosis, which, according to the United States Department of Health, is unlikely). Subsequently, the test will not be covered by insurance. NVTA will nonetheless process the physician’s request. It will sequence not only the BRCA 1 gene but also BRCA 2 and 20,000 others, if not the entire patient’s DNA, for future reference and to build its biobank. On top of that, it will likely not be paid. As a result, NVTA’s expenses are higher than the industry average, and gross margins are poor (as shown in the table below).

The problem is, at this stage, the molecular diagnostic industry is in its early stages, primarily focusing on providing accurate genetic testing for patients while navigating a precarious regulatory environment playing catch up with the industry’s rapid growth. Neither the genomic network nor the ecosystem NVTA is trying to create has yet materialized.

Last week, the company released a report showing how it uses patient data and with whom. Based on the report, in 2021, the company shared genomic data with 31 biopharma companies on top of about a dozen academic institutions as part of its collaboration programs and its bioinformatics offering, which it records as “Other Revenue” on its financial statements. The report is a welcomed development in the industry, constituting a step towards more transparency in genomic data-sharing as the industry strives to establish and maintain trust among all stakeholders involved in healthcare, including patients and their families. It also provides a glimpse of how other companies treat their customers’ data, further fuelling the debate around the ethical use of such data in medicine. During the Q3 earnings call, NVTA’s CEO made the following comment on NVTA’s bioinformatics business:

While currently a small part of our total revenue, our data segment is a high-growth, high-margin, and scalable business, and there are more opportunities in our pipeline. Ken Knight, Q3 Earnings Call

Although cybersecurity concerns have not been cited as major obstacles to the adoption of NGS-based diagnostic tests, there is growing concern that inadequately secured patient records may put patients’ privacy at risk. In the past few years, genomic databanks and patient records have been targeted by hackers and malicious actors looking to steal or exploit confidential information. Earlier this year, Ambry Genetics, now part of Konica Minolta (OTCPK:KNCAF), settled a class action suit related to the 2020 data breach, which saw patient records stolen from company servers.

Financial Position

After the Federal Reserve began tightening monetary policy, NVTA found it increasingly difficult to rely on the equity market as a funding source due to rising capital costs. The company is under a severe cash crunch at the moment.

Management implemented a restructuring plan in July to reduce cash outflows by about $300 million. From my experience, restructuring plans rarely go as planned. In its Q3 presentation, the company states that its ongoing quarterly cash burn is $108 million, translating to $432 million annually, weighed against about $600 million in dry powder. This number accounts for most of the cost reductions that NVTA anticipates from implementing its restructuring plan. The $168 million cushion ($600 million – $432 million = $168 million) doesn’t cover capital expenditure plans, which the company estimates at $200 million. As mentioned above, it is uncertain whether the company will be able to achieve its cash burn targets. For example, the plan assumes it will realize $84 million in cash reduction from the sale of its kitted business, and it has been trying to find a buyer for almost a year now. It also doesn’t incorporate the $170 million restructuring costs in the coming quarters.

The $200 million CAPEX deserves some elaboration. Part of this balance will likely go to upgrading its testing equipment. ILMN recently introduced a new device set to reduce whole genome sequencing costs. However, most expected cost reductions stem from productivity enhancements rather than cash savings. For example, the new system will lower turnaround times by half, making it critical for molecular diagnostic companies, whose turnaround times are a primary differentiation point, to acquire the product. Still, in cash terms, the impact on margins is limited.

Debt

NVTA is one of the few companies in the molecular diagnostic space with debt. Last year, the company issued $1.15 billion in convertible notes maturing in 2028, adding to the 2019 $350 million notes, which mature in 2024. The rates on these notes are attractive, standing at 1.5% and 2% for the 2028 and 2024 notes, respectively. At maturity, these notes are payable in cash or common stock at a conversion price of $43 and $30, respectively. The company will likely repay these balances with stock at maturity if prices remain below the strike value, given that the cash value significantly exceeds the current share price. However, while the covenants of these notes are favorable, including subdued rates it locked before the recent Fed rate hikes, the sheer amount of the balance adds up to more than $50 million of interest expenses. This expense line adds to NVTA’s already high net cash outflow from operating activities.

Summary

NVTA’s restructuring plan is riddled with uncertainty and carries serious risks. The company is currently facing tremendous pressure to improve its margins as market conditions remain challenging, making it harder to raise capital to fund operations. The only option for NVTA is to become a self-funding business. The company’s R&D initiatives carry operational obligations limiting its financial flexibility to react to the change in market conditions. Its debt, while carrying a low-interest rate, is large enough to strain its finances. According to management’s estimates, the restructuring program will cost the company $170 million, from severance to downsizing facilities and reconfiguring office spaces. For these reasons, I believe NVTA shares have yet to reach the bottom, despite the 33% share price drop since our November Sell report.

Be the first to comment